Claim my bonus

If you do not give your consent to the above, you may alternatively contact us via the members area or at support@xm.Com.

My list of forex bonuses

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trade forex and cfds on stock indices,

oil and gold.

Claim your 100%

up to $5,000 trading bonus

Risk warning: forex and CFD trading is high risk and can result

in the loss of all your invested capital. T&cs apply

- Trade with a regulated broker

- Zero commissions

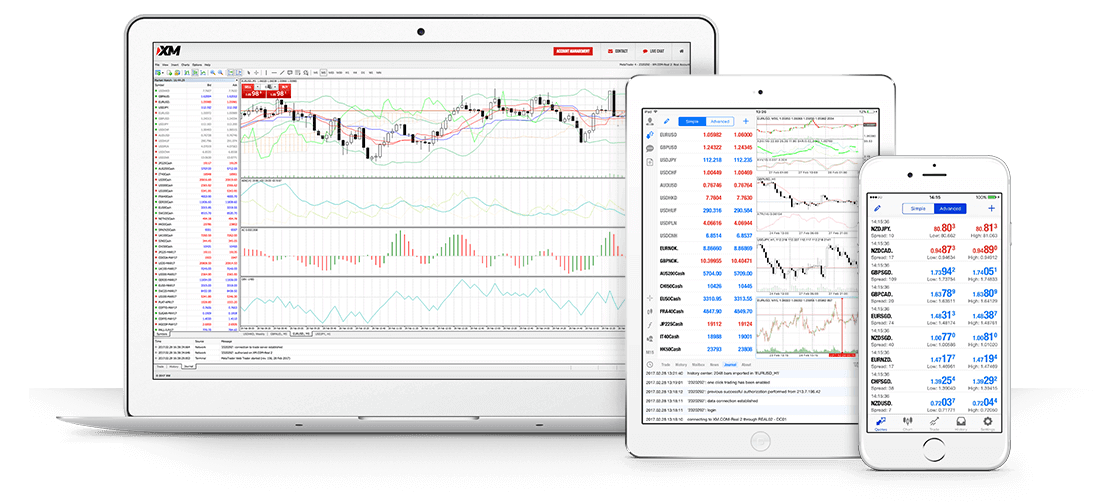

- Trade on desktop, mobile and tablet

- No hidden fees

Trade on 16 platforms from 1 account

MT4 and MT5, both available for desktop, tablet and mobile devices

Risk warning: forex and CFD trading is high risk and can result

in the loss of all your invested capital. T&cs apply

Why choose XM?

There is a reason why over 3.5 million clients have chosen XM for trading forex and cfds on stocks

stock indices, commodities, metals and energies.

Licensed and regulated

Trading with XM means trading with a licensed and regulated broker.

Up to 888:1 leverage

XM offers its clients up to 888:1 leverage with negative balance protection and no changes in margin overnight or at weekends.

24-hour support

At XM you can enjoy 24/5 support in over 30 languages by live chat, email and phone.

Over 1000 instruments

XM offers trading in over 1000 instruments ranging from forex and cfds on stock indices, oil and gold.

Legal: this website is operated by XM global limited with registered address at no. 5 cork street, belize city, belize, CA.

Trading point holdings ltd is the holding company of trading point of financial instruments limited, XM global limited, trading point of financial instruments UK limited, trading point of financial instruments pty ltd, and trading point MENA limited.

Trading point of financial instruments limited is authorised and regulated by the cyprus securities and exchange commission (cysec) (licence number 120/10).

XM global limited is authorised and regulated by the international financial services commission (IFSC) (license number 000261/106).

Trading point of financial instruments UK limited is authorised and regulated by the financial conduct authority (FRN: 705428).

Trading point of financial instruments pty ltd is authorised and regulated by the australian securities and investment commission (AFSL 443670).

Trading point MENA limited is authorised and regulated by the dubai financial services authority (DFSA) (reference no. F003484).

Risk warning: forex and CFD trading involves a significant risk to your invested capital. Please read and ensure you fully understand our risk disclosure.

Restricted regions: XM global limited does not provide services for the residents of certain countries, such as the united states of america, canada, israel and the islamic republic of iran.

XM live chat

By clicking the "enter" button, you agree for your personal data provided via live chat to be processed by XM global limited, as per the company's privacy policy, which serves the purpose of you receiving assistance from our customer support department.

If you do not give your consent to the above, you may alternatively contact us via the members area or at support@xm.Com.

Please enter your contact information. If you already have an XM account, please state your account ID so that our support team can provide you with the best service possible.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

For more information please read our cookie policy.

This website uses cookies

By clicking “continue”, you agree to the default cookie settings on our website.

XM uses cookies to ensure that we provide you with the best experience while visiting our website. Some of the cookies are needed to provide essential features, such as login sessions, and cannot be disabled. Other cookies help us improve our website’s performance and your experience through personalising content, providing social media features and analysing our traffic. Such cookies may also include third-party cookies, which might track your use of our website. You may change your cookie settings at any time.

Read more, or change your cookie settings.

Your cookie settings

What are cookies?

Cookies are small data files. When you visit a website, the website sends the cookie to your computer. Your computer stores it in a file located inside your web browser.

Cookies do not transfer viruses or malware to your computer. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs (i.E. They record user activity and remember stateful information) and they get updated every time you visit a website.

We may obtain information about you by accessing cookies, sent by our website. Different types of cookies keep track of different activities. For example, session cookies are used only when a person is actively navigating a website. Once you leave the website, the session cookie disappears.

Why are cookies useful?

We use functional cookies to analyse how visitors use our website, as well as track and improve our website’s performance and function. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For example, we might use cookies to keep track of which website pages are most popular and which method of linking between website pages is most effective. The latter also helps us to track if you were referred to us by another website and improve our future advertising campaigns.

Another use of cookies is to store your log in sessions, meaning that when you log in to the members area to deposit funds, a "session cookie" is set so that the website remembers that you have already logged in. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which language you wish to see when you log in.

Here is an overview of some of the functions our cookies provide us with:

- Verifying your identity and detecting the country you are currently visiting from

- Checking browser type and device

- Tracking which site the user was referred from

- Allowing third parties to customize content accordingly

This website uses google analytics, a web analytics service provided by google, inc. ("google"). Google analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. The information generated by the cookie about your use of the website (including your IP address) may be transmitted to and stored by google on their servers. Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. Google may also transfer this information to third parties, where required to do so by law, or where such third parties process the information on behalf of google. Google will not associate your IP address with any other data held. By using this website, you give your consent to google to process data about you in the manner and for the purposes set out above.

How to claim a bonus with a promo code

You may redeem promotional codes from our web in these 2 places showed below:

- Login to your mybookie account. If you still don’t have an account, click the ‘join’ button and enter your promotional code.

- After completing the sign-up process, go to the ‘cashier ‘, choose your bonus from the drop-down menu, or click on ‘see more options’ choose the bonus you like the most.

- Complete your deposit to receive your sign-up bonus.

- If you already have an account, log in.

- Go to the cashier and enter your promotional code, click on “see more options” and at the bottom of the menu redeem code.

- Alternatively, you may select a bonus from the drop-down menu or click on “see more options” to choose from our variety of bonuses available.

- Complete your deposit to receive your bonus.

If you have a promotional code, here’s how to redeem it on the site:

Login to your mybookie account. If you still don’t have an account, click the ‘join’ and complete the sign-up process. Or log in if you are an existing player.

- Go to the cashier: click on “see more options” a menu is going to show up, at the bottom of it, enter your promo code, and then click on redeem. Your new promotion is available now, select it, and complete a successful deposit! And get your bonus!

- Go to the sportsbook: below of your “betslip” you will see the option of “promo code” enter the code, and click on redeem now go to the cashier, complete a successful deposit! And get your bonus!

*this option is available on desktop only.

*we require a $45 minimum deposit to receive most sign-up and $100 for reload bonuses.

*crypto reload bonuses require a minimum deposit of $50.

We recommend reading the terms and conditions for your specific offer.

More articles related to these topics bonus

How to claim bonuses on unemployment claims

How much can I collect on partial unemployment in new jersey?

Unemployment insurance is governed at both the state and federal levels. The department of labor employment training administration governs unemployment insurance at the federal level. Each state has independent unemployment insurance guidelines, but they must also follow the established federal guidelines. "the general rule (for unemployment insurance eligibility) is that workers must have lost their jobs through no fault of their own and must be able, available, and actively seeking work," according to the department of labor's website. Further eligibility is determined at the state level.

File your initial claim

Gather your most recent pay stubs including final check, bonus payments, vacation pay-out and severance.

Closely follow your state's instructions on applying for unemployment insurance. Errors or failure to provide necessary information may result in the denial of your claim.

Report all bonus payments in the space provided on the claim form. If you are reporting the claim over the phone, you will receive a prompt to enter this information. In most cases, you will be asked to report the gross payment (amount before taxes).

State the time period for which the bonus was paid and the reason for the bonus, as this information may determine whether or not your benefit check is reduced.

Reporting bonus payment prior to your first benefit check

Retain the pay stub from the bonus check, as you will need that information when you report the income.

Immediately contact your state unemployment agency to report payment of the bonus, plus any other additional income.

Remember to make note of the time period of the bonus and why it was paid.

Mail the unemployment agency a copy of the pay stub if required.

Retain the pay stub for future reference and documentation.

Reporting the bonus after your claim is approved

Use the claim form that you received with your benefit check to report the bonus income. If you did not receive a claim form, contact the unemployment insurance agency.

Make note of the time period of the bonus and why it was paid, in the space provided on the claim form.

Provide documentation of the bonus if requested.

Retain a copy of the bonus pay stub for your records.

When reporting bonus income, pay close attention to the instructions on the claim form. If the form requests gross payment, list the amount before taxes. For net payment, list the amount after taxes.

Don't assume that bonus payment will automatically reduce your unemployment insurance benefits. Each state has separate guidelines on what income will reduce benefits.

Warnings

When reporting income to the unemployment agency it is essential to be accurate and truthful. Errors and omissions may result in denial of your claim. In addition, failure to report income may result in penalties and even criminal prosecution, depending on your state.

How to claim bonuses on unemployment claims

How much can I collect on partial unemployment in new jersey?

Unemployment insurance is governed at both the state and federal levels. The department of labor employment training administration governs unemployment insurance at the federal level. Each state has independent unemployment insurance guidelines, but they must also follow the established federal guidelines. "the general rule (for unemployment insurance eligibility) is that workers must have lost their jobs through no fault of their own and must be able, available, and actively seeking work," according to the department of labor's website. Further eligibility is determined at the state level.

File your initial claim

Gather your most recent pay stubs including final check, bonus payments, vacation pay-out and severance.

Closely follow your state's instructions on applying for unemployment insurance. Errors or failure to provide necessary information may result in the denial of your claim.

Report all bonus payments in the space provided on the claim form. If you are reporting the claim over the phone, you will receive a prompt to enter this information. In most cases, you will be asked to report the gross payment (amount before taxes).

State the time period for which the bonus was paid and the reason for the bonus, as this information may determine whether or not your benefit check is reduced.

Reporting bonus payment prior to your first benefit check

Retain the pay stub from the bonus check, as you will need that information when you report the income.

Immediately contact your state unemployment agency to report payment of the bonus, plus any other additional income.

Remember to make note of the time period of the bonus and why it was paid.

Mail the unemployment agency a copy of the pay stub if required.

Retain the pay stub for future reference and documentation.

Reporting the bonus after your claim is approved

Use the claim form that you received with your benefit check to report the bonus income. If you did not receive a claim form, contact the unemployment insurance agency.

Make note of the time period of the bonus and why it was paid, in the space provided on the claim form.

Provide documentation of the bonus if requested.

Retain a copy of the bonus pay stub for your records.

When reporting bonus income, pay close attention to the instructions on the claim form. If the form requests gross payment, list the amount before taxes. For net payment, list the amount after taxes.

Don't assume that bonus payment will automatically reduce your unemployment insurance benefits. Each state has separate guidelines on what income will reduce benefits.

Warnings

When reporting income to the unemployment agency it is essential to be accurate and truthful. Errors and omissions may result in denial of your claim. In addition, failure to report income may result in penalties and even criminal prosecution, depending on your state.

How to claim a bonus with a promo code

You may redeem promotional codes from our web in these 2 places showed below:

- Login to your mybookie account. If you still don’t have an account, click the ‘join’ button and enter your promotional code.

- After completing the sign-up process, go to the ‘cashier ‘, choose your bonus from the drop-down menu, or click on ‘see more options’ choose the bonus you like the most.

- Complete your deposit to receive your sign-up bonus.

- If you already have an account, log in.

- Go to the cashier and enter your promotional code, click on “see more options” and at the bottom of the menu redeem code.

- Alternatively, you may select a bonus from the drop-down menu or click on “see more options” to choose from our variety of bonuses available.

- Complete your deposit to receive your bonus.

If you have a promotional code, here’s how to redeem it on the site:

Login to your mybookie account. If you still don’t have an account, click the ‘join’ and complete the sign-up process. Or log in if you are an existing player.

- Go to the cashier: click on “see more options” a menu is going to show up, at the bottom of it, enter your promo code, and then click on redeem. Your new promotion is available now, select it, and complete a successful deposit! And get your bonus!

- Go to the sportsbook: below of your “betslip” you will see the option of “promo code” enter the code, and click on redeem now go to the cashier, complete a successful deposit! And get your bonus!

*this option is available on desktop only.

*we require a $45 minimum deposit to receive most sign-up and $100 for reload bonuses.

*crypto reload bonuses require a minimum deposit of $50.

We recommend reading the terms and conditions for your specific offer.

More articles related to these topics bonus

Car insurance no-claims bonuses explained

All you need to know about your car insurance no-claims bonus or no-claims discount - from how they work to whether it's worth paying out to protect it.

What is a 'no-claims' bonus or discount?

A no-claims bonus - also known as a no-claims discount - is a percentage discount your insurer shaves off your insurance premium to reward you for not having made a car insurance claim in the previous year.

So if, for example, you had a no-claims bonus of 30%, you’d pay £700 where you would otherwise have paid £1,000.

For each consecutive year that you don’t make any claims, the discount increases. So where your insurer might award you 30% for one year without claims, five claims-free years under your belt might net you 60%.

What’s the maximum no-claims bonus I can get?

As you build up more claims-free years, you progress along a no-claims bonus scale, which might look something like the example below.

Eventually, you’ll reach the number of claims-free years required to net the maximum discount your insurer will offer.

How no-claims discounts build up

Each insurer's no-claims bonus scheme is different - from the size of discounts to the number of claims-free years it takes to achieve them.

Maximum discounts range from around 40% to 80%, while the number of claims free-years you need before you’re at the top of the scale ranges from around five to 15 years.

What is a no-claims bonus worth?

By itself, a no-claims bonus doesn’t really say much about what you’ll pay - you need to know what the premium is to work out how much of a saving it represents.

Suppose you have two insurers. Both have a base premium of £1,000, to which the discount is applied. With insurer A, your no-claims bonus is 75%, and with insurer B, 60%. In this case, insurer A is clearly the cheapest.

But where the base premiums are different - as they’re likely to be in the real world - then the comparison changes. If insurer A’s base premium is £1,500 and insurer B’s, £900, for instance - then insurer B is cheaper.

| Insurer A | insurer B | |

|---|---|---|

| no-claims discount | 75% | 60% |

| base premium | £1,000 | £1,000 |

| premium with discount | £250 | £400 |

| base premium | £1,500 | £900 |

| premium with discount | £375 | £360 |

Some insurers will make a point of awarding generous no-claims bonuses in their marketing, but it's important to compare the final quote - with any discounts included - to determine which is the best deal. Read our guide on how to find an insurer with a lower premium.

The reason it’s worth keeping your no-claims bonus in mind is that you can lose it if you make a claim, meaning you'll pay higher premiums than you otherwise would have.

How can a claim affect my no-claims bonus?

If you make a car insurance claim, you may lose some of your no-claims bonus according to where you are on the insurer’s ‘step-back’ scale.

This basically bumps down the discount back to what it was in previous years. Insurers have different step-back scales.

In the example below, the driver has spent five years building their no-claims bonus up to 60%.

When they make a claim, that five-year discount reduces to a three-year discount - so at renewal they only get 40% off, and have to spend two years building their no-claims bonus back to what it was.

What claims don't affect my no-claims bonus?

There are certain kinds of claim that won't erode your no-claims bonus. Generally, insurers will leave your no-claims bonus alone if your claim was not a 'fault' claim.

This means they were able to recover their repair costs in full from the party at fault. Similarly, many insurers will disregard non-fault claims where the other driver was uninsured.

It's also quite common for insurers to make exceptions with glass damage claims.

Should I protect my no-claims bonus?

No-claims bonus protection is an added extra that you can buy with your insurance.

It will prevent a limited number of claims (two or three claims over a three-year period is common) from having an impact on your no-claims bonus.

No-claims bonus protection will certainly save you money if you make a claim. However, you'll need to pay extra for it (around £60 is fairly typical), so its value depends on how much discount you’d stand to lose by claiming.

Insurers don’t make this easy to find out - but they do have to show how much discount, on average, their customers were awarded for each year of no claims.

So this should give you a starting point in working out whether to buy no-claims bonus protection.

As a general rule of thumb, the bigger your no-claims bonus, the more you stand to lose through making a claim, and therefore the greater the value of the protection.

How does no-claims bonus protection work?

A fairly common misconception about bonus protection is that it stops your premiums from rising because of a claim.

Unfortunately, this isn’t true. If you make a claim and, as a result, the insurer thinks you’re more likely to make future claims, it will increase your premium. After this, it will apply whatever discount you have.

So, suppose your discount is 60%, you’re paying £400 instead of the base premium of £1,000. Then you make a claim - protected under the added extra you've paid for.

The following renewal your insurer could then increase that base premium to £1,300. With the same 60% discount in place, you’d now be paying £520.

Which? Collects data on no-claims bonus protection. The table below shows the policies of dozens of insurers we rate.

| Car insurer | number of claims you can make with a protected no-claims discount |

|---|---|

| AA insurance | 2 claims in 3 years |

| admiral | 2 claims in 3 years |

| age co | 2 claims in 3 years |

| ageas | 2 claims in 3 years |

| AXA | 2 claims in 3 years |

| budget | 2 claims in 3 years |

| by miles | unlimited |

| churchill | 2 claims in 3 years |

| co-op insurance | 4 claims in 3 years |

| diamond | 2 claims in 3 years |

| direct line | 2 claims in 3 years |

| elephant | 2 claims in 3 years |

| esure | unlimited |

| hastings direct | 2 claims in 3 years |

| insurepink | 2 claims in 3 years |

| john lewis finance | 2 claims in 3 years |

| LV | unlimited |

| M&S bank | 2 claims in 3 years |

| mercedes-benz | varies by underwriter |

| more than | unlimited |

| NFU mutual | 2 claims in 5 years |

| people's choice | 2 claims in 3 years |

| privilege | 2 claims in 3 years |

| provident | 2 claims in 5 years |

| RAC | 2 claims in 3 years |

| rias | 2 claims in 3 years |

| saga | 2 claims in 3 years |

| santander | 2 claims in 3 years |

| sheilas' wheels | unlimited |

| swiftcover | 2 claims in 3 years |

| swinton (classic policy) | 2 claims in 5 years |

| tesco bank | 2 claims in 3 years |

Note: policies may change - correct as of february 2021

Can I transfer my no-claims bonus to a new policy?

Yes. When you apply for car insurance, the insurer will ask and check how much no-claims bonus you’re entitled to.

In some cases, you’ll be asked to supply evidence from your previous insurer to back this up. This allows you to carry over the benefits of your accumulated claims record without having to start from scratch each time you switch insurer.

You’ll not always see perfect continuity, though - as insurers each have their own no-claims bonus schemes and will apply their own rules.

For example, some insurers may not recognise no-claims bonus you’ve accrued as a named driver on someone else’s policy, and if you’ve not been insured for a few years, the old no-claims bonus will lapse.

Our reviews of individual insurers record the maximum number of years of no-claims bonuses you can accumulate.

Do I need proof of my no-claims bonus?

In many cases, you won’t be asked for proof of your no-claims bonus, but you should always assume that you will and have it in order.

Insurers will often check online databases first to corroborate your no-claims bonus entitlement stated in your application.

Your no-claims bonus should also be stated in your paperwork from the insurer you’re leaving.

Where this isn’t available, you can write to your insurer and ask them to supply you with a letter detailing your number of claim-free years.

Bonuses

We are leading specialist UK employment law firm, and have advised thousands of individuals on their bonus rights. Please feel free to use the contact form or call on 020 7100 5256.

Employment law- bonuses

WHAT ARE THE DIFFERENT TYPES OF BONUSES?

- Discretionary bonuses;

- Contractual bonuses;

- A mix of the two;

What is a discretionary bonus?

Most bonus schemes are expressed to be discretionary. This means that bonus entitlements are not contractual and the requirements for awarding a bonus are flexible.

Such schemes will usually include criteria, such as reaching individual, team or company wide targets for determining the amount of the bonus. Your employer will always reserve the right to determine the extent of those payments or indeed whether a bonus is paid at all. This is a common source of conflict between employers and employees.

It is now accepted that there is no such thing as an “unfettered discretion” for an employer when considering what bonus payments to make. Various decisions by the courts in recent years have determined that an employer must exercise its discretion in good faith and on reasonable grounds. It follows therefore that if an employee satisfies the bonus criteria, the employer in turn, must have reasonable grounds for not paying that bonus if it is to show that it has acted in good faith. A decision cannot be made, for example, based on a personal dislike of an employee.

An employer may similarly find it difficult to establish reasonable grounds if these have not been communicated to staff beforehand, for example within the bonus documentation. Your employer’s failure here could give rise to a legal claim.

If you are not happy with your discretionary bonus payment, you should speak to your line manager about this in the first instance, and ask for information how the bonus was determined. You can always lodge an internal grievance if you are still not happy (or seek legal advice first).

What is a contractual bonus?

This is the clearest position for all parties, where a bonus is expressed to be “contractual” and based on a specific formula. For example, it may be linked to an individual performance and targets, or the company performance as a whole. There is little room for manoeuvre by an employer where you have a specific contractual bonus, even where you may be under notice before the bonus payment is made (assuming the full year has been worked). A failure to adhere to the contractual arrangements could give rise to a breach of contract claim and/or constructive dismissal.

A mix of the two

The bonus scheme may be a mix of the above two, with a discretionary element as to the amount of the bonus working alongside a contractual right to participate in a bonus scheme.

Custom and practice

Regardless of what type of bonus clause you have, your employer may find it difficult to withhold a bonus if it has by custom and practice, regularly paid previous bonuses to employees who have performed to a similar standard each year. In these circumstances, an implied term obligating your employer to pay a bonus could be deemed to have been incorporated into your contract of employment.

Deferred compensation- restricted stock units

An employer may implement a “long term incentive plan”, which is often in the form of restricted stock units (“RSU’s). This is particularly common in banking contracts.

An RSU is an agreement to issue stock or shares at the time the award vests. An award will usually vest when certain conditions have been met, including after the required period of time has passed, length of employment accrued or performance criteria having been satisfied. There will be a vesting schedule setting out when and to what extent the RSU’s will vest, which is usually on yearly anniversaries of the award date (for example, 20% per year over 5 years). In some cases, even after stock bonuses have vested, you may be also required to retain a percentage of your restricted stock units for a further period.

At each vesting date, you will receive stock equal to the net value of the RSU’s which have vested. Employers use units instead of the actual restricted stock or shares, because they can postpone shareholder dilution until the time of vesting; get more consistent tax treatment; and even if the share price falls after the award date, the RSU still retains some value- unlike a market value share option. Sometimes, you may receive a cash equivalent to the shares.

If you are disciplined for gross misconduct, or you breach your restrictive covenants, you are likely to be forfeit your deferred compensation.

Bonus payments on termination of employment

Often, the question arises whether payment of a discretionary bonus should still be made on termination of employment – whether the employee has resigned, or has been dismissed. There are certain factors that need to be considered here.

Gross misconduct

If you have been dismissed for gross misconduct, there will almost certainly be no requirement to pay outstanding bonuses. In cases of gross misconduct, an employee is deemed to be in breach of contract and will usually be dismissed summarily. Accordingly, any bonuses, which have been earned, but not paid, will be forfeited. It is worth noting, however, that if the dismissal is unfair on procedural grounds (even though an employer has labeled it “gross misconduct”), a potential claim for loss of earnings arising from the unfair dismissal can still be made, and this could include a lost entitlement to a bonus.

Bonus clauses

You will doubtless expect to receive your bonus if you have worked a full year. You may also have an expectation of receiving a pro-rata bonus payment if you leave employment before the year end. The problem for many employees is that to be eligible for a payment, most bonus clauses state that;

- You need to be employed at the bonus payment date and/or;

- You must not be working under notice.

If, therefore, you resign by giving notice before the bonus payment date, you may not be eligible to receive a bonus for that year even though you are still working at th etime the payment is usually made.

Where it is your employer who has given you notice (for example by reason of redundancy), there will be 3 alternative scenarios:-

(1) you will be allowed to work your notice period;

(2) you will be placed on garden leave;

(3) your employer may elect to pay you in lieu of your contractual entitlement to notice (in other words, you will not need to work your notice and your employer is bringing forward your termination date instead, paying your notice as a lump sum). This is commonly known as “PILON” -i.E. A payment in lieu of notice.

If your employer decides to make a payment in lieu of notice, you almost certainly will not be employed at the bonus payment date and will therefore not be entitled to receive a bonus for that year. This is unless your contract of employment specifically provides for a pro-rata bonus to be paid if you even if leave part of the way through the year (although this is rare).

In fact, some employers regularly use PILON payments to fast track employees out of the business just to avoid having to pay a bonus. This is quite common in the banking industry, which is why many redundancies take place shortly before the bonus payment date.

Where your employer cannot rely on a contractual PILON clause to avoid a bonus payment and you end up working your notice or you are on garden leave at the bonus payment date, the courts have come down on the side of employees. Employers have been compelled to honour the bonus payment in these circumstances, where those bonuses are also being paid to other remaining members of staff.

If your employer has not brought to your attention the fact that you need to be working and not “under notice” to receive a bonus, or if there is a policy in place that has also not been brought to your attention- then your employer will have difficulty in withholding a bonus payment which is being paid to other staff.

No PILON clause

If your employer has not reserved a contractual right to pay you in lieu of notice, the PILON would almost certainly amount to a breach of contract. In such circumstances, you could issue proceedings based on your employer’s breach. You could seek to recover the sums you would otherwise have received during your notice period – which would include a bonus payment.

How easy is it for your employer to deduct a discretionary bonus already paid on termination of your employment?

Where a non-contractual bonus has already been paid to you, it is treated as “wages” under the employment rights act, and due and payable on the date payment is made. In fact, this definition of wages also applies where your employer has exercised its discretion and awarded/declared a bonus (even if it has not yet been paid).

Promise of a bonus

In may 2012, commerzbank in a landmark case case lost a claim brought by a large group of bankers who were promised a bonus pool of 400m EUR in 2008. Such promise was made by dresdner kleinwort to help retain their staff before it was sold to commerzbank a few months later. In the end, only a tenth of that bonus was paid. Although the case turned on the particular contractual obligations of commerzbank to their staff, the court ruling could mean that more bankers will have the right to sue for similar promised bonuses- whether informally made or otherwise.

Bankers bonuses

New legislation to cap european bankers’ bonuses has taken effect from 1 january 2017. The legislation applies to all ‘code staff’ (i.E. Those identified as senior managers or those performing significant influence functions).

The cap prevents bonuses of more than 100% of your salary being paid out, although this can rise to 200% of your salary with shareholder approval. A minimum of 25% of any bonus exceeding 1 x salary must be deferred for at least five years in the form of long-term deferred instruments (LTDI’s)

To get around the cap, some banks have tried to pay “monthly allowances” for staff over a period of two to three years, which would replace variable bonuses, however this has been ruled as unlawful by the european banking authority. Other banks have significantly increased the fixed salary pay, or awards of shares not linked to performance to allow individuals to benefit from profits alongside shareholders.

Any settlement agreement you enter into at the termination of your employment should properly reflect your bonus situation, including in relation to deferred compensation payments and your “good leaver” status.

Bonuses whilst on maternity

If you have a contractual bonus entitlement, a ‘maternity equality clause’ is inferred into your contract. This entitles you to be paid a bonus where you have taken statutory maternity leave during the bonus year. However, the requirement is to only pay you for the relevant part of the bonus year:

- During which you were at work before going on maternity leave;

- During which you were absent for the 2 weeks’ compulsory maternity leave; and/or

- During which you were at work after your return from statutory maternity leave.

Where the bonus is expressed to be discretionary, your employer should exercise its discretion in good faith and not perversely -in the same way as they need to for employees who are not on maternity leave. If you have made a contribution to work for the above periods or whilst on maternity leave, then you should also be considered in the calculation of bonuses.

If there are no bonus clauses whatsoever in your contract of employment, and your employer nevertheless decides to make payments to other staff, then the law suggests that you should also be considered for a bonus. This would be on a pro- rata basis for the actual periods that you have worked.

Making a claim for non-payment of a bonus

You can make a claim in the employment tribunal for non–payment of a bonus. The quickest way of doing this would be to issue a claim for an unlawful deduction from wages. The process would need to be started by the claim being lodged with ACAS no later than 3 months less one day from the day that the bonus became due to be paid, or when you were told that you were not going to receive it. The lodging of a grievance does not extend this time.

A claim for the unlawful deduction from wages can generally only be made where amount is ascertainable and easily quantifiable, for example, through set performance targets and achievements. If you are claiming a bonus that is entirely discretionary in nature and one that cannot easily be referred back to a set formula, then such a claim would need to be one of “damages for breach of contract” instead, which is a different type of claim.

An employment tribunal has jurisdiction to consider such a breach of contract claims only if you are making the claim for not more than £25,000 -otherwise the claim would need to be made in the county court or the high court, and there is a 6 year time period to do so.

How to claim a bonus with a promo code

You may redeem promotional codes from our web in these 2 places showed below:

- Login to your mybookie account. If you still don’t have an account, click the ‘join’ button and enter your promotional code.

- After completing the sign-up process, go to the ‘cashier ‘, choose your bonus from the drop-down menu, or click on ‘see more options’ choose the bonus you like the most.

- Complete your deposit to receive your sign-up bonus.

- If you already have an account, log in.

- Go to the cashier and enter your promotional code, click on “see more options” and at the bottom of the menu redeem code.

- Alternatively, you may select a bonus from the drop-down menu or click on “see more options” to choose from our variety of bonuses available.

- Complete your deposit to receive your bonus.

If you have a promotional code, here’s how to redeem it on the site:

Login to your mybookie account. If you still don’t have an account, click the ‘join’ and complete the sign-up process. Or log in if you are an existing player.

- Go to the cashier: click on “see more options” a menu is going to show up, at the bottom of it, enter your promo code, and then click on redeem. Your new promotion is available now, select it, and complete a successful deposit! And get your bonus!

- Go to the sportsbook: below of your “betslip” you will see the option of “promo code” enter the code, and click on redeem now go to the cashier, complete a successful deposit! And get your bonus!

*this option is available on desktop only.

*we require a $45 minimum deposit to receive most sign-up and $100 for reload bonuses.

*crypto reload bonuses require a minimum deposit of $50.

We recommend reading the terms and conditions for your specific offer.

More articles related to these topics bonus

Learn crypto and blockchain

How do I claim my welcome bonus?

Phemex gives you three types of welcome bonuses. For each type of bonus, perform the following steps:

Deposit bonus

- Register an account on phemex.Com. For more information, please view how do I register an account on phemex?

- Deposit the required amount for any of the following currencies:BTC ≥ 0.2 USDT ≥ 2000 ETH ≥ 10 XRP ≥ 10,000 LINK ≥ 500

- Have a cumulative amount of BTC/USD contract transactions that is equal or greater than 50,000 USD.

- Navigate to https://phemex.Com/bonus and click the claim now button under the deposit bonus section.

- A pop-up window will indicate that your bonus has been successfully credited to your account.

Spot trading bonus

- Register an account on phemex.Com . For more information, please view how do I register an account on phemex?

- Complete a single spot order that is equal or greater than 500 USDT.

- Navigate to https://phemex.Com/bonus and click the claim now within the spot trading section.

- A pop-up window will indicate that your bonus has been successfully credited to your account.

Contract trading bonus

- Register an account on phemex.Com . For more information, please view how do I register an account on phemex?

- Complete a single BTC/USD contract transaction that is equal or greater than $5,000 USD.

- Navigate to https://phemex.Com/bonus and click the claim now within the contract trading section.

- A pop-up window will indicate that your bonus has been successfully credited to your account.

- All welcome and trading bonuses are subject to terms and conditions. For more information, please view the bonus terms and conditions.

- Deposits and transactions are only valid starting from 3:00 UTC june 22, 2020. Previous deposits and transactions will not be counted.

For any inquiries contact us at support@phemex.Com.

Follow our official twitter account to stay updated on the latest news.

Join our community on telegram to interact with us and other phemex traders.

Car insurance no-claims bonuses explained

All you need to know about your car insurance no-claims bonus or no-claims discount - from how they work to whether it's worth paying out to protect it.

What is a 'no-claims' bonus or discount?

A no-claims bonus - also known as a no-claims discount - is a percentage discount your insurer shaves off your insurance premium to reward you for not having made a car insurance claim in the previous year.

So if, for example, you had a no-claims bonus of 30%, you’d pay £700 where you would otherwise have paid £1,000.

For each consecutive year that you don’t make any claims, the discount increases. So where your insurer might award you 30% for one year without claims, five claims-free years under your belt might net you 60%.

What’s the maximum no-claims bonus I can get?

As you build up more claims-free years, you progress along a no-claims bonus scale, which might look something like the example below.

Eventually, you’ll reach the number of claims-free years required to net the maximum discount your insurer will offer.

How no-claims discounts build up

Each insurer's no-claims bonus scheme is different - from the size of discounts to the number of claims-free years it takes to achieve them.

Maximum discounts range from around 40% to 80%, while the number of claims free-years you need before you’re at the top of the scale ranges from around five to 15 years.

What is a no-claims bonus worth?

By itself, a no-claims bonus doesn’t really say much about what you’ll pay - you need to know what the premium is to work out how much of a saving it represents.

Suppose you have two insurers. Both have a base premium of £1,000, to which the discount is applied. With insurer A, your no-claims bonus is 75%, and with insurer B, 60%. In this case, insurer A is clearly the cheapest.

But where the base premiums are different - as they’re likely to be in the real world - then the comparison changes. If insurer A’s base premium is £1,500 and insurer B’s, £900, for instance - then insurer B is cheaper.

| Insurer A | insurer B | |

|---|---|---|

| no-claims discount | 75% | 60% |

| base premium | £1,000 | £1,000 |

| premium with discount | £250 | £400 |

| base premium | £1,500 | £900 |

| premium with discount | £375 | £360 |

Some insurers will make a point of awarding generous no-claims bonuses in their marketing, but it's important to compare the final quote - with any discounts included - to determine which is the best deal. Read our guide on how to find an insurer with a lower premium.

The reason it’s worth keeping your no-claims bonus in mind is that you can lose it if you make a claim, meaning you'll pay higher premiums than you otherwise would have.

How can a claim affect my no-claims bonus?

If you make a car insurance claim, you may lose some of your no-claims bonus according to where you are on the insurer’s ‘step-back’ scale.

This basically bumps down the discount back to what it was in previous years. Insurers have different step-back scales.

In the example below, the driver has spent five years building their no-claims bonus up to 60%.

When they make a claim, that five-year discount reduces to a three-year discount - so at renewal they only get 40% off, and have to spend two years building their no-claims bonus back to what it was.

What claims don't affect my no-claims bonus?

There are certain kinds of claim that won't erode your no-claims bonus. Generally, insurers will leave your no-claims bonus alone if your claim was not a 'fault' claim.

This means they were able to recover their repair costs in full from the party at fault. Similarly, many insurers will disregard non-fault claims where the other driver was uninsured.

It's also quite common for insurers to make exceptions with glass damage claims.

Should I protect my no-claims bonus?

No-claims bonus protection is an added extra that you can buy with your insurance.

It will prevent a limited number of claims (two or three claims over a three-year period is common) from having an impact on your no-claims bonus.

No-claims bonus protection will certainly save you money if you make a claim. However, you'll need to pay extra for it (around £60 is fairly typical), so its value depends on how much discount you’d stand to lose by claiming.

Insurers don’t make this easy to find out - but they do have to show how much discount, on average, their customers were awarded for each year of no claims.

So this should give you a starting point in working out whether to buy no-claims bonus protection.

As a general rule of thumb, the bigger your no-claims bonus, the more you stand to lose through making a claim, and therefore the greater the value of the protection.

How does no-claims bonus protection work?

A fairly common misconception about bonus protection is that it stops your premiums from rising because of a claim.

Unfortunately, this isn’t true. If you make a claim and, as a result, the insurer thinks you’re more likely to make future claims, it will increase your premium. After this, it will apply whatever discount you have.

So, suppose your discount is 60%, you’re paying £400 instead of the base premium of £1,000. Then you make a claim - protected under the added extra you've paid for.

The following renewal your insurer could then increase that base premium to £1,300. With the same 60% discount in place, you’d now be paying £520.

Which? Collects data on no-claims bonus protection. The table below shows the policies of dozens of insurers we rate.

| Car insurer | number of claims you can make with a protected no-claims discount |

|---|---|

| AA insurance | 2 claims in 3 years |

| admiral | 2 claims in 3 years |

| age co | 2 claims in 3 years |

| ageas | 2 claims in 3 years |

| AXA | 2 claims in 3 years |

| budget | 2 claims in 3 years |

| by miles | unlimited |

| churchill | 2 claims in 3 years |

| co-op insurance | 4 claims in 3 years |

| diamond | 2 claims in 3 years |

| direct line | 2 claims in 3 years |

| elephant | 2 claims in 3 years |

| esure | unlimited |

| hastings direct | 2 claims in 3 years |

| insurepink | 2 claims in 3 years |

| john lewis finance | 2 claims in 3 years |

| LV | unlimited |

| M&S bank | 2 claims in 3 years |

| mercedes-benz | varies by underwriter |

| more than | unlimited |

| NFU mutual | 2 claims in 5 years |

| people's choice | 2 claims in 3 years |

| privilege | 2 claims in 3 years |

| provident | 2 claims in 5 years |

| RAC | 2 claims in 3 years |

| rias | 2 claims in 3 years |

| saga | 2 claims in 3 years |

| santander | 2 claims in 3 years |

| sheilas' wheels | unlimited |

| swiftcover | 2 claims in 3 years |

| swinton (classic policy) | 2 claims in 5 years |

| tesco bank | 2 claims in 3 years |

Note: policies may change - correct as of february 2021

Can I transfer my no-claims bonus to a new policy?

Yes. When you apply for car insurance, the insurer will ask and check how much no-claims bonus you’re entitled to.

In some cases, you’ll be asked to supply evidence from your previous insurer to back this up. This allows you to carry over the benefits of your accumulated claims record without having to start from scratch each time you switch insurer.

You’ll not always see perfect continuity, though - as insurers each have their own no-claims bonus schemes and will apply their own rules.

For example, some insurers may not recognise no-claims bonus you’ve accrued as a named driver on someone else’s policy, and if you’ve not been insured for a few years, the old no-claims bonus will lapse.

Our reviews of individual insurers record the maximum number of years of no-claims bonuses you can accumulate.

Do I need proof of my no-claims bonus?

In many cases, you won’t be asked for proof of your no-claims bonus, but you should always assume that you will and have it in order.

Insurers will often check online databases first to corroborate your no-claims bonus entitlement stated in your application.

Your no-claims bonus should also be stated in your paperwork from the insurer you’re leaving.

Where this isn’t available, you can write to your insurer and ask them to supply you with a letter detailing your number of claim-free years.

So, let's see, what we have: get 100% deposit forex bonus. Open a forex account now and get 100% bonus on your deposit with our limited time offer. At claim my bonus

Contents of the article

- My list of forex bonuses

- Trade forex and cfds on stock indices, oil...

- Claim your 100%up to $5,000 trading...

- Trade on 16 platforms from 1 account

- Why choose XM?

- How to claim a bonus with a promo code

- How to claim bonuses on unemployment claims

- File your initial claim

- Reporting bonus payment prior to your first...

- Reporting the bonus after your claim is approved

- How to claim bonuses on unemployment claims

- File your initial claim

- Reporting bonus payment prior to your first...

- Reporting the bonus after your claim is approved

- How to claim a bonus with a promo code

- Car insurance no-claims bonuses explained

- What is a 'no-claims' bonus or discount?

- What’s the maximum no-claims bonus I can get?

- What is a no-claims bonus worth?

- How can a claim affect my no-claims bonus?

- What claims don't affect my no-claims bonus?

- Should I protect my no-claims bonus?

- How does no-claims bonus protection work?

- Can I transfer my no-claims bonus to a new policy?

- Do I need proof of my no-claims bonus?

- Bonuses

- Employment law- bonuses

- Deferred compensation- restricted stock units

- Bonus payments on termination of employment

- Promise of a bonus

- Bankers bonuses

- Bonuses whilst on maternity

- Making a claim for non-payment of a bonus

- How to claim a bonus with a promo code

- Learn crypto and blockchain

- How do I claim my welcome bonus?

- Deposit bonus

- Spot trading bonus

- Contract trading bonus

- Car insurance no-claims bonuses explained

- What is a 'no-claims' bonus or discount?

- What’s the maximum no-claims bonus I can get?

- What is a no-claims bonus worth?

- How can a claim affect my no-claims bonus?

- What claims don't affect my no-claims bonus?

- Should I protect my no-claims bonus?

- How does no-claims bonus protection work?

- Can I transfer my no-claims bonus to a new policy?

- Do I need proof of my no-claims bonus?

Contents of the article

- My list of forex bonuses

- Trade forex and cfds on stock indices, oil...

- Claim your 100%up to $5,000 trading...

- Trade on 16 platforms from 1 account

- Why choose XM?

- How to claim a bonus with a promo code

- How to claim bonuses on unemployment claims

- File your initial claim

- Reporting bonus payment prior to your first...

- Reporting the bonus after your claim is approved

- How to claim bonuses on unemployment claims

- File your initial claim

- Reporting bonus payment prior to your first...

- Reporting the bonus after your claim is approved

- How to claim a bonus with a promo code

- Car insurance no-claims bonuses explained

- What is a 'no-claims' bonus or discount?

- What’s the maximum no-claims bonus I can get?

- What is a no-claims bonus worth?

- How can a claim affect my no-claims bonus?

- What claims don't affect my no-claims bonus?

- Should I protect my no-claims bonus?

- How does no-claims bonus protection work?

- Can I transfer my no-claims bonus to a new policy?

- Do I need proof of my no-claims bonus?

- Bonuses

- Employment law- bonuses

- Deferred compensation- restricted stock units

- Bonus payments on termination of employment

- Promise of a bonus

- Bankers bonuses

- Bonuses whilst on maternity

- Making a claim for non-payment of a bonus

- How to claim a bonus with a promo code

- Learn crypto and blockchain

- How do I claim my welcome bonus?

- Deposit bonus

- Spot trading bonus

- Contract trading bonus

- Car insurance no-claims bonuses explained

- What is a 'no-claims' bonus or discount?

- What’s the maximum no-claims bonus I can get?

- What is a no-claims bonus worth?

- How can a claim affect my no-claims bonus?

- What claims don't affect my no-claims bonus?

- Should I protect my no-claims bonus?

- How does no-claims bonus protection work?

- Can I transfer my no-claims bonus to a new policy?

- Do I need proof of my no-claims bonus?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.