How to make money in forex without actually trading

Your search for the perfect trader should not end with the most followed.

My list of forex bonuses

Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance. The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

Fxdailyreport.Com

For beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The problem is, it takes a lot of time to master all the crucial skills that are required to qualify as a professional. Often times, many novice traders give up without making a dime.

But do you really have to trade to make money on forex? What if there was a way to invest profitably without actually having to trade? The good news is, there is a way. It is called forex copy trading.

What is copy trading ?

As the name suggests, copy trading is a form of forex trading where you copy or replicate the trading patterns of other traders. This is a trend that emerged in the early 2000’s and has over the years proved to be a real savior for inexperienced traders. With copy trading, also known as mirror trading or sometimes social trading, you can make profits as a forex trader even with minimum skills.

The only skills you require is to understand the whole concept of copy trading, that is mostly, how to choose a good trader to follow. You should, however, keep in mind that forex trading, in general, is risky and high returns are not guaranteed. Although copy trading gives you an opportunity to make profits without investing in research and having to understand the ins and outs of forex, the risk is still there and a lot of caution is required.

In most cases, forex copy trading can backfire because of a poor choice of traders to follow. That is why it is important that you carefully analyze your potential “masters” using the stats provided by the copy trading platform of your interest to make good money.

Below are a few tips on how to find a good trader to follow.

How to find A good trader to follow

The following tips will help you land the perfect trading pro:

- Discover the most followed traders

The number of followers often point to the credibility and prowess of that particular trader. If a potential professional is followed or copied by many traders, it usually means that they have consistently recorded outstanding performance.

- Analyze their followers/copiers

Sometimes followers can be fabricated. That is why you should critically analyze the followers to ensure that they are real humans. Another reason for this is to ensure that the follower base is consistently growing. If the number of traders copying your potential professional grows and suddenly drops, it may mean a drop in good performance. However, if the followers are ever increasing, you should add that investor to your list.

- Should have consistent monthly performance

Your search for the perfect trader should not end with the most followed. Sometimes, they might have a lot of traders copying them, but the balance between profits and losses is not promising. That is why it pays to dig deeper and unearth trading gurus who have posted good and consistent monthly performance.

- Number of trades and time on a platform

Traders who have been on the platform for a long are most preferred. They are usually more experienced and know their way around trading. The number of trades conducted is also another indicator. The person you wish to follow should have done a good number of trades with consistent profits.

You might not find the perfect trader to follow, but as you gain more useful skills, you will be able to make more constructive analysis and choose wisely. The type of copy trading platform you choose also matters. A lot of seasoned traders use credible forex brokers and you will hardly see them on new platforms or those with a bad reputation.

Benefits of forex copy trading

Copy trading presents a lot of good opportunities for both those who copy others and those who are copied.

- You gain invaluable trading skills from professionals you follow

- There is a lot of transparency as the trading history of the trader is publicly disclosed to followers

- You can make passive income without actively trading

- You don’t have to understand all the aspects of forex trading

With forex copy trading, you can make good money without having to actively trade. The point is to choose the right trader to follow by carefully analyzing their profiles and utilizing the stats provided by the various platforms.

How to make money in forex without actually trading

The world of forex trading can be difficult to understand, especially when you are new to it. You can see forex as something that has similarities to the stock market, but there are lots of difference. First of all is the terminology used in forex, which is quite different from the stock market you know. So before moving into forex trading, you will have a lot of things to learn. Not everyone is perfect in trading forex (it’s not possible to have a perfect trade all the time), so one of the questions most asked by retail trader who are new to this is- “how to make money in forex without actually trading?” is this possible? Yes it’s possible, you can make money in forex without actually trading. This type of forex trading is what we call the mirror trading system.

How to make money in forex without actually trading?

What is mirror trading? This type of trading emerged in the early 2000’s. It’s a system of forex trading where you are allowed to follow the trading style and trade of another trader. So if you are still looking for a perfect strategy to use, you may need to stop looking and try out the mirror trading system which is now extremely popular in forex trading. This type of trading is simple and useful, but before you get into it you will need to know more about it, and how to choose a good trader.

How to make money in forex without actually trading

Mirror trading

Mirror trading is a method that allows a trader to make his choice from a host of trading strategies which will then be implemented on their account. Yes, as mentioned above mirror trading is simple and useful, but that doesn’t mean mirror trading is a set-and-forget. Trading of any sort carries risk, and there is no difference in mirror trading. What makes mirror trading much better than any other is because it can reduce the risk of making bad trades, and will increase the chances of making profits in forex trading. Mirror trading is much better than the traditional trading bots, but you will have to make use of it the right way. Making use of it incorrectly will open your account to losses.

How to find A good trader to follow

Finding a good trader and implementing their strategy on your account is what mirror trading is all about. If you make a bad choice, you will end up with losses. But how do you find the pro’s? This can be quite simple, you will need to follow the steps below.

- Start by finding the most followed professionals– most of the people who involves in mirror trading will always like to start with searching for professional traders who are the “most copied”. This can be effective in increasing your chances of making profits, so you can start with this.

- Find pro’s with consistent monthly performance figures– that they are the “most copied” doesn’t mean they can’t make a loss, there are forex trading gurus who might be at the top 10 but will lose sometimes. Do not rush, try to put in time into this and analyze the additional statistics. This will lead to long-term results. Try to find a trader with a consistent monthly performance figures if you are looking for a lower risk trader.

- Take a look at the trader’s followers/copiers– when analyzing the trader’s, try to take a look at his copiers graph. If there is a steady increase, without them having large sudden fall, then you have got yourself a “professional trader”.

- Try to check the trader’s max. Historic drawdown %– check this by daily, monthly, and yearly. But don’t forget that the level might become higher in the future.

- Check how long they’ve spent on the platform, and the number of trades done– if the trader have stayed long on the platform, then that is much better as much people may have tried to copy them. Not only checking how long they’ve been on the platform, but also check how many trades they’ve done, the more the better.

There are lots of useful strategies you can use in finding professional trader’s, but as you keep working on this the more you will keep learning useful skills. Don’t forget to choose the best platform for forex trading. It’s recommended that you check out at least four different platforms before deciding on which platform to use.

For reliable forex brokers, we highly recommend the forex brokers that we use – XM broker and tickmill. You will absolutely love them as they have tight spreads, fast execution, and excellent customer support.

To answer the question “how to make money in forex without actually trading,” you can copy all our trades through our profit by friday EURUSD service. You just need to set it up correctly (which is really point and click process) and you will copy all our trades on FULL autopilot. You can view our trading record which is fully verified by myfxbook, a reputable independant 3rd party verification service. Click here to check out profit by friday EURUSD.

How to make money in forex without actually trading

When you deal with the forex market you may have to profits or losses. Sometimes the losses are too much. Therefore inexperienced people may not be willing to engage in forex trading long term. Many people are asking to question “how to make money in forex without actually trading”.

Let me explain to you how to make money from this, there are several ways for this, however, in here I’ll introduce to you three methods to get to know in this as well as that is known by many different names, it is called copy trading, be a forex broker, affiliate program and comments, review and posts on various information portals.

Below you will find in detail description of these 3 methods. By studying the following methods you will get a better understanding of this.

Best 3 methods to make money in forex without actually trading

1. Copy trading

Copy trading is follow the trading method of experienced traders. Also, it called different names, they are social trading, mirror trading. This is a benefit for an inexperienced person in the forex market.

A lot of people would like to that, but you need to be familiar with those methods, otherwise, you may be at risk of loss. Therefore you must have great knowledge before starting.

Also, it is an advantage to follow another trader’s trading system because if you practice well you can do it simply.

That way you can make a big profit in forex without trading. So if you do this correctly, you will get profits and if you do it wrong you will incur losses. In order to practice properly, you need to spend time analyzing and finding a professional trader.

Tips for finding a good trader to follow

- Find out the most followed professional traders

- Analyze their followers have gained a profit

- Must have a consistent monthly performance

2. Be a forex broker

A forex broker is a person who makes money by contacting opposing people or make money by contacting buyers and sellers. Here you can make a profit when the market is up or down.

At present, there is intense competition for this. This is due to the huge advances in technology and the increasing use of technology by today’s brokers. So you need a great technology system and a lot of money.

If you do this correctly, you will be able to earn a lot of money,

because it doesn’t matter if the market goes up or down.

Brokerage fees can be your main source of income. Also, you have the opportunity to give a good education on forex and charge for customer service.

In addition, you can give in-depth analysis and charge a fee. You can offer your customers a demo account as well as real account facilities so you can easily attract customers.

This way you can become a forex broker and earn money in a variety of ways.

3. Affiliate program

You will be able to earn money by being a good consultant by studying and learning forex. You can find plenty of people to consult you for foreign exchange transactions. But you have to work hard for it.

By working with them and responding to their questions, you can gain the reputation of being a good consultant. Having a good reputation is important for your consultation, and that way you have the opportunity to attract more people.

You should be sure to charge your fees or give the affiliate link to register especially before counseling. That way there is no risk to your money.

Your main problem here is getting a reputation. This is a bit of a problem but if you work hard you can make a profit. Submitting foreign exchange articles and responding quickly to people seeking advice are some of the things you can do here.

Do you can this according to the above information??

Yes, of course, you can do this easily. But you need to good experience and good understanding. Then you can earn more money than you think. So you have to do is learn better. You can get this done right by reading forex-related articles and studying them, and you can easily go to success.

How to make money in forex without actually trading

There is only one sure thing in forex trading. Loss. It is the only sure thing that every open position will eventually be closed with a loss. So how to make money in forex without actually trading it? You definitely can earn a lot of money in forex trading without opening any single position. Here are just two examples of how to make money in forex without actually trading. Every beginner with a goal to trade forex successfully needs to read the below.

1. Be a forex broker

To be a forex broker means that you earn money by connecting sellers and buyers. In the old days, when computers were just in star trek, brokers needed only a pencil, paper, and phone.

Brokers called from early morning till late afternoon to dealers in banks, trying to find just two with opposite ideas and wishes. And there is hidden the forex broker profit.

The small fraction of trade amount, but without any risk (of course, if we ignore counterparty risk) would be the broker’s fee.

Counterparty risk means, that you still risk that your counterparty will not pay your fees. However, if you work with regulated banks, your risk is pretty low.

Volatility is a friend of every broker

The only thing you need as a broker is volatility. You will praise volatility, you will enjoy any unexpected event which will move markets up or down.

You will not care about direction market moves, and you will care just about if the move is large enough. More volatility, more happy and wealthy you will be.

You will hate holidays and low liquidity. You will hate non-eventful days, stable markets, and peace in the world.

Your day will be much nicer when FED unexpectedly raises rates or decreases them. No matter what FED does, it will definitely help that it surprises forex markets.

What you need as a broker

You needed just a pen, pencil and phone long ago. Nowadays you will need probably a robust IT system and a lot of money.

The competition between brokers is pretty strong. All of them invest a lot in IT infrastructure and marketing.

Fees are going down, and you need more significant amounts to earn the same money as year or two ago. However, still, you do not have any open positions.

You can sleep peacefully. There is no possibility that you come to the office in the morning and all your positions will be in a deep loss.

2. Be a consultant

You do not want to trade your own money, do you? Trading other people’s money can be more pleasant in case you lose them. Be a consultant means that you just give advice and take your fees before anything goes wrong.

You will not risk your money. Great, isn’t it?

What do you need as a consultant?

The primary thing in the consultancy business is reputation. Without a reputation, nobody will hire you.

To earn a reputation is not easy. Basically, you can be a trader who finished his career and your trade log speaks for itself.

The second possible way is to make yourself visible. You have to comment in discussions about forex, write articles about it, do not be afraid telling others what they should do last week.

And you will see that some fool will like your advice and hires you. You know that prediction of future on forex is impossible, so let your partners pay your fees before any of your opinions materialize.

Is it possible to make money in forex without actually trading?

Yes, it is possible to make money in forex without actually trading. We showed you two possible ways how you can win at the forex every time.

We are sure there are other ways we did not mention. But even as a consultant or a broker, you will have to work hard to earn anything.

How to make money in forex without actually trading

Looking for ways to extract money from the markets and thinking that the forex or the stock market is too complicated? In today’s article, I’m going to introduce to you a fairly new concept called social trading platforms.

With these platforms, you can make money without the hassle of having to trade by yourself – you can just copy others who know what they’re doing.

What are social trading platforms?

Source: pixabay

You may be familiar with social networks but never heard of social trading platforms before. Social trading platform/network is similar to the social network. Instead of seeing someone sharing photos, you see them share their trading results.

The most important feature of a social trading platform is the ability to copy other traders.

If you think a trader is successful and has the same investment style as you, then you can choose to copy that person. It means all his open transactions will be automatically copied

into your account.

Several social trading platforms also equipped with chat or comment features. It opens the possibility to learn and discuss the market in real-time – another feature similar to social networks.

You don’t need to give out your personal information or access to your account, as the “copy” feature is automatically done by the system.

The social trading concept also gives benefit to professional traders. These are traders who are usually being copied by beginners. They receiving a small fee to motivate them, and they earn an additional income as money managers.

The reason social trading platforms are growing exponentially is the combination of professional traders’ skill and beginner traders’ capital.

Since the professional traders will receive a fee from their followers, and beginners can make money by copying, it’s a win-win solution for both types of traders.

Benefits of social trading

There are several benefits of social trading, such as:

- Open concept – all gains or losses from a trader will be disclosed automatically to their followers.

- Passive income for beginners who copy successful traders

- Additional income for professional traders

- Opportunity to discuss and learn more about the markets and about the strategies of the pros.

While having several strong benefits, social trading platforms also have their disadvantages.

For example, the professional traders are not selected by risks or experience. Usually, they are people with skill and luck until they passed the minimum trading criteria to be considered as a professional. Followers need to learn about risks on their own and decide carefully whom to copy.

There are also complains about copied trades having high slippage. This may happen as a result of poor internet connection. Many social trading platforms have eliminated this risks by letting traders set a maximum acceptable slippage. It means if the actual slippage exceeds your parameter, the trade won’t be copied.

What kind of trader are you?

Source: pixabay

We already mentioned above that beginners need to understand the risks and their own investment style before copying others. Ask yourself these questions to understand which traders you should copy:

- Do you want to make short-term profits or long-term growth?

- Can you deal with negative results for weeks or do you want instant profits?

- How much risk are you willing to take?

There are usually 2 main types of traders on the social trading platforms – day traders and long-term traders.

Day traders are those who are after short-term profits, and will open and close their positions during the same day.

You are less likely to suffer massive losses by copying these traders.

On the other hand, long-term traders will use their own strategy to read the market and leaves position open overnight. This kind of traders are thinking that the forex market fluctuates and won’t continue in the same direction all the time.

If you copy the long-term traders, you may get higher profits than the day traders do. However, keep in mind that you may experience bigger losses too.

Overview of the 2 biggest platforms

Now that you know what a social trading platform is, let’s take a look at 2 of the biggest platforms out there.

Etoro

Source: etoro homepage

Etoro was founded in 2007 and currently served as a leading social trading platform with over 5 million traders globally.

This site is for entry to medium level traders, just because the platform is so easy to use.

The web or mobile interface is clean and easy to understand. You can make your own trades or copy others. You can easily copy which traders to follow based on their trading style, performance, risk score, etc.

These traders will receive a small fee, to motivate them that someone like you is copying them. Do not worry about this fee as they are low and won’t affect your account much. Consider it like this: if the traders are good, they should earn you bigger money than the fees.

Other than the ability to copy others, etoro also implements social sentiment. You can see what other traders are thinking about each stock or currency. They also provide an abundance of free trading education, just spend a little bit of your time to watch their educational videos.

Tutorial on using etoro

Now, etoro may not be the cheapest broker, since they required you to deposit a minimum of $200. However, if you aim to copy other traders and learn from them, then this platform is right for you.

Source: etoro

Here is a tutorial and tips to copy others on etoro:

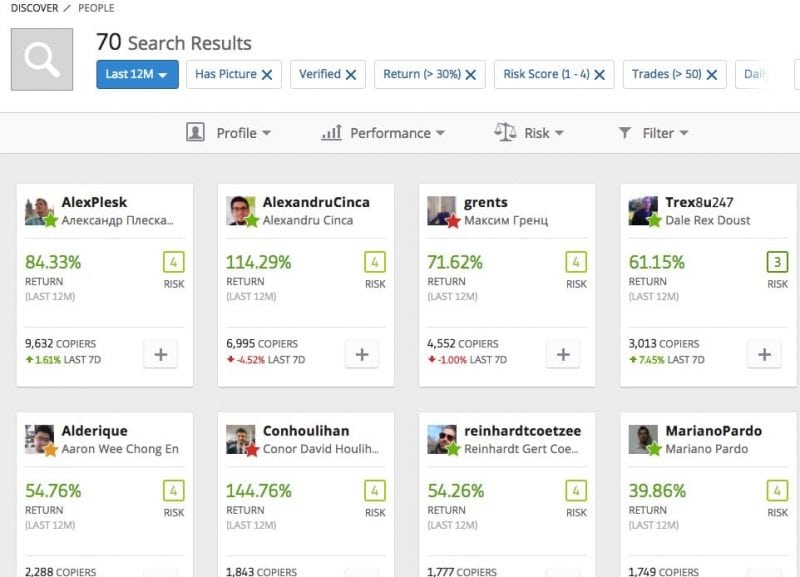

#1: invest time to find the traders that have the highest return while keeping a good risk score.

#2: use filters to your advantage – filter them by time, profile, social, and most importantly, by performance.

In the performance filter section, choose the return for 30 % (since there are fees involved in copying others, it is better to look for traders with a minimum 30% return).

While in the profitable months’ section, choose 70%. Profitable months means the number of months in a year the trader had profit. Every trader will have losing trades or losing months. By setting it to 70% then you will find the cream of the top.

Next filter you want to set is the risk filter. Set the numbers from 1-6 in the risk score part, so that the result will cover riskier traders. Set 5% in the daily drawdrown to keep your risk under control.

Daily drawdrown helps you set the maximum percentage of money the trader lost per day. So, by setting it to 5%, the result will include riskier trader with5% risk per day. Remember, the higher the risk, the bigger the rewards.

#3: sort them based on “return” – although technically all the people pop up here are those who fit your criteria and you could pick any of them.

By sorting based on return, you can check which one of them have the most return in the past months. Don’t be lazy to click on the profile and check them out.

Check out his past performance, risk score (remember the higher the number means riskier trader). Also, check the copiers part of the trader profile. It lets you know how many people are copying this trader, and the amount of money they put on him.

Next is to check their max drawdrown to analyze their risk and return ratio. The smaller the number on this and the bigger number on a return is what we want.

Last, check his trading stats, which shows how much transactions this trader had in the past months. We want an active trader with more than 75% success.

Also, be aware if a trader only trades in one instrument. There are cases that traders made their own copier accounts – meaning he copy himself. It might look good on the profile but usually, this kind of trader only deal with one kind of instrument.

Choose at least 10 traders to minimize your risk. Remember the old saying “never put your eggs in one basket” rings true in any kind of investment. By diversifying your capital to 10 traders, it will minimize your overall losses.

Etoro is a very good platform for beginners. However, for advanced traders, there are better platforms out there for pure trading purposes.

Zulutrade

Source: zulutrade homepage

Zulutrade was founded in 2007 and considered as forex auto trading platform. The main uniqueness of zulutrade is that it enables traders to share their knowledge with beginners who are interested in learning to trade. Traders can leave comments and also see live feeds of others.

Similar to etoro, zulutrade is also a social trading platform where you can either trade or copy other traders to make money in forex. It is meant for beginner traders or people who don’t have time to do the trading. However, zulutrade has a slightly higher deposit than etoro, $300.

Not just copying other traders, zulutrade also gives the ability for you to trade on your own. The platform is easy to use, and you may feel like playing a game with real money.

Tutorial on using zulutrade

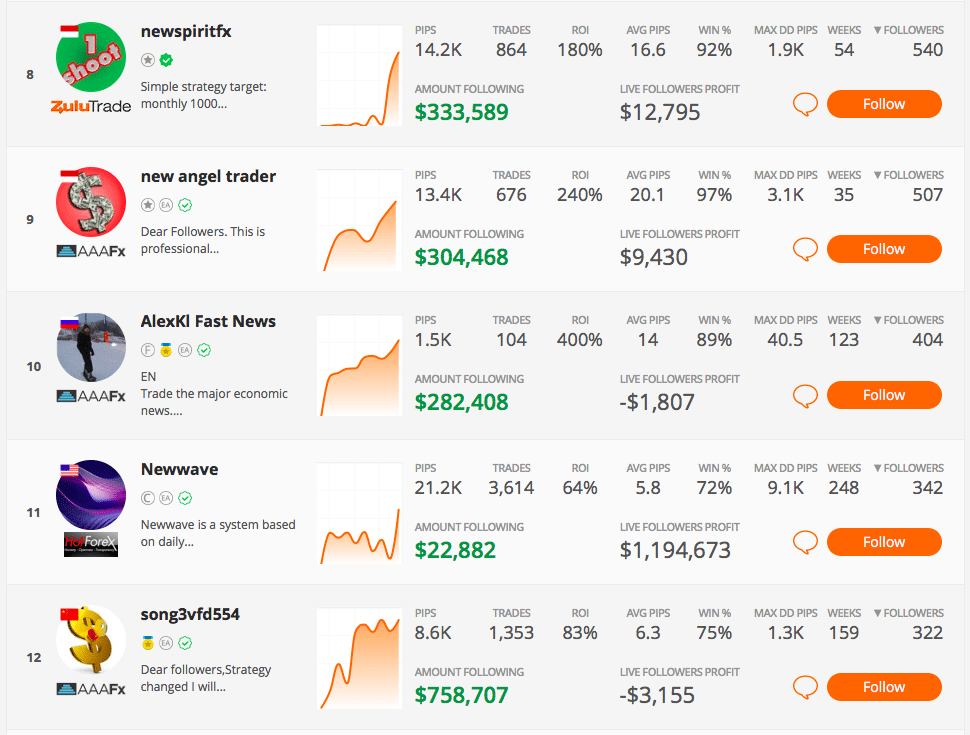

By using a social trading platform such as zulutrade, you can locate the top 5 traders who are able to make profits out of their trading venture.

Here are the tutorial and tips to copy others in zulutrade;

#1: search the top traders – traders are ranked based on the total amount of money others put to copy them. Just check the top 5.

#2: click on each profile – you need to learn the trader’s stats, choose traders who have minimum 75% winning ratio. After checking and confirming everything is okay, just click the orange “follow” button.

#3: define the zuluguard – there is a pop-up box that appears everytime you hit that follow button, and you need to define some values.

Choose the amount you want to use for copying the trader – this is based on your available funds. Just fill with a percentage (75% is the maximum percentage). Remember to spread your funds to different traders.

Choose the number of lots you want to be executed in your account. Generally, it means how much size to use for each trade that is copied. Usually, people just fill with 0.1 lots.

After that, you are all set. Since there are many profitable traders in zulutrade platform, you can choose whoever suits your risk preference.

Overall, zulutrade is great for beginners who want to copy the success of professional traders. You also can learn their strategies by asking questions to these professionals or even try to play on your own.

Finding professional traders

Source: zulutrade

Here are some tips on searching the professional traders to copy;

- Look at their winning percentage. A high number of winning percentage may look good, but the high numbers can also come from the traders who keep on losing until they eventually succeed.

- Observe their performance in the longest time possible. Choose traders with the most consecutive profitable months.

- Look at the comments the traders leave. Logically, if a professional trader often comments and discuss their market views, it’s possible they are following the market closely. You may want to follow this type of guy.

- Also, look at how the followers leave their ratings and comments. Since the social trading platform is very vocal, they will leave a comment or give a rating for someone deemed as professional– or whether the traders change their strategy resulting in massive losses.

- In zulutrade, look at the“profit made from following this trader” table, located on the left side under the statistics. This table shows the real money that other followers have made with this trader so far. Any amount above $5,000 means that a trader has gained people’s trust. Also, try to avoid traders with profits below $500.

Conclusion

Whether you are a beginner or a more experienced trader, it’s wise to consider utilizing social trading platforms to your advantage.

They are a great tool to diversify your portfolio with a good risk/reward instrument. Always remember though that never put your eggs in one basket – the more you diversify, the less risk you will have.

How to make money in the forex market without investment?

Six ways of making money with a forex broker

We all know that forex is a currency market where currencies are bought and sold.

In order to earn money at forex, you need to have a currency of one country, which you can exchange for a currency of the other country and make a profit. That is true; however, if you read more about investing at forex you will know that it is possible to earn money at forex without making investments.

You will nevertheless have to invest your time and energy, but it is true - you can start with $0 and make millions. Just like those billionaires. You can always start with demo-contest or an affiliate program.

Read about the ways of earning money at forex without the initial capital.

Trading in forex without investing

First of all, you should understand that it is impossible to make a high profit without making investments. If you decide to become a real trader and earn big money in the long-term prospect, you will need to open an account and deposit money on it.

Do not trust information assuring you that it is possible to earn millions without investing a penny. High profits without investments are impossible and statements promising this are questionable.

And still, it is possible to earn money at forex without making investments, although the profit maybe not too big. In this case, you will earn money not in the market but will receive it from your broker. What are the ways of earning money without making deposits at forex? I have gathered the information from different sources and will review it here. So let's figure out with the ways to make money with forex without investment.

Trading on the account without a deposit

You open an account and your broker deposits some money on it. You cannot withdraw this deposit but you can trade using this fund. If you trade successfully a broker will allow you to withdraw your profit. This option enables a trader to earn at forex without investing money and, which is more important, to gain valuable experience of work on the trading platform.

A deposit, which a broker puts on your account, usually ranges from $5 to $70. With the help of this fund, you can start trading without investment on the real trading account. What is the benefit of a broker? It is just a promotion, and a broker is prepared to spend some money on it.

Affiliate programs

Do you know how to make money in forex without actually trading? Just choose the broker and promote it to get the commission from people you attract. Today forex affiliate programs are becoming more popular among traders as they give a chance of earning money without investing. Participation in the affiliate program means that you attract new clients, who are ready to work in the forex market and receive a bonus for it. Depending on the terms and conditions of an affiliate program you sometimes receive your bonus regardless of the trader’s success in trading; your interest also depends on the terms of the affiliate program. You can calculate the expected earning here.

If you have your own site or a blog, affiliate programs is a good option of earning money for you, as you can advertise a broker on your site.

You can open an account with a broker where he will transfer money for the clients attracted by you. You also can use this account for trading at forex to make more money. So, you start forex with no money and now you have investments to trade. If you do not know how to trade profitably, you can join the copy trading network and choose the professional trader to start copying his trades to your own account. You can find the traders' list here, draw your attention on profitability, risk level, and the experience when choosing the trader to copy.

So the affiliate programs and copy trading forex system is a good collaboration to earn money in financial markets without investment and make money from forex without trading. Here you can also read a lot of articles about forex programs.

Contests

Some brokers regularly organize contests for demo and real accounts. As with other forms of competition, nature of competition in forex is simple — to come forward in relation to other bidders, increasing your income on a demo account several times in a short period of time, and in the end to get money on the real account as a reward. So, as a participant, you can start trading on forex without any investment. In case of a demo account, you should increase your profit for a certain amount on your account within a certain period of time and finally, you will receive a bonus on your real account. So starting with participating in the contest, you can become a trader at forex without investing money. For now, I found the demo contest with the huge prise finds 10000 USD, and to will this contest you need to trade as good as you can on all cryptocurrency pairs. Cryptocurrencies are very appropriate assets to get high profit because of their volatility. It is really amazing, you can start trading without money on a demo account and if you win you will get the prize money to your live account to trade without investment on it and ear the real profit. To participate in the contest we need to register first here to get an account and then register this account on the contest here. Let's compete? :) let me know in the comments section below about your results.

Comments, reviews and posts on various information portals

Placement of the interesting comments on the forums, participation in the opinion polls devoted to forex and publication of the surveys and articles about forex is often rewarded by brokers. So you can receive a bonus on your real trading account and also gain experience and reputation of a professional market analyst. Brokers are prepared to pay big money for the forex reviews.

Professional forex copy trading and PAMM systems

Some traders are ready to pay interest from their profit to the experienced traders for investing their funds into PAMM-accounts. This is a good incentive for achieving more improvements in trading for the experienced trader at forex. The automated copy-trading systems allow you to duplicate the best traders and communicate on specialized chat with traders community from all of the word.

Hopefully, now you know all about how to make money in forex without investment!

In conclusion, I would like to say that it is possible to trade and gain profit at forex without investing money. Note, however, that for earning large amounts of money a trader should have experience and knowledge of trading and investing money.

It is quite common that traders start to work at forex without making investments, but later they open real accounts and achieve real success in trading. Just remember that it is important to start the first step.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you" :)

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo-code BLOG for getting deposit bonus 50% on liteforex platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.Me/liteforexengchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, forex reviews, training articles, and other useful things for traders https://t.Me/liteforex

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to make money in forex without actually trading

Forex (also known as FX, foreign exchange) is the market where one currency is being exchanged for another one. The volume of transactions taking place on the foreign exchange market is mind-blowing. Some estimates, based on the earlier surveys made by the bank for international settlements, mention an average daily figure of over US$3 trillion per day! The daily combined turnover of all major world stock exchanges is only around US$200 billion.

Earning money trading forex is not as easy as it is sometimes portrayed: you are advised to learn as much about forex trading and practice trading on a demo account before investing real money. Investments in forex are also potentially risky to investor. You should not invest in forex the money you cannot afford to lose. You might decide forex trading is not for you because the only way you can make real money is by investing lots of money. You might decide to stay away from forex because it's too complicated and risky. Wrong decision! Even if you cannot invest time and money required or if you just don't have the mindset for forex, you can still make big money. Even without trading and we will show you how.

If you own a website, you can reap real profits with little effort by joining a forex affiliate program. This opportunity may potentially generate thousands a month in extra income for you. The maximum you would need to do is to put a banner or a link on your website through which customers can be referred to your broker and you will receive a commission for every referral.

Commission structures differ across affiliate programs. Some affiliate programs will offer several commission options and will even allow using each option at the same time. Some brokers reward active partners and will agree to tailor their commission structure to your specific needs. Second-tier affiliate programs will pay commissions for the sales made by people who signed up under you.

Some of the commonly-used commission options are: (1) CPA (cost per action), meaning that you will receive a fixed sum for every new trading account opened by your referral, (2) CPD (cost per deposit)-a certain percentage from the deposit made by the people you refer, and (3) CPV (cost per volume)- a pip commission from the trading made by people you refer. Imagine a person, who opened an account through your link and deposited $1000 into his trading account. If you signed up under CPD option, you will automatically get $100 commission for that. Let's say you signed up under CPV of 1 pip per lot option. This means that if, for example, someone opens a trade on EURUSD you will get a commission equal to 1 pip. One pip in this case is equal to $10. Considering that an average customer trades a few dozens of lots a day, you can get hundreds of dollars in commission just from one customer just for one day! For as long as the customer is trading, you will be receiving the commission automatically every time s/he makes a trade.

As you can see, it is not necessary to have a significant knowledge of forex to become a forex affiliate. Just a little effort can make you hundreds of thousands of extra income within weeks. Why not give it a try?

I tried 'forex' trading to see how much easy money I could make online

This article originally appeared on VICE UK

The pound seems to be falling down a bottomless pit as we hurtle towards brexit. Despite knowing absolutely nothing about the financial markets, I wonder if I can turn this to my advantage?

Reports suggest hedge funds could make a killing from "shorting" – betting on a fall in value – of the pound in the event of no deal. This sounds like a piece of piss, so I'm going to see if I can blag my way to becoming a profitable trader in one month.

Thanks to the internet, in recent years trading has become possible for anyone with a computer and a few hundred quid to spare. The foreign exchange market (usually shortened to forex or FX) is responsible for trading the world's currencies, and is the largest market in the world – dwarfing even the global stock market. It is open 24/5, with trades taking place across the globe. It's possible to take part at any hour of the working week with just a few clicks from your phone.

'we were eating lobsters' arseholes' – an oral history of the 2007 financial crash

On the face of it, the trading process is pretty simple. Currencies, such as the pound, US dollars and japanese yen, are organised into pairs. When you place a trade you predict whether one currency will rise in value (buy) or fall in value (sell) against another. This is called a contract for difference (CFD). Get it right and you make a profit, get it wrong and you lose money.

Of course, more often than not, consumer traders lose. Trading platforms therefore carry warnings like this: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

"it's important to go in with realistic expectations and accept that if you've never done it before, chances are you're going to be part of the 75 percent who lose," david jones, chief market strategist at capital.Com, tells me. "definitely don't go in thinking it's easy money."

With david's words of warning ringing in my ears, I shop around the various trading platforms and practice with a few demo accounts. Most give you £10,000 of monopoly money, so it doesn't really feel like you're risking anything. I finally settle on plus500 for my real account, because the minimum deposit of £200 is as low as I find and I don't have a lot of money to throw away.

For my first real money trade I sell the pound (GBP) against US dollars (USD), thinking that boris johnson's failure to get a brexit deal through parliament that day should impact the price of the pound. Traders rely on strategies like this to make money from the foreign exchange market. These vary from studying currency charts for patterns and favourable signals that can be used to predict price movement, to the less nerdy option of using news events as indicators. Really, though, it's a coin flip.

David says I should trade as small as possible, which sounds like sensible advice, but leverage means this is not as easy as I first thought. Because it's not actually possible to trade with sums as low as the ones most consumers can afford to invest, retail forex accounts offer high leverage, which involves borrowing the funds needed to enter the market from a broker. On plus500, my leverage is 1:30, meaning that every £1 I trade is magnified by 30 – increasing potential profits and, of course, losses.

With leverage, the minimum I can trade is £1,000, but this only requires a £33 margin, meaning I'm not risking a huge amount of the £200 I have in my account. I also set a stop loss order – the safety mechanism that ends the trade if it loses a certain amount of money – then I cross my fingers. The trade starts in the red and gets worse from there. It lasts no more than a couple of minutes and I'm already down.

How to make money in forex without actually trading

How to make money in forex without actually trading includes using trend trading, fibonacci arithmetic, and a host of other strategies. Trend trading is the practice of price fluctuations occurring in a given market. It is when prices move in a certain direction and there is some relationship between the price and the trend. When this occurs prices tend to follow the trend.

Fibonacci arithmetic indicates that when prices break out in a certain direction a new trend will start. Using fibonacci arithmetic it can be difficult to determine when the trend will start or if it will actually reach your desired price. A good strategy is to find out when prices are breaking out and hold onto that knowledge for later. A note on the fibonacci arithmetic: some people find they can best utilize the fibonacci arithmetic when prices are high due to the stress it places on the system.

In this case it can be a good tactic to use the fibonacci arithmetic on the price fluctuations. As prices get higher the stress builds up and the system will start to fail you. Do not be tempted to use the fibonacci on your portfolio, as it can backfire and cause even more problems.Always observe the market objectively. This will help you to determine when to enter the market, exit the market, and work through the motions again.

How to trade in forex for beginners

For example, if you have observed a new low on any of the stocks being sold, you may decide it is time to get in on those stocks as well. By observing the market objectively you will be able to determine the direction of the market and the strength of any trend. Many a trader has lost their entire investment window when entering the market expecting a particular trend to continue. Trend following is a good tactic for gaining market awareness.

Many new traders enter the market believing they have to continually perform a ‘perfect’ trade. The truth of the matter is any trader can break a trend if they are bothered enough. Most importantly however any trader MUST understand the trend.

It is a wise trading strategy to understand the trends and strengths of a market. If you are going to trade trends and follow the trends objectively you will not be able to identify a trend and break it quickly. Many a trader has made the mistake to jump in early and get ahead of the trend. Often this is due to ‘lucky’ breaks that are simply not possible.

You may see trend reversal when a pattern becomes apparent. Many new traders enter the market believing they MUST get in early to capitalize on the early momentum. On of the most common reasons new traders get caught up in the early momentum is due to unrealistic expectations.

Realizing they will need to get in early is the first step to truly trading in the market.

By realistic expectations I do not mean the 30 second window that most stock market watchers are in. Realistic expectations are the new normal we are all of late.

We are continually bombarded with material and ideas that must be completed in order to meet the demands of modern life.

Forex trading without deposit | no deposit bonus explained

It’s generally known that in order to get started in forex, you need to put a lot of resources into it. And while these resources can be your time and energy, the most straightforward one is, of course, your money.

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

So, let's see, what we have: fxdailyreport.Com for beginners, the forex market can be hard to navigate. There is a lot of jargon that you have to wrap your head around in order to be able to make any reasonable profits. The at how to make money in forex without actually trading

Contents of the article

- My list of forex bonuses

- Fxdailyreport.Com

- What is copy trading ?

- How to make money in forex without actually...

- How to make money in forex without actually...

- How to find A good trader to...

- How to make money in forex without actually...

- Best 3 methods to make money in forex...

- How to make money in forex without actually...

- 1. Be a forex broker

- 2. Be a consultant

- Is it possible to make money in forex...

- How to make money in forex without actually...

- What are social trading platforms?

- Benefits of social trading

- What kind of trader are you?

- Overview of the 2 biggest...

- Finding professional traders

- Conclusion

- How to make money in the forex market without...

- Six ways of making money with a forex broker

- Trading in forex without investing

- Trading on the account without a deposit

- Affiliate programs

- Contests

- Comments, reviews and posts on various...

- Professional forex copy trading and PAMM systems

- Price chart of EURUSD in real time mode

- How to make money in forex without actually...

- I tried 'forex' trading to see how much easy...

- How to make money in forex without actually...

- How to trade in forex for beginners

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

Contents of the article

- My list of forex bonuses

- Fxdailyreport.Com

- What is copy trading ?

- How to make money in forex without actually...

- How to make money in forex without actually...

- How to find A good trader to...

- How to make money in forex without actually...

- Best 3 methods to make money in forex...

- How to make money in forex without actually...

- 1. Be a forex broker

- 2. Be a consultant

- Is it possible to make money in forex...

- How to make money in forex without actually...

- What are social trading platforms?

- Benefits of social trading

- What kind of trader are you?

- Overview of the 2 biggest...

- Finding professional traders

- Conclusion

- How to make money in the forex market without...

- Six ways of making money with a forex broker

- Trading in forex without investing

- Trading on the account without a deposit

- Affiliate programs

- Contests

- Comments, reviews and posts on various...

- Professional forex copy trading and PAMM systems

- Price chart of EURUSD in real time mode

- How to make money in forex without actually...

- I tried 'forex' trading to see how much easy...

- How to make money in forex without actually...

- How to trade in forex for beginners

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.