Tickmill paypal

El tiempo estimado para completar su registro es de 3 minutos

por favor complete el siguiente formulario usando sólo caracteres latinos © 2015-2021 tickmill ™

My list of forex bonuses

condiciones de la pagina web & condiciones | términos de negocio | divulgación de riesgos

tickmill.Com es propiedad y es operado dentro de las empresas de tickmill group. Tickmill group consiste de tickmill UK ltd, regulado por financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulado por cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulado por financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulado por the financial services authority of seychelles y es 100% propiedad del subsidiario procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd – regulado por financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Tickmill paypal

El tiempo estimado para completar su registro es de 3 minutos

por favor complete el siguiente formulario usando sólo caracteres latinos

© 2015-2021 tickmill ™

condiciones de la pagina web & condiciones | términos de negocio | divulgación de riesgos

tickmill.Com es propiedad y es operado dentro de las empresas de tickmill group. Tickmill group consiste de tickmill UK ltd, regulado por financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulado por cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulado por financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulado por the financial services authority of seychelles y es 100% propiedad del subsidiario procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd – regulado por financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Aviso de riesgo: todos los productos financieros que se operan de forma apalancada conllevan un alto grado de riesgo para su capital. No son adecuados para todos los inversores y existe el riego de perder más que su depósito inicial. Asegúrese de comprender completamente los riesgos involucrados y busque asesoramiento independiente si es necesario. Vea nuestra divulgación de riesgos

la información en este sitio no está dirigida a residentes de los estados unidos y no está destinada a ser distribuida ni utilizada por ninguna persona en ningún país o jurisdicción donde tal distribución o uso sea contrario a la ley o regulación local.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

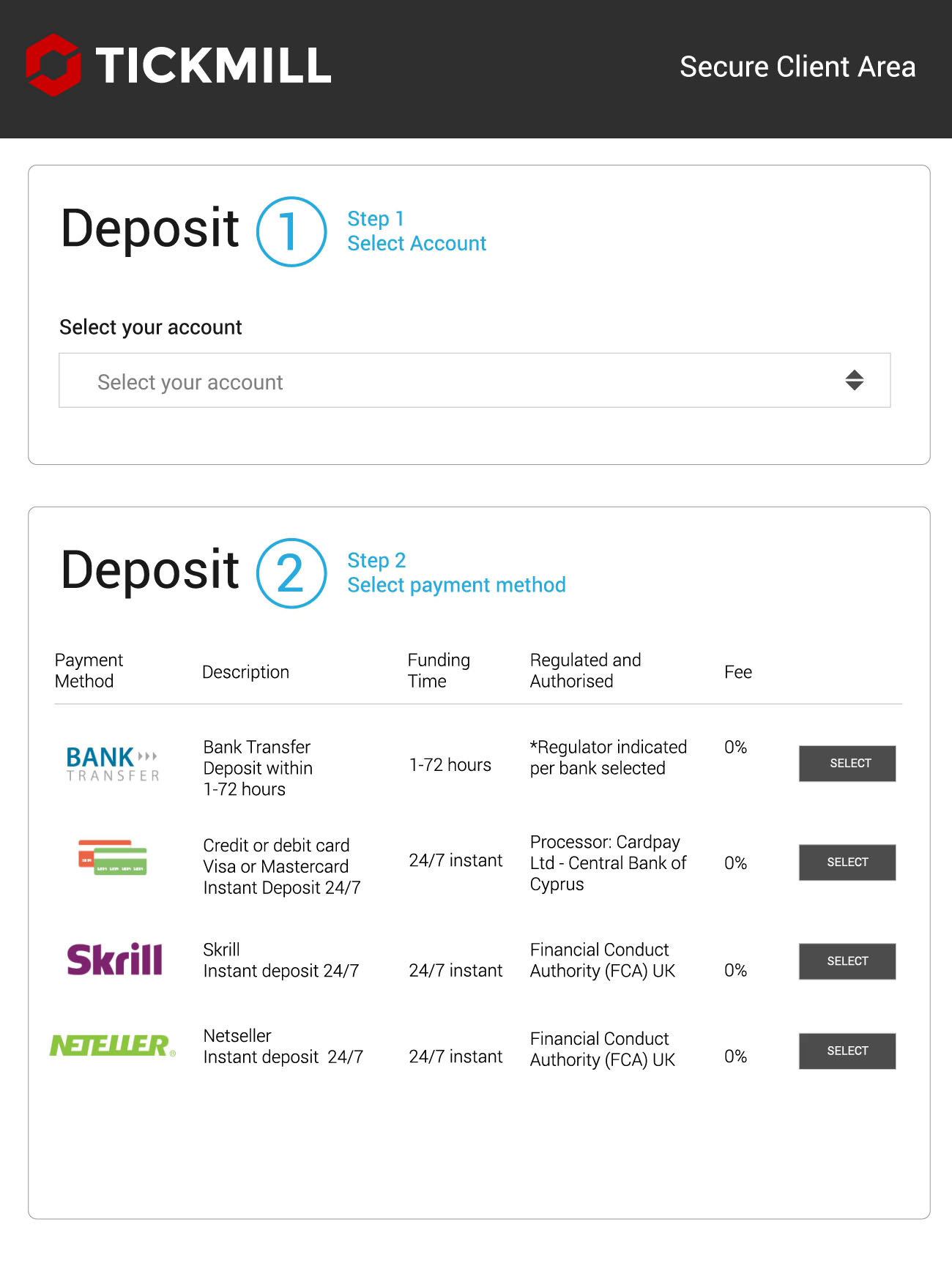

Deposit and withdrawals

Add, transfer or withdraw funds with ease, using the payment method that's most convenient for you.

Control

your account

Being able to make a deposit or withdrawal on your own terms is so important to your trading experience. At tickmill we think it’s crucial that you’re able to manage your funds effectively. So, we provide a range of secure, instant and easy to use deposit and withdrawal options.

All deposits starting from 5,000 USD or equivalent, processed in one transaction by bank wire transfer, are included in our zero fees policy. *

We will cover your transaction fees up to 100 USD or equivalent. Just email a copy of your bank statement or any other confirmation document for the transferred deposit to our support team. Within one calendar month after the deposit was made we will compensate your fee.

*we reserve the right to charge a maintenance fee where there is a lack of trading activity.

Deposit / withdrawal methods

Some options are only available to residents of certain countries. Also note that, when you request a withdrawal from your client area, the withdrawal will be in the base currency of your trading account. E.G. If your trading account is in USD, then your withdrawal will be processed in USD.

| Currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | within 1 working day |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR , GBP |

|---|---|

| min. Deposit | 100 EUR, USD, GBP |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , IDR |

|---|---|

| min. Deposit | $100 or 1,500,000 rp |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | CNY |

|---|---|

| min. Deposit | 700 ¥ or € / $ / £ 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | 1-2 hours |

| on withdrawal | within 1 working day |

| currencies | VND |

|---|---|

| min. Deposit | 2,000,000 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , RUB , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instant |

| on withdrawal | within 1 working day |

| currencies | USD , EUR |

|---|---|

| min. Deposit | 100 |

| min. Withdrawal | 25 |

| commission | |

| on deposit | none |

| on withdrawal | none |

| processing time | |

| on deposit | instantly |

| on withdrawal | within 1 working day |

Deposit and withdrawal conditions

Simply login to your client area and click on the green ‘deposit’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to deposit in. Step 2, will then automatically appear below.

Step 2: you then select the payment method using the buttons on the right of the payment method table. Step 3 will then automatically appear below.

Step 3: state how much you would like to deposit into your account.

You may also be prompted to enter the currency in which you’d like to make the deposit and some other options.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

We do not accept any payments made via a third-party source.

You must only use payment methods that are under your name and lawfully belong to you.

We reserve the right to require proof from you at any time. Failure to comply with this, will result in your payment getting frozen or being refunded.

We reserve the right to apply a penalty processing fee if a third-party payment is made.

If you use a credit/debit card to deposit, we may require scanned colour copies of both sides of your card to combat fraud. But, please do NOT send us any copies if we didn’t ask for them.

– upon receiving our request and before sending any copies to us, please cover (black-out) all digits except the last 4 on the front side of your card for security purposes.

– please also cover (black-out) the CVV code on the back of your card.

– all other details must be clear and visible.

– your card must be signed, and your signature must be clear and readable.

Please be informed that we will NEVER ask you for any sensitive card details (such as your full card number, CVV code, 3D-secure code, PIN code, etc.). If you received a suspicious request for any sensitive details from an unclear source, please contact us immediately.

If your credit/debit card deposit was unsuccessful, please try depositing again, while checking if:

– you have entered your card details correctly.

– you’re using a valid (not expired) card.

– you have sufficient funds on your card.

– if all of the above is fine, but your card deposit is still unsuccessful, it may mean that your issuing bank does not authorise your card to make the deposit. In that case, please use another card or any other payment method available in your trading account.

Simply login to your client area and click on the ‘withdrawal’ button, located to the left of your dashboard.

Step 1: you’ll first be prompted to select which account you’d like to withdraw from. Step 2, will then automatically appear below.

Step 2: you then select the method of withdrawal using the buttons on the right of the table. Step 3 will then automatically appear below.

Step 3: state how much you would like to withdraw from your account. Depending on the withdrawal method, you may have to enter more information related to the withdrawal type.

Please carefully read all of the instructions, terms and conditions and if you agree make sure that you check the box that says “I have read all instructions and agree with terms and conditions of payments operations.”

Click submit.

As a general rule, we only process withdrawals back to the payment method you originally used for depositing.

For credit cards ONLY:

– if you use a credit/debit card to deposit, we will always send the same total amount of withdrawals equal to your total deposits back to your card. Any remaining withdrawal amount which is above the deposited amount, will be processed to the payment method of your choice.

Example: if you deposited $100 by credit/debit card, earned a profit of $1,000 and requested a withdrawal of $1,000, you will get $100 back to your card and the remaining $900 to the payment method of your choice.

Alternative payment methods:

– if you use a credit/debit card and another method (e.G.: skrill ewallet) to deposit, your withdrawal will first be processed back to your card and any remaining withdrawal amount will be sent back to the other method used (e.G.: skrill ewallet).

Example: if you deposited $100 by skrill and $50 by credit/debit card, and requested a withdrawal of $90, you will get $50 back to your card and $40 to your ewallet.

Internal transfers from an MT4 account to another MT4 account are instant when the base currencies of both accounts are the same.

If the base currencies of the MT4 accounts are different, such internal transfers should be requested manually by sending an email to funding@tickmill.Com.

Internal transfers from an IB account to an MT4 account are processed automatically.

Please familiarise yourself with our general terms & conditions found on our website. Our customer support team is available monday – friday 07:00 am – 20:00 pm GMT to assist you if you need any help with making your payments.

It’s also important to note that, should we become aware that you’re purposely abusing our payment methods, we reserve the right to close your account and also charge you all applicable transfer and refund fees incurred on our side.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Compare brokers that accept paypal

For our paypal comparison, we found 6 brokers that are suitable and accept traders from ukraine.

We found 6 broker accounts (out of 147) that are suitable for paypal.

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Pepperstone

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About pepperstone

Platforms

Funding methods

Cfds and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading cfds.You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Fxpro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About fxpro

Platforms

Funding methods

80.52% of retail investor accounts lose money when trading cfds with this provider

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About HYCM

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

Finding a broker that accepts paypal

For those who are interested in opening an account with a forex broker, there are several factors which need to be considered.

Firstly, the broker in question should be regulated and trustworthy. Beyond that though, other features, such as a wide variety of underlying assets and amenable spreads, are also important. For example, the available payment methods can be just as critical, as you must be able to withdraw and deposit funds in order to trade.

Why use paypal as a trading payment option?

One thing that makes paypal a great payment option is that it’s simple to use. With just a few clicks, you can make instant deposits while paypal’s service coverage is offered in 202 countries worldwide and in 52 different currencies, including but not limited to USD, CAD, EUR, DKK, JPY, GBP and INR.

Paypal also supports a wide range of payment platforms including e-banking, PLAN and MXN. Paypal allows you to make payments online through your email address. You can deposit money to your account, instantly send it to your broker and receive any payout and withdraw it to your bank. It also offers a safe and secure online platform for sending money and receiving money electronically.

Paypal’s system of paying fees can also suit trading well. There are no fees charged for opening an account, while the payment fees for paypal vary according to your location and the payment method used.

Advantages & disadvantages of using paypal as a payment option

There are many benefits of using paypal for forex trading, including:

- It’s very simple and easy to use. With just a few clicks, you can make your deposits.

- It has a wide coverage and is available internationally in over 200 countries and 52 currencies.

- Forex traders don’t need a credit card as paypal account allows receiving and sending money to up to 202 countries globally, including but not limited to USA, canada, UK, france and italy.

- Payments are instant and withdrawals take less time to reflect in your bank account in comparison to traditional bank transfers.

- Payments made via credit cards or paypal account balance are processed instantly.

- Withdrawal of funds to bank account take at most 3 business days to reflect in bank account once approved by your bank.

- Forex companies recognise paypal as a payment method for speeding up transactions. With the endless number of benefits for forex traders, we believe paypal is certainly the easiest convenience that any trader can ever need.

The main disadvantages of using paypal are that the payment processing fees may be higher in comparison to a bank transfer, depending on your country and currency. If you don’t already have an account, there is also the additional work involved in setting up and managing a new paypal account.

Why choose avatrade

for paypal?

Avatrade scored best in our review of the top brokers for paypal, which takes into account 120+ factors across eight categories. Here are some areas where avatrade scored highly in:

- 12+ years in business

- Offers 250+ instruments

- A range of platform inc. MT4, mac, mirror trader, zulutrade, web trader, tablet & mobile apps

Avatrade offers four ways to tradeforex, cfds, spread betting, social trading. If you wanted to trade EURUSD

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

Avatrade have a AAA trust score. This is largely down to them being regulated by central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI, segregating client funds, being segregating client funds, being established for over 12

Trust score comparison

| avatrade | pepperstone | IG | |

|---|---|---|---|

| trust score | AAA | AAA | AAA |

| established in | 2006 | 2010 | 1974 |

| regulated by | central bank of ireland, ASIC, IIROC, FSA, FSB, UAE and BVI | financial conduct authority,UK and ASIC | financial conduct authority and ASIC |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of avatrade vs. Pepperstone vs. IG

Want to see how avatrade stacks up against pepperstone and IG? We’ve compared their spreads, features, and key information below.

Paypal brokers 2021 - which brokers accept paypal?

Paypal is by the far the world’s most recognisable form of online payment. The number of brokers that accept paypal is increasing and forex trading with paypal is becoming particularly common. Day trading with paypal brokers is popular because of how secure the method is and how quickly transfers can be made between accounts. Paypal is also easily linked to multiple debit and credit cards, which means making deposits and withdrawals is quick and easy. Paypal forex trading also has the advantage of their strict rules and payment guidelines. These mean that broker sites that accept paypal could be seen as more trustworthy than those that don’t.

Paypal brokers in ukraine

Note: despite what you may read elsewhere, the following traders do not currently accept paypal:

Avatrade

FXCM

FXTM

pepperstone

forexmart

Overview

With over a quarter of a billion active accounts, paypal is the world’s largest digital wallet. It was launched back in 1998 as confinity before merging with elon musk’s x.Com. This company was renamed paypal in 2001 and went public the following year. Since then paypal has evolved with mobile and web technology, making its options for transferring money even easier. In the EU, paypal is registered and licensed in luxembourg, having moved from the UK in 2007.

Paypal was not developed with trading in mind but, as its ubiquity has grown, so has the inevitability of traders wanting to trade with it. This had led to more and more brokerages accepting paypal.

Advantages

There are strong advantages to trading with brokers who accept paypal:

- Transferring funds with paypal is recognised as being fast, reliable and secure

- Paypal is easy to use, either on a desktop or through their app

- Making deposits and withdrawals with paypal is generally very quick and certainly faster than bank transfers

- Paypal accounts are easily linked to multiple credit cards, debit cards and bank accounts

- Paypal is recognised worldwide as a major ewallet

- Paypal’s strong anti-money laundering restrictions give traders security and potentially enhance the reputation of brokers with paypal

- High maximum transfer and withdrawal ($60,000)

- For forex traders, paypal works in 56 different currencies

- Free to open an account

- No charges for unused account

Drawbacks

However, day trading with paypal does have its disadvantages:

- Charges on every trading transaction

- FX fees (foreign transfer fees) are high at 4.5%

- High transfer fees of between 4-12%

- Although increasing, trading brokers that accept paypal are still relatively uncommon.

- Chargebacks only apply to tangible/physical goods, meaning forex and CFD traders etc. Aren’t eligible.

Speed of paypal payments

As long as there is money in your account, or in the bank account linked to the paypal account, funds for or from trading are generally transferred, if not instantly, then very quickly.

Security

There are claims that trading with paypal is actually safer than using your debit or credit card. Paypal stores your data in a ‘vault’, meaning that the other end of the transaction doesn’t receive any of your card or account details. In short, your privacy is assured.

The one problem of trading with paypal is that chargebacks can only be claimed for physical goods, not stocks or currencies etc.

Deposits and withdrawals with paypal

The vast majority of paypal traders, including all of those in the UK and US, are able to deposit and withdraw money to and from their paypal account.

However, some countries (currently including israel and the ukraine) are ‘send only’. This means that traders with accounts in those countries can make deposits in their paypal accounts and send money to others, but not withdraw money from paypal to their account. This would make paypal trading in such countries difficult.

Paypal fees or costs

Paypal accounts are free to open. New traders will probably already have an account for their online shopping.

Unlike other common day trading digital wallets, such as skrill or neteller, there is no charge if your account is unused for a period of time.

The fees for sending and receiving money are generally the same as other digital wallets, but there are instances where it is slightly less and slightly more. Any form of receiving trading money through paypal will incur a charge; the transfer fee which can rise as high as 12%.

Withdrawing money from your paypal account to your bank is free, unless you wish for a cheque to be issued.

Is paypal a good choice for traders?

Although not the most common, paypal is generally a good choice for traders although traders should factor in the potential of high transfer fees.

Paypal is becoming more and more integral to how we move money around so we expect brokers to continue to take it up as a payment method.

Traders dealing in larger amounts of money should bear in mind that paypal has a maximum of £10,000 for any single transaction.

Are there any paypal bonuses?

No. Paypal simply act as a middle-man between bank and broker. Any deposits held for a long period in paypal accounts don’t even accrue interest.

What countries can use paypal?

There are currently 203 countries and regions that use paypal, including all major developed economies.

Any location-specific information?

Paypal is country specific. This means that users in any given country can only link to a bank account they have in that country. The one exception is the USA: US paypal account holders can link to bank accounts in other countries.

Paypal charges up to four separate fees for cross-border transfers (all prices and percentages relate to the UK)

- A small, fixed amount per transaction (currently 20p, varies for different countries)

- A percentage of the transaction amount:

- Up to £1500 per month (3.4%)

- Up to £6000 per month (2.9%)

- Up to £15000 per month (2.4%)

- Over £15000 per month (1.9%)

- Currency conversion fee, currently 2.5% above the base exchange rate

- Potential fees for using debit or credit cards rather than paypal balance (this is on a transaction-by-transaction basis)

Stay logged in for faster checkout

Enable auto login on this browser and speed through checkout every time. (not recommended for shared devices.) what's this?

Connect your google account, check out faster on your devices

Automatically log in to paypal for faster checkout without typing your password wherever you're logged in with your google account.What's this?

Why connect my google account?

Linking your google account allows you to activate one touch quickly and easily when you check out. You can always opt out later in settings at paypal.Com.

Whenever you check out on a new device and browser when logged in with your google account, you can automatically log in at checkout without typing your password.

Stay logged in for faster checkout

Skip typing your password by staying logged in on this device. For security, we'll occasionally ask you to log in, including every time you update your personal or financial info. We don't recommend using one touch TM on shared devices. Turn this off at any time in your paypal settings.

Log in to your paypal account

Already set up to use your mobile number to log in? Type it below. Otherwise, click the link to log in with email.

Paypal one touch™ only works for checkout. Please login with your email.

Please login with your email and password.

Something went wrong on our end. Please login with your email and password.

Open the paypal app

Open the paypal app, tap yes on the prompt, then tap

Open the paypal app and tap yes on the prompt to log in.

Sorry, we couldn't confirm it's you

We didn't receive a response so we were unable confirm your identity.

Sorry, we couldn't confirm it's you

Verifying your information…

This may take a few seconds.

We recognize you on this device, and we’re securely logging you in.

We recognize you on this device, so no need to enter your password for this purchase.

We're taking you to paypal checkout to complete payment.

Honest tickmill forex broker review – scam or not?

| Review: | regulation: | min. Deposit: | forex pairs: | spreads: |

|---|---|---|---|---|

| (5 / 5) | FCA (UK), cysec (EU), FSA (SE) | 100$ | 50+ | 0.0 pips + 1$ commission per 1 lot |

Are you looking for real experiences and a critical test to the tickmill broker? – then you are exactly right on this page. As traders with more than 7 years of experience in the financial markets, we have tested the provider in detail for you with real money. Learn more about the conditions and seriousness of the broker. Is it really worth it to invest in forex broker tickmill money or not? – inform yourself in detail now.

Official website of tickmill

What is tickmill? – the company presented

Tickmill is an international broker for trading derivatives financial forex and cfds. The main headquarters are located in london: 1 fore street, london EC2Y 9DT, united kingdom. For many years, the company has proven itself to offer traders professional trading on the best terms. Also, there are branches in cyprus and seychelles.

According to the website, tickmill should provide an excellent trading experience with the cheapest spreads and commissions, which we will take a closer look at in the following test. Furthermore, the broker shines with many different awards in the industry and allows his traders to pursue any trading strategies.

Facts about tickmill:

- Forex broker from great britain (london)

- Made by traders for traders

- Specialized in forex trading with special conditions and lowest spreads

- Worldwide branches in different countries

- 114 billion average trading volume per month

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Is tickmill a regulated forex broker?

Regulations and licenses are important for traders and brokers so that a trusting relationship can be created. When a broker applies for a license, certain criteria and requirements must be met. A violation of the policy means in most cases a direct loss of the license.

Tickmill is even regulated several times. The broker has licenses from the FCA (UK), cysec (cyprus) and FSA (seychelles). It gives us a positive direct impression. European traders have to trade with the english license (FCA) or cysec license, which brings further benefits. On the other side, international traders have to choose the FSA license.

The safety of customer funds

The security of client funds should be given to a trusted broker. In online investments, trust in a broker is very important. Many smaller brokers with no license and experience sometimes handle money incorrectly. In order to avoid such a fraud, one should pay attention to certain criteria in broker selection.

Tickmill insures client funds separately from corporate funds to manage. For this purpose, the barclays bank is used, which operates internationally and is always liquid. In addition, client funds will be protected in the unlikely event of a bankruptcy or financial dilemma of tickmill with the financial services compensation scheme (FSCS) of up to £ 75,000. This is a very high value compared to other brokers, which usually have no deposit guarantee or a smaller one.

Regulation and safety:

- Regulated by FCA, cysec, and FSA

- Customer funds are managed by barclays bank

- High deposit guarantee of 75,000 GBP (FCA license)

- Safe website communication

Review of the tickmill conditions for traders

Tickmill is a true NDD broker (non-dealing desk) with well-known liquidity providers. It is traded herewith excluded conflict of interest between broker and customer. This is a big advantage as it is not a market maker.

There are more than 84 instruments available on the market. The broker is constantly trying to expand its offer and, for example, integrate new assets such as bitcoin. The offer is quite manageable and the tickmill tries to specialize with its offer on currencies (forex). Cfds (contracts for difference) are also available for commodities, government bonds or stock indices. Individual shares cannot be traded on this broker, so here’s a small smear in the rating that must be made.

Tickmill is characterized by its extremely tight spreads and low commission. We have compared many providers in recent years and tickmill is and remains the cheapest. The typical spread in the EUR/USD is only 0.00 – 0.01 pips small and the commission is a maximum of $ 2 per traded $ 100,000 (1 lot) in the pro account. Traders with higher deposits can even benefit from even smaller commissions ($ 1).

In addition, there are no requotes, as it is a true forex broker. This means you will always be able to open and close a position for the next best price in the market. The liquidity is always given by the various liquidity providers and the slippage is also very low on business news.

The best conditions:

- Very low spreads starting at 0.0 pips

- The extreme low commission in pro and VIP account is a huge advantage

- Pay only 2$ (pro) or 1$ (VIP) commission per 1 lot traded

- Fast execution and high liquidity

- More than 50 forex pairs

- Max. Leverage of 1:500

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

Tickmill trading platform test

As a trading platform, the metatrader 4 is offered to you. This is a proven and worldwide trading platform for private and professional traders. The platform is available for the browser (web), desktop (download), android (app) and ios (app). With the metatrader, you can easily and flexibly access the markets of tickmill from anywhere in the world.

The metatrader is perfect for any trader who wants to earn sustainable money in the markets. Even with small capital can be traded, because there are micro lots available. In addition, there is always a guaranteed execution at tickmill and no partial execution.

Professional charting and analysis

A trading platform should be user-friendly and flexible. This can offer the metatrader. Several chart settings for the technical analysis are adjustable. Use the well-known candlesticks for an even better analysis of the markets. Tickmill also provides educational tutorials for beginners.

In addition, use free indicators, which are adjustable for your personal strategy. The metatrader comes with a lot of tools after installation. If you do not have enough, you can add additional tools to metatrader 4. Use self-programmed indicators for every chart.

Facts about the platform:

- Flexible and user-friendly trading platform

- Available for every device

- Free indicators

- Very many different analysis tools

- Automated trading possible

Available for any device

In addition, tickmill offers education material and webinars for its clients.

Trading tutorial: how do forex and CFD trading work?

Forex is the largest market worldwide. Daily several trillions of dollars are being transacted in this market. That is why it is also highly liquid and interesting for beginners and experienced traders. Tickmill offers over 60 different currency pairs. Including many currencies from emerging markets. This is a huge advantage for those who are looking for an exotic currency pair for trading. For currencies, you can bet on falling or rising prices. Buy one currency and sell the other currency from the currency pair. The difference in the price is well written as profit.

Cfds are also offered. They are leveraged derivatives that can be traded on a variety of values. For the opening of a CFD trade, you do not buy directly the underlying asset, but only the contract to that value. This has several advantages because you can act with a high level of leverage and very easily place short trades. The broker rounds off the offering with cfds on stock indices, commodities, precious metals, and bonds.

Invest in falling or rising prices and secure the position with a stop loss and take profit. These are limits that automatically close your position. Since the calculation is sometimes confusing, tickmill offers a forex calculator. With this calculator, you can determine your risk and the position size in just a few seconds.

Tickmill offers fast order execution and high liquidity

Tickmill has several data and data centers around the world. In metatrader 4 you can choose the best access (server) for you. The broker is also characterized by its low latency. With the connection to the live server in london I have a latency of under 30 ms. If that is still too slow, you can rent a VPS server.

Personally, we had no problems with the order execution. The website also emphasizes that there are no requotes. Even with large position sizes 30 lot + can be traded easily. You always get a direct and immediate execution at the best prices.

Tickmill is a non-dealing desk broker, which has a similarity to an ECN broker. The difference between NDD and ECN is that the broker still sits between the market and clients. An obligation to pay additional funds can be excluded.

Use a VPS-server for the best connection

The provider allows any strategies and automatic programs. Expert advisors (eas) can run 24 hours a day automatically through a VPS server at tickmill. The latency is very low and the price from $ 22 a month too.

- The best choice for automatic programs

- Low latency

- Cheap fees (22$ per month)

Tickmill automated trading is possible

Tickmill allows every strategy and also automated programs. As mentioned above you can rent a VPS server very cheap. In connection with the metatrader 4 it works without problems and the setup is very simple. Program automatic programs for your trading or use provided trading systems. Today, more than 50% of the order executions are made automatically in the forex market.

Here you can see again that tickmill is a serious NDD broker. Dubious brokers forbid strategies or automatic programs. In addition, tickmill has no limit for stop-loss and take-profit brands. So it can be traded very small movements. Due to the low fees, it is worthwhile to scalping and day trading.

VPS-server allows you trading 24/7 on tickmill.

How to open your free tickmill account:

Another plus point for tickmill is the simple depot opening. According to the website, you need a maximum of 3 minutes for this and we can confirm this personally. Fill in the form with your personal data. Then you get direct access to the customer portal of tickmill. In addition, your email must be confirmed.

After that, the account has to be verified. Thanks to the strong regulations, brokers are not allowed to pay out to unverified customers. Even after the first deposit, the account must be verified urgently. Since our account is a bit older, we can not tell you whether a deposit without verification is possible.

For verification, it is sufficient to upload your ID and proof of address. The broker confirms the documents within 24 hours (weekdays). For even faster verification, contact support and say that your documents have been uploaded. Then you have access to the full functions of the trading account.

Unlimited demo account for beginners at tickmill

The free demo account of tickmill is perfect for beginners or experienced traders. It is unlimited and without expiration time. Traders can trade the markets with virtual assets and simulate real trading. Experienced traders learn new strategies or test new markets. For the demo account, no deposit or verification is necessary.

(note: get 5% spread rebate with the codes: IBU13836682 (EU) & IB60353132 (international))

3 different account types – which one you should choose?

Tickmill offers 3 types of accounts for traders. Interesting for us is only the pro and VIP account. From our experience, it is not worth the classic account to open, because the fees are accordingly higher than in the pro account. In the following text, we will inform you about the terms of each account.

As described above, the fees are sensationally low. Read the table below for more details. The pro accounts commission is only $2. So you pay only a fee of $4 per completed trade. When you open a VIP account, you save another 50%, because you only pay $2 for each completed trade. Even with our code (under the registration button) can save another 5%.

Tickmill gives you the exact interbank spreads from 0.0 pips. Trading is smooth and fast processing is provided by european servers. Upon request, an islamic account without swaps (interest) can be created.

| Classic | pro | VIP | |

|---|---|---|---|

| min. Deposit: | 100$ | 100$ | 50.000$ |

| spreads: | 1.6 pips | 0.0 pips | 0.0 pips |

| leverage: | max. 1:500 | max. 1:500 | max. 1:500 |

| commission: | 0$ | 2$ per 1 lot traded | 1$ per 1 lot traded |

Info: tickmill also offers its european customers to sign up as a professional trader and keep the high leverage of 1: 500.

The VIP account is the best choice for high volume forex traders

High-volume traders or companies can open a VIP account. From a deposit of 50,000$, you have even cheaper fees. You then only pay $ 1 per traded lot. This makes $ 2 per completed trader. These low costs can generate an increased profit. In addition, stop orders and limit orders are allowed close to market prices. This is a very good offer in comparison.

In summary, tickmill account types offer a great opportunity for every trader. The terms are very good and much better than other forex brokers. No matter if you want to trade the markets with small or big capital, tickmill is the right decision for beginners or advanced traders.

Compare the terms between tickmill and other brokers yourself. Tickmill is always the cheapest and has, therefore, made the first place in my forex broker comparison. With no other broker, you get so cheap trading fees without conflict of interest.

Review of the deposit and withdrawal of tickmill

At tickmill you can deposit and withdraw using the same methods. Bank transfer, credit card, skrill and neteller are available. On the payment and deposit, there are no fees.

My tests and experiences have shown that the payouts are very fast and the money is sent on the journey within 24 hours. You will receive a confirmation email after payment when the payout has been made.

How high is the minimum deposit? – trading with a small amount of money

The minimum deposit is regularly 100$/€. You can trade in the trading platform as low as 0.01 lot. This is a very small position size and the risk is in most cases only a few cents high. The provider is thus broadly positioned because even larger investors can trade without problems at this broker.

Tickmill deposit and withdrawal methods

Questions and tips for your transactions:

- Open your free account at tickmill. Complete your data and verify the account. After verification, all functions of the broker are available to you.

- How much money should you deposit? – this is entirely up to the goals and ideals of the trader. Some trading strategies, for example, are not feasible with a small sum of € 100. Be sure to test the demo account before making your first deposit.

- Are my transactions with tickmill safe? – yes, tickmill works only with the best banks and verified payment providers. You can check all transactions in the customer portal.

- Also, open several trading accounts in the customer portal. Thus it is possible to use different accounts for different strategies. An internal transfer takes only a few minutes.

New: now use sofortüberweisung (klarna) or paysafecard to capitalize your account even faster.

Is there negative balance protection?

The negative balance of an account is very feared by many traders. And this is also very justified. For some brokers, traders in the past have been able to build up debt or negative balance through extreme market conditions, which had to be balanced.

At tickmill there is no additional funding and you are thus protected against a negative balance.

With tickmill you cannot lose more money than your deposit.

Tickmill service and support for traders

One of the last important points in this review is trader support and service. Tickmill offers support in more than 10 different languages (also africa, asia, india, thai clients). From our experience, the broker employs international employees who exclusively look after every customer.

Support is available to customers 24 hours a week, 7 days a week. The support is provided by chat, phone or email. A trader should not lack anything here. My tests showed that the support is always fast and reliable!

Tickmill presented itself in different countries, for example at the world of trading in frankfurt. The broker had his own stand there and sought direct contact with his clients. Service is one of the most important things for traders and tickmill shows confidence and seriousness.

To further improve its service, well-known and professional traders are invited to hold webinars or other information sessions. Well-known names are giovanni cicivelli or mike seidel. The saying “by traders for traders” also applies here. Tickmill tries to give its customers the best performance combined with good service.

In summary, the support from tickmill is very good and professional. Our personal concerns were always resolved very quickly and we can make a clear recommendation here. Overall, the overall package is rounded off with a great service.

| Support: | available: | phone number: | special: |

|---|---|---|---|

| phone, chat, email | 24/5 | +44 (0)20 3608 6100 | webinars, 1 to 1 support, events |

Conclusion of my review: tickmill is one of the best forex brokers

My experience and tests show on this page that tickmill is a very good broker. He gets from us a 5-star rating. We recommend this forex broker with a clear conscience. Tickmill offers an offer for every type of trading.

With the world’s cheapest fees, the broker is currently topping any competitor. The trading experience is unique with this broker and you save a lot of money on the order execution. For every trader who trades forex, this is the right provider.

If you have further questions, contact support by phone or chat. International employees are ready to help you.

Advantages:

- UK regulation and high customer safety

- The cheapest forex broker of the world

- No requotes and high liquidity

- The best execution

- Good service and support

- The best conditions for forex traders

- Very low trading fees

Disadvantages:

- No stocks for trading

Tickmill is the best forex broker in the world because of the cheap trading fees and good execution. (5 / 5)

Read our other articles about tickmill:

Paypal brokers 2021 - which brokers accept paypal?

Paypal is by the far the world’s most recognisable form of online payment. The number of brokers that accept paypal is increasing and forex trading with paypal is becoming particularly common. Day trading with paypal brokers is popular because of how secure the method is and how quickly transfers can be made between accounts. Paypal is also easily linked to multiple debit and credit cards, which means making deposits and withdrawals is quick and easy. Paypal forex trading also has the advantage of their strict rules and payment guidelines. These mean that broker sites that accept paypal could be seen as more trustworthy than those that don’t.

Paypal brokers in ukraine

Note: despite what you may read elsewhere, the following traders do not currently accept paypal:

Avatrade

FXCM

FXTM

pepperstone

forexmart

Overview

With over a quarter of a billion active accounts, paypal is the world’s largest digital wallet. It was launched back in 1998 as confinity before merging with elon musk’s x.Com. This company was renamed paypal in 2001 and went public the following year. Since then paypal has evolved with mobile and web technology, making its options for transferring money even easier. In the EU, paypal is registered and licensed in luxembourg, having moved from the UK in 2007.

Paypal was not developed with trading in mind but, as its ubiquity has grown, so has the inevitability of traders wanting to trade with it. This had led to more and more brokerages accepting paypal.

Advantages

There are strong advantages to trading with brokers who accept paypal:

- Transferring funds with paypal is recognised as being fast, reliable and secure

- Paypal is easy to use, either on a desktop or through their app

- Making deposits and withdrawals with paypal is generally very quick and certainly faster than bank transfers

- Paypal accounts are easily linked to multiple credit cards, debit cards and bank accounts

- Paypal is recognised worldwide as a major ewallet

- Paypal’s strong anti-money laundering restrictions give traders security and potentially enhance the reputation of brokers with paypal

- High maximum transfer and withdrawal ($60,000)

- For forex traders, paypal works in 56 different currencies

- Free to open an account

- No charges for unused account

Drawbacks

However, day trading with paypal does have its disadvantages:

- Charges on every trading transaction

- FX fees (foreign transfer fees) are high at 4.5%

- High transfer fees of between 4-12%

- Although increasing, trading brokers that accept paypal are still relatively uncommon.

- Chargebacks only apply to tangible/physical goods, meaning forex and CFD traders etc. Aren’t eligible.

Speed of paypal payments

As long as there is money in your account, or in the bank account linked to the paypal account, funds for or from trading are generally transferred, if not instantly, then very quickly.

Security

There are claims that trading with paypal is actually safer than using your debit or credit card. Paypal stores your data in a ‘vault’, meaning that the other end of the transaction doesn’t receive any of your card or account details. In short, your privacy is assured.

The one problem of trading with paypal is that chargebacks can only be claimed for physical goods, not stocks or currencies etc.

Deposits and withdrawals with paypal

The vast majority of paypal traders, including all of those in the UK and US, are able to deposit and withdraw money to and from their paypal account.

However, some countries (currently including israel and the ukraine) are ‘send only’. This means that traders with accounts in those countries can make deposits in their paypal accounts and send money to others, but not withdraw money from paypal to their account. This would make paypal trading in such countries difficult.

Paypal fees or costs

Paypal accounts are free to open. New traders will probably already have an account for their online shopping.

Unlike other common day trading digital wallets, such as skrill or neteller, there is no charge if your account is unused for a period of time.

The fees for sending and receiving money are generally the same as other digital wallets, but there are instances where it is slightly less and slightly more. Any form of receiving trading money through paypal will incur a charge; the transfer fee which can rise as high as 12%.

Withdrawing money from your paypal account to your bank is free, unless you wish for a cheque to be issued.

Is paypal a good choice for traders?

Although not the most common, paypal is generally a good choice for traders although traders should factor in the potential of high transfer fees.

Paypal is becoming more and more integral to how we move money around so we expect brokers to continue to take it up as a payment method.

Traders dealing in larger amounts of money should bear in mind that paypal has a maximum of £10,000 for any single transaction.

Are there any paypal bonuses?

No. Paypal simply act as a middle-man between bank and broker. Any deposits held for a long period in paypal accounts don’t even accrue interest.

What countries can use paypal?

There are currently 203 countries and regions that use paypal, including all major developed economies.

Any location-specific information?

Paypal is country specific. This means that users in any given country can only link to a bank account they have in that country. The one exception is the USA: US paypal account holders can link to bank accounts in other countries.

Paypal charges up to four separate fees for cross-border transfers (all prices and percentages relate to the UK)

- A small, fixed amount per transaction (currently 20p, varies for different countries)

- A percentage of the transaction amount:

- Up to £1500 per month (3.4%)

- Up to £6000 per month (2.9%)

- Up to £15000 per month (2.4%)

- Over £15000 per month (1.9%)

- Currency conversion fee, currently 2.5% above the base exchange rate

- Potential fees for using debit or credit cards rather than paypal balance (this is on a transaction-by-transaction basis)

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least €25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/01/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

So, let's see, what we have: tickmill paypal el tiempo estimado para completar su registro es de 3 minutos por favor complete el siguiente formulario usando sólo caracteres latinos © 2015-2021 tickmill ™ condiciones at tickmill paypal

Contents of the article

- My list of forex bonuses

- Tickmill paypal

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Compare brokers that accept paypal

- We found 6 broker accounts (out of 147)...

- Avatrade

- Pepperstone

- Spreads from

- What can you trade?

- About pepperstone

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Fxpro

- Spreads from

- What can you trade?

- About fxpro

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About HYCM

- Platforms

- Funding methods

- Finding a broker that accepts paypal

- Why choose avatrade for paypal?

- A comparison of avatrade vs. Pepperstone vs. IG

- Paypal brokers 2021 - which brokers accept paypal?

- Paypal brokers in ukraine

- Overview

- Advantages

- Drawbacks

- Speed of paypal payments

- Security

- Deposits and withdrawals with paypal

- Paypal fees or costs

- Is paypal a good choice for traders?

- Stay logged in for faster checkout

- Connect your google account, check out faster on...

- Why connect my google account?

- Stay logged in for faster checkout

- Log in to your paypal account

- Open the paypal app

- Sorry, we couldn't confirm it's you

- Sorry, we couldn't confirm it's you

- Honest tickmill forex broker review – scam or not?

- What is tickmill? – the company presented

- Is tickmill a regulated forex broker?

- The safety of customer funds

- Review of the tickmill conditions for traders

- Tickmill trading platform test

- Professional charting and analysis

- Trading tutorial: how do forex and CFD trading...

- Tickmill offers fast order execution and high...

- Use a VPS-server for the best connection

- Tickmill automated trading is possible

- How to open your free tickmill account:

- Unlimited demo account for beginners at tickmill

- 3 different account types – which one you should...

- The VIP account is the best choice for high...

- Review of the deposit and withdrawal of tickmill

- How high is the minimum deposit? – trading with a...

- Is there negative balance protection?

- Tickmill service and support for traders

- Conclusion of my review: tickmill is one of the...

- Paypal brokers 2021 - which brokers accept paypal?

- Paypal brokers in ukraine

- Overview

- Advantages

- Drawbacks

- Speed of paypal payments

- Security

- Deposits and withdrawals with paypal

- Paypal fees or costs

- Is paypal a good choice for traders?

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

Contents of the article

- My list of forex bonuses

- Tickmill paypal

- Deposit and withdrawals

- Control your account

- Deposit / withdrawal methods

- Deposit and withdrawal conditions

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Compare brokers that accept paypal

- We found 6 broker accounts (out of 147)...

- Avatrade

- Pepperstone

- Spreads from

- What can you trade?

- About pepperstone

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Fxpro

- Spreads from

- What can you trade?

- About fxpro

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About HYCM

- Platforms

- Funding methods

- Finding a broker that accepts paypal

- Why choose avatrade for paypal?

- A comparison of avatrade vs. Pepperstone vs. IG

- Paypal brokers 2021 - which brokers accept paypal?

- Paypal brokers in ukraine

- Overview

- Advantages

- Drawbacks

- Speed of paypal payments

- Security

- Deposits and withdrawals with paypal

- Paypal fees or costs

- Is paypal a good choice for traders?

- Stay logged in for faster checkout

- Connect your google account, check out faster on...

- Why connect my google account?

- Stay logged in for faster checkout

- Log in to your paypal account

- Open the paypal app

- Sorry, we couldn't confirm it's you

- Sorry, we couldn't confirm it's you

- Honest tickmill forex broker review – scam or not?

- What is tickmill? – the company presented

- Is tickmill a regulated forex broker?

- The safety of customer funds

- Review of the tickmill conditions for traders

- Tickmill trading platform test

- Professional charting and analysis

- Trading tutorial: how do forex and CFD trading...

- Tickmill offers fast order execution and high...

- Use a VPS-server for the best connection

- Tickmill automated trading is possible

- How to open your free tickmill account:

- Unlimited demo account for beginners at tickmill

- 3 different account types – which one you should...

- The VIP account is the best choice for high...

- Review of the deposit and withdrawal of tickmill

- How high is the minimum deposit? – trading with a...

- Is there negative balance protection?

- Tickmill service and support for traders

- Conclusion of my review: tickmill is one of the...

- Paypal brokers 2021 - which brokers accept paypal?

- Paypal brokers in ukraine

- Overview

- Advantages

- Drawbacks

- Speed of paypal payments

- Security

- Deposits and withdrawals with paypal

- Paypal fees or costs

- Is paypal a good choice for traders?

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.