Fund trading account

Some may accept asset transfers and even paper stock certificates. – most “casual” traders invest with a relatively near-term goal.

My list of forex bonuses

The “make some money” mantra is the main driver behind such efforts. If this mantra describes your investment objectives, you likely need a traditional brokerage account. Such accounts do not offer any tax advantages. On the other hand, they do not tie up your investments long-term either.

You may also be able to trade on margin with such an account. Trading on margin involves borrowing money from the broker. The assets in your account will serve as collateral in this case. Trading on margin carries some obvious risks.

Forex trading accounts

To trade online, you need to open a forex trading account. When you sign up, you will likely have to choose among several account types. The best forex trading accounts are those that suit your personal needs perfectly. On this page, we look at the forex trading account options you have. We also discuss ways in which these account options will impact your trading performance. You will learn:

- Which is the best forex trading account?

- Account types. What is a standard account, a funded account, a mini/micro account, a managed account, etc?

- Geographic account type considerations.

Below are the best forex trading accounts in your location:

The top 5 forex trading accounts in the united kingdom

Opening a forex trading account

What do you need to consider when opening a new forex trading account?

- The brokerage firm. Is it reputable or is it a known scammer?

- The services the brokerage firm offers.

- Costs and incentives involved.

- The account type that best suits your needs.

Once you have gotten these issues sorted, there is 3 step process for opening an account:

- Fill out the application forms and provide the information your broker requires.

- Fund your account.

- Start looking for investment opportunities.

When you select a brokerage firm, you take all these factors into account. You need to know whether your would-be broker is a trustworthy destination for traders. Though fewer these days, rogue operations still exist. Creating a real money account with such a broker is flushing money down the toilet.

You also need to know what incentives your broker offers. Match up these incentives with the costs. The broker has to support the account type you prefer and it has to give you access to a proper suite of services. You may even have a preferred account funding method. The broker may or may not accept/support that method.

Services-wise, you are looking for:

- Proper trading platforms, with solid technical analysis tools.

- Access to education and research.

- Trading foreign markets.

- Special features you may want.

- Convenience. Some brokerage firms offer face-to-face guidance. Others do not. It always makes sense from the perspective of trust, to prefer an operator with physical offices close by.

As far as incentives go, some brokers offer commission-free trading. Others may even reward you for certain achievements as a trader. You may even want to keep your savings with the broker if it rewards you for it.

Make sure you read and understand the full pricing schedule/policy of your broker.

Determining the right trading account type to meet your needs depends on what kind of trader you are, and what your objectives are.

When you fill out your application forms, be aware that you will have to provide information on your employment status, investable assets, and net worth. Some find such probing on the part of the broker quite intrusive.

You also have to provide a copy of your ID/driver’s license. If you want to trade options or gain access to margin, you may have to provide additional information.

Brokers accept several account-funding methods.

- Various e-wallets. (neteller, paypal, skrill etc)

- Bank transfer.

- Electronic funds transfer.

- Checks.

Some may accept asset transfers and even paper stock certificates.

Which is the best forex trading account?

As mentioned, the best account type for you is the one that best suits your needs and personal profile. The factors you should consider in this regard fall into two main categories.

Your investment objectives.

The type of trader you are.

Choosing a forex trading account based on your investment objectives

– most “casual” traders invest with a relatively near-term goal. The “make some money” mantra is the main driver behind such efforts. If this mantra describes your investment objectives, you likely need a traditional brokerage account. Such accounts do not offer any tax advantages. On the other hand, they do not tie up your investments long-term either.

You may also be able to trade on margin with such an account. Trading on margin involves borrowing money from the broker. The assets in your account will serve as collateral in this case. Trading on margin carries some obvious risks.

– if your goal is to secure your nest-egg for your retirement, an IRA (individual retirement account) is your option. All IRA options, such as traditional IRA, roth IRA, and rollover IRA offer you tax benefits. On the downside, you will not be able to touch this money before you are old.

Choosing a forex trading account based on what type of investor you are

- – you are an absolute beginner. And as such, not much of an investor. What you need at this stage is education. Possibly some good trading signals as well. In a word, you need an account, through which the broker can hold your hand. It could be that your ambitions are not high. Still, you need to know why you are doing what you are doing. Customer service and user interface are important factors in your account selection.

- – you are a “value” investor. Such investors buy and hold assets, to sell them when they appreciate. Such investors are not active traders. If you are a value investor, you value fundamental analysis. You have little use for charting and fancy technical indicators, however.

- – passive investing. Those who invest in index funds passively do not require much from their broker. Unlike beginners, such traders don’t need their hands held either. They just need access to index funds, and good tradable asset selection within this category.

- – high frequency trader. Active traders do not hold their positions long-term. They buy and sell with high frequency. Thus, they need all the bells and whistles their broker can offer them. They want good trading platforms with superb charting. Outstanding reporting and a highly functional interface are also musts. Technical analysis is the bread and butter of this trader category. Trading costs are also very important for active traders.

Forex trading account types

There are four basic account type categories: standard, funded, mini and managed. We will look at each in turn.

Within these categories, there are a few additional variants, such as the micro accounts. There are a handful of special account types as well, such as islamic accounts, demo accounts, and VIP accounts. Every one of these account options carries some advantages and some disadvantages.

Standard trading accounts

The name of this account option stems from the standard lots to which it gives traders access. A standard currency lot is worth $100,000. Such a lot size seemingly places this account type out of the reach of average traders.

You do not have to have $100,000 in your account to trade, however. The existence of margin and leverage means that you only have to have $1,000 to trade a standard lot.

Leverage varies based on many things. In the EU, forex leverage is capped at 1:30. In other places, brokers may offer leverage up to 1:500 even on standard accounts.

Brokers offer full services for the holders of standard accounts. Such accounts require upfront capital, so these are all depositing traders. The profit potential of this account type is significant as well.

On the downside, the same goes for loss potential. For this reason, you should only trade through a standard account if you are an experienced trader.

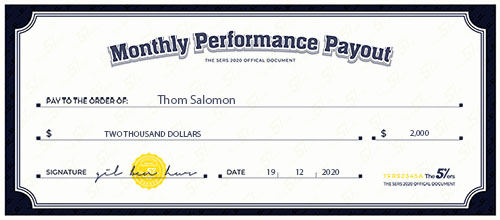

Funded trading accounts

Some brokers/other financial organizations fund certain traders. They provide them with starting capital, in exchange for a share of their future profits.

How does such a setup work?

Would-be funded account owners need to pass an evaluation program. If the broker’s analysts consider them to be good candidates, they grant them a funded account.

Funding can run into millions of dollars. Profit splits are in the 50% range. Funded accounts carry monthly profit targets. Traders who fulfill these targets can gain additional funding.

The broker pays out the profits periodically.

What do you need to do to secure such a funded account?

- Your first step is to sign up for the evaluation program.

- Trade through the evaluation account and reach the targets.

- Earn a proper funded account and start making money for you and the account provider.

Mini and micro trading accounts

A standard account features $100,000 lots. For traders who cannot afford to trade in that league, despite margin and leverage, mini accounts offer an alternative. A mini account supports mini lots. These lots are worth $10,000 each. Mini accounts usually accompany standard accounts and they target new traders.

Micro accounts take this approach a step further. They support micro-lots of $1,000. Such accounts are even more affordable than the mini ones. Like the minis, micro accounts target beginners as well.

The main advantage of mini and micro accounts resides in risk-reduction. For a mere $250-$500, you can open such a trading account. Trading in lower increments stretches your funds longer as well. This is one of the reasons why professional traders like to use such accounts. They can test their strategies in a low-risk, real-money environment.

In addition to the inherent risk-minimization benefits, mini and micro accounts let you spread your funds thinner. Thus, you can better micro-risk-manage them.

The obvious downside is that risk/loss minimization reduces profit potential as well. Such accounts are, therefore, hardly suited to cover the profit needs of professional/advanced traders.

Managed trading accounts

Forex trading account management works like this, A managed account is one that holds your funds but excludes you from decision-making. You make your deposit, and someone else – usually a broker-side expert – does the trading for you. You may be able to set objectives, however.

Why would you want to give up control through such a trading account?

– you are not an expert and you feel that the manager will do a better job than you ever could. Thus you let the manager handle your individual trading account.

– you feel that pooling your money with the funds of other investors offers you a degree of protection. Such managed accounts work like mutual funds. Managers handle the trading and they distribute the profits.

Managers rank these pooled accounts according to risk tolerance. Those looking for higher profits opt for more risky accounts. Those with a lower risk tolerance play it safer, earning less.

The main advantage of a managed account is that it allows you to cash in on the skills of a forex professional. Furthermore, you get to do it hands-off.

The disadvantage is that this forex expert will cut a commission from your profits. Managed accounts require larger deposits than regular ones. Individual accounts may require as much as $10,000. Pooled accounts are slightly cheaper at around $2,000.

Islamic trading accounts

Islam holds trading to be haram (not permitted). There are ways to turn it into halal (permitted), however.

All trading activity has to adhere to the principles of islamic finance.

- There must not be any interest (riba) involved.

- Exchanges involved in trading have to be immediate.

- No gambling is allowed.

- Risks, as well as benefits, have to be distributed.

Islamic accounts are swap-free accounts, through which transactions and the payments of costs associated with them, happen instantly. In the context of islamic trading accounts, the margin, commissions and administrative fees are not riba.

VIP accounts

Brokers reserve their VIP accounts to their most privileged clients. A VIP account holder enjoys special benefits, such as superior trading conditions. Forex brokerages often invite VIP traders to special events, treating them to special rewards.

What do you have to do to gain access to such an account?

You normally need to deposit an unusually large amount of money (often upward of $100,000). You will also need to trade frequently and perhaps meet certain trade volume requirements.

Demo accounts

A demo account is the “play money” simulation of a real account. It allows traders to test the platform and trading conditions. Some may also use such accounts to test-run certain strategies.

When you sign up for a demo account , the broker credits your account with a set amount of virtual funds. Some demo accounts offer the same functionality as a standard/mini/micro account. Others limit their users’ access to certain features.

Geographic considerations

Sometimes, your geographic location should play a role in your account type selection. Some jurisdictions may limit certain trade types. In the US, there is no CFD trading. The practice is against US securities laws.

Leverage varies greatly between EU regulated countries, the UK for example, and other parts of the world. In the EU forex margin is limited to 1:30 by ESMA, the european regulator.

In other parts of world, india and south africa for example, leverage can be offered up to 1:1000 (though 1:400 or 1:500 is more typical)

The taxes you have to pay on your profits also vary from one jurisdiction to another. Read our taxes page for more on that.

How to fund your account

Before you start trading, you first need to fund your account. You can find out more about the various funding methods available below.

Debit card

Execution time: instant deposit, via my IG within the trading platform.

Cost: free for visa and mastercard.

Credit card

Execution time: instant deposit, via my IG within the trading platform.

Cost: 1% charge for visa and 0.5% charge for mastercard.

HKD FPS

Execution time: up to three business days

Cost: free

NB: please quote your five-digit IG account number as a reference.

Transfer to our HK based HSBC account

Execution time: up to three business days.

Cost: free.

Please use the following details to make a transfer into IG's account:

IG international ltd – client trust account

The hongkong and shanghai banking corporation limited

1 queen's road central, hong kong

Additional bank details by currency:

NB: to ensure your funds are credited in a timely manner, please quote your five-digit IG account number as a reference. Your account number can be found in the web-based trading platform under 'my IG' > 'manage accounts' or in the email that we sent you upon activation of your account.

Please send a copy of your payment receipt to helpdesk.En@ig.Com

Important information

Please note that for security reasons payments must be made directly by the named IG account holder, and not by any third parties. The minimum funding amount for card payments is $300 USD, but there is no obligation to trade. There is no minimum funding amount for bank transfers. If your account is inactive for two years, an inactivity fee will apply.

We cannot accept cash, cheques, ATM and teller payments, commercial credit cards, or business credit cards.

Debit card and credit card payments can only be used for personal accounts.

All payments are subject to security checks and we may request more information from you before returning your funds, such as a screenshot of your bank statement or proof of identity.

We'll normally remit money in the same method and to the same place from which it was received. However, we may consider a suitable alternative at our absolute discretion.

Contact us

Questions about opening an account:

Existing client questions:

We're here 24hrs a day from 8am saturday to 10pm friday (UK time).

Markets

Trading platforms

Learn to trade

About

Contact us

The risks of loss from investing in cfds can be substantial and the value of your investments may fluctuate. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

CFD accounts provided by IG international limited. IG international limited is licensed to conduct investment business and digital asset business by the bermuda monetary authority and is registered in bermuda under no. 54814.

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG international limited is part of the IG group and its ultimate parent company is IG group holdings plc. IG international limited receives services from other members of the IG group including IG markets limited.

Trading account

What is a trading account?

A trading account can be any investment account containing securities, cash or other holdings. Most commonly, trading account refers to a day trader’s primary account. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. The assets held in a trading account are separated from others that may be part of a long-term buy and hold strategy.

Trading account

Basics of trading account

A trading account can hold securities, cash and other investment vehicles just like any other brokerage account. The term can describe a wide range of accounts, including tax-deferred retirement accounts. In general, however, a trading account is distinguished from other investment accounts by the level of activity, purpose of that activity and the risk it involves. The activity in a trading account typically constitutes day trading. The financial industry regulatory authority (FINRA) defines a day trade as the purchase and sale of a security within the same day in a margin account. FINRA defines pattern day traders as investors who satisfy the following two criteria:

- Traders who make at least four day trades (either buying and selling a stock or selling a stock sort and closing that short position within the same day) over a five-day week.

- Traders whose day-trading activity constitutes more than 6 percent of their total activity during that same week.

Brokerage firms can also identify clients as pattern day traders based on previous business or another reasonable conclusion. These firms will allow clients to open cash or margin accounts, but day traders typically choose margin for the trading accounts. FINRA enforces special margin requirements for investors it considers to be pattern day traders.

Opening a trading account requires certain minimum personal information, including social security number and contact details. Your brokerage firm may have other requirements depending on the jurisdiction and its business details.

FINRA margin requirements for trading accounts

Maintenance requirements for pattern day trading accounts are considerably higher than those of non-pattern trading. The base requirements of all margin investors are outlined by the federal reserve board’s regulation T. FINRA includes additional maintenance requirements for day traders in rule 4210. Day traders must maintain a base equity level of $25,000 or 25 percent of securities values, whichever is higher. The trader is permitted a purchasing power of up to four times any excess over that minimum requirement. Equity held in non-trading accounts is not eligible for this calculation. A trader who fails to meet these requirements will receive a margin call from their broker and trading will be restricted if the call is not covered within five days.

Trading mutual funds for beginners

Buying shares in mutual funds can be intimidating for beginning investors. There is a huge amount of funds available, all with different investment strategies and asset groups. Trading shares in mutual funds are different from trading shares in stocks or exchange-traded funds (etfs). The fees charged for mutual funds can be complicated. Understanding these fees is important since they have a large impact on the performance of investments in a fund.

What are mutual funds?

A mutual fund is an investment company that takes money from many investors and pools it together in one large pot. The professional manager for the fund invests the money in different types of assets including stocks, bonds, commodities, and even real estate. An investor buys shares in the mutual fund. These shares represent an ownership interest in a portion of the assets owned by the fund. Mutual funds are designed for longer-term investors and are not meant to be traded frequently due to their fee structures.

Mutual funds are often attractive to investors because they are widely diversified. Diversification helps to minimize risk to an investment. Rather than having to research and make an individual decision as to each type of asset to include in a portfolio, mutual funds offer a single comprehensive investment vehicle. Some mutual funds can have thousands of different holdings. Mutual funds are also very liquid. It is easy to buy and redeem shares in mutual funds.

There is a wide variety of mutual funds to consider. A few of the major fund types are bond funds, stock funds, balanced funds, and index funds.

Bond funds hold fixed-income securities as assets. These bonds pay regular interest to their holders. The mutual fund makes distributions to mutual fund holders of this interest.

Stock funds make investments in the shares of different companies. Stock funds seek to profit mainly by the appreciation of the shares over time, as well as dividend payments. Stock funds often have a strategy of investing in companies based on their market capitalization, the total dollar value of a company’s outstanding shares. For example, large-cap stocks are defined as those with market capitalizations over $10 billion. Stock funds may specialize in large-, mid-or small-cap stocks. Small-cap funds tend to have higher volatility than large-cap funds.

Balanced funds hold a mix of bonds and stocks. The distribution among stocks and bonds in these funds varies depending on the fund’s strategy. Index funds track the performance of an index such as the S&P 500. These funds are passively managed. They hold similar assets to the index being tracked. Fees for these types of funds are lower due to infrequent turnover in assets and passive management.

How mutual funds trade

The mechanics of trading mutual funds are different from those of etfs and stocks. Mutual funds require minimum investments of anywhere from $1,000 to $5,000, unlike stocks and etfs where the minimum investment is one share. Mutual funds trade only once a day after the markets close. Stocks and etfs can be traded at any point during the trading day.

The price for the shares in a mutual fund is determined by the net asset value (NAV) calculated after the market closes. The NAV is calculated by dividing the total value of all the assets in the portfolio, less any liabilities, by the number of outstanding shares. This is different from stocks and etfs, wherein prices fluctuate during the trading day.

An investor is buying or redeeming mutual fund shares directly from the fund itself. This is different from stocks and etfs, wherein the counterparty to the buying or selling of a share is another participant in the market. Mutual funds charge different fees for buying or redeeming shares.

Mutual fund charges and fees

It is critical for investors to understand the type of fees and charges associated with buying and redeeming mutual fund shares. These fees vary widely and can have a dramatic impact on the performance of an investment in the fund.

Some mutual funds charge load fees when buying or redeeming shares in the fund. The load is similar to the commission paid when buying or selling a stock. The load fee compensates the sale intermediary for the time and expertise in selecting the fund for the investor. Load fees can be anywhere from 4% to 8% of the amount invested in the fund. A front-end load is charged when an investor first buys shares in the fund.

A back-end load also called a deferred sales charge, is charged if the fund shares are sold within a certain time frame after first purchasing them. The back-end load is usually higher in the first year after buying the shares but then goes down each year after that. For example, a fund may charge 6% if shares are redeemed in the first year of ownership, and then it may reduce that fee by 1% each year until the sixth year when no fee is charged.

A level-load fee is an annual charge deducted from the assets in a fund to pay for distribution and marketing costs for the fund. These fees are also known as 12b-1 fees. They are a fixed percentage of the fund’s average net assets and capped at 1% by law. Notably, 12b-1 fees are considered part of the expense ratio for a fund.

The expense ratio includes ongoing fees and expenses for the fund. Expense ratios can vary widely but are generally 0.5 to 1.25%. Passively managed funds, such as index funds, usually have lower expense ratios than actively managed funds. Passive funds have a lower turnover in their holdings. They are not attempting to outperform a benchmark index, but just try to duplicate it, and thus do not need to compensate the fund manager for his expertise in choosing investment assets.

Load fees and expense ratios can be a significant drag on investment performance. Funds that charge loads must outperform their benchmark index or similar funds to justify the fees. Many studies show that load funds often do not perform better than their no-load counterparts. Thus, it makes little sense for most investors to buy shares in a fund with loads. Similarly, funds with higher expense ratios also tend to perform worse than low expense funds.

Because their higher expenses drag down returns, actively managed mutual funds sometimes get a bad rap as a group overall. But many international markets (especially the emerging ones) are just too difficult for direct investment – they're not highly liquid or investor-friendly – and they have no comprehensive index to follow. In this case, it pays to have a professional manager help wade through all of the complexities, and who is worth paying an active fee for.

Risk tolerance and investment goals

The first step in determining the suitability of any investment product is to assess risk tolerance. This is the ability and desire to take on risk in return for the possibility of higher returns. Though mutual funds are often considered one of the safer investments on the market, certain types of mutual funds are not suitable for those whose main goal is to avoid losses at all costs. Aggressive stock funds, for example, are not suitable for investors with very low-risk tolerances. Similarly, some high-yield bond funds may also be too risky if they invest in low-rated or junk bonds to generate higher returns.

Your specific investment goals are the next most important consideration when assessing the suitability of mutual funds, making some mutual funds more appropriate than others.

For an investor whose main goal is to preserve capital, meaning she is willing to accept lower gains in return for the security of knowing her initial investment is safe, high-risk funds are not a good fit. This type of investor has a very low-risk tolerance and should avoid most stock funds and many more aggressive bond funds. Instead, look to bond funds that invest in only highly rated government or corporate bonds or money market funds.

If an investor's chief aim is to generate big returns, she is likely willing to take on more risk. In this case, high-yield stock and bond funds can be excellent choices. Though the potential for loss is greater, these funds have professional managers who are more likely than the average retail investor to generate substantial profits by buying and selling cutting-edge stocks and risky debt securities. Investors looking to aggressively grow their wealth are not well suited to money market funds and other highly stable products because the rate of return is often not much greater than inflation.

Income or growth?

Mutual funds generate two kinds of income: capital gains and dividends. Though any net profits generated by a fund must be passed on to shareholders at least once a year, the frequency with which different funds make distributions varies widely.

If you are looking to grow her wealth over the long-term and is not concerned with generating immediate income, funds that focus on growth stocks and use a buy-and-hold strategy are best because they generally incur lower expenses and have a lower tax impact than other types of funds.

If, instead, you want to use her investment to create a regular income, dividend-bearing funds are an excellent choice. These funds invest in a variety of dividend-bearing stocks and interest-bearing bonds and pay dividends at least annually but often quarterly or semi-annually. Though stock-heavy funds are riskier, these types of balanced funds come in a range of stock-to-bond ratios.

Tax strategy

When assessing the suitability of mutual funds, it is important to consider taxes. Depending on an investor's current financial situation, income from mutual funds can have a serious impact on an investor's annual tax liability. The more income she earns in a given year, the higher her ordinary income and capital gains tax brackets.

Dividend-bearing funds are a poor choice for those looking to minimize their tax liability. Though funds that employ a long-term investment strategy may pay qualified dividends, which are taxed at the lower capital gains rate, any dividend payments increase an investor's taxable income for the year. The best choice is to direct her to funds that focus more on long-term capital gains and avoid dividend stocks or interest-bearing corporate bonds.

Funds that invest in tax-free government or municipal bonds generate interest that is not subject to federal income tax. So, these products may be a good choice. However, not all tax-free bonds are completely tax-free, so make sure to verify whether those earnings are subject to state or local taxes.

Many funds offer products managed with the specific goal of tax-efficiency. These funds employ a buy-and-hold strategy and eschew dividend- or interest-paying securities. They come in a variety of forms, so it's important to consider risk tolerance and investment goals when looking at a tax-efficient fund.

There are many metrics to study before deciding to invest in a mutual fund. Mutual fund rater morningstar (MORN) offers a great site to analyze funds and offers details on funds that include details on its asset allocation and mix between stocks, bonds, cash, and any alternative assets that may be held. It also popularized the investment style box that breaks a fund down between the market cap it focuses on (small, mid, and large cap) and investment style (value, growth, or blend, which is a mix of value and growth). Other key categories cover the following:

- A fund’s expense ratios

- An overview of its investment holdings

- Biographical details of the management team

- How strong its stewardship skills are

- How long it has been around

For a fund to be a buy, it should have a mix of the following characteristics: a great long-term (not short-term) track record, charge a reasonably low fee compared to the peer group, invest with a consistent approach based off the style box and possess a management team that has been in place for a long time. Morningstar sums up all of these metrics in a star rating, which is a good place to start to get a feel for how strong a mutual fund has been. However, keep in mind that the rating is backward-focused.

Investment strategies

Individual investors can look for mutual funds that follow a certain investment strategy that the investor prefers, or apply an investment strategy themselves by purchasing shares in funds that fit the criteria of a chosen strategy.

Value investing

Value investing, popularized by the legendary investor benjamin graham in the 1930s, is one of the most well-established, widely used and respected stock market investing strategies. Buying stocks during the great depression, graham was focused on identifying companies with genuine value and whose stock prices were either undervalued or at the very least not overinflated and therefore not easily prone to a dramatic fall.

The classic value investing metric used to identify undervalued stocks is the price-to-book (P/B) ratio. Value investors prefer to see P/B ratios at least below 3, and ideally below 1. However, since the average P/B ratio can vary significantly among sectors and industries, analysts commonly evaluate a company's P/B value in relation to that of similar companies engaged in the same business.

While mutual funds themselves do not technically have P/B ratios, the average weighted P/B ratio for the stocks that a mutual fund holds in its portfolio can be found at various mutual fund information sites, such as morningstar.Com. There are hundreds, if not thousands, of mutual funds that identify themselves as value funds, or that state in their descriptions that value investing principles guide the fund manager's stock selections.

Value investing goes beyond only considering a company's P/B value. A company's value may exist in the form of having strong cash flows and relatively little debt. Another source of value is in the specific products and services that a company offers, and how they are projected to perform in the marketplace.

Brand name recognition, while not precisely measurable in dollars and cents, represents a potential value for a company, and a point of reference for concluding that the market price of a company's stock is currently undervalued as compared to the true value of the company and its operations. Virtually any advantage a company has over its competitors or within the economy as a whole provides a source of value. Value investors are likely to scrutinize the relative values of the individual stocks that make up a mutual fund's portfolio.

Contrarian investing

Contrarian investors go against the prevailing market sentiment or trend. A classic example of contrarian investing is selling short, or at least avoiding buying, the stocks of an industry when investment analysts across the board are virtually all projecting above-average gains for companies operating in the specified industry. In short, contrarians often buy what the majority of investors are selling and sell what the majority of investors are buying.

Because contrarian investors typically buy stocks that are out of favor or whose prices have declined, contrarian investing can be seen as similar to value investing. However, contrarian trading strategies tend to be driven more by market sentiment factors than they are by value investing strategies and to rely less on specific fundamental analysis metrics such as the P/B ratio.

Contrarian investing is often misunderstood as consisting of simply selling stocks or funds that are going up and buying stocks or funds that are going down, but that is a misleading oversimplification. Contrarians are often more likely to go against prevailing opinions than to go against prevailing price trends. A contrarian move is to buy into a stock or fund whose price is rising despite the continuous and widespread market opinion that the price should be falling.

There are plenty of mutual funds that can be identified as contrarian funds. Investors can seek out contrarian-style funds to invest in, or they can employ a contrarian mutual fund trading strategy by selecting mutual funds to invest in using contrarian investment principles. Contrarian mutual fund investors seek out mutual funds to invest in that hold the stocks of companies in sectors or industries that are currently out of favor with market analysts, or they look for funds invested in sectors or industries that have underperformed compared to the overall market.

A contrarian's attitude toward a sector that has been underperforming for several years may well be that the protracted period of time over which the sector's stocks have been performing poorly (in relation to the overall market average) only makes it more probable that the sector will soon begin to experience a reversal of fortune to the upside.

Momentum investing

Momentum investing aims to profit from following strong existing trends. Momentum investing is closely related to a growth investing approach. Metrics considered in evaluating the strength of a mutual fund's price momentum include the weighted average price-earnings to growth (PEG) ratio of the fund's portfolio holdings, or the percentage year-over-year increase in the fund's net asset value (NAV).

Appropriate mutual funds for investors seeking to employ a momentum investing strategy can be identified by fund descriptions where the fund manager clearly states that momentum is a primary factor in his selection of stocks for the fund's portfolio. Investors wishing to follow market momentum through mutual fund investments can analyze the momentum performance of various funds and make fund selections accordingly. A momentum trader may look for funds with accelerating profits over a span of time; for example, funds with navs that rose by 3% three years ago, by 5% the following year and by 7% in the most recent year.

Momentum investors may also seek to identify specific sectors or industries that are demonstrating clear evidence of strong momentum. After identifying the strongest industries, they invest in funds that offer the most advantageous exposure to companies engaged in those industries.

The bottom line

Benjamin graham once wrote that making money on investing should depend “on the amount of intelligent effort the investor is willing and able to bring to bear on his task” of security analysis. When it comes to buying a mutual fund, investors must do their homework. In some respects, this is easier than focusing on buying individual securities, but it does add some important other areas to research before buying. Overall, there are many reasons why investing in mutual funds makes sense and a little bit of due diligence can make all the difference – and provide a measure of comfort.

How to get the best funded trading accounts?

Fully funded trading account

A forex trading job is recognized to be one of the most challenging jobs in the market due to the sheer of variables that need to be considered before implementing any decisions.

The forex market is extremely volatile, and there are very few alternatives offered to traders to accumulate funds for their account. However, you don’t have to worry about money when you get selected to trade with a funded trading account. That happens when you show great experience and skill in making profitable trades, along with the consistency of your trade.

If you show a proprietary trading firm that you are skilled and talented, and can be counted among the top forex traders, you will get the chance to join some of the best-funded proprietary funds in the market.

What are funded trading accounts at A proprietary forex fund?

A forex funded trading account at a proprietary forex fund is one of the main goals for all forex traders because that is the pinnacle of their industry. There are a lot of great proprietary forex funds that are offering traders the chance to showcase their talent and skill with a funded trading account. At the5ers proprietary firm, we offer traders the chance to elevate their trading career to the next level. We offer traders with everything they need to be successful in forex trading , if they prove their skills, and have a track record of being a successful trader.

How to choose the best funded trading accounts?

Here are some important points to understand about how to choose a funded trading account, which traders tend to get confused about, or that firms manipulate the way they present them to confuse traders:

Share split

It is important to analyze this point together with the possible account size.

Most companies will offer 60% to 80% percentage of the profits for the trader in 100K to 300K accounts.

The5ers gives up to 1.28 million accounts with a 50%-50% split. So you keep a little less percentage of the profits, in a significantly larger trading account.

Remember that when you are taking the very same winning performance, the actual money-earning potential is what matters and not the percentage split.

Payout and growing terms

The5ers is the only fund that actually pays every month, no minimum, and no maximum applied.

The5ers is the only fund that pays and at the same time saves your milestone progression at the same level!

Meaning you pull out money every month, and you don’t hold your growth rate.

With other companies, you have to choose between taking the profits or leaving them for growth.

Terms

The duration & phases of the time you spend on being evaluated are also interesting to compare.

Most companies have 2 phases of testing before real funding and in most cases, those phases happen on demo accounts.

The5ers has only 1 evaluation phase, and it is actually on a live trading account. So practically you are already being funded – only with 1/4th of the account, you will get once you succeed. And you get paid for the profits made during the evaluation by the 50% split share.

Most companies will ask you to make a 10% profit on your evaluation account, in one month! Although it is possible to achieve, this objective doesn’t suit long term strategies and promotes overleveraging. With the 5ers you need to make 6%-7% in a maximum period of 6 months.

Weekends and nights

Look if you are allowed to leave open trades overnight and over the weekends.

Most companies won’t allow it.

The5ers.Com allows overnight and over the weekend trades, which is crucial for long term traders.

Recurring fees

In some companies, you will have to pay an initial fee plus a monthly fee.

With the5ers, there are no monthly payments. To get evaluated you only need to pay a one-time enrollment fee.

How to get qualified for a funded trading account

There aren’t any special qualities that qualify you for a funded trading account, other than proving your skills. You must show consistent results in forex trading and prove that your trading strategy is profitable. There are plenty of traders that get good results, but it can also be a fluke win, and to qualify for a funded trading account, you must showcase consistently profitable trades.

Sign up to evaluate your trading

When you sign up to trade with some of the best forex proprietary funds in the market, your trading style is going to be evaluated by the firm first. You will have to pay for the signup fee, but other than that there are no additional costs to be in a forex funded account program.

After a few weeks in testing, you will be totally in the risk-free trading zone

Once you have passed the initial evaluation, you will be tested for a few weeks, so that the proprietary firm can get a good feel of your trading style. Once you pass those few weeks, you will enter the risk-free trading zone, which is when you will be given your own funded trading account.

Get paid to trade forex

After proving yourself in the forex market with consistently profitable trades, you will earn the right to get paid to trade in the forex market. This is the best step for your trading career, as it allows you with the chance to test yourself among the best traders that are currently trading in the market.

Develop your trading career from home

When you get the chance to work with a forex funded account, your trading career is on the rise. It is best to choose a remote proprietary trading firm to work with, like the5ers, since they offer traders the chance to develop their trading career from home. This additional flexibility allows traders to trade in the market at their own time, and from wherever they choose to trade from.

Get high capital to trade

Once you are in the forex funded account program, you must keep showcasing your skills as a forex trader to climb even higher up the ladder. If you show great results while forex trading, then you will get a funded trading account with even bigger capital, so you can trade more. Only the top forex traders get that chance, and only after they apply the risk management requirements of the proprietary firm.

You can trade any trading strategy

One of the primary benefits of trading with a funded trading account is that you can trade any style without any fear of your style being compromised. You can choose any style, from scalping, day trading, to long-term position holding, swing trading, fundamentals analysis, or technical analysis trading strategies. The only thing you must keep in mind is that you must deliver profitable trades and results with your trading style.

Get your funded trading account with the5ers

There are a lot of forex proprietary firms in the market, but the5ers stands head and shoulders above them all. We are a remote proprietary trading firm, that offers some of the best forex proprietary trading funds on the market. Our forex funded account program has helped countless traders to develop their trading career, and if you are among the top forex traders in the market you should enroll now.

We have worked with some of the best forex traders in the market and offer them the following incentives, along with the best forex trading job.

Risk-free trading

Don’t risk your money anymore on the forex market. This is risk-free trading that allows you to not only think big but take more chances to get profitable trades in the market.

Develop a trading career

One of the biggest benefits of trading with our funded trading account is that we give all traders the chance to develop their careers. You will be assigned for the highest rewarding trading growth program, where you can build up your trading assets to make a substantial living.

Zero cost from your side

You don’t need to worry about the cost because there are none from your side when you work with the5ers funded trading account. You only pay for the signup fee and the rest is handled by the proprietary firm, so you get complete freedom to become the best trader you can.

Bring your own trading strategy

Worried about compromising your trading strategy? That isn’t even a consideration when you work with a funded trading account, because you have complete freedom as a trader to use your own trading strategy. That ensures that you don’t second guess yourself and keep using the trading strategies that made you successful.

Apply the fund risk management requirements to your own trading strategy

When trading with a forex funded trading account, you must follow the risk management requirements of the funded account. That ensures that you don’t take unnecessary risks that may jeopardize the capital in your funded account.

Final words about funded trading accounts

There are a lot of forex proprietary firms in the market today that are offering traders the chance to elevate their trading career. Choosing the right firm, like the5ers, will give you the chance to trade with some of the best forex traders in the industry.

If you want to receive an invitation to our weekly forex analysis live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our newsletter.

Trading account

Invest for a better future with our award-winning everyday investing and trading account. Start today for only £9.99 a month.

Please remember, investment value can go up or down and you could get back less than you invest.

Benefits of our trading account

More opportunities

Over 40,000 UK and global stocks to choose from across 17 stock exchanges. Invest directly in shares, etfs, funds, investment trusts and more.

Cut your costs

Reduce your FX costs by managing your money in up to nine currencies across the world's leading exchanges, including US dollars, euros and sterling.

Always in control

Buy and sell investments, check your portfolio and fund your account anytime with our ios and android apps.

Stay in the know

Get the award-winning quotestream, level 2 streaming prices and real-time portfolio management for a low fixed price of £20 +VAT per month.

Get started today for only £9.99 a month.

Get the best investment choice and insight around

A fair flat fee of £9.99 a month. Our charges stay the same as your investment grows, giving you better value in the long term.

One free trade per month. We give you back £7.99 credit every month to buy or sell any investment.

Commission rates: only £7.99 for all UK and US trades. Regular investing is free.

Our fixed fee covers you for multiple accounts (add a SIPP today and pay no SIPP fee for six months. Then just £10 a month extra).

Looking for a general investment account?

The ii trading account is the ideal choice for investors looking for flexibility and uncapped investment options. It is our most flexible investment account and has the widest choice of investment options in the market, including funds, shares, investment trusts and etfs.

With our impartial expert ideas and analysis, you will have all the tools you need to be a confident investor. Plus you can access your money whenever you like and trade securely at any time, using our ios and android apps.

Get started today for only £9.99 a month.

Looking for a joint trading account?

The ii joint trading account is the ideal choice for a secure investment account with shared ownership. It offers simplified portfolio management and is easy for both parties to access. The joint trading account allows you to hold a wide range of investments, with holdings registered in both names.

Funded accounts

Trade with our capital

$50,000

Having a bigger account makes it easier to earn a living. Get funded with a 5-figure account to generate your own full time income.

80/20 SHARE

You’ll earn 80% of all the profits generated, while we absorb all of the losses. And you can withdraw your share every month.

Get started now

Minimum conditions required

Fast track to success

The complete currency trader funded account program, is a short cut to trading with enough capital to generate a full-time income. Prove you can make profit whilst safely managing risk, and we’ll fund an account with up to $50,000, and let you keep the lion’s share of the returns. Whether it’s scalping, position trading, trend following, or counter-trend trading; you have full control, and the style and frequency of your system are up to you.

MONEY

Money, makes more money, and the bigger your forex account, the easier it is to earn a living. Take advantage of our capital to become a full time professional trader.

FREEDOM

Trade any system on any time frame, from anywhere in the world, without targets or quota's. You have the freedom to choose where, when, and how you trade*.

SUCCESS

With a funded account, you have the capital behind you to finally earn a substantial living as a forex trader. Extra income; pay the bills; even quit your current day job.

96.4% rate complete currency trader as good or excellent.

WE STRIVE TO ENSURE YOU HAVE 100% SATISFACTION WITH OUR SERVICE.

*DETAILS

A minimum of 6 (most recent) months proven track record, plus 50 trades, demonstrating profitability and sound risk management is required before being accepted for a funded account. This can be achieved before or after applying for the program and can be in a demo account.

Your track record must demonstrate a positive expectancy in your system or strategy. There are no targets or minimum thresholds related to win rate or trade frequency, provided that on average, the expectancy is positive.

Your absolute returns must exceed your absolute draw-down by a factor of 1.5 to 1. If your track record shows a maximum draw-down of 10% of the account balance, your absolute gain must be 15% or more.

Your track record must demonstrate a low risk of ruin. Account safety is our paramount concern and we expect to see a degree of risk mitigation measures intended to safeguard the balance under normal conditions.

You must be a subscriber to one of our analysis tool bundles, and have completed our FREE inception and cybernetics courses. We want to know you have had a sensible education and use professional tools in your analysis.

Learn crypto and blockchain

How do I fund my contract trading accounts?

Phemex offers you both BTC and USD trading accounts which can be funded by either your BTC or USDT wallet. To fund either account, please perform the following steps:

BTC trading account

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the BTC trade account section, click the fund BTC trade account button.

- Enter your desired amount and click confirm.

NOTE: to withdraw, simply click the withdraw to wallet button and follow the same steps.

To initiate a withdrawal for the first time: learn how to make a withdrawal?

USD trading account

Funding with BTC

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the USD trade account section, click the fund USD trade account button.

- Select BTC wallet from the left-side drop-down menu.

- Enter your desired BTC amount and click get quotation. This will calculate and display the final USD amount to be deposited into your account.

- Click confirm.

Funding with USDT

- Log in to phemex.Com and click assets on the top right corner of the page.

- Select contract trade accounts.

- Inside the USD trade account section, click the fund USD trade account button.

- Select USDT wallet from the left-side drop-down menu.

- Enter your desired USDT amount and click get quotation. This will calculate and display the final USD amount to be deposited into your account.

- Click confirm.

NOTE: quotations will expire after 15 seconds.

NOTE: to withdraw, simply click the withdraw to wallet button and follow the same steps.

For any inquiries contact us at support@phemex.Com.

Follow our official twitter account to stay updated on the latest news.

Join our community on telegram to interact with us and other phemex traders.

Funded accounts

Trade with our capital

$50,000

Having a bigger account makes it easier to earn a living. Get funded with a 5-figure account to generate your own full time income.

80/20 SHARE

You’ll earn 80% of all the profits generated, while we absorb all of the losses. And you can withdraw your share every month.

Get started now

Minimum conditions required

Fast track to success

The complete currency trader funded account program, is a short cut to trading with enough capital to generate a full-time income. Prove you can make profit whilst safely managing risk, and we’ll fund an account with up to $50,000, and let you keep the lion’s share of the returns. Whether it’s scalping, position trading, trend following, or counter-trend trading; you have full control, and the style and frequency of your system are up to you.

MONEY

Money, makes more money, and the bigger your forex account, the easier it is to earn a living. Take advantage of our capital to become a full time professional trader.

FREEDOM

Trade any system on any time frame, from anywhere in the world, without targets or quota's. You have the freedom to choose where, when, and how you trade*.

SUCCESS

With a funded account, you have the capital behind you to finally earn a substantial living as a forex trader. Extra income; pay the bills; even quit your current day job.

96.4% rate complete currency trader as good or excellent.

WE STRIVE TO ENSURE YOU HAVE 100% SATISFACTION WITH OUR SERVICE.

*DETAILS

A minimum of 6 (most recent) months proven track record, plus 50 trades, demonstrating profitability and sound risk management is required before being accepted for a funded account. This can be achieved before or after applying for the program and can be in a demo account.

Your track record must demonstrate a positive expectancy in your system or strategy. There are no targets or minimum thresholds related to win rate or trade frequency, provided that on average, the expectancy is positive.

Your absolute returns must exceed your absolute draw-down by a factor of 1.5 to 1. If your track record shows a maximum draw-down of 10% of the account balance, your absolute gain must be 15% or more.

Your track record must demonstrate a low risk of ruin. Account safety is our paramount concern and we expect to see a degree of risk mitigation measures intended to safeguard the balance under normal conditions.

You must be a subscriber to one of our analysis tool bundles, and have completed our FREE inception and cybernetics courses. We want to know you have had a sensible education and use professional tools in your analysis.

So, let's see, what we have: guide to forex trading accounts with top list and comparison of different types. A must read if you want to open an online forex trading account. At fund trading account

Contents of the article

- My list of forex bonuses

- Forex trading accounts

- The top 5 forex trading accounts in the united...

- Which is the best forex trading account?

- Forex trading account types

- Standard trading accounts

- Funded trading accounts

- Mini and micro trading accounts

- Managed trading accounts

- Islamic trading accounts

- VIP accounts

- Demo accounts

- Geographic considerations

- How to fund your account

- Debit card

- Credit card

- HKD FPS

- Transfer to our HK based HSBC account

- Trading account

- What is a trading account?

- Basics of trading account

- FINRA margin requirements for trading accounts

- Trading mutual funds for beginners

- What are mutual funds?

- How mutual funds trade

- Mutual fund charges and fees

- Risk tolerance and investment goals

- Income or growth?

- Tax strategy

- Investment strategies

- Value investing

- Contrarian investing

- Momentum investing

- The bottom line

- How to get the best funded trading accounts?

- Fully funded trading account

- What are funded trading accounts at A proprietary...

- How to choose the best funded trading accounts?

- How to get qualified for a funded trading account

- Sign up to evaluate your trading

- After a few weeks in testing, you will be totally...

- Get paid to trade forex

- Develop your trading career from home

- Get high capital to trade

- You can trade any trading strategy

- Get your funded trading account with the5ers

- Risk-free trading

- Develop a trading career

- Zero cost from your side

- Bring your own trading strategy

- Apply the fund risk management requirements to...

- Final words about funded trading accounts

- Trading account

- Benefits of our trading account

- More opportunities

- Cut your costs

- Always in control

- Stay in the know

- Get started today for only £9.99 a month.

- Get the best investment choice and insight around

- Looking for a general investment account?

- Looking for a joint trading account?

- Funded accounts

- Trade with our capital

- *DETAILS

- Learn crypto and blockchain

- How do I fund my contract trading accounts?

- BTC trading account

- USD trading account

- Funded accounts

- Trade with our capital

- *DETAILS

Contents of the article

- My list of forex bonuses

- Forex trading accounts

- The top 5 forex trading accounts in the united...

- Which is the best forex trading account?

- Forex trading account types

- Standard trading accounts

- Funded trading accounts

- Mini and micro trading accounts

- Managed trading accounts

- Islamic trading accounts

- VIP accounts

- Demo accounts

- Geographic considerations

- How to fund your account

- Debit card

- Credit card

- HKD FPS

- Transfer to our HK based HSBC account

- Trading account

- What is a trading account?

- Basics of trading account

- FINRA margin requirements for trading accounts

- Trading mutual funds for beginners

- What are mutual funds?

- How mutual funds trade

- Mutual fund charges and fees

- Risk tolerance and investment goals

- Income or growth?

- Tax strategy

- Investment strategies

- Value investing

- Contrarian investing

- Momentum investing

- The bottom line

- How to get the best funded trading accounts?

- Fully funded trading account

- What are funded trading accounts at A proprietary...

- How to choose the best funded trading accounts?

- How to get qualified for a funded trading account

- Sign up to evaluate your trading

- After a few weeks in testing, you will be totally...

- Get paid to trade forex

- Develop your trading career from home

- Get high capital to trade

- You can trade any trading strategy

- Get your funded trading account with the5ers

- Risk-free trading

- Develop a trading career

- Zero cost from your side

- Bring your own trading strategy

- Apply the fund risk management requirements to...

- Final words about funded trading accounts

- Trading account

- Benefits of our trading account

- More opportunities

- Cut your costs

- Always in control

- Stay in the know

- Get started today for only £9.99 a month.

- Get the best investment choice and insight around

- Looking for a general investment account?

- Looking for a joint trading account?

- Funded accounts

- Trade with our capital

- *DETAILS

- Learn crypto and blockchain

- How do I fund my contract trading accounts?

- BTC trading account

- USD trading account

- Funded accounts

- Trade with our capital

- *DETAILS

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.