Startup forex

If you have limited capital, make sure your broker offers high leverage through a margin account.

My list of forex bonuses

If capital is not a problem, any broker with a wide variety of leverage options should do. A variety of options lets you vary the amount of risk you are willing to take. For example, less leverage (and therefore less risk) may be preferable for highly volatile (exotic) currency pairs. The forex (FX) market has many similarities to the equity markets, however, there are some key differences. This article will show you those differences and help you get started in forex trading.

Getting started in forex

The forex (FX) market has many similarities to the equity markets; however, there are some key differences. This article will show you those differences and help you get started in forex trading.

If you've decided to take a stab at forex trading, access to currency markets has never been easier with a wide range of online brokerage platforms offering everything from spot trading to futures and cfds.

Key takeaways

- Before you settle on a forex broker, carry out your due diligence and make sure you are choosing the best option for yourself.

- Look for low spreads and fees from a provider in a well-regulated jurisdiction that offers a suite of tools and access to leverage, among other factors.

- Once you've chosen your broker, study up on basic forex strategies and how to properly analyze currency markets.

- You may want to start with a demo account to try your strategy out and backtest before risking real money in the market.

Choosing a forex broker

There are many forex brokers to choose from, just as in any other market. Here are some things to look for:

Lower spreads save you money!

- Low spreads. The spread, calculated in "pips," is the difference between the price at which a currency can be purchased and the price at which it can be sold at any given point in time. Forex brokers don't charge a commission, so this difference is how they make money. In comparing brokers, you will find that the difference in spreads in forex is as great as the difference in commissions in the stock arena.

Make sure your broker is backed by regulatory agencies and a reliable institution!

- Quality institution.Unlike equity brokers, forex brokers are usually tied to large banks or lending institutions because of the large amounts of capital required (leverage they need to provide). Also, forex brokers should be registered with the futures commission merchant (FCM) and regulated by the commodity futures trading commission (CFTC). You can find this and other financial information and statistics about a forex brokerage on its website, the website of its parent company or through the financial industry regulatory authority's brokercheck website.

Get the tools you need to succeed!

- Extensive tools and research. Forex brokers offer many different trading platforms for their clients – just like brokers in other markets. These trading platforms often feature real-time charts, technical analysis tools, real-time news and data and even support for trading systems. Before committing to any broker, be sure to request free trials to test different trading platforms. Brokers usually also provide technical and fundamental information, economic calendars and other research.

Leverage your bets!

- Wide range of leverage options.Leverage is necessary in forex because the price deviations (the sources of profit) are merely fractions of a cent. Leverage, expressed as a ratio between total capital available to actual capital, is the amount of money a broker will lend you for trading. For example, a ratio of 100:1 means your broker would lend you $100 for every $1 of actual capital. Many brokerages offer as much as 250:1. Remember, lower leverage means lower risk of a margin call, but also lower bang for your buck (and vice-versa).

If you have limited capital, make sure your broker offers high leverage through a margin account. If capital is not a problem, any broker with a wide variety of leverage options should do. A variety of options lets you vary the amount of risk you are willing to take. For example, less leverage (and therefore less risk) may be preferable for highly volatile (exotic) currency pairs.

Make sure your broker uses the proper leverage, tools, and services relative to your amount of capital.

- Account types. Many brokers offer two or more types of accounts. The smallest account is known as a mini account and requires you to trade with a minimum of, say, $250, offering a high amount of leverage (which you need in order to make money with this size of initial capital). The standard account lets you trade at a variety of different leverages, but it requires a minimum of $2,000. Finally, premium accounts, which often require significantly higher amounts of capital, let you use different amounts of leverage and often offer additional tools and services.

Broker actions to avoid in forex trading

- Sniping or hunting. Sniping and hunting – defined as prematurely buying or selling near preset points – are inappropriate acts committed by brokers to increase profits. Unfortunately, the only way to determine the brokers that do this and those that do not is to talk to fellow traders. There is no blacklist or organization that reports such activity.

- Strict margin rules. When you are trading with borrowed money, your broker has a say in how much risk you take. As such, your broker can buy or sell at their discretion, which can be a bad thing for you. Let's say you have a margin account, and your position takes a dive before rebounding to all-time highs. Even if you have enough cash to cover, some brokers will liquidate your position on a margin call at that low. This action on their part can cost you a significant amount of capital.

Be sure to conduct thorough due diligence prior to selecting a broker! Once you've decided, signing up for a forex account is similar to getting an equity account. The only major difference is that for forex accounts, you are required to sign a margin agreement. This agreement states that you are trading with borrowed money, and, as such, the brokerage has the right to intervene in your trades to protect its interests. That said, once you sign up and fund your account, you'll be ready to trade.

Defining a basic forex trading strategy

Technical analysis and fundamental analysis are two of the oft-used strategies in the forex market. Technical analysis is by far the most common strategy used by individual forex traders, which we'll explain in further detail below.

Fundamental analysis

If you think it's difficult to value one company, try valuing a whole country! Fundamental analysis in the forex market is very complex, and is often used only to predict long-term trends; however, some traders do trade short term strictly on news releases. There are many fundamental indicators of currency values released at many different times such as:

These reports are not the only fundamental factors to watch. There are also several meetings where quotes and commentary can affect markets just as much as any report. These meetings are often called to discuss interest rates, inflation, and other issues that affect currency valuations. Even changes in wording when addressing certain issues—the federal reserve chairman's comments on interest rates, for example—can cause market volatility. Therefore, two important meetings for forex traders to watch are the federal open market committee and humphrey hawkins hearings.

Simply reading the reports and examining the commentary can help forex fundamental analysts gain a better understanding of long-term market trends and allow short-term traders to profit from extraordinary events. If you choose to follow a fundamental strategy, be sure to keep an economic calendar handy at all times so you know when these reports are released. Your broker may also provide real-time access to this type of information.

Technical analysis

Technical analysts of the forex analyze price trends, similar to their counterparts in the equity markets. The only key difference between technical analysis in forex and technical analysis in equities is the timeframe, as forex markets are open 24 hours a day. As a result, some forms of technical analysis that factor in time must be modified to factor in the 24-hour forex market. These are some of the most common forms of technical analysis used in forex:

Many technical analysts combine these studies to make more accurate predictions. (i.E., the common practice of combining the fibonacci studies with elliott waves.) others create trading systems to repeatedly locate similar buying and selling conditions.

Finding your forex trading strategy

Most successful traders develop a strategy and perfect it over time. Some focus on one particular study or calculation, while others use broad spectrum analysis to determine their trades.

Most experts suggest trying a combination of both fundamental and technical analysis in order to make long-term projections and determine entry and exit points. That said, it is the individual trader who needs to decide what works best for him or her (most often through trial and error) in the end.

Forex trading considerations to remember

- Open a demo account and paper trade until you can make a consistent profit. Many people jump into the forex market and quickly lose a lot of money due to taking on too much leverage. It is important to take your time and learn to trade properly before committing capital.

- Trade without emotion. Don't keep "mental" stop-loss points if you don't have the ability to execute them on time. Always set your stop-loss and take-profit points to execute automatically, and don't change them unless absolutely necessary.

- The trend can be your friend. If you go against the trend, make sure you have a good reason. That's because you have a higher chance of success in trading with the trend because the forex market tends to move in that direction than the other.

The bottom line

The forex market is the largest market in the world, and individuals are becoming increasingly interested in plying their trade in FX. However, there are multiple considerations to take into account before you begin trading, such as being sure your broker meets certain criteria and understanding a trading strategy that works best for you. One way to learn to trade forex is to open up a demo account and try it out.

How to start a forex trading business from home

If you are looking to set up your own forex trading business from home, you have come to the right place.

This post will tell you how you can make money by trading currency pairs. If you are a beginner, you must be aware that it involves some amount of risk, but you can learn to do it in an interesting manner and earn an income.

In the forex market, currencies worth US$5 trillion are traded on a daily basis. This means there is an opportunity for you to earn a lot of profits through your forex trading business without the need to invest too much of your hard-earned money. One of the biggest advantages is that you need not meet any formal requirements for starting a forex trading business.

The advantages of forex trading are as follows:

• unlike the stock market, the forex market operates round the clock.

• it is not possible for anyone to manipulate the forex market.

• the forex enables margin trading. This means that you can buy currencies worth thousands of dollars though you may have only less than US$100 with you. This is not possible in stock trading.

As such, all that you need to have with you are a little money, some amount of patience, a personal computer, and a reliable internet connection in order to become a currency trader. Here is how you can start your forex trading from home:

#1: learn the basics of currency trading

It is not easy to learn forex trading on your own through video tutorials. It is, therefore, recommended that you work with an expert to understand the nuances of trading. In addition, you should attend seminars/webinars and read a little bit to in order to sharpen your skills. Reading books on economics and business also helps you to broaden your insight, especially with respect to fundamental analysis. Additionally, you must master technical analysis as well.

#2: organize the trading capital

Fortunately, you are not required to have a large amount of money to start currency trading. This is because of the margin trading feature offered by brokers. You just need about US$10 to set up an account on the broker platform or you can use no-deposit bonus to start trading. However, it is a good idea to start with at least US$1,000 as it will ensure a little bit of buffer if you happen to incur losses.

#3: choose a reliable forex broker

Forex brokers make available online platforms to help you access the forex market and trade. You should go through the terms of trading before choosing any of the brokers. It is important that you work with the right forex broker in order to achieve your financial goals.

You should, therefore, compare the features offered by a few brokers prior to deciding to work with one. Some of the factors to be considered are trading options, terms and conditions, and user reviews. Then choose a broker that best fits your needs. You may also consult with an expert trader for this purpose.

#4: start by opening a demo account

After choosing the forex broker, open a demo account on the broker’s platform. The virtual account may be offered only for a certain specified amount of time period. However, it will give you an idea as to how you can use the trading platform offered by the broker. It will also be helpful in getting prepared for using the real platform. This means that you will not be using real money without testing the broker’s platform through the demo account.

#5: practice well

You cannot learn forex trading on the go. It is important to train yourself extensively so that you are in a position to buy and sell at the right time. You should trade on the demo platform for a few weeks so that the chances of you incurring losses are considerably reduced.

A demo account helps you to learn to implement various trading strategies successfully and develop a trading style of your own.

#6: start trading with real money

Open a live trading account with the forex broker after you have practiced enough and gained the confidence to go live. Actually, you should be able to convert the demo account into a live account. You may have to just deposit the minimum amount specified by the broker.

Some trading strategies will fetch you huge profits, some others will not work for you. The secret to increasing profits is repeating what works for you and avoiding what does not.

How to start forex trading

You can perform a forex trade 24 hours a day and five days a week. However, choosing the right account could help you get closer to earning a profit. Here is a guide on how to get started with forex trading.

What is forex trading?

Forex trading is a high-risk investment, and you could lose more amount than your deposit.

Look for a broker

You need to have a forex account with a broker as they will give you a platform that you could use to trade on.

Here is an example of two brokers and their bid and ask exchange rates for the EUR/USD:

| Broker | bid exchange rate | ask exchange rate | spread |

|---|---|---|---|

| A | 1.12310 | 1.12321 | 1 pip |

| B | 1.12310 | 1.12331 | 2 pips |

Going for the broker with the lowest spread implies that the exchange rate must only make a smaller movement before you can earn a profit, for example:

- To earn a profit with broker A, the exchange rate must move by 1.1 pip or more in your favour.

- To earn a profit with broker B, the exchange rate must move by 2.1 pips or more in your favour.

Even though most forex brokers combine the costs in the spread that they give you, some could charge you for the following:

- Inactivity fee: when you stop trading for a period, such as one or two years, your broker could charge you until you begin using your account again, for example, £12 per month.

- Adding/withdrawing charge: brokers charge if you add money to your account or withdraw from your account. This is ordinarily a set fee, such as £5 for every £200.

- Overnight trading: for leaving a trade overnight, some forex brokers charge you for interest. For example, 1.5% of the price of any open trades.

Open an account

After you pick a forex broker, you must complete an online registration form with them.

You will need to provide them with the following information:

- Full name

- Address

- Email address

- Mobile phone number

Your broker will then send a link via text message or email to validate your details.

You may also have to confirm your account by giving your driving licence or passport number. The name on your forex account must match the name on your ID.

If your selected broker owns demo account, make use of it to so that you can be familiar with their forex trading system before you begin using your own money.

Make a trade

You can trade in forex monday to friday, 24 hours a day, which means you can trade on currency pairs more frequently compared to other markets, such as commodities or indices.

Performing a trade is also called opening a position, and if you earn a profit or loss is based on the performance of the base currency as compared to the counter currency that you trade with.

The first currency is the base currency in one pair, the counter currency, on the other hand, is the second, for example, EUR/USD has a euro base currency, and a US dollar counter currency.

The exchange rate is the amount of the counter currency that you can purchase with the base currency. As an example, if the EUR/USD had an exchange rate of 1.12 you can earn $1.12 for every euro.

If the rate increases to 1.13 ($1.13 for one euro), this means that the euro’s value has increased against the US dollar as you can receive more of the counter currency for the base currency.

Forex trading tools

If you would want to manage your trades without watching them regularly, there are a few trading tools you could make use of:

- Limit order: you pick the exchange rate your trade closes at. This allows you take a profit when the rate reaches a level you have set.

- Stop loss: you pick the exchange rate your trade closes at. However, this does not guarantee further losses as brokers cannot always close the trade at an exact rate.

- Guaranteed stop loss: you pay a fee to the broker, and they will close your trade at the same exchange rate you choose.

- Ybuy limit: your broker will open a trade when the exchange rate reaches your chosen value. If the rate is not reached, the broker never actions your trade.

- Margin call: if your losses come near your margin, your broker will ask you to add more money. If you do not, your broker will then close your trades to stop further losses.

Close your trade

Before you close your trade, also known as closing your position, you can review if you are earning a profit or a loss by studying the active trades on the platform of your chosen broker.

If you are ready, choose the trade you want to close from your active trades tab and click on the close trade button.

You are then required to verify if you want to close your trade. Then you are shown how much profit or loss you have earned.

How to start as a forex trader (7 steps)

Do you want to start trading forex but you don’t know where to begin? Check out this video to find out how to start as a forex trader!

How to start as a forex trader

Please note that this article may contain affiliate links.

How to start as a forex trader – script

This video is broken down into 7 steps to becoming a forex trader. Let’s dive right in!

1. Find a reputable broker

There are important points to consider when choosing a broker. Such as:

- What is their software like? You want to make sure that they offer a high-quality software platform, ideally metatrader4.

- As well as a powerful platform, you want to make sure that your broker offers excellent support.

- Fast trade executions

- Low-spreads.

I started as a forex trader by signing up to my broker which is oanda. Oanda offer both a free demo account as well as a live trading account. I have found them to be great and they are based in the UK.

2. Use a demo account

As mentioned above, oanda offer a FREE demo account and I highly recommend starting in a demo. Because it would be incredibly risky and unnecessary to start off as a forex trader using real money in a live environment.

This means starting using paper money whereby there is nothing to lose but you can use the time to develop important skills, knowledge and experience for trading. Starting in a demo allows you to build major skills for trading including;

- Technical analysis

- Risk management

- Trade management

- Trading strategies

Whilst you are using your time wisely practising in a demo, this will allow you to build your trade plan.

3. Create a trade plan

I have a free downloadable trade plan, click here to download a copy. This is my personal trade plan for forex and also includes a template where you can create your own trade plan.

Having a trading plan is essential if you want to take your trading seriously and if you want to become a professional trader. In addition, a trading plan gives structure to your trades. Remember that if you are not following a trading plan, then essentially you are gambling.

A trading plan can consist of; strategies, time-frames, indicators, processes, risk management and targets. It allows you to monitor your performance and review your trades which is massively important to help you to improve and grow as a forex trader.

4. Education

Education is essential for trading. There are many key topics to research and study to become a forex trader. These include:

- Technical analysis involving; candlesticks, chart patterns, identifying trends, channels, pivots and trendlines.

- Riskmanagement; risk is everything when it comes to trading.

- Trademanagement; calculating entries and exits.

- Tradingpsychology; a major factor in becoming a successful forex trader.

5. Major currencies

When starting out trading forex, it is important to stick to trading the major currencies, because these tend to be the most volatile, as they usually have the most volume for trading.

Major currencies: GBP, USD, CHF, AUD, NZD, JPY, CAD & EUR.

6. Start small

A great tip is to start small and to remember that trading is not a race, it is a marathon. It is important to take your time through each stage of your trading journey. In addition, give yourself plenty of practice in the demo. Furthermore, take your time studying and gathering vital experience trading. When you are ready to trade with real money, certainly start small and use low risk per trade during your transition to real money.

7. Be disciplined

Finally, it is important to be disciplined. Whenever you trade in the demo, it is important to carry out your practice seriously and to treat it like real money, because it is not a game. If you treat trading like your job, then you are more likely to succeed long term.

How to start as a forex trader – conclusion

- Find a reputable broker

- Use a demo account

- Create and follow your trade plan

- Educate yourself and build your knowledge

- Trade the major currency pairs

- Take it slow and steady

- Be disciplined and keep your focus

If you follow all of these points, then you are well on your way to becoming a consistently profitable forex trader, and I wish you the best of luck!

Ready to become a successful trader?

Sign up below to receive a FREE forex trading plan. Including examples, templates & tips for trading success!

You have successfully subscribed!

You can unsubscribe anytime. For more details, review our privacy policy

Forex startup review – stay away from this illegal broker [no license]

In this review we show that forexstartup is a broker that has no authorization to operate in the financial markets.

What is forex startup

Forex startup is a broker that will let you trade financial derivatives with underlying assets like stocks, currencies and commodities. Although the broker shows logos of several cryptocurrencies, it seems that it offers bitcoin only.

Trading happens with forex startup through binary options that require you to predict whether the price of a certain asset will go up or down.

The minimum deposit is 500 USD and you will get a 20% deposit bonus. With deposits higher than 2999 USD you will get a 100% deposit bonus. Three types of trading accounts are available: bronze, silver and gold. The higher the account, the higher the bonus.

Forex startup claims to be based in the united states and regulated. Can you trust this broker, is it legit?

Illegal broker

Unfortunately, forex startup is not legit. It is an illegal broker and we are not afraid to say it is a scam. The reason is that the broker is lying about its regulatory status, it is not authorized at all.

As a binary options broker located in the united states, forex startup has the duty to obtain an authorization from the regulators before offering its services to the public.

But forex startup has no authorization whatsoever, in the US or any other country in the world. Binary options are securities and they are regulated in most countries.

When you make a research about the forex startup’s license, you will see that it is not registered. Therefore there is no doubt that forex startup is not regulated and that it is an illegal broker.

The broker is clearly lying on its website when it says it regulated, therefore it is also a scam.

Moreover we have every reason the believe that the new york address the broker is showing on its website is fake, the company is not located there. The owners of the broker are hiding and they know why, they are breaking the laws not only in the united states.

Trading with unregistered brokers always is very risky, because they can disappear any time and your money is not protected in any way. You will have a hard time finding out where your deposit went. Then it will be very difficult to try to get it back.

If a broker is knowingly lying and breaking the laws, you can expect your money to get lost with such a company. They clearly are in the business to rip off people, and not to trade financial markets and provide genuine investment services.

User experience with forex startup

One of the reasons we decided to publish this forex startup review, is a complaint that we have received from one of our readers.

Our reader told us that together with their friend they got scammed by forex startup. Which, given what we explained above, unfortunately does not surprise us. Forex startup is very shady and the best thing you can do is to stay away from it.

If you already made a deposit with this broker, try to get it back as soon as possible. It the broker refuses your withdrawal, see with the payment provider you used to make the deposit if there is any way to recover your money.

Forex startup review – conclusion

Forex startup is lying, in reality it is not regulated. It’s an illegal broker that is not authorized by any regulator in the world. You should stay away from it.

If you are interested in financial trading, use only regulated brokers and start on a demo account to learn your way through with virtual money.

If one day you decide to trade with real money, make yourself familiar with the risk and prepare a solid strategy.

How to start as a forex trader (7 steps)

Do you want to start trading forex but you don’t know where to begin? Check out this video to find out how to start as a forex trader!

How to start as a forex trader

Please note that this article may contain affiliate links.

How to start as a forex trader – script

This video is broken down into 7 steps to becoming a forex trader. Let’s dive right in!

1. Find a reputable broker

There are important points to consider when choosing a broker. Such as:

- What is their software like? You want to make sure that they offer a high-quality software platform, ideally metatrader4.

- As well as a powerful platform, you want to make sure that your broker offers excellent support.

- Fast trade executions

- Low-spreads.

I started as a forex trader by signing up to my broker which is oanda. Oanda offer both a free demo account as well as a live trading account. I have found them to be great and they are based in the UK.

2. Use a demo account

As mentioned above, oanda offer a FREE demo account and I highly recommend starting in a demo. Because it would be incredibly risky and unnecessary to start off as a forex trader using real money in a live environment.

This means starting using paper money whereby there is nothing to lose but you can use the time to develop important skills, knowledge and experience for trading. Starting in a demo allows you to build major skills for trading including;

- Technical analysis

- Risk management

- Trade management

- Trading strategies

Whilst you are using your time wisely practising in a demo, this will allow you to build your trade plan.

3. Create a trade plan

I have a free downloadable trade plan, click here to download a copy. This is my personal trade plan for forex and also includes a template where you can create your own trade plan.

Having a trading plan is essential if you want to take your trading seriously and if you want to become a professional trader. In addition, a trading plan gives structure to your trades. Remember that if you are not following a trading plan, then essentially you are gambling.

A trading plan can consist of; strategies, time-frames, indicators, processes, risk management and targets. It allows you to monitor your performance and review your trades which is massively important to help you to improve and grow as a forex trader.

4. Education

Education is essential for trading. There are many key topics to research and study to become a forex trader. These include:

- Technical analysis involving; candlesticks, chart patterns, identifying trends, channels, pivots and trendlines.

- Riskmanagement; risk is everything when it comes to trading.

- Trademanagement; calculating entries and exits.

- Tradingpsychology; a major factor in becoming a successful forex trader.

5. Major currencies

When starting out trading forex, it is important to stick to trading the major currencies, because these tend to be the most volatile, as they usually have the most volume for trading.

Major currencies: GBP, USD, CHF, AUD, NZD, JPY, CAD & EUR.

6. Start small

A great tip is to start small and to remember that trading is not a race, it is a marathon. It is important to take your time through each stage of your trading journey. In addition, give yourself plenty of practice in the demo. Furthermore, take your time studying and gathering vital experience trading. When you are ready to trade with real money, certainly start small and use low risk per trade during your transition to real money.

7. Be disciplined

Finally, it is important to be disciplined. Whenever you trade in the demo, it is important to carry out your practice seriously and to treat it like real money, because it is not a game. If you treat trading like your job, then you are more likely to succeed long term.

How to start as a forex trader – conclusion

- Find a reputable broker

- Use a demo account

- Create and follow your trade plan

- Educate yourself and build your knowledge

- Trade the major currency pairs

- Take it slow and steady

- Be disciplined and keep your focus

If you follow all of these points, then you are well on your way to becoming a consistently profitable forex trader, and I wish you the best of luck!

Ready to become a successful trader?

Sign up below to receive a FREE forex trading plan. Including examples, templates & tips for trading success!

You have successfully subscribed!

You can unsubscribe anytime. For more details, review our privacy policy

Forex trading without deposit | no deposit bonus explained

It’s generally known that in order to get started in forex, you need to put a lot of resources into it. And while these resources can be your time and energy, the most straightforward one is, of course, your money.

It’s no surprise that one regular lot is equal to 100,000 currency units – forex trading is definitely an expensive endeavor. However, there are still some ways in which you can start trading forex while maintaining some sort of profitability without spending hundreds of thousands of dollars.

No deposit bonus in a glance

In forex trading you can, in fact, start trading with no money of your own or even making a deposit. With free no deposit bonus offered by the top forex brokers, you can start forex trading without deposit with a good boost.

There is no sense in hiding the fact that FX trading is risky, especially if you are trading without proper knowledge and at least minimal experience. In an attempt to prevail over the risk of losing your money and to stay safe, it is undoubtedly better to start trading with a free forex account or no deposit bonus offered by various FX brokers. Especially if such deals are not so rare at this time and even best forex brokers sometimes offer such deals.

It is always better to preview all conditions that offer you an option to trade without money of your own. So, be sure to start forex trading without a deposit now and get yourself a good and reliable deal!

But let’s say that although you’ve learned how to start deposit free forex trading, it’s still too risky for you. Thankfully, there is an alternative. One way to start trading with a broker is by opening a free forex demo account for beginners. A demo account will allow you to try your hand at trading on the real market without ever touching real money. One of the best brokers to try a free demo account with would be FXTM. If you don’t want to be working with FXTM and want access to a reliable forex broker that offers its services around the globe, alpari offers a similar service, including forex trading demo accounts. If you are a US citizen that wants to trade with local brokers, then you should go for forex.Com, who offer their services within the US and are known to be one of the best brokers in the world.

Transparent pricing and fast, reliable trade executions on over 80 currencies

Start trading with the largest forex broker in the US

How to start forex trading without deposit: tips & recommendations

As a matter of fact, a lot of brokers worldwide try to offer their clients those no deposit deals, and we’ve even seen some trading apps without deposit popping up here and there. Do not perceive this as an act of generosity though, those bonuses serve as a sort of protection for them also. But still, this is good for you if you want to start forex trading without a deposit.

Here are some of the main considerations that can help you spot a decent no deposit bonus:

- If you somehow dislike conditions and terms offered by the broker – simply skip the promotion. Let’s investigate the ways that may help you find the best bonus in FX. First of all, bonuses must be easy to understand and transparent in general conditions. If you see non-explicit information presented, avoid the promotion or ask the broker for clarification.

- If you wish to take part in the particular promotion and start forex trading without investment, then do not overlook terms and conditions. Even the smallest detail must be in your sight. A free bonus is actually not always 100% free. Some brokers may ask you to deposit some money in order to collect your profits. Indeed, such promotions are scams.

- Be attentive, because some forex brokers can demonstrate a good opportunity with their no deposit bonus, however it may ask to complete the trading volume requirement. Stay away from the bonus that asks to complete more than 1 lot for $10 to further unlock the profits and balance.

- Bonuses can vary in terms of geographical location requirements. Therefore, ensure that FX bonus accounts of the broker are given in your country as well if you desire to start forex trading without investment. Furthermore, there can be account restrictions. This means that no deposit bonuses may not always be available for every account at a particular broker. Thus, check whether you applied for a correct account.

- In addition, make sure what instruments can be traded to withdraw your profit before you begin trading as sometimes FX bonus accounts are not available for some of them. As for the withdrawal, some forex bonus brokers limit the maximum profit available to withdraw from the account. So, do not miss this field before you start trading on your no deposit FX bonus account.

- Bonuses are frequently represented only in 1 currency equivalent. However, there are many no deposit bonuses that evaluate a similar amount in your local currency, so doing your research in order to figure out how to join forex trading without making any deposits is a good way for ensuring success in the long run.

Not ready for live trading? Try IQ option demo account!

Practice your trading skills with free $10,000 practice account!

How to start forex trading without a deposit?

How to start forex trading without a deposit?

As one of the cases, no deposit bonus may come with SMS verification. It is recommended to make sure that you have the right phone number prior to start applying for the bonus.

One of the last tips that can help you find a trustworthy no deposit bonus, or at least help you get through a scammer, is to save the terms and conditions document as a .Pdf file. Do this even if you deal with the best no deposit forex bonus account. You can use the help of your account manager and ask him to confirm all the statements of the bonus promotion in which you participate.

Start forex trading without deposit: introduction to best no deposit bonuses

Although there are very good no deposit bonuses offered by industry leaders and most proficient brokers, you should understand one fact: FX bonuses without a deposit are most frequently offered by bad brokers. That is the very reason why you should be very careful not to get entangled with a scammer.

All this leads to us stressing how important it is to be attentive at all times, so be attentive to details when researching how to start trading with no deposit bonuses. Fortunately, we have examples of the best brokers/investment firms.

Start forex trading without investment: XM forex broker

To begin with, XM is recognized by the united kingdom-based organization – investors in people for its powerful efforts in developing individuals to realize their entire potential and achieve both individual and corporate goals. We should also admit that this organization provides a huge amount of proven tools and resources specially designed to complement its unique framework with an aim to boost performance and indeed maximize sustainability. XM achieves this standard by showing that it is a driving force in the online trading sector and is committed to the provision of services and products of the best quality. How to start forex trading without money? If you are interested, you can claim the XM 30 USD no deposit bonus!

Get your 30 USD no deposit bonus with XM, and start trading today

Sign up with top tier broker and get the best no deposit deal on the market

*clients registered under the EU regulated entity of the group are not eligible for the bonus

No deposit bonus as an alternative – is it worth it?

So, now that you know what no deposit bonuses are and how they work, one question remains active: is it actually worth it to sign up for one yourself? Will you get any significant benefit from it?

The answer to that question is subjective; some traders can definitely find use in this type of promotion by amassing a small account balance and then turning it into a full-blown trading career. But in order to do so, you need to be very careful not to catch a scammer instead of a legitimate promotion issuer.

As for other traders, they often prefer spending their own money, which gives them more incentive to be more careful in the market – after all, it’s their own money they’re risking.

So, suffice to say no deposit bonuses have their time and place; one just has to seize that exact moment.

Learn to trade

for free

As seen in:

Join the leading online trading academy

Starttrading.Com has a variety of features that make it the best place to learn how to start trading. Our course is designed to help you prepare for success in the financial markets. Not only will we teach you the technical and fundamental side of trading, we will also teach you the mentality needed to trade like a pro.

40 + in-depth online trading lessons.

40+ in-depth trading lessons throughout 7 detailed units.

Learn to trade in your own time.

Learn, practice & understand the markets anywhere, anytime!

Learn trading, no matter your experience level.

Learn the basics, through to advanced trading strategies.

Track your progress through the trading course.

Keep track of lessons you’ve completed.

Trading course overview

Unit 1 - preschool

Forex basics

Currency trading? Forex trading? FX trading? Totally clueless about forex? Here’s an introduction to the foreign exchange market.

For those of you who are complete newbies to forex trading and are trying to learn the ropes, it can often be an overwhelming and daunting world, but it doesn’t have to be. This unit will bring you up to speed with everything forex!

Understanding the market

When making any investment it is important to gain some understanding in what you’re getting into. This will allow you to achieve the best results possible and limits the amount of mistakes you make.

If you want to actually learn how to trade forex, you’ll need a basic understanding on how forex trading works to begin with. After this unit you will know exactly how the market works.

Unit 3 - elementary school

Technical analysis basics

Every trader needs a basic understanding of technical analysis. Unit 3 will introduce you to the basics of technical analysis, and how it can be used to trade the financial markets.

Learning the basics of technical analysis will give you a foundation of how to identify profitable opportunities in the market.

Technical analysis

Want to master technical analysis and learn how to use indicators to accurately predict the market? We’ve got you covered.

This unit will teach you the advanced trading strategies used by professionals.

Mindset

If you want to become a profitable trader you need to master your mentality and risk management. These are arguably the most important things on your journey to becoming a successful trader.

This unit will give you the structure and guidance you need to limit any mistakes and start to see consistent results much faster.

Economics

The forex market is open 24 hours a day, 5 days a week and is constantly moving in value. Have you ever asked yourself “what moves the market?”.

Learn exactly why currencies change in value and how to predict their movements.

Start trading

You are now ready to hit the markets! Get guided through setting up your trading account and how to place trades.

Ready to learn how to trade?

Want to earn whilst you learn?

Products

Learn more

Newsletter

Sign up for our news letter and stay up to date with the latest market trends.

Risk warning – investing involves a substantial degree of risk and may not be suitable for all investors. Past performance is not necessarily indicative of future results. The information provided by starttrading is for educational purposes only and is not a recommendation to buy or sell any security. By accessing any starttrading content, you agree to be bound by the terms of service. Click here to review the privacy policy and risk disclosure. We use cookies to provide a personalized experience for our users. Read more from our privacy policy.

Starttrading content is for entertainment and education only. In no event will starttrading be liable for any loss or damage including, without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of starttrading content on our newsletter, youtube, instagram, twitter, facebook, fanable, patreon, discord or any other platform it is broadcasted on. Starttrading is not a licensed broker/financial planner. All financial decisions made by the viewer should be done after talking with a licensed professional. Everything on the starttrading channel is for entertainment only. Starttrading’s video content may change over time, or become outdated or invalid. Starttrading reserves the right to change his opinions and entertainment content at any time. I also have affiliate links in this description that I can earn money off of to help support the channel. Thank you from starttrading.

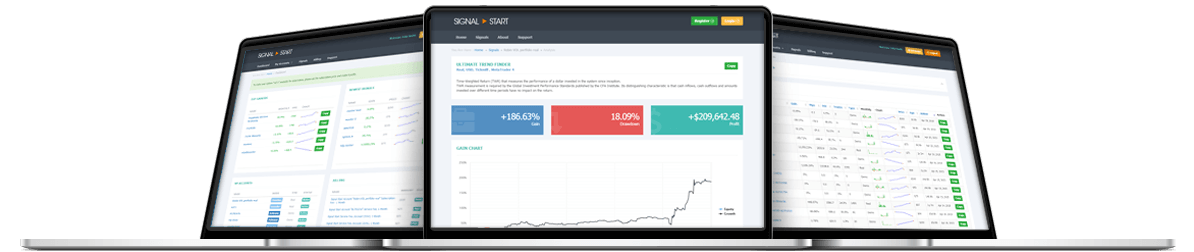

A professional signal service.

What makes us different?

It is all in the details.

Fantastic support

Mobile compatibility

Access signal start

from any device

Account analysis

Industry standard analytics

White label

If you're a signal provider, fully

white label our technology

Superior technology

Signal start is powered by

robust proprietary technology

Fully hosted

Your account is always

connected 24/5.

Quick and easy setup

Setup your account and start copying signals in under 5 minutes

Multi platform, multi broker

Copy any forex system from any broker*

Customer testimonials

Customer satisfaction is our top priority.

I can't believe how much thought was put into signal start to make it bullet proof for users like me :)

I was pleasantly surprised when started using the service - well worth the money.

Great product with even greater support! Definitely the one to use for copying signals.

Pricing

There are no hidden charges or costs. Signal start service fee is only $25/month per account (subscription to signals is billed separately, based on the selected signals). Additionally, if you are a signal provider, we charge only 30% of your subscription fee for which you get a complete, professional and managed solution for your signal service.

Time limited offer for signal followers! Test our service for 1 week for $1 only (instead of $25 per month)!

Time limited offer for signal providers! Pay only a one time setup fee of $25 (instead of $25 per month)!

About

Signal start is a professional one stop shop signal service for signal followers and signal providers.

Contact us

HIGH RISK WARNING: foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice.

PAST PERFORMANCE RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR BY PAST PERFORMANCE RESULTS. PROSPECTIVE CLIENTS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON PAST PERFORMANCE RESULTS AND SHOULD NOT BASE THEIR DECISION ON INVESTING IN ANY TRADING PROGRAM SOLELY ON THE PAST PERFORMANCE PRESENTED. ADDITIONALLY, IN MAKING AN INVESTMENT DECISION, PROSPECTIVE CLIENTS MUST ALSO RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY MAKING THE TRADING DECISIONS AND THE TERMS OF THE ADVISORY AGREEMENT INCLUDING THE MERITS AND RISKS INVOLVED.

So, let's see, what we have: before entering the foreign exchange (forex) market, you should define what you need from your broker and from your strategy. Learn how in this article. At startup forex

Contents of the article

- My list of forex bonuses

- Getting started in forex

- Choosing a forex broker

- Lower spreads save you money!

- Make sure your broker is backed by regulatory...

- Get the tools you need to succeed!

- Leverage your bets!

- Make sure your broker uses the proper leverage,...

- Broker actions to avoid in forex trading

- Defining a basic forex trading strategy

- Finding your forex trading strategy

- Forex trading considerations to remember

- The bottom line

- How to start a forex trading business from home

- If you are looking to set up your own forex...

- #1: learn the basics of currency trading

- #2: organize the trading capital

- #3: choose a reliable forex broker

- #4: start by opening a demo account

- #5: practice well

- #6: start trading with real money

- How to start forex trading

- What is forex trading?

- Look for a broker

- Open an account

- Make a trade

- Forex trading tools

- Close your trade

- How to start as a forex trader (7 steps)

- How to start as a forex trader

- How to start as a forex trader – script

- 1. Find a reputable broker

- 2. Use a demo account

- 3. Create a trade plan

- 4. Education

- 5. Major currencies

- 6. Start small

- 7. Be disciplined

- How to start as a forex trader – conclusion

- How to start as a forex trader – script

- Ready to become a successful trader?

- You have successfully subscribed!

- Forex startup review – stay away from this...

- What is forex startup

- Illegal broker

- User experience with forex startup

- Forex startup review – conclusion

- How to start as a forex trader (7 steps)

- How to start as a forex trader

- How to start as a forex trader – script

- 1. Find a reputable broker

- 2. Use a demo account

- 3. Create a trade plan

- 4. Education

- 5. Major currencies

- 6. Start small

- 7. Be disciplined

- How to start as a forex trader – conclusion

- How to start as a forex trader – script

- Ready to become a successful trader?

- You have successfully subscribed!

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Learn to trade for free

- Join the leading online trading academy

- 40 + in-depth online trading lessons.

- Learn to trade in your own time.

- Learn trading, no matter your experience level.

- Track your progress through the trading course.

- Trading course overview

- Forex basics

- Understanding the market

- Technical analysis basics

- Technical analysis

- Mindset

- Economics

- Start trading

- Newsletter

- A professional signal service.

- What makes us different?

- It is all in the details.

- Fantastic support

- Mobile compatibility

- Account analysis

- White label

- Superior technology

- Fully hosted

- Quick and easy setup

- Multi platform, multi broker

- Customer testimonials

- Pricing

- About

- Contact us

Contents of the article

- My list of forex bonuses

- Getting started in forex

- Choosing a forex broker

- Lower spreads save you money!

- Make sure your broker is backed by regulatory...

- Get the tools you need to succeed!

- Leverage your bets!

- Make sure your broker uses the proper leverage,...

- Broker actions to avoid in forex trading

- Defining a basic forex trading strategy

- Finding your forex trading strategy

- Forex trading considerations to remember

- The bottom line

- How to start a forex trading business from home

- If you are looking to set up your own forex...

- #1: learn the basics of currency trading

- #2: organize the trading capital

- #3: choose a reliable forex broker

- #4: start by opening a demo account

- #5: practice well

- #6: start trading with real money

- How to start forex trading

- What is forex trading?

- Look for a broker

- Open an account

- Make a trade

- Forex trading tools

- Close your trade

- How to start as a forex trader (7 steps)

- How to start as a forex trader

- How to start as a forex trader – script

- 1. Find a reputable broker

- 2. Use a demo account

- 3. Create a trade plan

- 4. Education

- 5. Major currencies

- 6. Start small

- 7. Be disciplined

- How to start as a forex trader – conclusion

- How to start as a forex trader – script

- Ready to become a successful trader?

- You have successfully subscribed!

- Forex startup review – stay away from this...

- What is forex startup

- Illegal broker

- User experience with forex startup

- Forex startup review – conclusion

- How to start as a forex trader (7 steps)

- How to start as a forex trader

- How to start as a forex trader – script

- 1. Find a reputable broker

- 2. Use a demo account

- 3. Create a trade plan

- 4. Education

- 5. Major currencies

- 6. Start small

- 7. Be disciplined

- How to start as a forex trader – conclusion

- How to start as a forex trader – script

- Ready to become a successful trader?

- You have successfully subscribed!

- Forex trading without deposit | no deposit bonus...

- No deposit bonus in a glance

- How to start forex trading without deposit: tips...

- Start forex trading without deposit: introduction...

- No deposit bonus as an alternative – is it worth...

- Learn to trade for free

- Join the leading online trading academy

- 40 + in-depth online trading lessons.

- Learn to trade in your own time.

- Learn trading, no matter your experience level.

- Track your progress through the trading course.

- Trading course overview

- Forex basics

- Understanding the market

- Technical analysis basics

- Technical analysis

- Mindset

- Economics

- Start trading

- Newsletter

- A professional signal service.

- What makes us different?

- It is all in the details.

- Fantastic support

- Mobile compatibility

- Account analysis

- White label

- Superior technology

- Fully hosted

- Quick and easy setup

- Multi platform, multi broker

- Customer testimonials

- Pricing

- About

- Contact us

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.