Instaforex minimum deposit

FXTM is another major force in the forex trading industry and an excellent place to get started if you are looking for a low minimum deposit broker.

My list of forex bonuses

Our FXTM broker review showed that you can start micro trading here with the cent account for as little as a $10 deposit. When it comes to XM deposit methods, you can choose between the ever-present wire transfer, all major credit cards from either visa or mastercard and some ewallet and local specific methods. All of these methods, for the most part, are free of any XM fee.

Best forex brokers with low/no minimum deposit for 2021

Top rated:

If you are thinking of getting involved in the forex trading market and you are looking for the top forex brokers, or maybe you are already dealing with an FX broker, one of the most important things you may be thinking about is the minimum deposit.

In the forex market, there are often a few trading conditions that you will have to abide by, which sometimes means a minimum deposit to get into forex trading. With these brokers though, that is not the case.

The reviews we have conducted for this top 10 show that they do not have any minimum deposit requirement, although in some cases you will find a forex broker minimum deposit based on funding amount.

The following top 10 brokers are great for all traders, but particularly for new traders seeking an excellent low deposit start in currency trading, particularly with the credit/debit card deposits that are often cheaply available.

Table of contents

Why a minimum or 0$ deposit is not the only thing to consider

Conducting an in-depth technical analysis in search of a broker with no minimum deposit or a low one is not all you should think about though.

You should also consider the fact that you will likely be trading with some kind of leverage. This and other factors can really help determine the best broker choice for your forex trading future.

In fact, the best situation for you is one where you have a minimum deposit broker that also allows you to trade with minimum trade size. This is something we will get into more at the end of the post.

For now, let’s take a look at the very best forex brokers with low or no minimum deposit.

Best forex brokers with low or no minimum deposits

In no particular order, here is the best low or no minimum deposits brokers chosen after thorough broker reviews on each:

1. Oanda

Trading with oanda broker, the first thing you will be glad to notice is that there is no minimum deposit at all.

The broker also has no minimum trade size. In the forex market and for your trading career, this can mean great flexibility as you can trade as low as 1 unit in your base currency without worrying about lot-size trading.

Deposits for trading with the oanda broker and trading platform can be made in the form of wire transfers, all major credit cards (visa/mastercard), ewallets such as paypal and some other oanda deposit methods may be available depending on your area. Almost all of these come with no real money fee attached at all.

Oanda can also be connected with zulutrade to open many copy trading opportunities and is widely considered to be a very trustworthy option particularly if you are based in europe and want to get started in forex trading with a small amount of money.

2. FBS

Getting into the forex market with FBS is one of the best value ways you can become a trader. This is because you can start a mini account with FBS that only requires $10 from within europe, or $1 from outside as the minimum deposit. This is the FBS cent account. A micro account with a $5 minimum deposit is also available but not within europe.

These kinds of currency trading account types allow you to trade in micro lost of 1,000 units and to trade as low as 10 units or 0.1 nano lots. Compared to the standard forex market trading lot size, this would be 0.0001 standard lots. So, as you can see, real money is still at risk, but in a very controlled way.

Again here, the wire transfer, visa/mastercard, and ewallets like neteller and skrill are all available for deposit with on fee in the majority of cases.

The FBS accounts are also a great choice for non-europeans with super high leverage available, and islamic accounts too.

Of the 5 XM accounts that are offered, two, in particular, have a very low and attractive minimum deposit if you are getting involved in the forex market. These are the micro and standard accounts both with a minimum deposit of just $5.

As with other brokers, the micro account will make it less risky in terms of your real money trading. Here you can benefit from micro lots down to 0.1 nano lots to help you get a taste of the forex market.

When it comes to XM deposit methods, you can choose between the ever-present wire transfer, all major credit cards from either visa or mastercard and some ewallet and local specific methods. All of these methods, for the most part, are free of any XM fee.

Islamic trading accounts are also widely available from the broker as well as the XM ultra low account, which allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50

4. FXTM

FXTM is another major force in the forex trading industry and an excellent place to get started if you are looking for a low minimum deposit broker. Our FXTM broker review showed that you can start micro trading here with the cent account for as little as a $10 deposit.

Again these accounts allow for mini trading with micro lots of 1,000 units and nano lots of just 10 units making trading here very accessible indeed.

Deposits are made available through all of the popular channels including wire transfers, major credit and debit cards from visa, mastercard, and maestro, and ewallets like neteller and skrill. Other localized funding methods may be available depending on location, and all FXTM deposits should be free of any fees.

FXTM islamic accounts are again available where needed and the broker caters particularly well to traders in african countries like nigeria who want to get into the forex market. Crypto deposits are also accepted if you are based outside the remit of european regulations.

5. Roboforex

If you are looking to jump into forex trading with a wide range of account choices, then roboforex may be just the place for you. There are a total of 6 account types to choose from, 3 of these account types have a great low minimum deposit of just $10. These forex trading accounts are the pro standard, ECN pro, and pro cent which allows for micro trading from micro lots of 1,000 units to nano lots of 100 units through the MT4 trading platform and the MT5 trading platform through which you can trade as low as 0.1 nano lots.

For deposits with this broker you can avail of wire transfers, major credit cards, and ewallet options like neteller, webmoney, advcash, and perfectmoney. There may be other funding methods available depending on your area, and most of the deposit methods mentioned carry no fee at all from the broker.

Yet again, if you are in forex trading and need an islamic account, this broker has you covered and is a really good choice if you are looking for standard forex trading accounts with a low minimum deposit.

6. Instaforex

Considering forex brokers with a low or no minimum deposit, then instaforex is another option. They offer two types of micro trading cent accounts with a minimum deposit of just $1 on each. These allow you to engage in mini trading for as little as 0.0001 standard lots, a real risk-free way to engage in the forex market.

Spreads on these accounts start from just 1 pip and the cent eurica account offers a zero spread option with commission from 0.03% in its place which could be an attractive proposition depending on your forex trading style.

Deposits at instaforex can be made by way of wire transfer, major credit cards, and ewallets such as neteller and skrill. In many cases, there are no fees at all to get started trading or make a deposit.

As with the majority of top brokers today, islamic trading is well catered for with this broker.

7. Alpari

The next broker with a very low minimum deposit for forex trading that you should consider is alpari. This broker offers micro trading accounts with the low minimum deposit of $5 to get started. With these accounts as with other cent type mini trading accounts, you can expect both micro and nano lots of 1000, and 10 units to be available.

Deposits to fund your real money forex trading here can be made with a wire transfer, trusted credit cards from either visa, mastercard, or maestro, and ewallet options from neteller and skrill respectively. There are typically no deposit fees with this broker.

Alpari has extensive experience in the forex trading industry, offering the best in trading platforms and islamic accounts for those who require them.

Why is lot size important with low deposits?

You may be wondering why the lot size has been mentioned frequently and why this may impact you as a trader.

The fact is that if you are a european based forex trader, it has become very difficult to have a low minimum deposit and be able to trade significant amounts within the standard trading accounts that this opens up. This is all due to the 30:1 leverage limitation placed by regulators in europe. For example, in order to invest 1$ in a micro lot (1000 units), you would need minimum leverage of 1000:1.

So, if you don’t have leverage, the only solution is to have the smallest trading sizes available.

Some brokers will allow you to open positions for 0.1 nano lots (basically 1/100 of a micro lot), which translates in minimum leverage terms to 10:1.

The only solution that you have available for really low deposit trading if nano lots are not available is unfortunately just to step up your deposit a little more. In these cases as a forex trader, $50 is typically sufficient although it depends on the asset.

With all of that said, given the number of broker options available, it is still very much possible for european traders, even those constrained by strict 30:1 leverage to experience very low deposit trading in the forex market and others.

Brokers with low or 0$ minimum deposit good for non EU users

The following brokers still have very low, or even no minimum deposit requirements to enter the forex market as the brokers above also have. The only difference here is that with these brokers, micro trading through cent accounts is not necessary.

In this case, the best thing you can do is use these brokers to avail of higher leverage availability if you are located outside of an area like cysec regulation where leverage is limited.

Berapa minimum deposit di instaforex

Deposit di akun real instaforex memang sebuah keharusan yang mesti dilakukan sebelum melakukan trading,

Berbeda dengan akun demo yang tidak perlu melakukan deposit karena saldo dapat terisi secara otomatis,

Berapa minimum deposit di instaforex? Mungkin itu menjadi pertanyaan umum bagi calon trader yang ingin mendaftar di broker ini,

Bisa dibilang setiap broker luar negeri memberikan batas minimum deposit yang kecil serta nilai leverage yang besar,

Mungkin hal ini yang membuat orang lebih nyaman menggunakan broker luar negeri karena tidak butuh modal besar,

Namun sebagai trader, ketika bergabung dengan broker luar negeri harus siap risiko karena secara legalitas belum diakui di indonesia,

Selain itu biasanya akan mengalami kesulitan masuk ke website resmi karena di blok oleh menkominfo. Meskipun demikian, kamu masih bisa masuk menggunakan VPN,

Jika kamu tertarik untuk melakukan trading forex dengan modal kecil, maka bisa mencoba broker luar negeri ini karena sudah ternama di indonesia,

Instaforex login

Untuk melakukan login di instaforex langkahnya juga sangat mudah, bagi kamu yang sudah mendaftar maka akan mendapatkan nomor id dan password,

Dari data tersebut kamu bisa masuk sebagai partner atau trader,

Jika kamu seorang trader maka tinggal pilih pada opsi trader kemudian masukkan nomor id dan password tersebut maka kemudian kamu akan langsung dibawa ke dalam dashboard instaforex,

Cara deposit instaforex lewat bank lokal

Mungkin dulu orang sangat kesulitan jika ingin melakukan deposit di instaforex karena memerlukan kartu kredit, tetapi saat ini bisa mengisi dengan rekening bank di indonesia seperti mandiri, BNI, BCA, dan BRI,

Lihat saja artikel tersebut maka kamu sudah bisa mengisi saldo di akun instaforex dengan mudah dan cepat,

Berapa minimum deposit di instaforex.

Ternyata tidak, minimum deposit di instaforex hanya butuh uang $1. Kamu sudah bisa mengisi dengan saldo yang sangat minimum,

Namun untuk menjaga margin agar tidak cepat terkenal margin call maka sebaiknya melakukan deposit di atas $100 dengan lots paling kecil,

Ketahanan dalam trading forex adalah sangat penting, oleh sebab itu orang akan menerapkan money management forex agar bisa menjaga agar akun tidak mudah terkena margin call,

Karena kunci kesuksesan dalam trading forex adalah menjaga saldo tetap bertahan dengan mencari peluang yang paling baik untuk melakukan aksi jual atau beli,

Maka percuma jika trading hari ini menang tetap beberapa hari kemudian terjadi loss hingga profit hari ini ikut berkurang,

Banyak cara untuk melakukan trading atau sistem trading. Oleh sebab itu jangan malu untuk belajar trading memakai akun demo terlebih dahulu seperti akun demo yang ada di instaforex,

Bonus tanpa deposit instaforex

Tetapi jika ingin serius untuk mencari profit di instaforex, lebih baik melakukan deposit dan jangan tergiur dengan promosi bonus deposit karena jika tidak memahami syarat dan ketentuan maka bisa jadi malah merugikan,

Saat ini banyak orang yang merasa terjebak oleh bonus deposit yang memberikan bonus sekian persen dari jumlah deposit,

Tetapi ketika trading dan terjadi floating pada batas tertentu maka bonus tersebut secara otomatis akan hilang dan saldo menjadi nol,

Maka dari itu cermati mengenai syarat dan ketentuan yang berlaku dalam sistem bonus deposit tersebut,

Oke sahabat jurnalforex sekalian, itu tadi informasi berapa minimum deposit di instaforex serta beberapa informasi tambahan,

Semoga apa yang kami sajikan ini dapat menjawab pertanyaan mengenai dunia trading khususnya broker instaforex,

Instaforex.Eu review

Table of contents

OPEN A FREE DEMO ACCOUNT

Broker information

- Company name: instaforex.Eu

- Founded: 2017

- Country: cyprus

Broker services

- Regulators: -

- Minimum deposit: 100 €

- Leverage: up to 1:30

- US clients: no

- EURUSD spread: from 0.8 pips

Platform info

Try some trades with A free demo account

No deposit required

INSTAFOREX PROS

- Well-regulated with a strong reputation

- More than 7 million existing clients

- A choice of market-leading trading platforms

- Flexible account structure

- Client-focussed and dedicated multi-lingual staff

INSTAFOREX CONS

- No proprietary trading platform options

- A satisfactory but not ground-breaking number of markets to trade

Instaforex positively surprises with its array of trader support functions and accolades. Discover more in our in-depth review.

TRADERS’ VIEWPOINT

The service instaforex offers is hard to resist. The online broker is well-regulated and has invested heavily in building a framework, which gives plenty of reasons for it to be trusted. A solid track record is always important, and the firm has been around since 2007. It’s also got an eye on detail and has set up cash deposit and withdrawal processes, making signing up smoother and more reliable.

Instaforex has the feel of a brokerage site run by people who have listened to feedback from the trading community and set about addressing the issues raised, even the small ones.

This approach is to be welcomed, and it’s no coincidence the broker now has more than 7 million clients. Any service provider that sets out to give clients what they want will be popular. Instaforex also shows enough knowledge of the markets to have built a structure that can also help those clients prosper.

The two platforms on offer include the ever-reliable metatrader MT4 and webtrader. Choosing the world’s most popular retail forex platform, MT4 is a good start. Balancing that against the user-friendly functionality of webtrader is another good move.

There are enough markets to trade and forex traders, in particular, will appreciate having all the major, minor and exotic pairs on offer. Automated trading is available, and strategies such as scalping are permitted. If help is needed, the customer service team is super-helpful.

When all of this is added up, it translates to instaforex being a platform that knows how to tilt the scales in favour of traders.

ABOUT INSTAFOREX

Instaforex is a global broker with more than 7 million existing clients. Its success is based on building trust with traders and has a straightforward and transparent approach.

The firm operates globally, with different instaforex entities providing coverage to different geographical regions. The instaforexeu entity has been created to offer the firm’s unique brand of broking to EU clients and is based in cyprus and regulated by cysec.

- Instaforexeu head office: spetson 23A, leda court, block B, office B203, 4000 mesa, limassol, cyprus

- Instaforexeu branch office: pražská 11, 811 04, bratislava, slovakia

- Instaforexeu branch office: na hradbách 2632/18, moravská ostrava, 702 00 ostrava, czech republic

- Instaforexeu representative office: dworcowa 47, bydgoszcz 85-009 poland

The firm’s been very successful in terms of the number of clients signing up, and it continues to develop into a global brand. It sponsors a range of ambassadors in various sports, from chess to rally driving, and has event partnered with czech airlines, branding one of its airbus A319 as the instaforex airplane.

Who does instaforex appeal to?

Instaforex will appeal to those who want a broker that has thought of everything. The instaforex approach involves checking every detail and ensuring everything possible is done to improve the client experience.

It offers the choice of two much-loved trading platforms and excellent customer service. The educational and learning tools are also worth mentioning and will be particularly appealing to beginners.

The sector instaforex operates in is very competitive, and each broker needs to find its own position. Instaforex appears to have done that, as demonstrated by its growing client base. It can, with justification, be confident that its unique approach will attract even more customers.

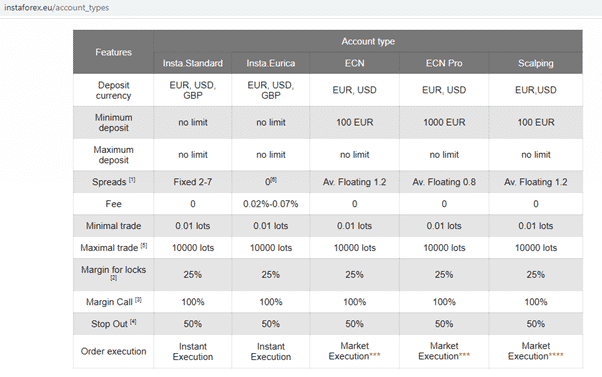

INSTAFOREX ACCOUNT TYPES

Instaforex takes the approach of offering up a range of six different accounts to ensure potential clients can find one that suits them. Providing a greater than average number of accounts to choose from is to be welcomed.

It can be the case that having so many accounts to choose from can make direct comparisons of T&cs hard to do. Instaforex goes a long way to solving that issue by providing a range of in-depth and informative reports to help you choose the best account for you.

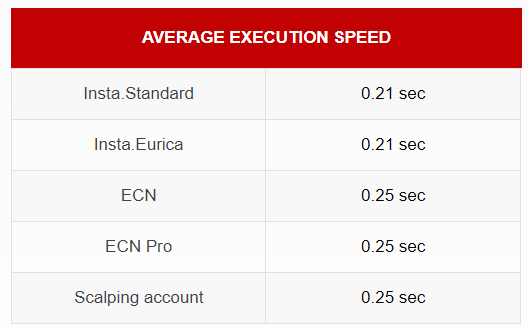

The six accounts to choose from are called: insta.Standard, insta.Eurica, ECN, ECN pro and scalping. Instaforex also provides the option of a VIP account. To make sure everyone gets a chance at finding a best fit, there are also islamic / swap free, options as well.

MARKETS AND TERRITORIES

Instaforex is a global operation. It is formed of a group of corporate entities, each one set up to cater to the needs of a specific geographical region. Instaforexeu caters to EU citizens and complies with EU regulations.

EU citizens are able to trade the global financial markets using instaforex, while staying under the protective regulatory umbrella of cysec and MIFID.

In line with standard EU regulations, leverage on positions is capped at 1:30.

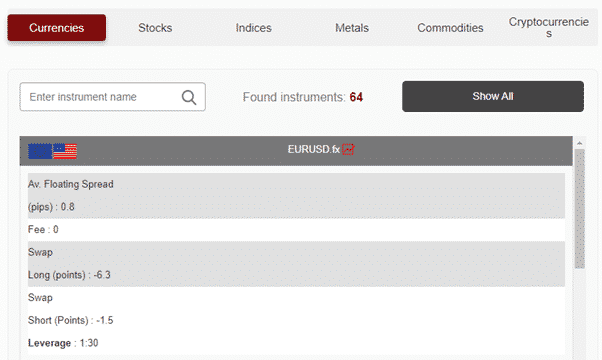

INSTRUMENTS AND SPREADS

Instaforex provides markets in a good number of asset groups. The total number of markets is in excess of 200, which will be enough to meet the demands of most traders. There’s certainly enough for beginners, and by focussing on these markets, instaforex is able to take an approach that is about quality rather than quantity.

The list of trading instruments includes the following assets:

- 110 currency pairs

- 7 stock indices cfds

- 5 commodities

- 89 cfds on shares listed on the world’s leading exchanges

- 5 cryptocurrency cfds

The broker’s devotion to transparency and detail is reflected in the database of instruments and markets. The above table for EURUSD T&cs provides an example of the comprehensive breakdown of terms and what is involved when trading this instrument.

A spread of 0.8 pips on EURUSD demonstrates that instaforex is more than competitive in terms of price. The exact T&cs will depend on which type of account is selected, but there are options for operating using fixed spreads, floating spreads or commissions.

- Fixed spreads from 2 pips

- Floating spreads from 0.8 pips

- Fees from 0.02%

All the instruments available to trade can be assessed using this tool, which leaves no questions unanswered.

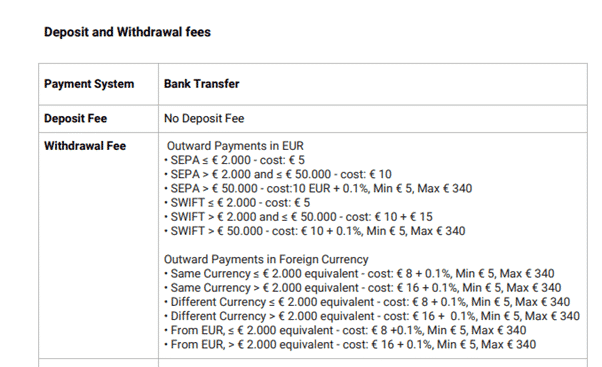

INSTAFOREX FEES AND COMMISSIONS

Instaforex doesn’t charge fees relating to cash deposits. While third-party agents may take a cut, instaforex does not charge any fees on cash going into client accounts.

There are some fees associated with withdrawing funds. This is because the broker needs to pass on costs it incurs, and studying the T&cs can help clients manage the situation. Rates of charges differ across the different payment agents, so a bit of forward planning and choosing the right payment system can help minimise charges.

No-one likes paying administrative costs, but one of the neat features of the instaforex approach is that the broker is completely transparent about what they are. Instaforex also goes into granular detail, so that at least they aren’t any surprises.

INSTAFOREX TRADING PLATFORM REVIEW

Three types of platform are on offer at instaforex. First up is the robust and ever-popular metatrader MT4, which remains the go-to platform for currency traders. The webtrader platform offers an alternative desktop-based approach, and then there are the mobile platforms, which help those who like to trade on the move.

Metatrader MT4

The metatrader MT4 service is the world’s most widely used forex trading platform. It has been established for many years and is robust and reliable. Its popularity is largely down to the trader-focused functionality, and it is highly customisable and available in a range of languages.

The MT dashboards is packed full of charting software and indicators. The default settings are powerful enough, but can be added to by bolting on third-party tools, which are widely available.

MT4 supports systematic trading. The MQL language enables instaforex clients to create automated trading programs for their own use.

Webtrader

Webtrader is host to three interface modes: dashboard, classic and chart. On the webtrader platform, users have the ability to adjust a list of the most traded instruments with the added function of monitoring your trading results.

The dashboard monitor allows you to follow up to 12 markets at once, and the tick chart on the chart monitor is a neat tool. Other features, which can help you spot trading opportunities, include a trend direction and trader’s position tools.

Order execution

Some of the behind-the-scenes work done by instaforex means that its trading platforms are set up to provide top-grade market access. Having nine trading servers in place means trade execution takes place near the exchanges being traded.

Clients with account balances in excess of EUR 1,000 can take advantage of the free VPS hosting service offered by the broker. Low-latency translating as better-quality execution and better prices.

Instaforex facilitates either market or instant execution, depending on the account type.

MOBILE TRADING

Those looking to trade on the go can take advantage of the instaforex mobile apps, which are free to download and are compatible with android and ios devices.

The mobiletrader app supports account administration and trading. This is complemented by a selection of other additional apps — all designed to give you that trading edge.

- Forex quotes and analysis app — online forex rates and market news.

- Forex courses — well-structured educational courses designed to be studied on the move.

- Forex signals — receive updates on market developments and trading opportunities for free.

- IFX alarm clock — input the level you want to consider trading and IFX will alert you when it comes.

SOCIAL TRADING AND COPY TRADING

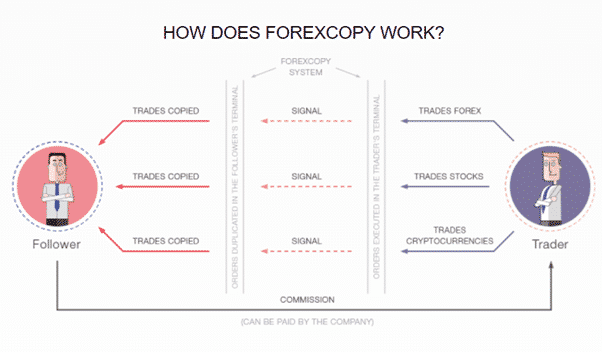

All markets can be self-traded on a social basis through the forexcopy system.

Forexcopy offers clients the chance to take on others’ ideas and for a charge, apply them to their own account. There is still risk involved with following a third-party, but the approach can be popular with beginners. It also appeals to those who want to get some exposure to the markets but don’t have much time to devote to analysis and following prices.

If you find that trading suits you and you make profits, then forexcopy also allows clients to offer their trading ideas to others. The commissions generated by this would then result in a second income stream.

CRYPTO TRADING WITH INSTAFOREX

Instaforex isn’t a crypto specialist but offers the key markets and T&cs, which are in line with the peer group.

CHARTING AND TOOLS

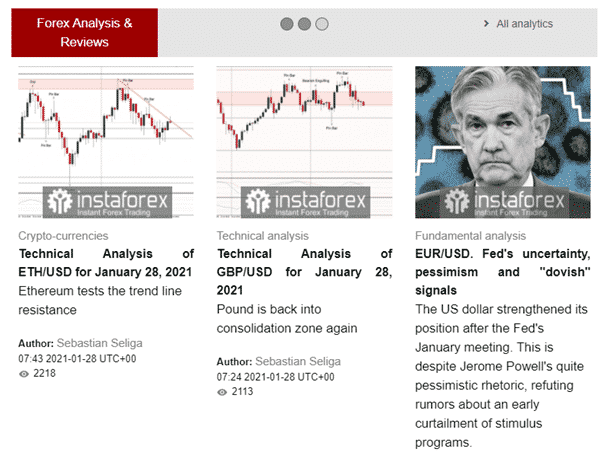

The MT4 trading platform provides market-leading charting functionality. Its razor-sharp aesthetics are designed to help traders spot trading opportunities.

Webtrader offers a more colourful dashboard, but one that still includes all the charting tools needed to make an informed decision.

EDUCATION

The feeling that instaforex has carefully planned its approach feeds into the educational service it provides its clients. For starters, the site has a dedicated section ‘for beginners’. This is broken down into general information (guide to forex), how to trade (getting started), developing trading skills (training) and a free demo account.

Each section is tailored to improving the trading experience of those who are starting out in trading.

Once you’ve grasped the basics, the instaforex site provides a collection of other research and news services to support your trading.

- Over 30 currency strategists provide comprehensive daily market analysis

- Forex news service

- Economic calendar

- Instaforex TV

- Video analytics

TRADER PROTECTIONS BY TERRITORY

Regulation, compliance and consumer protection are areas in which instaforex scores highly. The instaforex group of companies supports traders across the globe, but EU clients are serviced exclusively by the brand’s member instant trading EU ltd.

- INSTANT TRADING EU LTD is a cyprus investment firm (HE266937) regulated by the cyprus securities and exchange commission, license number 266/15.

- INSTANT TRADING EU LTD is providing investment services under instaforex brand and operates instaforex.Eu website.

By gaining a license in an EU territory, instaforex is bound to comply with the MIFID rules and regulations.

- Client funds being segregated from those of brokers. This means if the firm fails, your funds are held away from them.

- According to the protocols of the investor compensation fund, eligible clients can get compensation of up to 20,000 euros in the event that their broker becomes insolvent.

- While trading clients are protected by the brokers, they need to comply with their execution policy.

- Negative balance protection means that clients can’t lose more than their initial stake.

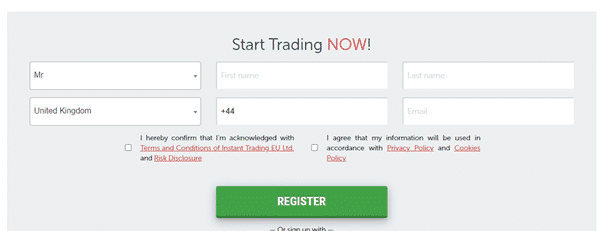

HOW TO OPEN AN ACCOUNT

Setting up a demo account takes moments to do and is a really good way to get hands-on experience of any broker. It’s free, no-strings and the bare minimum of personal information has to be supplied.

Instaforex offers a fairly standard number of payment options for those looking to deposit funds.

- Bank card

- Bank transfer

- Skrill

- Neteller

- B2B in pay

- Bitcoin via skrill

- Sofort

The stand-out feature here isn’t the number of methods, but the variety. Included are the tried-and-tested bank-transfer and card payment methods. These tend to be the fastest.

Withdrawals do incur fees — these vary depending on size and payment agent, but most funds are returned next business day.

The stand-out feature is the option to use bitcoin via skrill as a payment option. Even on the subject of payments processing, instaforex has again demonstrated a willingness to keep up with current trends and give clients the type of service they desire.

CUSTOMER SUPPORT

Being able to access members of an informed and responsive customer support team is crucial. It’s not an overestimation to say that it can be the difference between a trade making a loss or a profit.

Instaforex has taken note and provides a high-quality service, which is accessible in a variety of ways.

The customer support team can be accessed 24/5, by email, phone, or live chat. The broker has also embraced other means of communication, and clients can seek help using skype, viber, whatsapp, telegram and facebook messenger.

Platform base languages at instaforex.Eu include english, italian, bulgarian, spanish, german, french, czech, portuguese, slovenian, dutch, polish and russian.

The bottom line

Instaforex has the feel of a new entrant, in a good way. There is a buzz about the firm and its range of innovative new features are, at times, eye-catching. It doesn’t just back major flagship developments, but instead comes across as a trading platform that has had every detail thoughtfully considered.

The firm, though, isn’t a newbie, and at the same time as being innovative and exciting, is also a broker that inspires trust. It’s been operating for more than 10 years and its 7 million existing clients are a sign of prolonged success. If it covers the markets you want to trade, then it’s very much worth trying out —at least in demo account format. It offers all the standard tools, some interesting new ones and is very user-friendly.

Since its inception, instaforex has picked up 30 international awards. Its operations now include more than 30 analysts, and 9 trading servers. It doesn’t have the widest range of markets in the sector, but has more than enough for most traders. All of this adds to the feeling of dealing with a reputable firm, with a growing reputation.

How do I open a demo account with instaforex?

An instaforex demo account can be set up in moments by filling in the few lines of information needed.

Is instaforex a regulated broker?

Yes. Instaforex is a global company and EU-based traders will benefit from the firm being regulated by cyprus securities and exchange commission (cysec).

What fees does instaforex charge?

This is a bit complicated. The pricing schedules are actually very transparent, but the broker offers five different account so that it can provide each trader with a best-fit option.

How do I withdraw money from instaforex?

This is all done online. You simply instruct instaforex to return funds back to the account that made the initial payment. The firm reports most payments are processed within one working day.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Instaforex minimum deposit

The instaforex minimum deposit amount that instaforex requires is US dollar 1.

The minimum deposit amount of US dollar 1 when registering a live account is equivalent to ZAR17,59 at the current exchange rate between US dollar and south african rand on the day that this article was written.

Instaforex is a russia-based broker which is authorized and regulated by some of the strictest and most demanding regulating entities namely cysec, BVI FSC and FSC, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as instaforex are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

Instaforex does not charge any fees when deposits are made into the trader’s account.

Some of the payment methods that can be used when making the minimum deposit include, but is not limited to:

- Credit/debit cards

- Bank wire transfer

- Southeast asia bank transfer

- Skrill

- Bitcoin

- Neteller, and several others.

Instaforex only supports three deposit currencies in which traders can fund their accounts including:

- USD

- EUR

- RUB

Traders should take note that payments made in any other currency apart from the base currencies of the various accounts may be subjected to conversion rates charged by their payment provider. The base currencies are USD, EUR, and GBP.

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by following these steps:

- Log into the client portal and select ‘deposit’

- Select the deposit method along with the amount.

- After the trader has made their selection, they will be redirected to the payment processor page to confirm their deposit.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. None noted |

| 2. Quick and easy depositing of funds |

What is the minimum deposit for instaforex?

How do I make a deposit and withdrawal with instaforex?

Some of the payment methods that can be used when making the minimum deposit include, but is not limited to:

- Credit/debit cards

- Bank wire transfer

- Southeast asia bank transfer

- Skrill

- Bitcoin

- Neteller, and several others.

Instaforex review

Instaforex is a brokerage company specialized in forex trading. This broker offers its traders analysis, specific market information and exclusive news updates. Regardless of the political or economic background, forex can be a good investment target. Also, if you are a trader and want to start your trading career with forex and CFD trading, you need to find a broker that is trustworthy, professional.

What we can say as a big advantage of instaforex is the variety of bonuses that can be used during the trading process and the brand is also recognizable by its partnership with big stars like victoria azarenka, janko tipsarević, porsche and liverpool FC.

Instaforex account features

The first thing that caught us around is a demo account that is allowed to all traders who choose to trade with instaforex. Simply enter your name and email address and you will be automatically logged on to the MT4 / 5 platform. This way, you can test all the features, tools and settings that you can use during trading with instaforex. It is important to note that the demo account uses virtual money and cannot be withdrawn. Also, you can choose the amount you want to get with a demo account.

Instaforex account types

Instaforex offers two types of accounts on its platform: standard account and eurica account. What make these two accounts different is the fee structure. The standard account does not include any fees and is preferred for beginners. As most traders certainly know, as always there is a spread. The difference between bidding price and asking for a trade price is called the spread. While we were testing accounts, the standard account spread on EURUSD was 3 pips and it is fixed.

Instaforex eurica account is a little bit different. This account does not include spread, which is not seen often in the forex trading industry, but they carry a fixed commission which can be equivalent of 3 pips.

In addition to demo account, instaforex offers its users cent accounts. These accounts are designed for beginners and traders who have a small bankroll. Many prices are 0.01 cent and are adjusted for trading in cents which reduces the potential unwanted losses. This kind of account seems very interesting to us.

In order to make trading more interesting and educate you about the instaforex accounts, we have listed each account and their benefits:

Instaforex standard account

- EUR and USD

- 1$ deposit minimum

- Max 1:1000 leverage

- Spreads from 3 pips

- 5% annual interest rate

Instaforex cent standard account

- Usc and eurc

- 1000$ maximum deposit

- Min 0.0001 trade amount

- 1$ deposit minimum

- Spreads from 3-7

Instaforex eurica account

Instaforex cent eurica account

What can we state as the difference between these accounts? In our opinion, there are not too many differences. The only changeable thing is the max deposit cap on cent accounts. However, it’s good to be well-informed and familiar with everything in the available accounts and to know more you can always contact instaforex customer support team.

Instaforex islamic account

For all traders wishing to trade with different options without violating islam religious beliefs, instaforex has provided such an option. With the help of the islamic account, traders can be relaxed and have all the benefits that such traders usually have. There are no trades closed at night and no interest in overnight charges or credits to the account.

Instaforex bonus

Instaforex offers its customers several types of bonuses. As we always note, please read the FAQ rules where you can find all the details regarding the bonus policy. The first bonus is a redeposit bonus and it is 250% or 55% bonus for each new deposit. The following is a 30% deposit bonus and a chance for an additional $ 1,000 to $ 10,000 from a common prize pool that is enabled as an additional cash prize to all traders.

It is important to mention that profit can be withdrawn anytime and small bonuses don’t require documents for verification. Also, there is an interesting bonus called instaforex no deposit bonus.

Instaforex no deposit bonus

This promotion will surely attract the attention of all traders. Instaforex offers all cfds traders up to $ 1000 no deposit bonus just for signing up. To accept this promotion, you must contact instaforex support team and request a bonus and more information if needed.

Instaforex software

To trade with instaforex, traders have the opportunity to use the well-known metatrader4 and metatrader5 platforms. Also, it is possible to use a webtrader that is integrated with the browser so no additional download is required.

Instaforex web trader

Webtrader is user-friendly and interesting to use. This platform contains everything you need to trade. Keep in mind that a platform that allows the interface to be run from the browser does not mean that it is either bad or of a low quality. With webtrader, traders can use every tool and see all features connected with their account such as open trades, closed trades, history, different charts, log tabs, balance, margin levels, spreads etc.

Instaforex was not just created to trade forex and cfds. There are also other instruments that can be traded with instaforex and one of them is the planetary popular bitcoin.

Instaforex bitcoin

With instaforex, you can trade bitcoin, but the big advantage is that you can make a deposit with this cryptocurrency. There is no large number of brokers that allow deposit with a bitcoin and precisely because of this instaforex created the special bitcoin account.

Instaforex assets

There are more than 100 different currency pairs, cfds based on US stocks but also cfds based on futures and indices. What is important to binary options traders is that they can also trade with binary options at any moment.

Instaforex support information

When we talk about customer support, it’s important to emphasize that customer support is often decisive factor for traders. What we have noticed with instaforex is that their support is available 24/7 which means you can have access to all information at any time.

Also, instaforex does not only use a classic chat for traders but also viber, skype, whatsapp, ICQ, yahoo messenger, telegram and AOL messenger.

You can also contact them by phone that is specific to the site for the specific country. Take a look at their website if you prefer this kind of communication with a broker. Also, keep in mind that you can read FAQ rules and see more information and seek for answers that you are interested in.

Instaforex payment methods

As we have already mentioned, the deposit with instaforex is $ 1. This is indeed a turning point because traders are already accustomed to brokers offering $ 250 minimum deposits, which is for beginners really discouraging.

To help you find the deposit methods easier, we’ve decided to list all the methods you can use to deposit with instaforex:

- Bank card

- Bank wire

- Megatransfer

- Payco

- Skrill

- Benecard

- Neteller

- Union pay chi

- Alipay

- Boleto

- Bpaymm

- Carta bleue

- Cartasi

- Eoayments standard

- Giropay

- Ideal

- Maestro

- Nordea solo

- Poli payments

- Postepay

- Przelewi24

- Sofort

- Trustrly

- Paxum

Withdrawal methods are processed in the same way as for deposit methods which means that you can most of the payment methods listed above. For withdrawals, the time period of 24 hours is usually needed to process, the minimum is at least $ 1. However, some methods require a larger limit like bank wire ($ 300). For more information regarding fees, visit the instaforex site or contact customer support.

Instaforex license

Instaforex has no EU country license. However, this is a broker who has been registered with the central bank of russia, which gives us a special mark on its credibility. In our testing, instaforex has shown incredible settings, features, and tools that will provide each trader with a specialty in the trading process. As the central bank of russia strengthens our view on instaforex, we do not expect that traders will have any issues with instaforex broker.

Berapa minimum deposit di instaforex

Deposit di akun real instaforex memang sebuah keharusan yang mesti dilakukan sebelum melakukan trading,

Berbeda dengan akun demo yang tidak perlu melakukan deposit karena saldo dapat terisi secara otomatis,

Berapa minimum deposit di instaforex? Mungkin itu menjadi pertanyaan umum bagi calon trader yang ingin mendaftar di broker ini,

Bisa dibilang setiap broker luar negeri memberikan batas minimum deposit yang kecil serta nilai leverage yang besar,

Mungkin hal ini yang membuat orang lebih nyaman menggunakan broker luar negeri karena tidak butuh modal besar,

Namun sebagai trader, ketika bergabung dengan broker luar negeri harus siap risiko karena secara legalitas belum diakui di indonesia,

Selain itu biasanya akan mengalami kesulitan masuk ke website resmi karena di blok oleh menkominfo. Meskipun demikian, kamu masih bisa masuk menggunakan VPN,

Jika kamu tertarik untuk melakukan trading forex dengan modal kecil, maka bisa mencoba broker luar negeri ini karena sudah ternama di indonesia,

Instaforex login

Untuk melakukan login di instaforex langkahnya juga sangat mudah, bagi kamu yang sudah mendaftar maka akan mendapatkan nomor id dan password,

Dari data tersebut kamu bisa masuk sebagai partner atau trader,

Jika kamu seorang trader maka tinggal pilih pada opsi trader kemudian masukkan nomor id dan password tersebut maka kemudian kamu akan langsung dibawa ke dalam dashboard instaforex,

Cara deposit instaforex lewat bank lokal

Mungkin dulu orang sangat kesulitan jika ingin melakukan deposit di instaforex karena memerlukan kartu kredit, tetapi saat ini bisa mengisi dengan rekening bank di indonesia seperti mandiri, BNI, BCA, dan BRI,

Lihat saja artikel tersebut maka kamu sudah bisa mengisi saldo di akun instaforex dengan mudah dan cepat,

Berapa minimum deposit di instaforex.

Ternyata tidak, minimum deposit di instaforex hanya butuh uang $1. Kamu sudah bisa mengisi dengan saldo yang sangat minimum,

Namun untuk menjaga margin agar tidak cepat terkenal margin call maka sebaiknya melakukan deposit di atas $100 dengan lots paling kecil,

Ketahanan dalam trading forex adalah sangat penting, oleh sebab itu orang akan menerapkan money management forex agar bisa menjaga agar akun tidak mudah terkena margin call,

Karena kunci kesuksesan dalam trading forex adalah menjaga saldo tetap bertahan dengan mencari peluang yang paling baik untuk melakukan aksi jual atau beli,

Maka percuma jika trading hari ini menang tetap beberapa hari kemudian terjadi loss hingga profit hari ini ikut berkurang,

Banyak cara untuk melakukan trading atau sistem trading. Oleh sebab itu jangan malu untuk belajar trading memakai akun demo terlebih dahulu seperti akun demo yang ada di instaforex,

Bonus tanpa deposit instaforex

Tetapi jika ingin serius untuk mencari profit di instaforex, lebih baik melakukan deposit dan jangan tergiur dengan promosi bonus deposit karena jika tidak memahami syarat dan ketentuan maka bisa jadi malah merugikan,

Saat ini banyak orang yang merasa terjebak oleh bonus deposit yang memberikan bonus sekian persen dari jumlah deposit,

Tetapi ketika trading dan terjadi floating pada batas tertentu maka bonus tersebut secara otomatis akan hilang dan saldo menjadi nol,

Maka dari itu cermati mengenai syarat dan ketentuan yang berlaku dalam sistem bonus deposit tersebut,

Oke sahabat jurnalforex sekalian, itu tadi informasi berapa minimum deposit di instaforex serta beberapa informasi tambahan,

Semoga apa yang kami sajikan ini dapat menjawab pertanyaan mengenai dunia trading khususnya broker instaforex,

Best forex brokers with low/no minimum deposit for 2021

Top rated:

If you are thinking of getting involved in the forex trading market and you are looking for the top forex brokers, or maybe you are already dealing with an FX broker, one of the most important things you may be thinking about is the minimum deposit.

In the forex market, there are often a few trading conditions that you will have to abide by, which sometimes means a minimum deposit to get into forex trading. With these brokers though, that is not the case.

The reviews we have conducted for this top 10 show that they do not have any minimum deposit requirement, although in some cases you will find a forex broker minimum deposit based on funding amount.

The following top 10 brokers are great for all traders, but particularly for new traders seeking an excellent low deposit start in currency trading, particularly with the credit/debit card deposits that are often cheaply available.

Table of contents

Why a minimum or 0$ deposit is not the only thing to consider

Conducting an in-depth technical analysis in search of a broker with no minimum deposit or a low one is not all you should think about though.

You should also consider the fact that you will likely be trading with some kind of leverage. This and other factors can really help determine the best broker choice for your forex trading future.

In fact, the best situation for you is one where you have a minimum deposit broker that also allows you to trade with minimum trade size. This is something we will get into more at the end of the post.

For now, let’s take a look at the very best forex brokers with low or no minimum deposit.

Best forex brokers with low or no minimum deposits

In no particular order, here is the best low or no minimum deposits brokers chosen after thorough broker reviews on each:

1. Oanda

Trading with oanda broker, the first thing you will be glad to notice is that there is no minimum deposit at all.

The broker also has no minimum trade size. In the forex market and for your trading career, this can mean great flexibility as you can trade as low as 1 unit in your base currency without worrying about lot-size trading.

Deposits for trading with the oanda broker and trading platform can be made in the form of wire transfers, all major credit cards (visa/mastercard), ewallets such as paypal and some other oanda deposit methods may be available depending on your area. Almost all of these come with no real money fee attached at all.

Oanda can also be connected with zulutrade to open many copy trading opportunities and is widely considered to be a very trustworthy option particularly if you are based in europe and want to get started in forex trading with a small amount of money.

2. FBS

Getting into the forex market with FBS is one of the best value ways you can become a trader. This is because you can start a mini account with FBS that only requires $10 from within europe, or $1 from outside as the minimum deposit. This is the FBS cent account. A micro account with a $5 minimum deposit is also available but not within europe.

These kinds of currency trading account types allow you to trade in micro lost of 1,000 units and to trade as low as 10 units or 0.1 nano lots. Compared to the standard forex market trading lot size, this would be 0.0001 standard lots. So, as you can see, real money is still at risk, but in a very controlled way.

Again here, the wire transfer, visa/mastercard, and ewallets like neteller and skrill are all available for deposit with on fee in the majority of cases.

The FBS accounts are also a great choice for non-europeans with super high leverage available, and islamic accounts too.

Of the 5 XM accounts that are offered, two, in particular, have a very low and attractive minimum deposit if you are getting involved in the forex market. These are the micro and standard accounts both with a minimum deposit of just $5.

As with other brokers, the micro account will make it less risky in terms of your real money trading. Here you can benefit from micro lots down to 0.1 nano lots to help you get a taste of the forex market.

When it comes to XM deposit methods, you can choose between the ever-present wire transfer, all major credit cards from either visa or mastercard and some ewallet and local specific methods. All of these methods, for the most part, are free of any XM fee.

Islamic trading accounts are also widely available from the broker as well as the XM ultra low account, which allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50

4. FXTM

FXTM is another major force in the forex trading industry and an excellent place to get started if you are looking for a low minimum deposit broker. Our FXTM broker review showed that you can start micro trading here with the cent account for as little as a $10 deposit.

Again these accounts allow for mini trading with micro lots of 1,000 units and nano lots of just 10 units making trading here very accessible indeed.

Deposits are made available through all of the popular channels including wire transfers, major credit and debit cards from visa, mastercard, and maestro, and ewallets like neteller and skrill. Other localized funding methods may be available depending on location, and all FXTM deposits should be free of any fees.

FXTM islamic accounts are again available where needed and the broker caters particularly well to traders in african countries like nigeria who want to get into the forex market. Crypto deposits are also accepted if you are based outside the remit of european regulations.

5. Roboforex

If you are looking to jump into forex trading with a wide range of account choices, then roboforex may be just the place for you. There are a total of 6 account types to choose from, 3 of these account types have a great low minimum deposit of just $10. These forex trading accounts are the pro standard, ECN pro, and pro cent which allows for micro trading from micro lots of 1,000 units to nano lots of 100 units through the MT4 trading platform and the MT5 trading platform through which you can trade as low as 0.1 nano lots.

For deposits with this broker you can avail of wire transfers, major credit cards, and ewallet options like neteller, webmoney, advcash, and perfectmoney. There may be other funding methods available depending on your area, and most of the deposit methods mentioned carry no fee at all from the broker.

Yet again, if you are in forex trading and need an islamic account, this broker has you covered and is a really good choice if you are looking for standard forex trading accounts with a low minimum deposit.

6. Instaforex

Considering forex brokers with a low or no minimum deposit, then instaforex is another option. They offer two types of micro trading cent accounts with a minimum deposit of just $1 on each. These allow you to engage in mini trading for as little as 0.0001 standard lots, a real risk-free way to engage in the forex market.

Spreads on these accounts start from just 1 pip and the cent eurica account offers a zero spread option with commission from 0.03% in its place which could be an attractive proposition depending on your forex trading style.

Deposits at instaforex can be made by way of wire transfer, major credit cards, and ewallets such as neteller and skrill. In many cases, there are no fees at all to get started trading or make a deposit.

As with the majority of top brokers today, islamic trading is well catered for with this broker.

7. Alpari

The next broker with a very low minimum deposit for forex trading that you should consider is alpari. This broker offers micro trading accounts with the low minimum deposit of $5 to get started. With these accounts as with other cent type mini trading accounts, you can expect both micro and nano lots of 1000, and 10 units to be available.

Deposits to fund your real money forex trading here can be made with a wire transfer, trusted credit cards from either visa, mastercard, or maestro, and ewallet options from neteller and skrill respectively. There are typically no deposit fees with this broker.

Alpari has extensive experience in the forex trading industry, offering the best in trading platforms and islamic accounts for those who require them.

Why is lot size important with low deposits?

You may be wondering why the lot size has been mentioned frequently and why this may impact you as a trader.

The fact is that if you are a european based forex trader, it has become very difficult to have a low minimum deposit and be able to trade significant amounts within the standard trading accounts that this opens up. This is all due to the 30:1 leverage limitation placed by regulators in europe. For example, in order to invest 1$ in a micro lot (1000 units), you would need minimum leverage of 1000:1.

So, if you don’t have leverage, the only solution is to have the smallest trading sizes available.

Some brokers will allow you to open positions for 0.1 nano lots (basically 1/100 of a micro lot), which translates in minimum leverage terms to 10:1.

The only solution that you have available for really low deposit trading if nano lots are not available is unfortunately just to step up your deposit a little more. In these cases as a forex trader, $50 is typically sufficient although it depends on the asset.

With all of that said, given the number of broker options available, it is still very much possible for european traders, even those constrained by strict 30:1 leverage to experience very low deposit trading in the forex market and others.

Brokers with low or 0$ minimum deposit good for non EU users

The following brokers still have very low, or even no minimum deposit requirements to enter the forex market as the brokers above also have. The only difference here is that with these brokers, micro trading through cent accounts is not necessary.

In this case, the best thing you can do is use these brokers to avail of higher leverage availability if you are located outside of an area like cysec regulation where leverage is limited.

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

When trading small amounts, you are usually constricted to put the majority of your money into a single trade. This, however, helps you reduce commissions. Traders are usually more likely to be sloppy when you are going to be making 20 trades in a day. But when trading with small amounts forces traders to be more selective about the trades they take.

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

so, let's see, what we have: discover our top 10 featuring the best forex brokers with a very low or even a no minimum deposit and minimum trade size for a better trading experience. At instaforex minimum deposit

Contents of the article

- My list of forex bonuses

- Best forex brokers with low/no minimum deposit...

- Why a minimum or 0$ deposit is not the only thing...

- Best forex brokers with low or no minimum deposits

- Why is lot size important with low deposits?

- Brokers with low or 0$ minimum deposit good for...

- Berapa minimum deposit di instaforex

- Instaforex login

- Cara deposit instaforex lewat bank lokal

- Berapa minimum deposit di instaforex.

- Bonus tanpa deposit instaforex

- Instaforex.Eu review

- Try some trades with A free demo account

- TRADERS’ VIEWPOINT

- ABOUT INSTAFOREX

- Who does instaforex appeal to?

- INSTAFOREX ACCOUNT TYPES

- MARKETS AND TERRITORIES

- INSTRUMENTS AND SPREADS

- INSTAFOREX FEES AND COMMISSIONS

- INSTAFOREX TRADING PLATFORM REVIEW

- SOCIAL TRADING AND COPY TRADING

- CHARTING AND TOOLS

- EDUCATION

- TRADER PROTECTIONS BY TERRITORY

- HOW TO OPEN AN ACCOUNT

- CUSTOMER SUPPORT

- The bottom line

- How do I open a demo account with instaforex?

- Is instaforex a regulated broker?

- What fees does instaforex charge?

- How do I withdraw money from instaforex?

- Instaforex minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- Instaforex review

- Instaforex account features

- Instaforex account types

- Instaforex standard account

- Instaforex cent standard account

- Instaforex eurica account

- Instaforex cent eurica account

- Instaforex islamic account

- Instaforex account types

- Instaforex bonus

- Instaforex software

- Instaforex bitcoin

- Instaforex assets

- Instaforex support information

- Instaforex payment methods

- Instaforex license

- Berapa minimum deposit di instaforex

- Instaforex login

- Cara deposit instaforex lewat bank lokal

- Berapa minimum deposit di instaforex.

- Bonus tanpa deposit instaforex

- Best forex brokers with low/no minimum deposit...

- Why a minimum or 0$ deposit is not the only thing...

- Best forex brokers with low or no minimum deposits

- Why is lot size important with low deposits?

- Brokers with low or 0$ minimum deposit good for...

- Forex minimum deposit

- Trading with a small deposit

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

Contents of the article

- My list of forex bonuses

- Best forex brokers with low/no minimum deposit...

- Why a minimum or 0$ deposit is not the only thing...

- Best forex brokers with low or no minimum deposits

- Why is lot size important with low deposits?

- Brokers with low or 0$ minimum deposit good for...

- Berapa minimum deposit di instaforex

- Instaforex login

- Cara deposit instaforex lewat bank lokal

- Berapa minimum deposit di instaforex.

- Bonus tanpa deposit instaforex

- Instaforex.Eu review

- Try some trades with A free demo account

- TRADERS’ VIEWPOINT

- ABOUT INSTAFOREX

- Who does instaforex appeal to?

- INSTAFOREX ACCOUNT TYPES

- MARKETS AND TERRITORIES

- INSTRUMENTS AND SPREADS

- INSTAFOREX FEES AND COMMISSIONS

- INSTAFOREX TRADING PLATFORM REVIEW

- SOCIAL TRADING AND COPY TRADING

- CHARTING AND TOOLS

- EDUCATION

- TRADER PROTECTIONS BY TERRITORY

- HOW TO OPEN AN ACCOUNT

- CUSTOMER SUPPORT

- The bottom line

- How do I open a demo account with instaforex?

- Is instaforex a regulated broker?

- What fees does instaforex charge?

- How do I withdraw money from instaforex?

- Instaforex minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- Instaforex review

- Instaforex account features

- Instaforex account types

- Instaforex standard account

- Instaforex cent standard account

- Instaforex eurica account

- Instaforex cent eurica account

- Instaforex islamic account

- Instaforex account types

- Instaforex bonus

- Instaforex software

- Instaforex bitcoin

- Instaforex assets

- Instaforex support information

- Instaforex payment methods

- Instaforex license

- Berapa minimum deposit di instaforex

- Instaforex login

- Cara deposit instaforex lewat bank lokal

- Berapa minimum deposit di instaforex.

- Bonus tanpa deposit instaforex

- Best forex brokers with low/no minimum deposit...

- Why a minimum or 0$ deposit is not the only thing...

- Best forex brokers with low or no minimum deposits

- Why is lot size important with low deposits?

- Brokers with low or 0$ minimum deposit good for...

- Forex minimum deposit

- Trading with a small deposit

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.