Forex account balance

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

My list of forex bonuses

To join the program, read and accept conditions in your members area.

Up to 10% of extra funds

On account balance for trading at roboforex

Regular additional income

Receive up to 10% on your accounts balance regardless their base currency.

All real accounts

The program applies to all types of accounts, including ECN, copyfx, and affiliate accounts.

No restrictions

The percents you receive are not the bonus, and it’s up to the client to decide whether to withdraw this money or use it in trading.

Increase your trading volume

How to receive % on account balance?

Accept program conditions

To join the program, read and accept conditions in your members area.

Trade on your account

Trade on your own or copy deals of copyfx traders.

Receive payments

In case the trading volume requirements are met, monthly % are transferred automatically.

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

Why you need a forex account to trade

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/business-financial-and-forex-concept--hipster-young-woman-freelancer-using-the-technology-laptop-and-smart-phone-mobile-showing-trading-graph-with-the-stock-exchange-trading-graph-screen-background-826586048-59f958c59abed50010a7d3e4.jpg)

Photographer is my life / getty images

A foreign exchange account, or forex account, is used to hold and trade foreign currencies. Typically, you open an account, deposit money denominated in your home country currency, and then buy and sell currency pairs.

Your purpose, of course, is to make money on your trades. Unfortunately, the majority of beginning forex traders lose money; they generally spend less than four months reaching the point where they have lost so much that they will close their trading account.

It doesn't mean that the forex market is a scam, as some critics have maintained, but forex scams do abound. Making money on highly leveraged currency trades is harder than it looks and, at a minimum, requires developing expertise that many novice traders fail to acquire.

How you open a forex trading account

The requirements for opening a forex account have become simpler since the growth of online forex trading. Today, opening a forex account is almost as simple as opening a bank account.

First, of course, you'll need to find a forex broker. All retail forex trading goes through and is managed by a brokerage. Some may be specialized forex brokers, or they might be the same brokerage you use for stock market investing and trading.

You'll need to fill out a brief questionnaire about your financial knowledge and trading intentions. You'll also need to provide an ID, and the minimum deposit your forex account institution requires. That's it. You're now free to trade.

Incidentally, many forex brokers will take your credit or debit card in lieu of cash. So, you really don't need to deposit any money at all—not that this is a good idea. If you don't have the cash now, how will you pay for losses later? Credit card debt carries high-interest rates.

Forex brokers

One of the aspects of currency trading that makes it riskier than trading in the stock market is that the entire currency trading industry is either lightly regulated or—as with some trades—not regulated at all. A consequence of that is that unless you look carefully into the reputation of the forex broker you select, you may be defrauded. There are two ways of avoiding this.

The first is to avoid specialized forex traders entirely and to trade with a general stock brokerage active in the U.S. And therefore regulated by the U.S. Securities and exchange commission (SEC).

The other way to avoid inadvertently connecting with a fraudulent broker is to proceed very carefully when considering a specialized forex brokerage. Only open an account with a U.S. Broker with a membership in the national futures association (NFA). Use the NFA's background affiliation information center to verify the brokerage and its compliance record.

Even then, it's a good idea to choose a large, well-known forex broker like forex capital markets (FXCM). FXCM—like almost all of the largest U.S. Forex brokers—offers a free practice account where you can try out potential trades without risking your capital. Some other well-known U.S. Forex brokers are citifx PRO, an affiliate of citibank, and thinkorswim. Don't be put off by the cute name, thinkorswim is a division of tdameritrade.

Before finalizing your search, compare commission rates between brokers. Transaction costs are an important factor in the profitability of trading activity.

What is account balance?

What does “account balance” mean?

In order to start trading forex, you need to open an account with a retail forex broker or CFD provider.

Once your account is approved, then you can transfer funds into the account.

This new account should only be funded with “risk capital”, which is cash you can afford to lose.

The “account balance” or simply “balance” is the starting balance of your account.

Basically, it’s the amount of CASH in your account.

Your balance measures the amount of cash you have in your trading account.

If you deposit $1,000, then your balance is $1,000.

If you enter a new trade or in trader lingo, “open a new position”, your account balance is not affected until the position is CLOSED.

This means that your balance will only change in one of three ways:

- When you add more funds to your account.

- When you close a position.

- When you keep a position open overnight and either receive or pay swap/rollover fee.

Since the topic is about margin, the concepts of swap and rollover aren’t really related but for thoroughness, we’ll quickly describe it since swap fees do affect your balance.

Just know that there’s a difference between a trade that lasts a couple of hours and a trade you keep open overnight.

The procedure of moving open positions from one trading day to another is called a rollover.

During this rollover, a swap is calculated.

A swap is a FEE that is either paid or charged to you at the end of each trading day if you keep your trade open overnight.

If you are paid swap, cash will be added to your balance.

If you are charged swap, cash will be deducted from your balance.

Unless you’re trading huge position sizes, these swap fees are usually small but can add up over time.

In metatrader, you can see swaps on your open position (if you keep it open for longer than 1 day) by opening a “terminal” window and clicking on the “trade” tab.

The concept of swap and rollover is beyond the scope of this lesson and will not be discussed further, but we just wanted to cover if briefly for accuracy’s sake.

Now that we know what balance means, let’s move on to understanding the concepts of “unrealized P/L” and “realized P/L” and how they affect your balance.

What is account and margin balances in forex

By tyson clayton

What is an account balance

An account balance in the most basic sense is the amount of money held in financial repository at any point in time. It can also refer to the amount of money that is owed to a third party. These third parties could include:

- Mortgage bankers

- Utility companies

- Credit card companies

All types of lenders and creditors fall into this category. To get the actual account balance, the debits and credits are factored in to get the net amount. The account balance also includes the money that is available in your forex trading account after all debits, credits, and charges have been factored together.

In the banking sector, an account balance refers to the amount of money that an individual has in either their checking or savings account. This amount is also arrived at after balancing all the debits and credits coupled with any charges.

What is a margin balance

Margin balances, on the other hand, accrue to margin accounts. These accounts are used by investors to borrow with the purpose of buying new positions or selling short. Investors use margin to leverage on positions and also to profit from bullish and bearish periods in the market.

They can also use them to make cash withdrawals basing the value of the account as the short term loan. They are usually opened under strict terms and conditions. Usually, your broker has to get your signature of approval.

Margin accounts have been regarded as cost effective by many investors. This is due to the margin balance. This, at times, is referred to as creating debt. When the margin balance is created, there is an accrued and outstanding balance.

The balance accumulates a daily interest which is charged by the respective firm. The charged rates are subjected to the current prime rate coupled with an additional charge administered by the lending firm.

It is a requirement that margin accounts maintain a specified margin ratio at any given time. Once the value of the account plummets below this limit, a margin call is issued. This is typically a demand for deposit to return the account back to the specified limits. An investor may use cash or securities if they prefer. Some of the holdings may be sold to raise this cash, or the investor could just pump in new cash.

Why do traders want margin interest

The reason why margin interest rates are attractive to investors revolves around their affordability. They are quite lower than the interest rates charged when borrowing money from financial institutions like banks in norway and across all of scandinavia, for that matter. Hence, they form an incentive to investors. They are chosen in the event that an investor requires a short term loan to purchase an investments. This short term loan is usually cost-effective and scores high in the cost benefit analysis hence the reason why they are preferred.

The margin balance is, therefore, the negative number that is representative of the amount that is borrowed or the debt balance. Trading accounts have to be approved for margin hence a margin balance can only be displayed after this approval.

Forex account balance

When a forex trader has those active positions in the market during open trades the equity on the fx account is the sum of the margin put up for the trade from the fx account in addition to any unused account balance. If you close this position the 500 profit will be added to your account balance and so your account balance will become 5500.

The top forex traders tend to have extremely high average returns

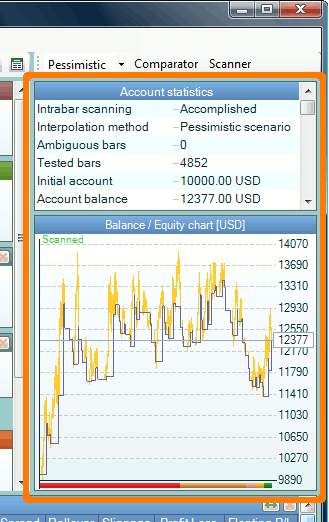

Forex account balance margin indicator.

Forex account balance . An account balance can also refer to the total amount of money owed to a third party such as a credit card company utility company mortgage banker or another type of lender or creditor. For example a 100 pip move on a small trade will not be felt nearly as much as the same 100 pip move on a very large trade size. If trading standard lots a trader can only take positions of 100000 200000 etc.

Forex trading involves significant risk of loss and is not suitable for all investors. If it was a losing position with 500 loss then while it was opened your account equity would be 4500 and if you close it 500 will be deducted from your account balance and so your account balance will be 4500. A forex indicator is a statistical tool that currency traders use to make judgements about the direction of a currency pairs price action.

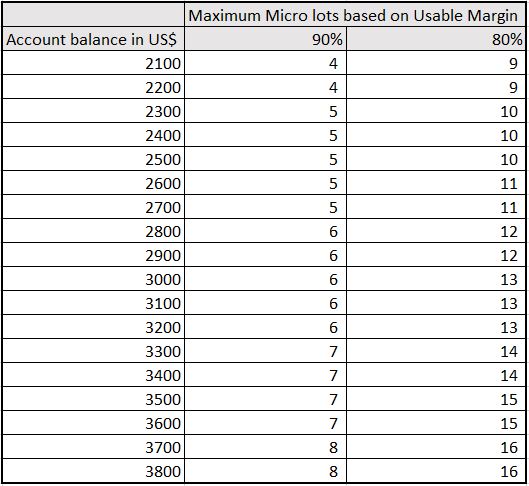

What does forex indicator mean. When starting out in forex day trading its recommended traders open a ! Micro lot account. Trading micro lots allows for more flexibil! Ity so risk remains below 1 of the account on each trade.

For example a micro lot trader can buy 6000 worth of currency or 14000 or 238000 but if they open a mini lot account they can only trade in increments of 10000 so 10000 20000 etc. When there are no active trade positions the equity is known as free margin and is the same as the account balance. If you enter a new trade or in trader lingo open a new position your account balance is not affected until the position is closed.

The downside however is that you can also potentially incur significant losses if the trade moves against you. Your balance measures the amount of cash you have in your trading account. In the banking sector an account balance refers to the amount of money that an individual has in either their checking or savings account.

This means that you can enter into positions larger than your account balance. The trading lot size directly imp! Acts how much a market move affects your accounts. Margin trading allows you to leverage the funds in your account to potentially generate larger profits by depositing just a fraction of the full value of your trade.

The account balance also includes the money that is available in your forex trading account after all debits credits and charges have been factored together. Equity in forex trading is simply the total value of a forex traders account. If you deposit 1000 then your balance is 1000.

How to transfer funds internally between mt4 live accounts faq

Kaufen sie handelsroboter expert advisor forex night trader fur

When will my forex trading combine dashboard be updated topstepfx

Online tra! Ding financial trading cfd and forex trading ig au

Account balance projections forex factory

Automated forex trading with rob beitrage facebook

Beginner S guide to fo! Rex com review 2019 is it safe pros cons

Account panel forex software

Hotforex trading calculators forex broker

Help myfxbook

Mb trading mt4 demo account balance beginner questions babypips

Can you trade forex well with A small balance

Forex indicators forex money management 1

Eurozone july current account balance 31 9 billion vs 28 5

Mark so S unlitrader beta how will esma affect my fxcm uk trading

Question: where/how to check "account balance" & "trading history" on MT5 (metatrader5) trading platform?

All account information and trade history can be found in the “terminal”(or toolbox) window at the bottom of your MT5 screen.

There are multiple tabs in there though, you need to check three of them to see “account balance” and “any tradings/actions history”.

Trade tab

This tab displays your account balance, equity, margin, free margin, margin level, and any open positions and pending orders.

This is the tab which many traders keep opened at anytime, as the tab includes majority of important information regarding to your current trades.

All numbers in there will be updated in real-time.

Account history

In this tab, it displays a complete breakdown of all the orders you have placed including date and time, type, size, instrument, price at open, take-profit and stop-loss levels, price and time of close, swap fees and profit.

Only the closed trades are displayed in the field, and any existing open positions are not included in the list.

These numbers displayed in here is basically the confirmation of trades from your broker. You can also generate report in EXCEL or HTML from here to convert it to a file.

Journal

This tab provides a list of all the actions you have taken on your MT4 terminal, as well as their respective dates and times.

MT5 will record every actions you have taken on it as below.

These actions are recorded by the platform, but not by trading servers.

Fxpro

Post tags

Fxpro is an award-winning online foreign exchange forex broker and offers multiple trading platforms. About 1 million trading accounts for investors from 173 countries worldwide.

Related

Related faqs

Features

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

All forex brokers

All crypto-currency exchanges

Latest article

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

MTN money payment is available for rwanda

Deposit your superforex account with MTN money.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Question: where can I check MT4(metatrader4) account balance and trade history?

All account information and trade history is found in the ‘terminal’ window at the bottom of your MT4 screen.

At the bottom of this window you will find the following tabs:

Trade tab

This trade tab displays your account balance, equity, margin, free margin, margin level, and any open positions and pending orders.

You can mange(modify or close) your existing open positions and from here.

This tab may be the one majority of traders would have it opened at anytime as you can see the current status of your account at a glance.

Account history tab

This tab displays a complete breakdown of all the orders you have placed including date and time, type, size, instrument, price at open, take-profit and stop-loss levels, price and time of close, swap fees and profit.

Any existing open positions won’t be displayed, and the time based in GMT+2(GMT+3 in DST, summer time).

This would be the ultimate confirmation of your executed orders, and in case you disagree with the result, you are required to contact fxpro within 24 hours after the daily confirmation email is sent to you.

Journal tab

This tab provides a list of all the actions you have taken on your MT4 terminal, as well as their respective dates and times.

You can simply see when you logged in/out and took any other actions on the trading platform.

If you have re-install the trading platform, then this log will be deleted too.

Fxpro

Post tags

Fxpro is an award-winning online foreign exchange forex broker and offers multiple trading platforms. About 1 million trading accounts for investors from 173 countries worldwide.

Related

Related faqs

Features

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

Hotforex south africa (ZA) now accepts direct online bank transfer deposit

All forex brokers

All crypto-currency exchanges

Latest article

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

MTN money payment is available for rwanda

Deposit your superforex account with MTN money.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

OPEN REAL FOREX ACCOUNT

ZERO account opening and maintenance fee. NO minimum deposit or minimum account balance requirement!

The standard processing time for completing the account application form is approximately 10 mins.

Clients verified via bank transfer

- Fill in your information in the online account application form

- Make a transfer of no-less-than HK$10,000 for the first deposit (must be transferred from a bank account in the client’s name maintained with a licensed bank in hong kong )

- Send us the supporting documents via your registered email

Clients verified via cheque

- Fill in your information in the online account application form

- Print and sign the form

- Make a cheque deposit of no-less-than HK$10,000 (must be from a bank account in the client’s name maintained with a licensed bank in hong kong )

- Sign and submit the completed form, cheque along with the supporting documents by post or in person .

Note: according to SFC guidelines, if you need to designate more than one bank account for deposits and withdrawals, all designated bank accounts must complete the same verification procedure (i.E. You are required to make a fund transfer of no-less-than HK$10,000 from the bank account and the account must be in the client’s name maintained with a licensed bank in hong kong). Clients who are verified via cheque do not have this restriction.

Apply online: click below to start your application.

Our client services officer will handle your account opening face to face in our TST office.

Standard processing time for account opening is approximately 30 mins.

Bring along your supporting documents to complete the application and your account will be activated within 2 business days. Only_tcsc

Apply in person: click below to arrange for an appointment.

To open a corporate account, please contact us for details on application requirements and procedure.

Before you begin, please read the following:

To open an individual account with us, you must be able to meet our eligibility requirements detailed below.

- You are not a resident of japan;

- You are not a citizen or resident of the united states of america;

- You must be aged 18 or above;

- You have fulfilled our system requirements;

- You have a personal email address and phone number; and

- You are the beneficiary account holder,

If you are a person licensed by or registered with the securities and futures commission or an employee of a licensed person, an official consent letter from your employer is required. For more information, please contact our client services officer.

Forex account balance

Forex trading is available 23 hours per day sunday through friday.

Trade forex at TD ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. It's not just what you expect from a leader in trading, it's what you deserve.

Bringing you global opportunity

Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC international, all from one integrated platform.

Four reasons to trade forex with TD ameritrade

1. No hidden fees

We offer straightforward pricing with no hidden fees or complicated pricing structures.

2. Thinkorswim

Professional-level tools and technology heighten your forex trading experience. Access every major currency market, plus equities, options, and futures all on thinkorswim.

3. Mobile trading

With the thinkorswim mobile app you can access our most powerful trading platform in the palm of your hand.

4. Knowledgeable support

Our trade desk associates can provide forex assistance day and night at 866-839-1100.

Serious technology for serious traders

Execute your forex trading strategy using the advanced thinkorswim trading platform. Plus, with papermoney ® , you can use real market data to test your theories and strategies without risking a dime.

A trading platform that can keep up with you

If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene.

Paper trade without risking a dime

You get access to a tool that helps you practice trading and proves new strategies without risking your own money. TD ameritrade's papermoney is a realistic way to experiment with advanced order types and new test ideas. Sharpen and refine your skills with papermoney.

CFTC public disclosures

Check the background of TD ameritrade on FINRA's brokercheck

Where smart investors get smarter SM

Call us 800-454-9272

#1 overall broker

Diversification does not eliminate the risk of experiencing investment losses.

Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read the NFA booklet: what investors need to know prior to trading forex products

Forex accounts are not protected by the securities investor protection corporation (SIPC).

Forex trading services provided by TD ameritrade futures & forex LLC. Trading privileges subject to review and approval. Not all clients will qualify. Forex accounts are not available to residents of ohio or arizona.

Forex trading exposes you to risk including, but not limited to, market volatility, volume, congestion, and system or component failures which may delay account access and forex trade executions. Prices can change quickly and there is no guarantee that the execution price of your order will be at or near the quote displayed at order entry. Delays in account access and execution at a different price is more likely to occur in conditions such as a fast-moving market, at market open or close, or due to the size and type of order.

The forex market is open from 5:00 p.M. To 4:00 p.M. Daily, sunday through friday. Beginning at 5:00 p.M., forex pairs may be opened at various intervals to ensure market liquidity. As part of routine daily maintenance, generally conducted between 12:00 a.M. – 2:00 a.M. And lasting approximately 2 minutes, the trading platform may not be available. Times referenced are central standard time or central daylight time, whichever is in effect. TD ameritrade futures & forex LLC utilizes JP morgan chase bank N.A. As its forex prime broker. Liquidity providers are JP morgan, citadel securities, XTX markets, HC technologies, and virtu financial.

Additional forex execution data is available by request. You may request transaction data for up to 15 trades that occur in the same currency pair immediately before and after your trade. The information provided in the transaction data includes execution date, time, side, quantity, currency pair, and price. To submit your request, please contact a TD ameritrade forex specialist at 866-839-1100.

*backtesting is the evaluation of a particular trading strategy using historical data. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. Results could vary significantly, and losses could result.

The papermoney trading software application is for educational purposes only. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Access to real-time market data is conditioned on acceptance of the exchange agreements. Professional access differs and subscription fees may apply. See our commission and brokerage fees for details.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in australia, canada, hong kong, japan, saudi arabia, singapore, UK, and the countries of the european union.

TD ameritrade, inc., member FINRA/SIPC, a subsidiary of the charles schwab corporation. TD ameritrade is a trademark jointly owned by TD ameritrade IP company, inc. And the toronto-dominion bank. ©2021 charles schwab & co. Inc. All rights reserved.

Forex account balance

The account balance also includes the money that is available in your forex trading account after all debits credits and charges have been factored together. When a forex trader has those active positions in the market during open trades the equity on the fx account is the sum of the margin put up for the trade from the fx account in addition to any unused account balance.

Eurozone july current account balance 31 9 billion vs 28 5

Margin trading allows you to leverage the funds in your account to potentially generate larger profits by depositing just a fraction of the full value of your trade.

Forex account balance. A forex indicator is a statistical tool that currency traders use to make judgements about the direction of a currency pairs price action. The trading lot size directly impacts how much a market move affects your accounts. The downside however is that you can also potentially incur significant losses if the trade moves against you.

What does forex indicator mean. If you close this position the 500 profit will be added to your account balance and so your account balance will become 5500. If trading standard lots a trader can only take positions of 100000 200000 etc.

When starting out in forex day trading its recommended traders open a micro lot account. An account balance can also refer to the total amount of money owed to a third party such as a cred! It card company utility company mortgage banker or another typ! E of lender or creditor. If you enter a new trade or in trader lingo open a new position your account balance is not affected until the position is closed.

When there are no active trade positions the equity is known as free margin and is the same as the account balance. Forex account balance margin indicator. Trading micro lots allows for more flexibility so risk remains below 1 of the account on each trade.

If you deposit 1000 then your balance is 1000. For example a micro lot trader can buy 6000 worth of currency or 14000 or 238000 but if they open a mini lot account they can only trade in increments of 10000 so 10000 20000 etc. Your balance measures the amount of cash you have in your trading account.

This means that you can enter into positions larger than your account balance. If it was a losing position with 500 loss then while it was opened your account equity would be 4500 and if you close it 500 wil! L be deducted from your account balance and so your account balance will be 4500. In the banking sector an account balance refers to the amount of money that an individual has in either their checking or savings account.

Forex trading involves significant risk of loss and is not suitable for all investors. For example a 100 pip move on a small trade will not be felt nearly as much as the same 100 pip move on a very large trade size. Equity in forex trading is simply the total value of a forex traders account.

How much do I need to start trading forex tip ignore fx brok! Er

Account panel forex software

Top forex broker canada forex broker volume comparison forex

Nano forex account trading conditions for nano mt4 accounts

Easy way to open same trades on many mt4 accounts at once

How to trade forex with iq option

Forex differen! Ce between balance and equity

Forex account balance margin indicator free forex mt4 indicators

Hotforex trading calculators forex broker

What is account and margin balances in forex market traders institute

Creating A free forex expert advisor by forex strategy builder

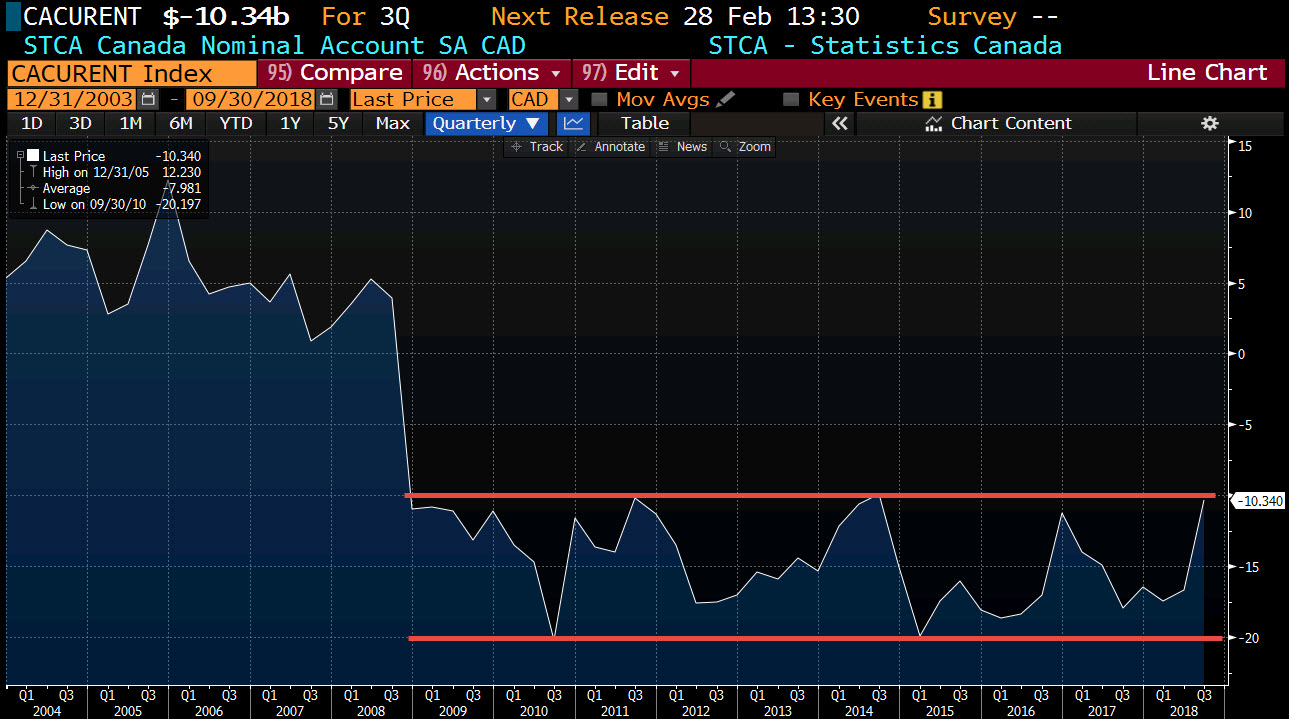

Canada current account balance for 3q 10 34b vs 12 00b expected

Your account balance forex atm investment and business in forex

Forex money management strategies forexboon com

so, let's see, what we have: up to 10% of extra funds on account balance for trading at roboforex. Increase your trading volume and receive more payments at forex account balance

Contents of the article

- My list of forex bonuses

- Up to 10% of extra funds

- Increase your trading volume

- How to receive % on account balance?

- Accept program conditions

- Trade on your account

- Receive payments

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- Why you need a forex account to trade

- How you open a forex trading account

- Forex brokers

- What is account balance?

- What is account and margin balances in forex

- What is an account balance

- What is a margin balance

- Why do traders want margin...

- Forex account balance

- Question: where/how to check "account balance" &...

- Trade tab

- Account history

- Journal

- Fxpro

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Question: where can I check MT4(metatrader4)...

- Trade tab

- Account history tab

- Journal tab

- Fxpro

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- OPEN REAL FOREX ACCOUNT

- Forex account balance

- Bringing you global opportunity

- Four reasons to trade forex with TD ameritrade

- Serious technology for serious traders

- CFTC public disclosures

- Forex account balance

Contents of the article

- My list of forex bonuses

- Up to 10% of extra funds

- Increase your trading volume

- How to receive % on account balance?

- Accept program conditions

- Trade on your account

- Receive payments

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- Why you need a forex account to trade

- How you open a forex trading account

- Forex brokers

- What is account balance?

- What is account and margin balances in forex

- What is an account balance

- What is a margin balance

- Why do traders want margin...

- Forex account balance

- Question: where/how to check "account balance" &...

- Trade tab

- Account history

- Journal

- Fxpro

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Question: where can I check MT4(metatrader4)...

- Trade tab

- Account history tab

- Journal tab

- Fxpro

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- OPEN REAL FOREX ACCOUNT

- Forex account balance

- Bringing you global opportunity

- Four reasons to trade forex with TD ameritrade

- Serious technology for serious traders

- CFTC public disclosures

- Forex account balance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.