Real forex trading

Step by step, clear trading rules for entry, exit & position sizing. Many real trading examples with real results and live trading.

My list of forex bonuses

Advanced real forex trading

Чему вы научитесь

Требования

Описание

Advanced, hands on trading course for forex, stock indices, futures, cfds, cryptocurrencies, etc.

Step by step, clear trading rules for entry, exit & position sizing.

Methods for end of day and intra day trading.

Many real trading examples with real results and live trading.

Daily trading technical analysis routine - no trading ambiguity.

How to create and follow a solid business plan to make significant income working from home.

Challenges prohibiting trading success, how to overcome and become a professional trader.

Practical trading methodology, acquired from 30 years trading experience, anyone can use.

Basic forex knowledge required. Beginners can study some of the suggested free lessons mentioned in our course.

Trading experience not necessary. We teach step by step how to start, learn, open your account and practice until you become profitable.

Why this course is different

In all other courses I have seen, during my 30 years occupation with trading, there is first a general description of theory and technical indicators without clear, conclusive instructions on how to use those indicators to enter specific trades. Then some random, perfect looking, trading examples are presented in different markets and different timeframes from 5min to daily or weekly or even monthly. I was always totally puzzled how the instructor came up with the specific trades, out of at least 50 major markets and more than 10 available timeframes? That's a total of 500 different charts! How did he select the specific chart and trade, out of many thousands of similar setups, which most of them would be losers?

That's why I decided to write a course where I do not do that! In this course we go over specific charts, continuously over time and we identify all potential setups and trades. We present a profitable strategy including all trades, winners and losers and we give specific rules so you learn how to identify and trade all of them by yourself. We also publish all our trades on our web site.

By taking this course you will discover a clear career path for becoming a professional trader and start making money every month, working from home or from anywhere in the world! We are always available to help you on the way to your success, answer any questions you have and clarify everything you need. What's holding you back?

9 forex trading tips

The best traders hone their skills through practice and discipline. They also perform self-analysis to see what drives their trades and learn how to keep fear and greed out of the equation. These are the skills any forex trader should practice.

Key takeaways

- Trading forex can be a great way to diversify a broader portfolio or to profit from specific FX strategies.

- Beginners and experienced forex traders alike must keep in mind that practice, knowledge, and discipline are key to getting and staying ahead.

- Here we bring up 9 tips to keep in mind when thinking about trading currencies.

8 tricks of the successful forex trader

Define goals and trading style

Before you set out on any journey, it is imperative to have some idea of your destination and how you will get there. Consequently, it is imperative to have clear goals in mind, then ensure your trading method is capable of achieving these goals. Each trading style has a different risk profile, which requires a certain attitude and approach to trade successfully.

For example, if you cannot stomach going to sleep with an open position in the market, then you might consider day trading. On the other hand, if you have funds you think will benefit from the appreciation of a trade over a period of some months, you may be more of a position trader. Just be sure your personality fits the style of trading you undertake. A personality mismatch will lead to stress and certain losses.

The broker and trading platform

Choosing a reputable broker is of paramount importance and spending time researching the differences between brokers will be very helpful. You must know each broker's policies and how they go about making a market. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets.

Also, make sure your broker's trading platform is suitable for the analysis you want to do. For example, if you like to trade off of fibonacci numbers, be sure the broker's platform can draw fibonacci lines. A good broker with a poor platform, or a good platform with a poor broker, can be a problem. Make sure you get the best of both.

A consistent methodology

Before you enter any market as a trader, you need to have some idea of how you will make decisions to execute your trades. You must know what information you will need to make the appropriate decision on entering or exiting a trade. Some people choose to look at the underlying fundamentals of the economy as well as a chart to determine the best time to execute the trade. Others use only technical analysis.

Whichever methodology you choose, be consistent and be sure your methodology is adaptive. Your system should keep up with the changing dynamics of a market.

Determine entry and exit points

Many traders get confused by conflicting information that occurs when looking at charts in different timeframes. What shows up as a buying opportunity on a weekly chart could, in fact, show up as a sell signal on an intraday chart.

Therefore, if you are taking your basic trading direction from a weekly chart and using a daily chart to time entry, be sure to synchronize the two. In other words, if the weekly chart is giving you a buy signal, wait until the daily chart also confirms a buy signal. Keep your timing in sync.

Calculate your expectancy

Expectancy is the formula you use to determine how reliable your system is. You should go back in time and measure all your trades that were winners versus losers, then determine how profitable your winning trades were versus how much your losing trades lost.

Take a look at your last 10 trades. If you haven't made actual trades yet, go back on your chart to where your system would have indicated that you should enter and exit a trade. Determine if you would have made a profit or a loss. Write these results down. Total all your winning trades and divide the answer by the number of winning trades you made. Here is the formula:

Example:

If you made 10 trades, six of which were winning trades and four of which were losing trades, your percentage win ratio would be 6/10 or 60%. If your six trades made $2,400, then your average win would be $2,400/6 = $400.

If your losses were $1,200, then your average loss would be $1,200/4 = $300. Apply these results to the formula and you get E= [1+ (400/300)] x 0.6 - 1 = 0.40, or 40%. A positive 40% expectancy means your system will return you 40 cents per dollar over the long term, if you keep your risk equivalent to 1% of your account on every trade.

Focus and small losses

Once you have funded your account, the most important thing to remember is your money is at risk. Therefore, your money should not be needed for regular living expenses. Think of your trading money like vacation money. Once the vacation is over, your money is spent. Have the same attitude toward trading. This will psychologically prepare you to accept small losses, which is key to managing your risk. By focusing on your trades and accepting small losses rather than constantly counting your equity, you will be much more successful.

Positive feedback loops

A positive feedback loop is created as a result of a well-executed trade in accordance with your plan. When you plan a trade and execute it well, you form a positive feedback pattern. Success breeds success, which in turn breeds confidence, especially if the trade is profitable. Even if you take a small loss but do so in accordance with a planned trade, then you will be building a positive feedback loop.

Perform weekend analysis

On the weekend, when the markets are closed, study weekly charts to look for patterns or news that could affect your trade. Perhaps a pattern is making a double top and the pundits and the news are suggesting a market reversal. This is a kind of reflexivity where the pattern could be prompting the pundits, who then reinforce the pattern. In the cool light of objectivity, you will make your best plans. Wait for your setups and learn to be patient.

Keep a printed record

A printed record is a great learning tool. Print out a chart and list all the reasons for the trade, including the fundamentals that sway your decisions. Mark the chart with your entry and your exit points. Make any relevant comments on the chart, including emotional reasons for taking action. Did you panic? Were you too greedy? Were you full of anxiety? It is only when you can objectify your trades that you will develop the mental control and discipline to execute according to your system instead of your habits or emotions.

The bottom line

The steps above will lead you to a structured approach to trading and should help you become a more refined trader. Trading is an art, and the only way to become increasingly proficient is through consistent and disciplined practice.

Forex live trading

Live forex trading is usually short-term trading, based on real-time charts and quick execution. Forex live trading accounts make use of special trading platforms, which support this type of trading activity. Live trading webinars or forums also represent a great learning tool. Most live currency trading decisions stem from technical analysis. Read on to find out more…

Traders can use real-time charts and technical analysis to place long-term trades as well. In this case, however, tracking by-the-second changes in price offers no advantage.

We are taking a closer look at real-time forex trading and its peculiarities. We cover different aspects of the practice, such as:

- Live forex trading brokers and accounts.

- Live trading services.

- Live prices, quotes, and charts.

- Trading videos.

Live forex brokers in the united kingdom

Trading forex ‘live’

Live forex brokers are service providers that act as intermediaries between retail traders and the forex markets.

They make it possible for traders to access the markets. A live forex broker features real-time charts and extremely fast electronic execution. This way, it lets traders react to price movements in real-time.

Most forex brokers generate revenue through the bid/ask spread. They may also charge commissions. Some brokers have adopted unique, creative ways to “turn a buck” off their services.

Accounts

To access the services of a forex broker, you need to create a forex account. Brokers offer several types of trading accounts .

Of these, the demo account is the quickest and simplest to open. You may only need to provide an email address to get such an account going.

Real money accounts, on the other hand, require a lot of paperwork. Some brokers will want to know your financial situation, your revenue sources and other such sensitive bits of personal information.

You have to make sure that you open the right kind of forex trading account with the right broker.

Real-time forex trading is electronic. Given the need for real-time price information and near-instant execution, it cannot be of any other kind.

In addition to being an online operation, your real-time forex broker cannot be a market maker. Some brokerages engage in market making. There is not much point in trying to trade live with such a broker.

Live traders need real-time charts. What you need to know in this respect is that different brokers have different liquidity providers.

Depending on these liquidity providers, there may be slight differences in the real-time prices the brokers use.

Platforms

Forex trading platforms, such as metaquotes’ popular MT4, let traders place trades. Most such platforms offer live charts.

Some of these platforms even allow traders to open positions directly from the chart. In regards to the platform, you have to understand that it is a mere interface.

It does not define the offer of your broker. It does, however, define how you can interact with the markets.

What can you expect from your live forex platform?

All forex trading platforms feature charting these days. You need live charting.

Make sure your broker does indeed feature live prices. Understand that the pricing of your broker depends on its liquidity providers to some degree.

They also offer a selection of technical indicators and trading tools.

Most platforms also provide live news-streams. Through this feature, you can handle the fundamental part of your analysis.

Forex trading platforms support several order types. As a live trader, you need to understand how limit orders and stop orders work, among others.

A proper trading platform comes with a reporting function. You will need to use this for tax purposes. Some platforms report transactions erratically, while others produce high-quality reports.

Demo accounts

Demo accounts let you trade for virtual money.

Not all brokers support such accounts, but the majority of them do.

Most forex trading platforms are free to download and use. There are some exceptions in this regard.

As an online forex trader, however, you will probably only deal with free platforms.

As a live trader, you have to resort to a demo account first. You need to acquaint yourself with the ins and outs of the platform.

You should place around 50 demo trades before you move on to real money trading. Experienced traders should go through these demo paces as well.

Only skilled traders should trade in real-time. How do you know whether you possess the minimum required skills? Ask yourself these questions:

- Do you know what a limit order, a stop order and a market order are?

- Can you set a limit and a stop when you enter a trade?

- What is the typical spread of your broker?

- Is the spread on your traded asset fixed or variable?

- What lot sizes can you trade?

- If your connection goes down, can you give the dealing desk a direct call?

Live forex trading apps

Most forex trading apps running on android and ios mobile devices are “mini” versions of the full trading platforms.

As such, they offer the same degree of functionality and the same features, reformatted for smaller screens.

You can download such live forex trading apps from google play or the app store. Forex trading apps are usually free to download and use.

Make sure you understand exactly what your forex trading app offers you. Take it on a demo spin, as most mobile trading platforms support demo accounts.

Ask yourself and answer all the mentioned questions before you begin real money trading through a live forex trading app.

Forex live trading room reviews

Live forex trading rooms are chat rooms through which professional traders interact with and educate an audience. Such chat rooms run from the most sophisticated, dedicated platforms, to simple skype chat groups.

Sophisticated live trading rooms allow their professional users to monetize their seminars and trading sessions.

Educators can share charts, embed various widgets, stream live video, perform analysis and complete trades in a live setting.

Some traders have found much value in such live trading setups. It is fair to say, however, that some of these trading rooms are little more than scams or half-hearted efforts.

Before joining such a trading room, read some reviews on it. Users are usually not shy to share their experiences, whether profitable or not.

What else should you consider?

- The focus of the trading room. There are chat rooms focused on swing trading, on scalping, on forex only, on commodities, etc.

The reputation of the live trading room. As mentioned, users are generally keen to share their experiences. - The monetization model. With some trading rooms, you only have to pay for sessions that turn a profit. That sounds like an advantageous monetization model.

- The platform used for communication. Trading-dedicated communication platforms are superior to ad-hoc solutions.

Live trading services

In addition to making good use of a demo account, a beginner live trader may also find it useful to employ the services of an expert.

Inthemoneystocks

Inthemoneystocks claims to have outperformed top hedge funds since 2007. The trading room peddles the services of several professional traders. Gareth soloway and nick santiago are their headliners.

The specialties of the mentioned traders include swing trading on stocks and options trading.The website of the trading room provides education as well as verified trading alerts.

Prices start from $299.99 per month.

Investors underground

Investors underground is a trading room that offers free video lessons, as well as full, step-by-step guidance.

Nathan michaud is the founder and star day-trader of the operation. He is something of a celebrity in trading circles.

Michaud is, however, only one of some 10 trading experts who peddle their services through investors underground.

The trading room is keen on not making outlandish claims. The community feedback concerning the quality of services offered by investors underground is outstanding, however.

Monthly subscriptions start from $297.

A basic package includes access to the live trading floor, study groups and pre-market broadcasts.

Forex.Com live trading webinars

Forex.Com’s live trading webinars offer market commentary, mixed with real-time insights.

Experts also answer live questions and offer actionable live trading ideas. Forex.Com users can sign up for the webinars through a special form at the broker’s official site.

Those who register can select up to three sessions.

Live trading signals

Forex trading signals are trade triggers. They tell the recipient whether to buy or sell a certain currency pair. The signal may contain additional information about the timing, stop loss, take profit, etc.

Trading signals may originate from expert traders or various technical indicators.

Live prices

For live forex traders, access to live prices and quotes is of the essence. The current price of a currency is its most recent selling price at an exchange.

Trading videos

The benefits of using trading videos to improve your profitability are obvious. Most educators deliver their lessons through videos.

Trading rooms use videos to disseminate knowledge as well.An interesting take on using videos for trading is to record yourself.

This way, you can analyze your emotional reactions later. It is important to record the screen as well as yourself when shooting such videos.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

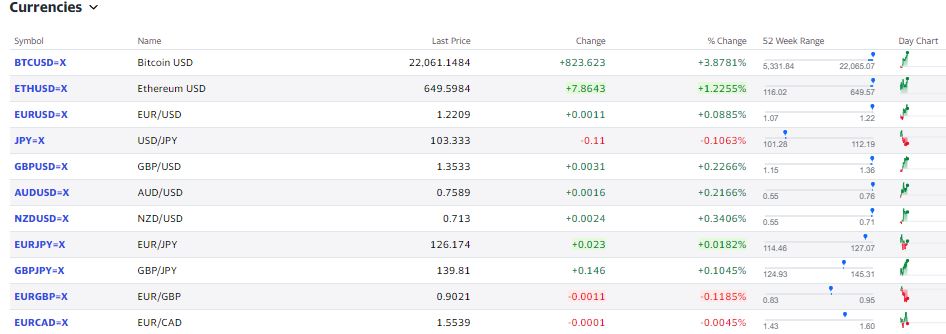

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Forex trading: A beginner's guide

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism. According to a recent triennial report from the bank for international settlements (a global bank for national central banks), the average was more than $5.1 trillion in daily forex trading volume.

Key takeaways

- The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another.

- Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

- Currencies trade against each other as exchange rate pairs. For example, EUR/USD.

- Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

What is the forex market?

The foreign exchange market is where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. And want to buy cheese from france, either you or the company that you buy the cheese from has to pay the french for the cheese in euros (EUR). This means that the U.S. Importer would have to exchange the equivalent value of U.S. Dollars (USD) into euros. The same goes for traveling. A french tourist in egypt can't pay in euros to see the pyramids because it's not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the egyptian pound, at the current exchange rate.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur via computer networks between traders around the world, rather than on one centralized exchange. The market is open 24 hours a day, five and a half days a week, and currencies are traded worldwide in the major financial centers of london, new york, tokyo, zurich, frankfurt, hong kong, singapore, paris and sydney—across almost every time zone. This means that when the trading day in the U.S. Ends, the forex market begins anew in tokyo and hong kong. As such, the forex market can be extremely active any time of the day, with price quotes changing constantly.

A brief history of forex

Unlike stock markets, which can trace their roots back centuries, the forex market as we understand it today is a truly new market. Of course, in its most basic sense—that of people converting one currency to another for financial advantage—forex has been around since nations began minting currencies. But the modern forex markets are a modern invention. After the accord at bretton woods in 1971, more major currencies were allowed to float freely against one another. The values of individual currencies vary, which has given rise to the need for foreign exchange services and trading.

Commercial and investment banks conduct most of the trading in the forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency against another for professional and individual investors.

Spot market and the forwards & futures markets

There are actually three ways that institutions, corporations and individuals trade forex: the spot market, the forwards market, and the futures market. Forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In the past, the futures market was the most popular venue for traders because it was available to individual investors for a longer period of time. However, with the advent of electronic trading and numerous forex brokers, the spot market has witnessed a huge surge in activity and now surpasses the futures market as the preferred trading market for individual investors and speculators. When people refer to the forex market, they usually are referring to the spot market. The forwards and futures markets tend to be more popular with companies that need to hedge their foreign exchange risks out to a specific date in the future.

More specifically, the spot market is where currencies are bought and sold according to the current price. That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, sentiment towards ongoing political situations (both locally and internationally), as well as the perception of the future performance of one currency against another. When a deal is finalized, this is known as a "spot deal." it is a bilateral transaction by which one party delivers an agreed-upon currency amount to the counter party and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead they deal in contracts that represent claims to a certain currency type, a specific price per unit and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the chicago mercantile exchange. In the U.S., the national futures association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiry, although contracts can also be bought and sold before they expire. The forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well.

Note that you'll often see the terms: FX, forex, foreign-exchange market, and currency market. These terms are synonymous and all refer to the forex market.

Forex for hedging

Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange markets provide a way to hedge currency risk by fixing a rate at which the transaction will be completed.

To accomplish this, a trader can buy or sell currencies in the forward or swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

The blender costs $100 to manufacture, and the U.S. Firm plans to sell it for €150—which is competitive with other blenders that were made in europe. If this plan is successful, the company will make $50 in profit because the EUR/USD exchange rate is even. Unfortunately, the USD begins to rise in value versus the euro until the EUR/USD exchange rate is 0.80, which means it now costs $0.80 to buy €1.00.

The problem the company faces is that while it still costs $100 to make the blender, the company can only sell the product at the competitive price of €150, which when translated back into dollars is only $120 (€150 X 0.80 = $120). A stronger dollar resulted in a much smaller profit than expected.

The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. That way, if the dollar rose in value, the profits from the trade would offset the reduced profit from the sale of blenders. If the USD fell in value, the more favorable exchange rate will increase the profit from the sale of blenders, which offsets the losses in the trade.

Hedging of this kind can be done in the currency futures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forward markets, which are decentralized and exist within the interbank system throughout the world.

Forex for speculation

Factors like interest rates, trade flows, tourism, economic strength, and geopolitical risk affect supply and demand for currencies, which creates daily volatility in the forex markets. An opportunity exists to profit from changes that may increase or reduce one currency's value compared to another. A forecast that one currency will weaken is essentially the same as assuming that the other currency in the pair will strengthen because currencies are traded as pairs.

Imagine a trader who expects interest rates to rise in the U.S. Compared to australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. Will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. This means that it requires $0.50 USD to buy $1.00 AUD. If the investor had shorted the AUD and went long the USD, he or she would have profited from the change in value.

Currency as an asset class

There are two distinct features to currencies as an asset class:

- You can earn the interest rate differential between two currencies.

- You can profit from changes in the exchange rate.

An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. Prior to the 2008 financial crisis, it was very common to short the japanese yen (JPY) and buy british pounds (GBP) because the interest rate differential was very large. This strategy is sometimes referred to as a "carry trade."

Why we can trade currencies

Currency trading was very difficult for individual investors prior to the internet. Most currency traders were large multinational corporations, hedge funds or high-net-worth individuals because forex trading required a lot of capital. With help from the internet, a retail market aimed at individual traders has emerged, providing easy access to the foreign exchange markets, either through the banks themselves or brokers making a secondary market. Most online brokers or dealers offer very high leverage to individual traders who can control a large trade with a small account balance.

Forex trading: A beginner’s guide

Forex trading risks

Trading currencies can be risky and complex. The interbank market has varying degrees of regulation, and forex instruments are not standardized. In some parts of the world, forex trading is almost completely unregulated.

The interbank market is made up of banks trading with each other around the world. The banks themselves have to determine and accept sovereign risk and credit risk, and they have established internal processes to keep themselves as safe as possible. Regulations like this are industry-imposed for the protection of each participating bank.

Since the market is made by each of the participating banks providing offers and bids for a particular currency, the market pricing mechanism is based on supply and demand. Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing.

Most small retail traders trade with relatively small and semi-unregulated forex brokers/dealers, which can (and sometimes do) re-quote prices and even trade against their own customers. Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe.

Most retail investors should spend time investigating a forex dealer to find out whether it is regulated in the U.S. Or the U.K. (dealers in the U.S. And U.K. Have more oversight) or in a country with lax rules and oversight. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent.

Pros and challenges of trading forex

Pro: the forex markets are the largest in terms of daily trading volume in the world and therefore offer the most liquidity. this makes it easy to enter and exit a position in any of the major currencies within a fraction of a second for a small spread in most market conditions.

Challenge: banks, brokers, and dealers in the forex markets allow a high amount of leverage, which means that traders can control large positions with relatively little money of their own. Leverage in the range of 100:1 is a high ratio but not uncommon in forex. A trader must understand the use of leverage and the risks that leverage introduces in an account. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly.

Pro: the forex market is traded 24 hours a day, five days a week—starting each day in australia and ending in new york. The major centers are sydney, hong kong, singapore, tokyo, frankfurt, paris, london, and new york.

Challenge: trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their inter-connectedness to grasp the fundamentals that drive currency values.

The bottom line

For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than other markets. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals driving currency values and experience with technical analysis may help new forex traders to become more profitable.

Trade major US tech stocks this earnings season

Why are traders choosing FOREX.Com?

Global market leader

Connecting traders to the currency markets since 2001

Professional accounts

Discover the FOREX.Com

pro service

Innovative & award-winning

Our new mobile app offers one-swipe trading and lightning fast execution

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex trading platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader trading platforms" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Top stories

Watch for news over the weekend as to if the.

Central banks may not have as much patience as stock.

Find out the definition of a short squeeze, and how.

Ready to learn about forex?

/media/forex/images/global/homepage/newtrader.Svg" alt="new trader" />

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

/media/forex/images/global/homepage/createplan-latest.Svg" alt="new trader" />

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

/media/forex/images/global/homepage/strategies-latest.Svg" alt="have some experience" />

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

*based on active metatrader servers per broker, apr 2019. **based on CFD spreads and financing competitor comparison on 28/08/19.

Try a demo account

Your form is being processed.

By opening this demo account you confirm your acceptance of our demo account terms and conditions, privacy policy and disclosures.

I would like to learn about

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

CFD and forex trading are leveraged products and your capital is at risk. They may not be suitable for everyone. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.Com is a trading name of GAIN capital UK limited. GAIN capital UK ltd is a company incorporated in england and wales with UK companies house number 1761813 and with its registered office at devon house, 58 st katharine’s way, london, E1W 1JP. GAIN capital UK ltd is authorised and regulated by the financial conduct authority in the UK, with FCA register number 113942. GAIN capital UK ltd is a wholly-owned subsidiary of stonex group inc.

FOREX.Com is a trademark of GAIN capital UK ltd.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our privacy policy.

FOREX.Com products and services are not intended for belgium residents.

We use cookies, and by continuing to use this site or clicking "agree" you agree to their use. Full details are in our cookie policy.

9 forex trading tips

The best traders hone their skills through practice and discipline. They also perform self-analysis to see what drives their trades and learn how to keep fear and greed out of the equation. These are the skills any forex trader should practice.

Key takeaways

- Trading forex can be a great way to diversify a broader portfolio or to profit from specific FX strategies.

- Beginners and experienced forex traders alike must keep in mind that practice, knowledge, and discipline are key to getting and staying ahead.

- Here we bring up 9 tips to keep in mind when thinking about trading currencies.

8 tricks of the successful forex trader

Define goals and trading style

Before you set out on any journey, it is imperative to have some idea of your destination and how you will get there. Consequently, it is imperative to have clear goals in mind, then ensure your trading method is capable of achieving these goals. Each trading style has a different risk profile, which requires a certain attitude and approach to trade successfully.

For example, if you cannot stomach going to sleep with an open position in the market, then you might consider day trading. On the other hand, if you have funds you think will benefit from the appreciation of a trade over a period of some months, you may be more of a position trader. Just be sure your personality fits the style of trading you undertake. A personality mismatch will lead to stress and certain losses.

The broker and trading platform

Choosing a reputable broker is of paramount importance and spending time researching the differences between brokers will be very helpful. You must know each broker's policies and how they go about making a market. For example, trading in the over-the-counter market or spot market is different from trading the exchange-driven markets.

Also, make sure your broker's trading platform is suitable for the analysis you want to do. For example, if you like to trade off of fibonacci numbers, be sure the broker's platform can draw fibonacci lines. A good broker with a poor platform, or a good platform with a poor broker, can be a problem. Make sure you get the best of both.

A consistent methodology

Before you enter any market as a trader, you need to have some idea of how you will make decisions to execute your trades. You must know what information you will need to make the appropriate decision on entering or exiting a trade. Some people choose to look at the underlying fundamentals of the economy as well as a chart to determine the best time to execute the trade. Others use only technical analysis.

Whichever methodology you choose, be consistent and be sure your methodology is adaptive. Your system should keep up with the changing dynamics of a market.

Determine entry and exit points

Many traders get confused by conflicting information that occurs when looking at charts in different timeframes. What shows up as a buying opportunity on a weekly chart could, in fact, show up as a sell signal on an intraday chart.

Therefore, if you are taking your basic trading direction from a weekly chart and using a daily chart to time entry, be sure to synchronize the two. In other words, if the weekly chart is giving you a buy signal, wait until the daily chart also confirms a buy signal. Keep your timing in sync.

Calculate your expectancy

Expectancy is the formula you use to determine how reliable your system is. You should go back in time and measure all your trades that were winners versus losers, then determine how profitable your winning trades were versus how much your losing trades lost.

Take a look at your last 10 trades. If you haven't made actual trades yet, go back on your chart to where your system would have indicated that you should enter and exit a trade. Determine if you would have made a profit or a loss. Write these results down. Total all your winning trades and divide the answer by the number of winning trades you made. Here is the formula:

Example:

If you made 10 trades, six of which were winning trades and four of which were losing trades, your percentage win ratio would be 6/10 or 60%. If your six trades made $2,400, then your average win would be $2,400/6 = $400.

If your losses were $1,200, then your average loss would be $1,200/4 = $300. Apply these results to the formula and you get E= [1+ (400/300)] x 0.6 - 1 = 0.40, or 40%. A positive 40% expectancy means your system will return you 40 cents per dollar over the long term, if you keep your risk equivalent to 1% of your account on every trade.

Focus and small losses

Once you have funded your account, the most important thing to remember is your money is at risk. Therefore, your money should not be needed for regular living expenses. Think of your trading money like vacation money. Once the vacation is over, your money is spent. Have the same attitude toward trading. This will psychologically prepare you to accept small losses, which is key to managing your risk. By focusing on your trades and accepting small losses rather than constantly counting your equity, you will be much more successful.

Positive feedback loops

A positive feedback loop is created as a result of a well-executed trade in accordance with your plan. When you plan a trade and execute it well, you form a positive feedback pattern. Success breeds success, which in turn breeds confidence, especially if the trade is profitable. Even if you take a small loss but do so in accordance with a planned trade, then you will be building a positive feedback loop.

Perform weekend analysis

On the weekend, when the markets are closed, study weekly charts to look for patterns or news that could affect your trade. Perhaps a pattern is making a double top and the pundits and the news are suggesting a market reversal. This is a kind of reflexivity where the pattern could be prompting the pundits, who then reinforce the pattern. In the cool light of objectivity, you will make your best plans. Wait for your setups and learn to be patient.

Keep a printed record

A printed record is a great learning tool. Print out a chart and list all the reasons for the trade, including the fundamentals that sway your decisions. Mark the chart with your entry and your exit points. Make any relevant comments on the chart, including emotional reasons for taking action. Did you panic? Were you too greedy? Were you full of anxiety? It is only when you can objectify your trades that you will develop the mental control and discipline to execute according to your system instead of your habits or emotions.

The bottom line

The steps above will lead you to a structured approach to trading and should help you become a more refined trader. Trading is an art, and the only way to become increasingly proficient is through consistent and disciplined practice.

Exploring scams involved with forex trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/stock-market-convict-184977844-59d6c68d22fa3a0010adb629.jpg)

While foreign exchange (forex) investing is a legitimate endeavor and not a scam, plenty of scams have been associated with trading forex. As with many industries, plenty of predators exist out there, looking to take advantage of newcomers. Regulators have put protections in place over the years and the market has improved significantly, making such scams increasingly rare.

Foreign exchange trading involves the trading of pairs of currencies. for example, someone might exchange euros for U.S. Dollars. In september of 2019, 1 euro ranged in value from about $1.09 to about $1.12. So, a trader who exchanged 100 euros for $112 when the value of the dollar is high could profit by exchanging those $112 for euros when the value of the dollar drops back to $1.09 per euro. Such a transaction would result in a net profit of less than 3%, which likely would be wiped out by the broker's commission.

Forex is a legitimate endeavor. You can engage in forex trading as a real business and make real profits, but you must treat it as such. Don't look at forex trading as a get-rich-overnight business, no matter what you may read in hyped-up forex trading guides.

Exchange rates are volatile and can go up or down unpredictably. When accounting for commissions brokers take from transactions, making money requires significant changes in exchange rates in favor of the trader. High profits are possible, but it's not a market where anyone should expect quick and easy cash.

What makes a scam?

Forex trading first became available to retail traders in the late 1990s. the first handful of years was wrought with overnight brokers that seemed to pop up and then close down shop without notice.

The common denominator was that these brokers were based in nonregulated countries. While some did take place in the united states, the majority seemed to originate overseas where the only requirement to set up a brokerage was a few thousand dollars in fees.

A distinct difference exists between a poorly-run brokerage, which isn't necessarily a scam, and a fraudulent one. Even a poorly run brokerage can run for a long time before something takes it out of the game.

Some common examples of scams investors should look for include churning and brokers who simply underestimate risk. Churning involves brokers who execute unnecessary trades for the sole purpose of generating commissions.

Additionally, some brokers often overestimate the ability of investors to make a lot of money quickly and easily through the forex market. They typically prey on new investors who don't understand that forex trading is what is known as a zero-sum game. When a currency's value against another currency gets stronger, the other currency must get proportionally weaker.

How to avoid being scammed

The first step to take is to check the location of the brokerage's headquarters and research how long it has been in business and where they are regulated. The more the better.

If you feel you are being scammed, contact the U.S. Commodity futures trading commission.

The simple act of finding out who you should call if you feel that you've been scammed, before investing with a brokerage, can save you a lot of potential heartache down the road. If you can't find someone to call because the brokerage is located in a non-regulated jurisdiction, this is usually a red flag and a sign that it's best to find more regulated alternatives.

Trade with confidence on the world's leading social trading platform

Join millions who've already discovered smarter investing in multiple types of assets. Choose an investment product to start with.

Choose an investment product to get started and discover why over 10 million users trust etoro

Stocks & etfs

0% commission means thereвђ™s no markup on stocks & etfs вђ“ no matter how much you invest

Cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

CFD trading

Go long or short on FX from just 1 pip. Trade commodities and indices with flexible leverage.

Invest commission free

No markup on stocks & etfs from leading exchanges вђ“ no matter how much you invest

Buy & sell cryptocurrencies

Buy, sell and store bitcoin and other leading cryptos with ease

Advanced trading, more opportunities

Go long or short on FX, commodities and indices with flexible leverage

New to trading?

Discover copytrader™: replicate the trading strategies of top-performing traders

100% stocks, 0% commission

Join the social trading revolution. Connect with other traders, discuss trading strategies, and use our patented copytraderв„ў technology to automatically copy their trading portfolio performance.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Meet our popular investors

Etoroвђ™s popular investor program recognises talented, savvy, responsible traders who share their knowledge. Our top-tier popular investors earn up to 2% annually on their assets under management.

Etoro is a fantastic trading platform, both from an ease of use and technical perspective.

It provides a huge variety of investments and a great community of traders.

Great platform for starting traders. Great selection and transparent fee system! .

Etoro has been making my trading experience enjoyable and secure.

Great service. Fast feedback. Social forum give a lot of info.

I am very satisfied with the services etoro platform provides.

The global leader of social trading

Discover why millions of users from over 140 countries choose to trade with etoro

Regulated

Our company is regulated by the FCA and cysec

Security

Your funds are protected by industry-leading security protocols

Privacy

We will never share your private data without your permission

In the press

See what the media has to say about etoroвђ™s trading and investing platform

Those with less expertise might like to try a platform called etoro, which allows customers to copy вђњstar tradersвђќ directly, and can make traders of even the least informed of punters.

The best returns occur when investors are plugged into diverse social groups that enable them to collide with information from multiple networks. In the social media world, as in real life, it pays to hover on the edge of cliques вђ“ but not get slavishly sucked into just one.

Internet social networks that let users follow investments the way they track status updates on facebook are attracting record interest, turning top performers into market stars for individual investors.

A recent research we carried out with the massachusetts institute of technology has shown that copy trading, where traders watch the trading activity of other people and make their decisions accordingly, performs significantly better than manual trading.

Etoro is the worldвђ™s leading social trading platform, which offers both investing in stocks and cryptocurrencies, as well as trading CFD with different underlying assets.

Top instruments

Support

Learn more

Find us on

About us

Privacy and regulation

Partners and promotions

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money.

Etoro (europe) ltd., a financial services company authorised and regulated by the cyprus securities exchange commission (cysec) under the license # 109/10.

Etoro (UK) ltd, a financial services company authorised and regulated by the financial conduct authority (FCA) under the license FRN 583263.

Etoro AUS capital pty ltd. Is authorised by the australian securities and investments commission (ASIC) to provide financial services under australian financial services licensce 491139

Past performance is not an indication of future results

general risk disclosure | terms & conditions

You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Under no circumstances shall etoro have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to cfds or (b) any direct, indirect, special, consequential or incidental damages whatsoever. Cryptocurrencies markets are unregulated services which are not governed by any specific european regulatory framework (including mifid). Therefore when using our cryptocurrencies trading service you will not benefit from the protections available to clients receiving mifid regulated investment services, such as access to the cyprus investor compensation fund (ICF)/the financial services compensation scheme (FSCS) and the financial ombudsman service for dispute resolution. Trading with etoro by following and/or copying or replicating the trades of other traders involves a high level of risks, even when following and/or copying or replicating the top-performing traders. Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an etoro community member is not a reliable indicator of his future performance. Content on etoro's social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of etoro - your social investment network.

Copyright В© 2006-2021 etoro - your social investment network, all rights reserved.

So, let's see, what we have: learn from a professional forex trader with 30 years experience at real forex trading

Contents of the article

- My list of forex bonuses

- Advanced real forex trading

- Чему вы научитесь

- Требования

- Описание

- 9 forex trading tips

- Define goals and trading style

- The broker and trading platform

- A consistent methodology

- Determine entry and exit points

- Calculate your expectancy

- Focus and small losses

- Positive feedback loops

- Perform weekend analysis

- Keep a printed record

- The bottom line

- Forex live trading

- Live forex brokers in the united kingdom

- Trading forex ‘live’

- Live forex trading apps

- Forex live trading room reviews

- Live trading services

- Live trading signals

- Live prices

- Trading videos

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

- 9 forex trading tips

- Define goals and trading style

- The broker and trading platform

- A consistent methodology

- Determine entry and exit points

- Calculate your expectancy

- Focus and small losses

- Positive feedback loops

- Perform weekend analysis

- Keep a printed record

- The bottom line

- Exploring scams involved with forex trading

- What makes a scam?

- How to avoid being scammed

- Trade with confidence on the world's leading...

- Choose an investment product to get...

- Stocks & etfs

- Cryptocurrencies

- CFD trading

- New to trading?

- 100% stocks, 0% commission

- Join the social trading revolution. Connect with...

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- The global leader of social trading

- In the press

- Top instruments

- Support

- Learn more

- Find us on

- About us

- Privacy and regulation

- Partners and promotions

Contents of the article

- My list of forex bonuses

- Advanced real forex trading

- Чему вы научитесь

- Требования

- Описание

- 9 forex trading tips

- Define goals and trading style

- The broker and trading platform

- A consistent methodology

- Determine entry and exit points

- Calculate your expectancy

- Focus and small losses

- Positive feedback loops

- Perform weekend analysis

- Keep a printed record

- The bottom line

- Forex live trading

- Live forex brokers in the united kingdom

- Trading forex ‘live’

- Live forex trading apps

- Forex live trading room reviews

- Live trading services

- Live trading signals

- Live prices

- Trading videos

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Forex trading: A beginner's guide

- What is the forex market?

- A brief history of forex

- Spot market and the forwards & futures markets

- Forex for hedging

- Forex for speculation

- Currency as an asset class

- Why we can trade currencies

- Forex trading risks

- Pros and challenges of trading forex

- The bottom line

- Trade major US tech stocks this earnings season

- Why are traders choosing FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Open an account in as little as 5 minutes

- Try a demo account

- 9 forex trading tips

- Define goals and trading style

- The broker and trading platform

- A consistent methodology

- Determine entry and exit points

- Calculate your expectancy

- Focus and small losses

- Positive feedback loops

- Perform weekend analysis

- Keep a printed record

- The bottom line

- Exploring scams involved with forex trading

- What makes a scam?

- How to avoid being scammed

- Trade with confidence on the world's leading...

- Choose an investment product to get...

- Stocks & etfs

- Cryptocurrencies

- CFD trading

- New to trading?

- 100% stocks, 0% commission

- Join the social trading revolution. Connect with...

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- Meet our popular investors

- The global leader of social trading

- In the press

- Top instruments

- Support

- Learn more

- Find us on

- About us

- Privacy and regulation

- Partners and promotions

- Contents of the article

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.