Forex broker xm

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front.

My list of forex bonuses

They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

- Variety of banking options

- Quick processing times

Review

Introduction

XM was first started back in 2009 in london and now they have an offering of more than 400 different instruments.

This includes over 350 cfds, as well as 57 currency pairs and 5 cryptocurrency cfds. XM is regulated by the FCA in the united kingdom and they have european passports with the mifid, as well as being regulated by the cysec in cyprus, as well as being regulated in australia as an ASIC entity.

They offer more than 30 language options for their users and they cater for any and all levels of trader. One of the recent awards they have received is being named as the best FX broker in europe in 2018 by the world finance magazine.

- Over 30 supported languages

- Numerous esteemed awards

- Regulated by well-respected authorities

Trading conditions

XM offer three different types of account for their users. The micro account is best suited to beginners, with the standard account being ideal for flexible traders. The XM zero account generally is best suited for regular traders or those who place significant trades.

Depending on the specific instrument, for each of the account types you will be dealing with leverage ranging from 1:1 up to 30:1. While there are seven base currency options available with micro and standard accounts, you can only deal with USD and EUR when you have a XM zero account.

You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission. Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

XM always have a range of promotions they are running at any given time. They have a 100% deposit bonus up to $5,000, they have free VPS services and there are no fees on both deposits and withdrawals.

- Wide ranging promotions

- Commission free account options

- 3 different account types

Products

In total, there are 356 different cfds offered by XM, with five of these being cryptocurrency cfds. There are 57 currency pairs on offer and they don’t offer any ETF products.

- 356 CFD options

- No ETF products

- 57 currency pairs

Regulation

Having been around since 2009, XM are regulated by a number of trusted authorities. They are authorised in the european union, as well as being regulated by the FCA in the united kingdom. They have the necessary approval from the cysec in cyprus as well as being a ASIC regulated entity in australia.

Platforms

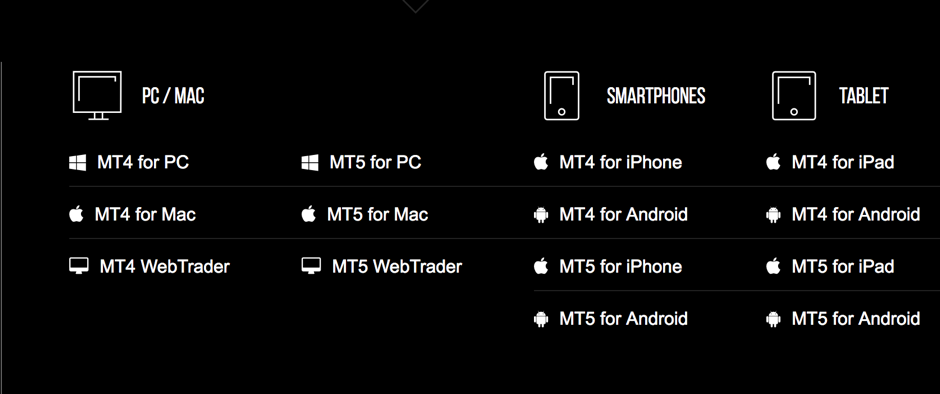

The only platform that is offered by XM is metatrader, which is an industry standard trading platform. They offer both metatrader 4 and metatrader 5 and they have tweaked them slightly to suit the specific needs of their users.

You have access to virtual trading, but those using mac desktop computers will not be able to run this trading platform optimally. There are 51 different trading indicators available to you and there are 31 charting tools you can utilise.

- Metatrader is the only trading platform available

- 51 trading indicators

Mobile trading

As a result of being a metatrader only platform, you will able to utilise the platforms on ios and android devices, whether it is through the MT4 or mt5 apps which can be downloaded straight away from either the app store or the android play store.

There are 30 trading charting indicators available on the mobile apps and you have the full range of trading instruments to choose from with these apps.

Pricing

With XM the amount of fees and commission that you have to pay will be dependent on what sort of account you have with them. There are three different account types in total. You have two accounts which are free from commissions – standard and micro accounts, while the XM zero account is based on commission.

Looking at the XM zero account, the average spread for EUR/USD is 0.1 pips excluding the commission. For the same pair on the other two accounts, the average spread for this currency pair is 1.7 pips.

The commission is $5 per side, so you are looking at competitive pricing as a whole.

Lower overall spreads can be achieved by XM as they are the sole dealer in every single trade.

- Competitive spreads thanks to XM being the sole dealer

- Varying commissions and fee levels depending on account type

Deposits & withdrawals

With the micro and standard account types, you are not subject to a minimum deposit, but usually you will have to deposit at least $5 due to system requirements. There is a minimum required deposit of $100 for the XM zero account type.

All of the usual forms of deposit and withdrawal are available with XM, such as neteller moneybookers, debit and credit cards and skrill. Most of the deposit options will allow you to have your deposit processed instantly. Bank transfers will take between 2 and 5 business days to process though.

When it comes to withdrawing from XM, most options will have your withdrawal processed within 24 hours without having a minimum required withdrawal. If you are withdrawing via a bank transfer, then you will have to wait between 2 and 5 business days for it to be processed and there is a minimum withdrawal of $200 in place.

- Variety of banking options

- Quick processing times

Customer support

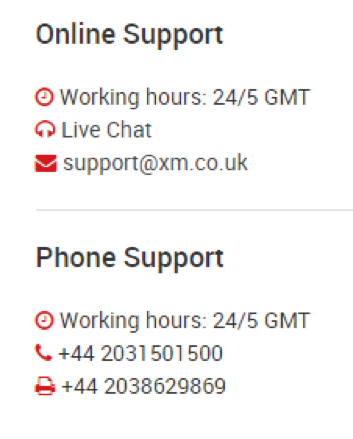

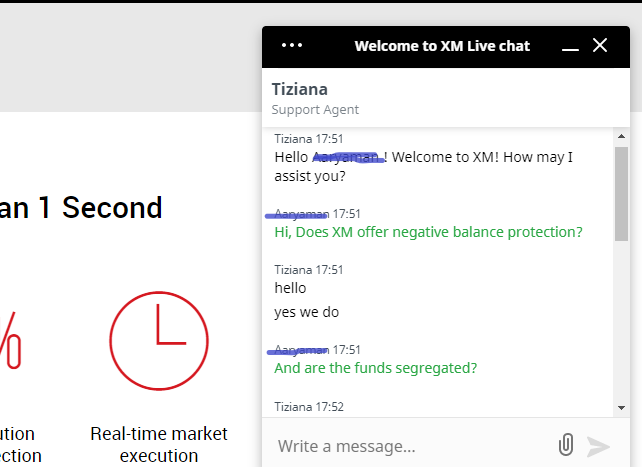

More than 14 languages are catered for through the customer support service at XM. You can reach them no matter what time of day it may be through their live chat feature.

You can also give them a call or send them an email, with the team working on weekdays only.

- 14 languages catered for

- 24/5 customer support

Research & education

There is a library of free educational materials for XM users including the likes of week interactive webinars and video tutorials. They always have the latest news from the world of forex as well as providing regular market analysis from the team of experts at the platform. They also have a range of tools and calculators that provide everything a trader needs when making certain calculations.

Noteworthy points

As a whole XM is a trusted broker that has a solid and unspectacular offering for their users. They look after the needs of their clients through quality customer support and they have regular promotions such as a free VPS service.

As they are completely reliant on metatrader platforms, those familiar with the sector can easily utilize the broker as it is similar to a lot of other offerings out there.

Catering for 30 languages and having received numerous awards in recent years, including being named as the best FX broker in europe in 2018 by the world finance magazine, they hold a reputable place in the sector.

- 30 languages catered for

- Free VPS service

- Best broker in europe 2018 – world finance magazine

Conclusion

XM is a broker that has been around since 2009 and now employs more than 300 people. They have a diverse offering of instruments, which caters for the needs of their users in an adequate manner.

As they are reliant on metatrader for the trading software, you are not going to be surprised by anything on this front. They have a decent welcome bonus, matching your first deposit 100% up to a max bonus of $5,000.

They have a wide ranging section for education, including free weekly webinars that are interactive. It is an ideal learning ground for beginner traders and with three different account types, they cater for all kinds of traders depending on what their specific needs may be.

If you are looking for a platform that is easy and straightforward to use and that looks after their users, XM could be the right option for you.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

XM deposit and withdrawal methods in 2021

In our xm.Com broker review, we described the basic features and offers of this famous forex broker. In this article, we will analyze only deposit and withdrawal options.

XM is one of the leading foreign exchange (forex) brokers globally, and millions of traders worldwide are using XM for forex trading. Many of these forex traders are investing large amounts of money for forex trading. They would like to find out the XM deposit and withdrawal methods to make a decision accordingly. One of the factors affecting the choice of the deposit or withdrawal method is the country in which the trader is residing. Some payment/withdrawal methods are popular in each country due to several factors, and the trader will usually use that method since the fees will be less. Unless specified, the currencies for the deposit and withdrawal methods are USD, EUR, GBP, CHF, HUF, PLN, AUD.

XM deposit and withdrawal methods are online payment methods that XM forex broker allows for traders. XM.Com deposit and withdrawal methods are credit card, debit card, neteller, skrill, unionpay, bank wire. XM withdrawal options for partners are skrill, neteller, and bank wire.

XM offers payment options for traders, such as:

- VISA

- VISA electron

- Mastercard

- Maestro

- Diners club international

- Unionpay

- XM card

- Skrill

- Neteller

- Web money

- Bank wire

The minimum deposit for an XM account is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, $10 000 for SHARES accounts.XM minimum withdrawal value is $5 for MICRO and STANDARD forex trading accounts, $50 for ULTRA LOW trading accounts, while for SHARES accounts is $10 000. The minimum deposit value for the XM account and minimum withdrawal for the XM account is related to the type of order and not the payment method. Skrill withdrawal option is one of the most used payment methods, and the minimum deposit for skrill (withdrawal too) is based on account types.

XM deposit methods

How to deposit the XM account? There are several XM deposit options:

XM credit/debit card

XM accepts deposits using credit and debit cards from visa, visa electron, mastercard, maestro. The minimum deposit amount is $5, and the amount is immediately credited to the user’s forex account. There are no fees for using this deposit method. Since most people have a debit or credit card, this deposit method is widely preferred. However, most credit and debit cards have a limit, so the amount which can be deposited is also limited.

XM electronic payment

All the electronic payment methods have no fees and a minimum deposit of $5. Neteller, skrill, and unionpay are some of the electronic payment methods. For neteller and skrill, the amount is credited to the forex account immediately, while for union pay, the deposit will be processed within 24 hours. Cash only accepts USD deposits and przelewy24 accepts PLN deposits, and the amount is instantly credited to the forex account. For bitcoin, deposits in only three currencies, USD, EUR, JPY, are accepted, and it may take up to one hour for the payment to get processed.

XM banking

For sofort banking, deposits are only accepted in eur & GBP. Though the minimum amount is $5, and there are no fees, the deposit processing time will vary depending on the country. For conventional bank transfer of deposit amount in the forex account, at least two hundred USD or equivalent will have to be deposited in the forex account at a time. The fees depend on the bank, which is used. The amount deposited in the bank account will be credited to the forex account within two to five business days.

XM withdrawal review

If a user wishes to withdraw his money from the XM account, they will have to provide the know your customer (KYC) documents, which are specified. These documents are necessary to prevent money laundering according to the various regulatory bodies’ requirements in different countries. XM has an online and offline form where the customer’s personal information and background details have to be provided. This information will help XM in providing better service to their customers.

Compared to deposits, there are fewer withdrawal methods, which are discussed below. Unless specified, the XM user will have to withdraw at least five USD at a time, and there are no fees for withdrawal. The processing time for the withdrawal request is usually 24 hours on working days if the customer has completed the KYC requirements and submitted the documents required. These documents are the identity proof and proof of address of the trader. However, the amount will be credited to the linked bank account, usually only after three to five business working days.

XM credit cards and electronic payment

Visa, visa electron credit and debit cards, maestro and mastercard credit cards can be used for withdrawing funds. Unionpay is another option for fund withdrawal. Similarly, skrill ( earlier called moneybookers) and neteller are electronic payment methods used for fund withdrawal. Bitcoin can also be used for withdrawing the money in the XM account, though funds can only be withdrawn in USD, EUR, and JPY. Usually, credit/debit card withdrawals are given top priority by XM, followed by bitcoin withdrawals and neteller/skrill (e-wallet) withdrawals.

XM bank wire transfer

Many of the forex traders are trading in large amounts, and they prefer to make bank wire transfers to withdraw their profit.

The smallest amount permitted for making a withdrawal to a bank account is two hundred dollars. The withdrawal fees will vary based on the bank selected by the trader. The amount is usually credited to the bank account two to five business days after the withdrawal request is made. XM may process the bank withdrawal requests more slowly. The longest period of XM bank wire transfer withdrawal was 5 days in my last 8 years.

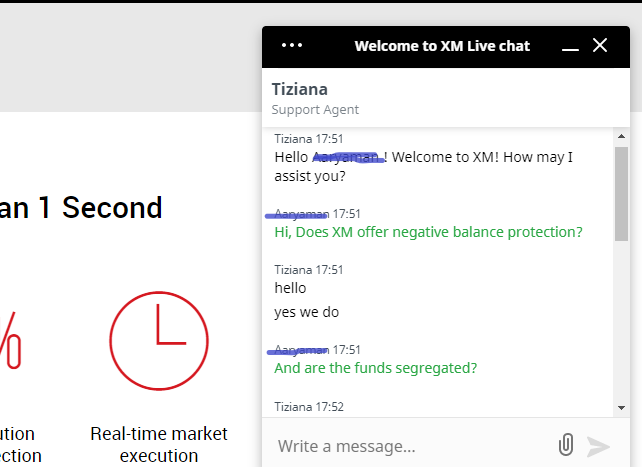

XM fund safety

To keep their clients’ funds, the forex traders safe, XM takes all measures to prevent unauthorized access to their information systems. All the funds of their clients are segregated and kept with the most reputed banks worldwide. Additionally, XM is also offering negative balance protection to their clients. XM has a risk management system implemented, which will ensure that the trader’s loss will be limited to the amount deposited with XM only.

Forex trading without any deposit

Many people are interested in forex trading yet do not have the money to take the risk. However, it is still possible to get some experience in forex trading without making a deposit.

XM no deposit bonus

To encourage people who are curious about forex trading, XM offers a $30 no deposit bonus to all those who create a new account with XM. This allows the new trader to take the risk of trading without risking his own money. The amount is directly credited to the live trading account and helps the trader understand market conditions.

XM demo account

XM also allows new traders to create a demo or virtual account to trade in forex with virtual money. The trader will be given $50,000 in virtual money for each account created, which he can use to trade, become familiar with the features, and test strategies. A trader can create any number of demo accounts to practice trading. If the demo account is inactive for a long period, it will be deleted immediately.

XM malaysia review 2021

XM is our #3 ranked forex broker for malaysia traders. Well regulated, low spread with ultra low account, wide instruments are their pros. But XM does not have a malaysian phone number.

Regulated by: ASIC, cysec, IFSC, DFSA

Headquarters: belize

Foundation year: 2009

XM is a well-established market maker forex broker that was founded in 2009, and they accept traders from malaysia. XM provides its services in more than 30 languages including malay & english.

The XM website is run by ‘XM global’ which is a company registered in belize and licensed by the IFSC. The XM group companies are regulated by reputable financial authorities such as the ASIC (australia), cysec (cyprus), and DFSA (UAE). So, they are considered a safe broker.

XM forex broker gives traders the option to choose between 4 different account types which are: micro account, standard account, XM ultra low account, and shares account. XM also offers islamic account services for those who have subscribed to the micro, standard, XM ultra low account types.

The trading fees at XM depends on the type of account that you open. XM offers you the option of using the metatrader 4 or metatrader 5 trading platforms that are available for smartphones, desktops, web browsers, and tablets.

XM offers malaysian traders the opportunity to trade 55+ currency pairs and cfds on 1000+ stocks, commodities, equity indices, precious metals, and energy.

In this XM malaysia review, we discuss the pros and cons of this broker, how safe they are, the fees charged by them, their trading conditions, customer support, and everything else you need to know.

- XM is a market maker broker, however, they claim that they do not benefit from client losses. So there is no conflict of interest.

- They do not charge deposit or withdrawal fees on any method.

- XM offers negative balance protection to traders in malaysia

- They are regulated by the tier- 1 ASIC (australia) financial authority, tier-2 cysec, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an islamic account to malaysian traders.

- They offer a wide variety of instruments to trade.

- XM does not have a proprietary trading platform, they only offer MT4 & MT5.

- They do not have an office in malaysia.

XM malaysia – A quick look

| �� our verdict on XM | #3 forex broker in malaysia |

| �� broker name | XM malaysia |

| �� typical EUR/USD spread | 1.7 pips (with standard account) |

| �� year founded | 2009 |

| �� website | www.Xm.Com/my/ |

| �� XM malaysia minimum deposit | $5 |

| ⚙️ maximum leverage | 1:888 for trades between $5 to $20,000 with micro account |

| ⚖️ XM regulations | ASIC, cysec, IFSC, DFSA |

| ��️ trading instruments | 55+ currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy cfds, and 100 shares |

| �� trading platforms | MT4, MT5 for desktop, tablet, web & mobile |

Is XM malaysia regulated?

XM global limited, which is the company that runs the XM trading website, is registered in belize with its registered address at no. 5 cork street, belize city, belize, CA.

XM global limited is authorized to provide trading services by the international financial services commission (IFSC) and holds the license number 000261/106.

The XM group companies are regulated by one tier-1 financial regulator, and other reputed financial authorities. The group first started its operations in 2009 and have catered to millions of clients across the world.

XM is regulated and licensed by the following financial authorities:

XM is registered with the cyprus securities and exchange commission (cysec) under the name ‘trading point of financial instruments limited’ – and holds the license number 120/10

XM is considered a safe forex broker for malaysian traders.

In addition to being regulated by multiple reputed financial authorities, XM also maintains safe practices such as segregation of funds and also offers negative balance protection.

XM malaysia fees

XM is a variable spread broker, and they only charge spread with 3 forex trading accounts. XM charges commissions only with their shares account types.

The exact spread that are charged by XM malaysia depends on the type of account the trader is holding, the instrument that is being traded, and the time when the trade is being made.

To give traders an idea of the fees that is charged, we will be using a few benchmark examples for this review.

Here is a breakdown of trading & non-trading fees at XM malaysia:

Tight variable spreads – XM offers fractional pip pricing, which gives traders more accurate spreads for their trades. The exact spread depends on the instrument being traded, and trader’s account type.

For example, the average spread charged for trading the benchmark EURUSD currency pair through their standard account is 1.7 pips.

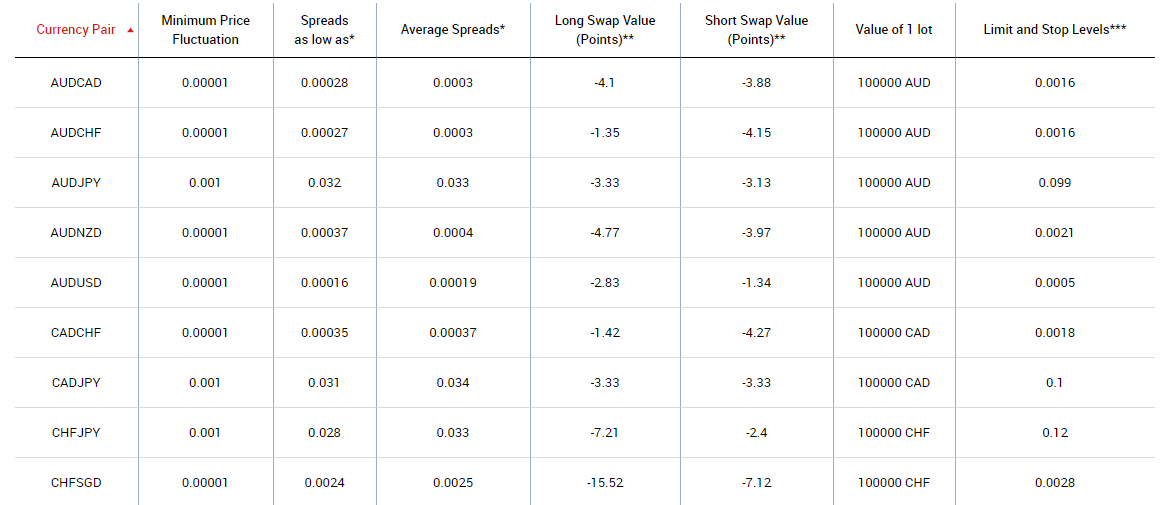

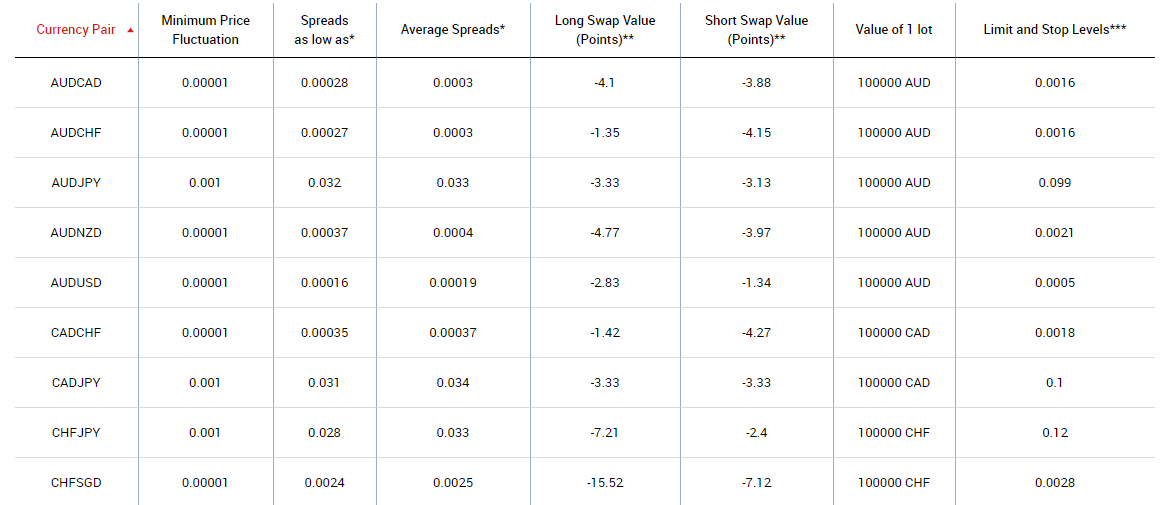

Here is a screenshot of the typical spread charged for various currency pairs with the standard account at XM.

Variable commission with shares account – XM does not charge any commission under the standard, micro, and ultra low account types. Commission is charged for traders using the shares account.

The commission that XM charges depends on the type of shares that you are trading. They also charge a minimum commission per transaction. For example, if you’re looking to trade US-based shares, then you will be charged $0.04 commission per share with a minimum commission of $1 per transaction.

Overall, XM is a medium-cost broker. Their spreads with standard account are average compared to other similar brokers. You should open “ultra low” account for lower spread.

They charge a minimum commission for every trade under their shares account. They do not charge any deposit or withdrawal fee but they do charge an inactivity fee.

XM bonus

XM bonus is available to traders in malaysia. We reviewed XM bonus promos, here is a breakdown of their active promotions.

XM welcome bonus – XM offers a deposit bonus of 15% up to a maximum limit of $500. They credit this bonus instantly and it is automatic for all traders. But traders cannot withdraw the amount of the bonus.

XM $30 bonus – malaysian traders can avail the $30 trading bonus at XM. This is a limited period bonus.

Loyalty program – traders will automatically earn XM points which can be traded credit bonus rewards. Traders are grouped into four different levels under the loyalty program and the XM points that are earned depend on that level.

Refer a friend – traders can earn up to $35 for referring a friend to XM. These earnings can be withdrawn from the account.

Seasonal bonuses – in addition to the above bonuses, XM also offers various seasonal and occasional bonuses to its traders for limited periods of time. Certain bonuses are special invite-only bonuses as well.

XM deposit and withdrawal

XM offers a variety of ways to make deposits and withdrawals for traders in malaysia.

Deposits and withdrawals can be made through multiple credit cards, multiple electronic payment methods, bank wire transfer, local malaysian bank transfer, and other payment methods, along with local depositors.

Once a trader opens an account, they can log in to XM’s members area, select a payment method of their preference on the deposits/withdrawal pages, and follow the instructions given.

Remember that XM does not charge any fee for making a deposit or withdrawal. In addition to not charging a deposit or withdrawal fee, XM may also cover the fee charged by your payment service.

XM account types

XM offers four different types of accounts to traders in malaysia. Each type of account has its own pros and counts and is suitable for different types of traders. For example, the shares account is suitable for high-volume traders since it charges very low spreads and a commission per trade.

XM has a minimum deposit of 5 USD.

It is worth noting that XM does not offer MYR as the base currency under any type of account. Traders can use the USD or other base currencies depending on the type of account. The maximum leverage at XM is 1:888.

XM also offers an islamic account option.

Here is a breakdown of the different types of accounts offered by XM.

XM islamic account – XM offers an islamic account that does not charge any swap rates or overnight rollover interest. You can choose to make your trading account an islamic account after you have opened an account with XM.

The islamic account option is available to traders using the micro, standard, or ultra low account, and shares account types. XM has also stated that they do not charge higher spreads from traders using islamic accounts. Islamic accounts can have a leverage of up to 888:1. The trading conditions remain the same as other account types.

XM micro account – the spread under this type of account can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under micro accounts.

Standard account – the spread charged can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under standard accounts.

XM ultra low account – the spread under the ultra low account can be as low as 0.6 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $50 to $20,000. The minimum account deposit is $50. There is no commission under ultra low accounts.

Shares account – no hedging is allowed under this type of account. Traders are charged a commission per trade along with a minimum commission per transaction. The spread that is charged depends on the underlying exchange. You cannot avail any leverage under the shares account. The minimum deposit for this account is $10,000.

XM trading instruments

XM offers the option to trade more than 55 currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy cfds, and 100 shares.

Overall, XM offers a very large range of instruments for traders to choose from compared to other similar brokers. Their selection of stock cfds is especially high and XM is particularly suitable for traders looking to trade stock cfds.

However, they do not offer any cryptocurrencies for trading which is different from brokers such as hotforex.

XM trading platforms

XM is a metatrader-based forex and CFD broker.

Traders from malaysia have the option of using either the metatrader 4 or the metatrader 5 trading platforms. Both platforms are popular with forex and CFD traders.

The MT platforms are available on smartphones, computers, web browsers, and tablets. Both the platforms have a mac and windows version for desktop users. The mobile apps of these platforms are available for both android and ios users.

The MT platforms are convenient to use and offer proper functionality for traders.

It should be noted that XM does not offer its own proprietary trading platform.

XM customer support

XM users in malaysia can contact customer support through live chat, email, or by phone.

Customers can also read their FAQ section to find answers to their issues. The customer support team is available at all times during weekdays.

Good live chat support – we used the english live chat support during the writing of this review, and found it to be quick and helpful. The hold time before you are connected to a representative was below 2 minutes. They also answered your questions quite quickly. We found the entire process to be quite painless.

The malay chat support is only available during business hours in malaysia.

Email support in malay – traders in malaysia can contact them through their email “[email protected]” for malaysian traders. While writing this review, we used their english email ID and it took three hours for them to provide a response.

No local phone number – traders in malaysia will need to contact their global phone lines +501 223-6696 for customer service. They do not have a local phone number that malaysians can call.

Overall, we found XM’s customer support to be helpful, but we gave them 4 stars due to unavailability of local phone number. Still. They offer a variety of ways in which malaysian traders can get in touch with them.

Do we recommend XM malaysia?

Absolutely, we recommend XM forex broker for traders in malaysia.

XM is a reputable international broker that has a proven track record. They are safe to trade through considering that they are well regulated, and observe safety practices such as negative balance protection and segregation of funds.

They offer a very wide range of instruments to trade. However, they do not offer cryptocurrency cfds. They do not have a proprietary trading platform, but the MT4 and MT5 trading platforms are quite popular with users.

They also offer islamic accounts and they do not charge a wider spread for islamic users.

The primary drawback to trading with XM is that they do not have offices in malaysia. They also do not have a local phone number for malaysian traders to call.

XM review and tutorial 2021

XM.Com offer a range of account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service.

XM.Com deliver ultra low spreads across a huge range of forex markets. Flexible lot sizes, and micro and XM zero accounts accommodate every level of trader.

XM review; touted as the next generation broker for online forex and commodity trading, XM global webtrade is suitable for beginner and seasoned traders alike. Traders can get started with the trading software real account, or test the waters with a demo account platform with $100,000USD of virtual currency.

Highlights of this particular broker service include auto trading, no hidden fees or commissions and fast order executions, with 99.35% taking place in under 1 second.

Company details

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

The platform boasts over 1.5 million clients with traders in 196 countries. The XM ethos is all about being big, fair and human. The company prides itself on things like excellent customer service and a personalised approach for every client, no matter their investment goals.

XM trading platform

XM offers 2 trading platforms which are accessible from both real and demo accounts. The multi-award winning metatrader 4 is predominantly a forex trading platform that supports stop, limit, market and trailing orders.

The metatrader 5 platform is a multi-asset trading platform which also offers access to stocks, stock indices and precious metals. Both platforms are available on apple and android devices, which makes for a smooth and easy-to-use mobile trading experience.

The trading area offers additional, optional tools, such as economic calendar or trade volume stats.

Assets / markets

This broker has more than 1000 financial instruments which can be traded on the MT4/MT5 platforms and this includes forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds and energies cfds.

Forex trading is available on over 55 pairs, including the major USD, GBP, EUR and JPY pairs.

XM does not offer binary options or futures.

Spreads & commission

Spreads vary depending on the kind of account opened. It’s possible to open a micro account, standard account and XM zero account. The minimum spread across all accounts is 0.1 pips, and the average spread for a major pair such as EUR/USD is 0.1 pips.

XM operates a strict “no hidden fees or commission” policy. As such, commission is only given for XM zero accounts. XM covers all transfer fees and same-day withdrawals are guaranteed.

Leverage

Depending on the instrument, the leverage can range from 2:1 to 30:1. This is completely flexible and XM offers its clients the chance to manage their own leverage risk. Margin requirements remain constant throughout the week and never widen at weekends or at night.

This leverage applies to clients registered under the EU regulated entity of the group.

XM mobile apps

XM is available on a number of android and apple devices, including apple iphone, apple ipad and android tablets and android phones. Login is super-easy and can be done via fingerprint. You can download their apps from the apple app store or the google play store.

They are both fully functional and allow for monitoring and trading on-the-go. The desktop platforms for PC and mac both support one-click trading.

XM global trading platforms

Payment methods

In line with conventional KYC regulations, users need to provide a colour copy of an official identification document such as a passport or a driver’s license. They also need to provide a recent utility bill dated within the last three months as proof of address.

Once registered, the minimum deposit amount is $5 for micro and standard accounts, while zero accounts require a minimum deposit of $100.

Deposits can be made using most major credit cards, electronic payment methods, wire transfer, local bank transfer and more.

Deposits can be made in any currency and it will be automatically converted into the currency you select as your base currency when opening the account.

All withdrawals are processed in 24 hours and there are no fees to take your money out of your ewallet.

Demo account

XM excels in its demo account offering. Users can set up a demo account with just a few details and then get trading with a virtual balance of $100,000USD. The XM demo account is unique in that it offers exactly the same trading conditions as the real thing.

There are no time limits on how long you can use your demo account.

Bonus deals and promotions

XM also offers a free VPS (virtual private server) service to help increase the speed of trades. This VPS is accessible from anywhere and available 24/7. They claim to eliminate downtime and are available across the globe.

XM are also offering commission and fee free withdrawals and deposits.

As an EU regulated brand, XM comply with the ESMA ban on bonuses, and the $30 deposit bonus is no longer available to EU traders.

Regulation and licensing

As noted above, XM group has a range of brands covered by different regulators.

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments was established in 2009 and is regulated by the cyprus securities and exchange commission (cysec 120/10).

Trading point of financial instruments pty ltd was established in 2015 and is regulated by the australian securities and investments commission (ASIC 443670).

XM global was established in 2017 and is regulated by the international financial services commission (000261/106).

Additional features

One of the biggest perks available on the XM platform is the wealth of training and educational materials available. The platform hosts regular webinars aimed at newcomers and seasoned professionals alike.

The platform is inherently social, encouraging users to learn from their team of instructors. The company also published research and technical analysis.

XM MT4 and MT5 forex trading

XM account types

There are four levels of trading account, micro, standard and zero. All accounts allow up to 200 open/pending positions per client.

- Micro accounts: micro accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and can get started with a minimum deposit of $5USD. 1 micro lot is 1,000 units of the base currency.

- Ultra low accounts: XM ultra low accounts, can use EUR, USD, GBP, AUD, ZAR, SGD as the base currency and traders will require a minimum deposit of $50 USD. 1 standard ultra lot is 100,000 units of the chosen base currency, whereas, 1 micro ultra lot is 1,000 units of the base currency. XM ultra low accounts are not applicable to all entities of the group.

- Standard: standard accounts can use USD, EUR, GBP, CHF, AUD, JPY, HUF and PLN as the base currency and traders can get started with just $5USD. 1 standard lot is 100,000 units of the chosen base currency.

- Zero accounts: zero accounts can use USD, JPY and EUR as the base currency and traders will require a minimum deposit of $10USD. Like the standard account, 1 standard lot is 100,000 units of the chosen base currency.

Benefits

XM offers a full-service education package on forex, ideal for those making their first steps into trading.

However, this isn’t at the expense of the more seasoned professional, who also have access to expert analysis and unparalleled tracking tools. As a company that prides itself on solid customer service, their users are well-served with support available in many different languages.

Drawbacks

While the support may be strong, some users dislike that customer support is only available monday to friday. Another disadvantage is the lack of diversity between the different account types makes for a less personalised feel.

Other brokers offer more a distinct offering in their accounts, but the micro, standard and zero accounts are almost identical. And finally, paypal deposits are not currently supported, which can be problematic for some.

Traders from certain regions are also forbidden to open an account due to licensing laws, these include canada and the united states.

Trading hours

In line with worldwide forex market hours, XM is available 24 hours a day. For phone trading, the XM trading hours are sunday 22:05 GMT through to friday at 21:50 GMT.

Contact details / customer support

The easiest way to contact XM is through their live chat feature found on the contact page of their website.

You can also email support on: support@xm.Com

Safety and security

There are no obvious security concerns with the website. Users are required to confirm their email address in order to open a demo account but signing up for email updates is not a requirement. In order to open a trading account, identification documents are required.

According to the company privacy policy, XM has organisational procedures in place to ensure that personal data is kept secure.

Overall verdict

XM offers a comprehensive broker service to traders of all levels. Whether you are just starting out and learning the ropes, or if you’re a seasoned trader looking for a reliable and efficient platform, XM is a solid choice.

Despite the shortcomings with the different account options, the platform is easy to use and simple to navigate.

Accepted countries

XM accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use XM from united states, canada, israel, iran, portugal, spain.

XM forex broker review – scam or not?

Should you avoid the forex broker XM or is it actually a recommendable company? – on this page, we share our own experiences in the form of a test report on this forex and CFD broker. Learn about the terms and offers for traders in the following texts. Also, we will show you a step by step tutorial which shows you how to trade successfully. Is it worth it to invest his money or not? – inform now transparently.

The official website of the forex broker XM

What is XM.COM? – the forex broker presented

XM group (XM) is a group of regulated online brokers. Trading point of financial instruments ltd was established in 2009 and it is regulated by the cyprus securities and exchange commission (cysec 120/10), trading point of financial instruments pty ltd was established in 2015 and it is regulated by the australian securities and investments commission (ASIC 443670) and XM global limited was established in 2017 with headquarters in belize and it is regulated by the international financial services commission (IFSC/60/354/TS/19). The company was founded in 2009 and has since enriched more than 1.500.000 customers in over 196 countries. Even the broker is one of the biggest in his industry.

The goal is to give the customer a very fair and reliable offer for investing in international financial markets. Customer support is also a top priority for this company and is available in more than 30 languages. We will check this in the following experience report exactly. In addition, the broker is very active in distributing advertising and sponsorship. Especially for customers, the broker is even to be found at seminars or financial fairs worldwide.

XM offers trading in currencies (forex) and cfds on commodities, precious metals, energies, stocks, and indices. Currently, over 1000 different markets are offered to traders. The broker works as an intermediary for tradable contracts for difference. In summary, the offer is very large at first glance and also the company data prove to be trustworthy.

Facts about the FX broker XM.Com:

- Founded in 2009

- More than 1.500.000 international customers

- Worldwide offices (cyprus, australia, belize)

- Huge variety of assets

- Support and service in international languages

- More than 15+ award-winning forex boker

(risk warning: 73.57% of retail investor accounts lose money when trading cfds)

Regulation of XM and safety of customer funds

An official regulation or license radiates trustworthiness and security. Every trader should find out about opening an account with a broker. The regulation is intended to push frivolous and fraudsters out of the market. Licenses require certain criteria and regulations that guarantee a clean and secure trade.

Another good impression on me is that XM has several licenses. In more than 4 countries, the broker is regulated by an official financial regulator. In addition, the company is registered in many european countries with appropriate supervision and has an EEA freedom to provide services.

In addition, customer funds are managed in different investment-grade banks. XM is only doing business with regulated payment providers. Also, the broker is a member of the investor compensation fund. XM does not trade versus its clients, which is forbidden through the regulation, and for more safety, there is negative balance protection.

XM is a highly regulated broker

XM is a very safe forex broker:

- Regulation of official finance regulator in the cyprus (cysec), australia (ASIC), and belize (IFSC)

- Member of the investor compensation fund (only for trading point of financial instruments ltd.)

- XM does not trade versus clients

- The client’s funds are kept in segregated client bank accounts

- Negative balance protection

ESMA regulation

In 2018, the leverage for traded derivatives (forex and cfds) was massively restricted to 1:30 by the european financial services authority (ESMA). Brokers, which have a license in europe, are only allowed to offer this small lever to customers. This is a significant problem for some traders because certain strategies (such as hedging) can no longer be performed.

However, the leverage of 1:30 applies to clients registered under the EU regulated entity of the group. Leverage depends on the financial instrument traded.

Review of the conditions for traders

XM is very broad with over 1000+ tradable instruments. There should be no lack of choice here for a trader. As mentioned above, a variety of stocks, commodities, currencies (forex), precious metals, and energies are offered for trading. Especially stock trading is a huge advantage with XM, assets from more than 14 different countries are available.

In terms of trading platforms, XM relies on the world-famous platform metatrader 4 and 5. This is, in our opinion, one of the best software for private traders. We will give you a more detailed explanation in the section trading platforms.

Assets and markets of XM.Com

The terms of trading in leveraged financial products are, in my experience and tests, very good and competitive. XM relies on several different account types, which give a trader excellent conditions, depending on the capital strength. Spreads can start at 0.0 pips on the most traded markets. In addition, the execution is very reliable and there are 100% no requotes.

As a trader, you can start trading for as little as $ 5 minimum deposit or use a free demo account. In addition, there are different account types for every type of capital (more on that later). All in all, the conditions make a very positive impression on us and XM can be one of the cheap and reliable brokers.

Conditions for traders:

- Spreads starting at 0.0 pips

- Different account types

- Maximum leverage is 1:30 for clients who registered under EU regulated entity

- Maximum leverage is 1:500 for clients who registered under belize or ASIC regulated entity

- Minimum deposit of 5$

- Free and unlimited demo account

- More than 1,000 different markets

| regulation: | support: | assets: | special: |

|---|---|---|---|

| cysec, ASIC, IFSC | 24/5 in different languages, webinars and training tutorials | 1000+ (forex trading, stocks cfds, commodities cfds, equity indices cfds, precious metals cfds, and energies cfds) | different account types |

Test of the XM trading platform

As mentioned before in this review, the well-known trading platform metatrader in version 4 and 5 are offered. In our opinion, there is no better trading platform for private traders worldwide, because it offers many universal options. The trading platform is characterized by its flexibility and user-friendliness.

With the metatrader, you can adapt your trading to any trading style. The platform can be customized and even programmed. Whether long-term or short-term hands, the metatrader always delivers the right settings. Robots or automatic programs are also allowed with this program.

Trading platform available for any device

The advantages of the XM metatrader:

- 1 login and access to the web trader, app, and desktop version

- Automatic programs may be used

- No requotes

- Rental of a VPS server possible

- Complete video tutorial is available from XM

Charting and analysis for forex trading

Of course, charting and analytics are very important to successful traders. It is not uncommon that traders even need to access external software. This will not be necessary with XM, because the metatrader offers all-important charting and analysis options. Choose between more than 4 different chart types in the software.

Any timeframe (time unit) of the chart can be set for the analysis. The software also offers the right tools. Free indicators can be added at any time. There are also a number of drawing tools available. If that is not enough, you can program the indicators yourself or insert them externally.

- Individually customizable tools

- Free indicators

- Big range of technical drawing tools

Mobile trading for any device

Another benefit of the software is that it is available for every device. Use the metatrader also on apple (ios) and android devices. Mobile trading today is a standard requirement for the trading software, as it is important to be able to respond to news from within. Positions can be opened, managed, or closed by your smartphone. Furthermore, you only need access to each device. With your account data, you can log in everywhere.

(risk warning: 73.57% of retail investor accounts lose money when trading cfds)

Trading tutorial: learn how to trade with XM step by step

In the following section, we would like to give you a guide to trading with forex broker XM. In the picture below you can see the order mask of the metatrader. There are many different settings options for trade execution. The following points will tell you how the typical trading process works.

- First, analyze one out of 1000 different markets/assets at XM and decide to invest or open a trading position. For this purpose, the fundamental analysis or technical analysis can be used. Metatrader offers enough tools and settings.

- As you can see in the order mask, you can always bet on rising or falling prices. This is easily possible with forex trading and happens during CFD trading via short sale.

- Now you have to choose the position size (volume) and the stop loss or take profit. All sizes are dependent on your planned risk. Choose specific price tags when to open and close a trade. The position sizes are given in lot (1 lot = 100,000 units of the base currency). Beginners should definitely use the XM forex calculator, which is available on the website.

- The stop-loss stops you in a loss at a certain price (risk) and the take profit automatically closes your position at a certain price in profit. Learn to divide the profit-risk ratio.

- Pending orders are another way to open positions. Place orders at specific prices in the market. If the market touches this price, your position will be opened (whether sell or buy).

Open your free account with XM

Next, we would like to look at the account opening in this review. On the website, it is clear that you can open a demo or live account directly. In a few minutes, the depot opening works according to the support. Simply use a valid email and other personal information. The email address must be confirmed after opening the account.

Free and unlimited demo account

A demo account is a virtual balance account. You can use it to try out all the features of broker XM and trade without risk. It simulates the real money trade with “play money”. It is also a great way for beginners and advanced traders to develop their own strategies or test of new markets.

XM offers a free demo account of over $ 100,000 in virtual credit. If desired, a currency other than the USD may be taken. This account can be used indefinitely and it is the perfect way to get practice with the broker.

Open your account in less than 60 seconds

How to open your real account

Once you have chosen XM, you can open the real money account. This requires more data. The broker also asks a few questions about your knowledge in trading before opening an account. You also need to confirm your phone number to ensure additional security for the account. Before the capitalization, the account should and should be verified. This is very easy with the upload of a passport and proof of residence.

XM guides you through the account opening process. There is a detailed and accurate step by step guide so nothing can go wrong. If you have questions, you can contact the support. In summary, opening an account is very easy and works in a short time.

(risk warning: 73.57% of retail investor accounts lose money when trading cfds)

Choose the best account type for you

XM offers the advantage of 3 different account types. It can be decided between the “micro”, “standard” and “XM zero account”. The account types are adjusted to the capital strength of the customer. For example, in a micro account, you can trade with very small position sizes (risk of a few cents). There is a separate cent contract size.

In the “standard” and “XM zero account”, there are normal lot sizes. The difference between these two accounts lies in the fees and the possible currency of the account. For example, you can choose 7 different currencies for the standard account and only 2 for the “XM zero account”. Spreads are much lower in the “XM zero account” and start at 0.0 pip. But you have to pay a commission of $ 3.5 per $ 100,000 traded. Overall, the “XM zero account” is still much cheaper than the standard account.

| Micro | standard | XM zero spread | |

|---|---|---|---|

| min. Deposit: | 5$ | 5$ | 100$ |

| currency: | USD, EUR, GBP, CHF, AUD, HUF, PLN | USD, EUR, GBP, CHF, AUD, HUF, PLN | USD, EUR |

| spreads: | 1.0 pips | 1.0 pips | 0.0 pips |

| commission: | no | no | 3,5$ commission per 1 lot traded |

| islamic account | yes | yes | yes |

(XM also offers the XM ULTRA LOW account which allows you to trade with either micro or standard lots, lower spreads from 0.6 pips and it has a minimum initial deposit of $50. The XM ULTRA LOW account is not applicable to all entities of the group)

Should you choose fix or variable spreads?

Some brokers offer fixed spreads. This means that the spread (the difference between buying and selling price) is always the same. He is also not dependent on the market situation. The problem here is that usually high fees or insurance premiums have to be paid. In addition, it is difficult to guarantee fixed spreads, because the stock market does not work on the principle. Fixed spreads are generally unnatural.

XM offers the direct interbank spreads for your clients. This also has the advantage that there is no conflict of interest. The spreads are reduced to the lowest and you always get directly the current market prices. It is not better. XM is very transparent here and reaps a clear plus point for us.

XM always offers the best and tightest spreads

Do your first deposit

Now it is your turn to capitalize on the trading account. From our experience, this also works pretty fast. We will give you an overview of this section about the payment methods. You can use electronic methods or a classic transfer for the deposit. Using electronic methods (credit card, e-wallets, neteller, skrill) the money is credited directly to the account. Bank transfer can take 1 to 3 days. There are no fees for the deposit.

Review of the withdrawal

Another important point of a good broker is a quick and easy payment of client funds. It is not uncommon for a broker to experience difficulty in paying large sums and delays.

This is not the case with XM. The company is always liquid and makes payments in less than a day. The fees are to look for in vain. The only fee that can be incurred if you pay less than $ 200 by bank transfer. From my experience with XM, you are with a very secure broker who treats client funds with the highest confidence.

The conditions for payments:

- Credit card (VISA, VISA electron, mastercard, maestro)

- Electronic wallets (neteller, skrill, and more)

- Bankwire

- Minimum deposit 5$

- Withdrawal within 24 hours

- No withdrawal fees (except bank wire under 200$)

Is there a negative balance protection?

Cruel stories about account balances thanks to the extra payroll haunting the internet. Many traders are afraid of additional funding and would like to act without them. These concerns are completely correct.

With XM.COM there is no additional payment obligation. The balance can not end up in a negative balance. The broker will automatically stop all postings before. Should the account balance become negative anyway, XM will compensate him (very unlikely).

XM support and service for traders tested

With XM you get more than one trading account because the customer service is provided by many employees of the company. Over 30 different languages are available in customer support. International employees also work for the company and help you around the clock. Use a telephone, email or chat support.

For example, you can also access professional training and webinars. The webinars are held almost daily and are accessible to every customer. There are also daily market analyzes and even signals to trade. Another plus is the personal account manager from XM. Each customer is assigned an employee who is available for questions and suggestions. It tries to find the best deal for you personally as a trader.

In summary, we can say from my experience that the analyzes offered, etc. Are very well applicable for their own trade. Beginners and advanced traders can expand and improve their knowledge for free. In addition, the service makes a good impression on me.

Facts about the service:

- Personal account manager

- 24/5 support in different languages

- Daily webinars and analysis

- Service for beginners and advanced traders

Conclusion of the XM forex broker review – scam or reliable company?

XM can hold its own in comparison to other brokers and gets a very good rating from me on this page. With several licenses and regulations, the company exudes a high level of security and trustworthiness. In addition, client funds at XM are managed separately from corporate funds, which eliminates a conflict of interest.

Overall, the broker with its over 1000+ markets offers a very large offer for private traders. Take, for example, markets from distant countries. The portfolio will also be supplemented by the new markets. The metatrader trading platform is also perfect for analyzing markets and opening trades. Diversity for customers is 100% guaranteed by this broker.

Another advantage is the terms of trade and in the deposit and withdrawal. The fees are so low that XM can count to one of the cheapest brokers. The positive features of the company are rounded off by customer support. At XM, you not only get technical help but also a great way to educate yourself in the trade.

The advantages of XM:

- More than 1000 different assets

- A regulated and safe company

- Cheap trading fees

- No hidden fees

- 3 different account types

- Metatrader software

- Professional support and service

- Accept international customers (europe, africa, indonesia, asia, india, china, and more)

In summary, XM is a recommended and trusted forex broker. We highly recommend this company after our test. Happy trading (5 / 5)

XM malaysia review 2021

XM is our #3 ranked forex broker for malaysia traders. Well regulated, low spread with ultra low account, wide instruments are their pros. But XM does not have a malaysian phone number.

Regulated by: ASIC, cysec, IFSC, DFSA

Headquarters: belize

Foundation year: 2009

XM is a well-established market maker forex broker that was founded in 2009, and they accept traders from malaysia. XM provides its services in more than 30 languages including malay & english.

The XM website is run by ‘XM global’ which is a company registered in belize and licensed by the IFSC. The XM group companies are regulated by reputable financial authorities such as the ASIC (australia), cysec (cyprus), and DFSA (UAE). So, they are considered a safe broker.

XM forex broker gives traders the option to choose between 4 different account types which are: micro account, standard account, XM ultra low account, and shares account. XM also offers islamic account services for those who have subscribed to the micro, standard, XM ultra low account types.

The trading fees at XM depends on the type of account that you open. XM offers you the option of using the metatrader 4 or metatrader 5 trading platforms that are available for smartphones, desktops, web browsers, and tablets.

XM offers malaysian traders the opportunity to trade 55+ currency pairs and cfds on 1000+ stocks, commodities, equity indices, precious metals, and energy.

In this XM malaysia review, we discuss the pros and cons of this broker, how safe they are, the fees charged by them, their trading conditions, customer support, and everything else you need to know.

- XM is a market maker broker, however, they claim that they do not benefit from client losses. So there is no conflict of interest.

- They do not charge deposit or withdrawal fees on any method.

- XM offers negative balance protection to traders in malaysia

- They are regulated by the tier- 1 ASIC (australia) financial authority, tier-2 cysec, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an islamic account to malaysian traders.

- They offer a wide variety of instruments to trade.

- XM does not have a proprietary trading platform, they only offer MT4 & MT5.

- They do not have an office in malaysia.

XM malaysia – A quick look

| �� our verdict on XM | #3 forex broker in malaysia |

| �� broker name | XM malaysia |

| �� typical EUR/USD spread | 1.7 pips (with standard account) |

| �� year founded | 2009 |

| �� website | www.Xm.Com/my/ |

| �� XM malaysia minimum deposit | $5 |

| ⚙️ maximum leverage | 1:888 for trades between $5 to $20,000 with micro account |

| ⚖️ XM regulations | ASIC, cysec, IFSC, DFSA |

| ��️ trading instruments | 55+ currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy cfds, and 100 shares |

| �� trading platforms | MT4, MT5 for desktop, tablet, web & mobile |

Is XM malaysia regulated?

XM global limited, which is the company that runs the XM trading website, is registered in belize with its registered address at no. 5 cork street, belize city, belize, CA.

XM global limited is authorized to provide trading services by the international financial services commission (IFSC) and holds the license number 000261/106.

The XM group companies are regulated by one tier-1 financial regulator, and other reputed financial authorities. The group first started its operations in 2009 and have catered to millions of clients across the world.

XM is regulated and licensed by the following financial authorities:

XM is registered with the cyprus securities and exchange commission (cysec) under the name ‘trading point of financial instruments limited’ – and holds the license number 120/10

XM is considered a safe forex broker for malaysian traders.

In addition to being regulated by multiple reputed financial authorities, XM also maintains safe practices such as segregation of funds and also offers negative balance protection.

XM malaysia fees

XM is a variable spread broker, and they only charge spread with 3 forex trading accounts. XM charges commissions only with their shares account types.

The exact spread that are charged by XM malaysia depends on the type of account the trader is holding, the instrument that is being traded, and the time when the trade is being made.

To give traders an idea of the fees that is charged, we will be using a few benchmark examples for this review.

Here is a breakdown of trading & non-trading fees at XM malaysia:

Tight variable spreads – XM offers fractional pip pricing, which gives traders more accurate spreads for their trades. The exact spread depends on the instrument being traded, and trader’s account type.

For example, the average spread charged for trading the benchmark EURUSD currency pair through their standard account is 1.7 pips.

Here is a screenshot of the typical spread charged for various currency pairs with the standard account at XM.

Variable commission with shares account – XM does not charge any commission under the standard, micro, and ultra low account types. Commission is charged for traders using the shares account.

The commission that XM charges depends on the type of shares that you are trading. They also charge a minimum commission per transaction. For example, if you’re looking to trade US-based shares, then you will be charged $0.04 commission per share with a minimum commission of $1 per transaction.

Overall, XM is a medium-cost broker. Their spreads with standard account are average compared to other similar brokers. You should open “ultra low” account for lower spread.

They charge a minimum commission for every trade under their shares account. They do not charge any deposit or withdrawal fee but they do charge an inactivity fee.

XM bonus

XM bonus is available to traders in malaysia. We reviewed XM bonus promos, here is a breakdown of their active promotions.

XM welcome bonus – XM offers a deposit bonus of 15% up to a maximum limit of $500. They credit this bonus instantly and it is automatic for all traders. But traders cannot withdraw the amount of the bonus.

XM $30 bonus – malaysian traders can avail the $30 trading bonus at XM. This is a limited period bonus.

Loyalty program – traders will automatically earn XM points which can be traded credit bonus rewards. Traders are grouped into four different levels under the loyalty program and the XM points that are earned depend on that level.

Refer a friend – traders can earn up to $35 for referring a friend to XM. These earnings can be withdrawn from the account.

Seasonal bonuses – in addition to the above bonuses, XM also offers various seasonal and occasional bonuses to its traders for limited periods of time. Certain bonuses are special invite-only bonuses as well.

XM deposit and withdrawal

XM offers a variety of ways to make deposits and withdrawals for traders in malaysia.

Deposits and withdrawals can be made through multiple credit cards, multiple electronic payment methods, bank wire transfer, local malaysian bank transfer, and other payment methods, along with local depositors.

Once a trader opens an account, they can log in to XM’s members area, select a payment method of their preference on the deposits/withdrawal pages, and follow the instructions given.

Remember that XM does not charge any fee for making a deposit or withdrawal. In addition to not charging a deposit or withdrawal fee, XM may also cover the fee charged by your payment service.

XM account types

XM offers four different types of accounts to traders in malaysia. Each type of account has its own pros and counts and is suitable for different types of traders. For example, the shares account is suitable for high-volume traders since it charges very low spreads and a commission per trade.

XM has a minimum deposit of 5 USD.

It is worth noting that XM does not offer MYR as the base currency under any type of account. Traders can use the USD or other base currencies depending on the type of account. The maximum leverage at XM is 1:888.

XM also offers an islamic account option.

Here is a breakdown of the different types of accounts offered by XM.

XM islamic account – XM offers an islamic account that does not charge any swap rates or overnight rollover interest. You can choose to make your trading account an islamic account after you have opened an account with XM.

The islamic account option is available to traders using the micro, standard, or ultra low account, and shares account types. XM has also stated that they do not charge higher spreads from traders using islamic accounts. Islamic accounts can have a leverage of up to 888:1. The trading conditions remain the same as other account types.

XM micro account – the spread under this type of account can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under micro accounts.

Standard account – the spread charged can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under standard accounts.

XM ultra low account – the spread under the ultra low account can be as low as 0.6 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $50 to $20,000. The minimum account deposit is $50. There is no commission under ultra low accounts.

Shares account – no hedging is allowed under this type of account. Traders are charged a commission per trade along with a minimum commission per transaction. The spread that is charged depends on the underlying exchange. You cannot avail any leverage under the shares account. The minimum deposit for this account is $10,000.

XM trading instruments

XM offers the option to trade more than 55 currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy cfds, and 100 shares.

Overall, XM offers a very large range of instruments for traders to choose from compared to other similar brokers. Their selection of stock cfds is especially high and XM is particularly suitable for traders looking to trade stock cfds.

However, they do not offer any cryptocurrencies for trading which is different from brokers such as hotforex.

XM trading platforms

XM is a metatrader-based forex and CFD broker.

Traders from malaysia have the option of using either the metatrader 4 or the metatrader 5 trading platforms. Both platforms are popular with forex and CFD traders.

The MT platforms are available on smartphones, computers, web browsers, and tablets. Both the platforms have a mac and windows version for desktop users. The mobile apps of these platforms are available for both android and ios users.

The MT platforms are convenient to use and offer proper functionality for traders.

It should be noted that XM does not offer its own proprietary trading platform.

XM customer support

XM users in malaysia can contact customer support through live chat, email, or by phone.

Customers can also read their FAQ section to find answers to their issues. The customer support team is available at all times during weekdays.

Good live chat support – we used the english live chat support during the writing of this review, and found it to be quick and helpful. The hold time before you are connected to a representative was below 2 minutes. They also answered your questions quite quickly. We found the entire process to be quite painless.

The malay chat support is only available during business hours in malaysia.

Email support in malay – traders in malaysia can contact them through their email “[email protected]” for malaysian traders. While writing this review, we used their english email ID and it took three hours for them to provide a response.

No local phone number – traders in malaysia will need to contact their global phone lines +501 223-6696 for customer service. They do not have a local phone number that malaysians can call.

Overall, we found XM’s customer support to be helpful, but we gave them 4 stars due to unavailability of local phone number. Still. They offer a variety of ways in which malaysian traders can get in touch with them.

Do we recommend XM malaysia?

Absolutely, we recommend XM forex broker for traders in malaysia.

XM is a reputable international broker that has a proven track record. They are safe to trade through considering that they are well regulated, and observe safety practices such as negative balance protection and segregation of funds.

They offer a very wide range of instruments to trade. However, they do not offer cryptocurrency cfds. They do not have a proprietary trading platform, but the MT4 and MT5 trading platforms are quite popular with users.

They also offer islamic accounts and they do not charge a wider spread for islamic users.

The primary drawback to trading with XM is that they do not have offices in malaysia. They also do not have a local phone number for malaysian traders to call.

So, let's see, what we have: forexbroker is your one stop portal for comparing the best forex brokers, stock brokers and trading platforms in the world! At forex broker xm

Contents of the article

- My list of forex bonuses

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM deposit and withdrawal methods in 2021

- XM malaysia review 2021

- XM malaysia – A quick look

- Is XM malaysia regulated?

- XM malaysia fees

- XM bonus

- XM deposit and withdrawal

- XM account types

- XM trading instruments

- XM trading platforms

- XM customer support

- Do we recommend XM malaysia?

- XM review and tutorial 2021

- Company details

- XM trading platform

- Assets / markets

- Spreads & commission

- Leverage

- XM mobile apps

- Payment methods

- Demo account

- Bonus deals and promotions

- Regulation and licensing

- Additional features

- XM account types

- Benefits

- Drawbacks

- Trading hours

- Contact details / customer support

- Safety and security

- Overall verdict

- Accepted countries

- XM forex broker review – scam or not?

- What is XM.COM? – the forex broker presented

- Test of the XM trading platform

- Charting and analysis for forex trading

- Mobile trading for any device

- Trading tutorial: learn how to trade with XM step...

- Open your free account with XM

- Free and unlimited demo account

- How to open your real account

- Choose the best account type for you

- Should you choose fix or variable spreads?

- Do your first deposit

- Review of the withdrawal

- Is there a negative balance protection?

- XM support and service for traders tested

- Conclusion of the XM forex broker review – scam...

- XM malaysia review 2021

- XM malaysia – A quick look

- Is XM malaysia regulated?

- XM malaysia fees

- XM bonus

- XM deposit and withdrawal

- XM account types

- XM trading instruments

- XM trading platforms

- XM customer support

- Do we recommend XM malaysia?

Contents of the article

- My list of forex bonuses

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- XM deposit and withdrawal methods in 2021

- XM malaysia review 2021

- XM malaysia – A quick look

- Is XM malaysia regulated?

- XM malaysia fees

- XM bonus

- XM deposit and withdrawal

- XM account types

- XM trading instruments

- XM trading platforms

- XM customer support

- Do we recommend XM malaysia?

- XM review and tutorial 2021

- Company details

- XM trading platform

- Assets / markets

- Spreads & commission

- Leverage

- XM mobile apps

- Payment methods

- Demo account

- Bonus deals and promotions

- Regulation and licensing

- Additional features

- XM account types

- Benefits

- Drawbacks

- Trading hours

- Contact details / customer support

- Safety and security

- Overall verdict

- Accepted countries

- XM forex broker review – scam or not?

- What is XM.COM? – the forex broker presented

- Test of the XM trading platform

- Charting and analysis for forex trading

- Mobile trading for any device

- Trading tutorial: learn how to trade with XM step...

- Open your free account with XM

- Free and unlimited demo account

- How to open your real account

- Choose the best account type for you

- Should you choose fix or variable spreads?

- Do your first deposit

- Review of the withdrawal

- Is there a negative balance protection?

- XM support and service for traders tested

- Conclusion of the XM forex broker review – scam...

- XM malaysia review 2021

- XM malaysia – A quick look

- Is XM malaysia regulated?

- XM malaysia fees

- XM bonus

- XM deposit and withdrawal

- XM account types

- XM trading instruments

- XM trading platforms

- XM customer support

- Do we recommend XM malaysia?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.