Stock trading with 100 dollars

However much money you have to invest, shop around for a fund with a share price in your price range that invests in something that you think has the potential to do well.

My list of forex bonuses

Make sure you understand the fee structure and how it compares to other investments. Many penny stocks are what are called over-the-counter stocks, meaning they're not listed on the major stock exchanges like the new york stock exchange or nasdaq exchange. You can still usually buy and sell them through brokerages and get recent stock quotations, but it can take longer to find a buyer or seller, meaning prices may fluctuate when you go to buy or sell shares in these companies. There's sometimes less information available about OTC stocks than those listed on the major exchanges, but you should still use whatever data you can find to research any potential investments.

Can I invest 100 dollars in the stock market?

It is easy to invest $100 in the stock market.

More articles

You can easily invest $100 in the stock market through a brokerage of your choice. You can look for stocks for 100 dollars or less, of which there are many available, or you can invest in a fund that will invest your $100 in stocks. Make sure you understand any commissions and fees involved in buying and selling stocks, since these can take a big bite out of smaller investments. Watch for scams that are sometimes associated with low-priced stocks.

How the stock market works

The stock market allows you to buy and sell shares of companies that you wish to invest in. Each share represents a partial ownership stake in the company. It often enables you as a shareholder to vote on certain corporate decisions and to attend and ask questions at shareholder meetings. It also enables you to receive dividends, which are payments from the company to the shareholder made proportional to how many shares they own.

Typically, investors buy stocks in companies they expect will rise in value over time. Then, at a later point, they can sell the shares to reap a profit. Naturally, essentially no investor will always predict the market correctly, and there is always a chance you will lose some or all of your investment if the stock price drops or even dwindles away to zero if the company you invested in goes bankrupt.

Brokerages and commissions

You generally buy stock in a company through a stock brokerage. The brokerage will manage your holdings in stocks, distribute dividends to you, potentially pass on notices from the companies in which you've invested and enable you to buy and sell shares as you see fit. Many brokerages can also help you with other investments, including bonds, mutual and index funds and certain bank products like certificates of deposit.

Many, but not all, brokerages charge a fee called a commission when you buy and sell shares. Typically you will be charged the same commission no matter how many shares of a company you buy or sell in one transaction. Some brokerages may charge other fees for particular services, like access to investment advisors or analyst reports. Some offer all trades free from commission, while others may offer free trades under certain circumstances.

Different brokerages have different levels of commissions and other fees. If you're only investing a relatively small amount of money in the market, it's particularly important to understand these fees and shop around for a good commission structure for your needs, because commissions can heavily eat into your profits on small trades.

If you find yourself dissatisfied with the fee structure or the services at your brokerage, you can consider opening an account at another brokerage and either using it for new stock purchases or transferring your assets from your old account. Generally, you can work with the brokerage where you wish to move your account to transfer assets from the old account without having to sell stocks and buy them anew, which can incur fees and tax liabilities.

Stocks for 100 dollars?

Plenty of stocks are available for $100 or less across all different sectors of the economy. Many investors will be able to find a stock in that price range that they imagine will do well, which makes investing $100 in stocks an easy feat. Of course, if you do end up with your heart set on a stock that sells for more than $100, you can always keep the money in the bank until you have enough to buy the share that you want.

Look through stock price listings at a brokerage website or on a financial website or publication to find stocks that meet your particular price criteria. Keep in mind, though, that many companies that are doing well and seeing stock prices rise will use a stock split, where each share is replaced with a larger number of new shares at a lower price, in order to keep their shares affordable for everyday investors.

You'll typically want to look at factors about the stock beyond its share price. Look at the annual and quarterly reports the company has filed with the securities and exchange commission and take a look at what analysts and financial writers have been saying about the stock. Check news reports about the company for any controversies or issues that might be a sign of trouble to come and see how the company is doing compared to peers in its industry.

Penny stocks and OTC stocks

Stocks with low share prices are sometimes referred to as penny stocks. The term nowadays typically refers to stocks whose shares trade for $5 or less.

Penny stocks can be an attractive option for investors with only a bit of money to put into the market thanks to their low prices. They can also turn out to be quite lucrative if a company turns out to do well and its share price rises dramatically. But they can also be risky investments, since many companies with low share prices are either struggling businesses that have fallen on hard times or fledgling startups that may fail to get traction.

Many penny stocks are what are called over-the-counter stocks, meaning they're not listed on the major stock exchanges like the new york stock exchange or nasdaq exchange. You can still usually buy and sell them through brokerages and get recent stock quotations, but it can take longer to find a buyer or seller, meaning prices may fluctuate when you go to buy or sell shares in these companies. There's sometimes less information available about OTC stocks than those listed on the major exchanges, but you should still use whatever data you can find to research any potential investments.

Watching out for scams

Penny stocks are often used in investment scams known as "pump-and-dump" scams. In these scams, a fraudster will purchase shares in a low-priced stock and then tout it to investors without disclosing that he owns the stock. Often this will be done through financial websites or email newsletters with listings such as "top 10 penny stocks" or "stocks to look out for."

When new investors buy into the stock, the price will rise, allowing the fraudulent investor to sell his holdings. Since there was no actual basis for the price to rise beyond the fraud, the price will typically then drop, causing the new investors to lose money. Fraudsters don't necessarily have to have connections to the company to benefit from a pump-and-dump scam.

To avoid falling for these types of scams, only take investment advice from trusted sources. Try to avoid relying on information from anonymous newsletters, online forums and similar sources and stay with advice from trusted analysts and what you can glean yourself from a company's own reports.

Pump-and-dump scams aren't limited to stocks and have also popped up in cryptocurrency markets in recent years as those investments have gotten more valuable.

Mutual funds and index funds

Whether you have a little money or a lot of money, you can also invest in the stock market indirectly through mutual funds and index funds. Traditional mutual funds rely on human investment experts to pick stocks and other investments that they make using the money of people who have contributed to the funds. Some fund managers earn good reputations for their successful stock picking and they can then command higher fees from investors.

Index funds, on the other hand, invest in stocks based on some sort of formula. Many invest in all the stocks on a common financial index, like the S&P 500, the dow jones industrial average or the nasdaq index. Some follow indexes geared toward particular sectors of the economy, such as energy, retail or real estate. They charge lower fees than traditional mutual funds, since they don't need as much human intervention.

You can invest in mutual funds through the companies that operate them. Many index funds are exchange-traded funds, meaning that they carry ticker symbols similar to individual stocks and can be purchased by using that symbol with any broker. Some brokerages may also offer their own index funds.

However much money you have to invest, shop around for a fund with a share price in your price range that invests in something that you think has the potential to do well. Make sure you understand the fee structure and how it compares to other investments.

Stocks and your taxes

When you sell a stock at a profit, you generally must pay tax on the amount the price went up. If you held on to the stock for a year or longer, you can pay tax at the federal long-term capital gains rate for your tax bracket. For most taxpayers, this is 15 percent, although some will pay 0 percent and some will pay 20 percent. If you hold on to the stock for less than a year before selling it, you must pay tax on any profit at your ordinary income rate, which is the same rate you pay on income from work and bank interest.

The long-term capital gains rate is typically lower than the ordinary income rate, so if you're planning on selling stock before a year is up, it's worth considering whether to hold on to it for a few more months, especially on a small investment where the taxes might make a big difference to your dollar gain.

If you sell stocks at a loss, you can claim a capital loss on your taxes. Capital losses can offset capital gains and a limited amount of ordinary income. They can be rolled into future tax years but not previous tax years. Depending on your stock holdings, you may want to time sales at a loss and sales at a gain to minimize your tax burden. Consider consulting with an accountant or tax expert for guidance.

Retirement plans and stocks

In some cases, you may want to buy stocks or put money into stock funds through a retirement plan offered by your employer such as a 401(k) or 403(b) or through a retirement plan you open for yourself, such as an individual retirement arrangement, or IRA.

The mechanics of buying stock or investing in a stock fund through such a plan isn't too different from investing from a normal brokerage account. The difference lies in how the money you put into the account is taxed. Typically, you can put money into employer-sponsored accounts directly from your paycheck without having to pay tax on it until you withdraw it from the account, and you can claim a deduction on your taxes for money that you put into an IRA.

If you only have less than $100 to put into a retirement account, make sure that the account does not charge any kind of fee for having a low balance.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

Can I invest 100 dollars in the stock market?

It is easy to invest $100 in the stock market.

More articles

You can easily invest $100 in the stock market through a brokerage of your choice. You can look for stocks for 100 dollars or less, of which there are many available, or you can invest in a fund that will invest your $100 in stocks. Make sure you understand any commissions and fees involved in buying and selling stocks, since these can take a big bite out of smaller investments. Watch for scams that are sometimes associated with low-priced stocks.

How the stock market works

The stock market allows you to buy and sell shares of companies that you wish to invest in. Each share represents a partial ownership stake in the company. It often enables you as a shareholder to vote on certain corporate decisions and to attend and ask questions at shareholder meetings. It also enables you to receive dividends, which are payments from the company to the shareholder made proportional to how many shares they own.

Typically, investors buy stocks in companies they expect will rise in value over time. Then, at a later point, they can sell the shares to reap a profit. Naturally, essentially no investor will always predict the market correctly, and there is always a chance you will lose some or all of your investment if the stock price drops or even dwindles away to zero if the company you invested in goes bankrupt.

Brokerages and commissions

You generally buy stock in a company through a stock brokerage. The brokerage will manage your holdings in stocks, distribute dividends to you, potentially pass on notices from the companies in which you've invested and enable you to buy and sell shares as you see fit. Many brokerages can also help you with other investments, including bonds, mutual and index funds and certain bank products like certificates of deposit.

Many, but not all, brokerages charge a fee called a commission when you buy and sell shares. Typically you will be charged the same commission no matter how many shares of a company you buy or sell in one transaction. Some brokerages may charge other fees for particular services, like access to investment advisors or analyst reports. Some offer all trades free from commission, while others may offer free trades under certain circumstances.

Different brokerages have different levels of commissions and other fees. If you're only investing a relatively small amount of money in the market, it's particularly important to understand these fees and shop around for a good commission structure for your needs, because commissions can heavily eat into your profits on small trades.

If you find yourself dissatisfied with the fee structure or the services at your brokerage, you can consider opening an account at another brokerage and either using it for new stock purchases or transferring your assets from your old account. Generally, you can work with the brokerage where you wish to move your account to transfer assets from the old account without having to sell stocks and buy them anew, which can incur fees and tax liabilities.

Stocks for 100 dollars?

Plenty of stocks are available for $100 or less across all different sectors of the economy. Many investors will be able to find a stock in that price range that they imagine will do well, which makes investing $100 in stocks an easy feat. Of course, if you do end up with your heart set on a stock that sells for more than $100, you can always keep the money in the bank until you have enough to buy the share that you want.

Look through stock price listings at a brokerage website or on a financial website or publication to find stocks that meet your particular price criteria. Keep in mind, though, that many companies that are doing well and seeing stock prices rise will use a stock split, where each share is replaced with a larger number of new shares at a lower price, in order to keep their shares affordable for everyday investors.

You'll typically want to look at factors about the stock beyond its share price. Look at the annual and quarterly reports the company has filed with the securities and exchange commission and take a look at what analysts and financial writers have been saying about the stock. Check news reports about the company for any controversies or issues that might be a sign of trouble to come and see how the company is doing compared to peers in its industry.

Penny stocks and OTC stocks

Stocks with low share prices are sometimes referred to as penny stocks. The term nowadays typically refers to stocks whose shares trade for $5 or less.

Penny stocks can be an attractive option for investors with only a bit of money to put into the market thanks to their low prices. They can also turn out to be quite lucrative if a company turns out to do well and its share price rises dramatically. But they can also be risky investments, since many companies with low share prices are either struggling businesses that have fallen on hard times or fledgling startups that may fail to get traction.

Many penny stocks are what are called over-the-counter stocks, meaning they're not listed on the major stock exchanges like the new york stock exchange or nasdaq exchange. You can still usually buy and sell them through brokerages and get recent stock quotations, but it can take longer to find a buyer or seller, meaning prices may fluctuate when you go to buy or sell shares in these companies. There's sometimes less information available about OTC stocks than those listed on the major exchanges, but you should still use whatever data you can find to research any potential investments.

Watching out for scams

Penny stocks are often used in investment scams known as "pump-and-dump" scams. In these scams, a fraudster will purchase shares in a low-priced stock and then tout it to investors without disclosing that he owns the stock. Often this will be done through financial websites or email newsletters with listings such as "top 10 penny stocks" or "stocks to look out for."

When new investors buy into the stock, the price will rise, allowing the fraudulent investor to sell his holdings. Since there was no actual basis for the price to rise beyond the fraud, the price will typically then drop, causing the new investors to lose money. Fraudsters don't necessarily have to have connections to the company to benefit from a pump-and-dump scam.

To avoid falling for these types of scams, only take investment advice from trusted sources. Try to avoid relying on information from anonymous newsletters, online forums and similar sources and stay with advice from trusted analysts and what you can glean yourself from a company's own reports.

Pump-and-dump scams aren't limited to stocks and have also popped up in cryptocurrency markets in recent years as those investments have gotten more valuable.

Mutual funds and index funds

Whether you have a little money or a lot of money, you can also invest in the stock market indirectly through mutual funds and index funds. Traditional mutual funds rely on human investment experts to pick stocks and other investments that they make using the money of people who have contributed to the funds. Some fund managers earn good reputations for their successful stock picking and they can then command higher fees from investors.

Index funds, on the other hand, invest in stocks based on some sort of formula. Many invest in all the stocks on a common financial index, like the S&P 500, the dow jones industrial average or the nasdaq index. Some follow indexes geared toward particular sectors of the economy, such as energy, retail or real estate. They charge lower fees than traditional mutual funds, since they don't need as much human intervention.

You can invest in mutual funds through the companies that operate them. Many index funds are exchange-traded funds, meaning that they carry ticker symbols similar to individual stocks and can be purchased by using that symbol with any broker. Some brokerages may also offer their own index funds.

However much money you have to invest, shop around for a fund with a share price in your price range that invests in something that you think has the potential to do well. Make sure you understand the fee structure and how it compares to other investments.

Stocks and your taxes

When you sell a stock at a profit, you generally must pay tax on the amount the price went up. If you held on to the stock for a year or longer, you can pay tax at the federal long-term capital gains rate for your tax bracket. For most taxpayers, this is 15 percent, although some will pay 0 percent and some will pay 20 percent. If you hold on to the stock for less than a year before selling it, you must pay tax on any profit at your ordinary income rate, which is the same rate you pay on income from work and bank interest.

The long-term capital gains rate is typically lower than the ordinary income rate, so if you're planning on selling stock before a year is up, it's worth considering whether to hold on to it for a few more months, especially on a small investment where the taxes might make a big difference to your dollar gain.

If you sell stocks at a loss, you can claim a capital loss on your taxes. Capital losses can offset capital gains and a limited amount of ordinary income. They can be rolled into future tax years but not previous tax years. Depending on your stock holdings, you may want to time sales at a loss and sales at a gain to minimize your tax burden. Consider consulting with an accountant or tax expert for guidance.

Retirement plans and stocks

In some cases, you may want to buy stocks or put money into stock funds through a retirement plan offered by your employer such as a 401(k) or 403(b) or through a retirement plan you open for yourself, such as an individual retirement arrangement, or IRA.

The mechanics of buying stock or investing in a stock fund through such a plan isn't too different from investing from a normal brokerage account. The difference lies in how the money you put into the account is taxed. Typically, you can put money into employer-sponsored accounts directly from your paycheck without having to pay tax on it until you withdraw it from the account, and you can claim a deduction on your taxes for money that you put into an IRA.

If you only have less than $100 to put into a retirement account, make sure that the account does not charge any kind of fee for having a low balance.

Can I invest 100 dollars in penny stocks?

The difference between a micro cap, small cap and penny stock

Penny stocks refers to stocks trading at low prices, generally either below $5 per share or below $1. Stock purchases carry varying degrees of risk and penny stocks are some of the riskiest. Most penny stocks may not endure the regulatory scrutiny that established more expensive stocks do.

TL;DR (too long; didn't read)

You can invest $100 in a penny stock. A stock that is trading for less than $5 is considered to be a penny stock.

The lure of penny stocks

The allure of buying penny stocks and making a fortune is appealing. This idea is frequently fed by compelling marketing. Penny stocks include a wide range of prices. The securities and exchange commission considers any stock trading less than $5 per share to be a penny stock, while others apply the name to stocks trading under $1. If you are considering investing $100, then you are probably looking at stocks trading in the bottom range. Because many penny stocks are not subject to the same reporting requirements as larger companies, fact-finding is consequently more difficult. Getting accurate financial statements may be difficult, for example. The bottom line for you as an investor is research your investments carefully.

Research companies

When you buy a penny stock – just as you would with any stock – you need to research the company carefully. Many penny stocks are cheap for a reason. If there are no profits and no sales, walk away from it. If the company is billed as a turnaround situation or the next apple computer, be sure there is real potential before you take a position. If there are several companies engaged in the same industry, be sure to buy only the best of the lot. Be sure to read the disclaimers – be certain you have a real opportunity, not just a blind gamble.

Problems with scammers

While you should read all you can, beware of promotions that promise a quick buck. Frequently, the pop is caused by people who are enticed into buying by the promotion. Those purchases drive the price up as promised, whereupon the investors in the know sell their stock and the price collapses. This “pump-and-dump” marketing will usually be accompanied by a mailer with a disclaimer written in very small print. Beware of any stock that a marketing firm has been hired to promote.

Market conditions

Many penny stocks have low daily trading volume. If the volume is low, you may have a problem when you buy and sell. When you place your order, your purchase may be sufficient to drive the price up, so you end up paying an inflated price. Then when you sell the stock, the additional shares you put into the market drive the price down. Stocks have two prices – the bid and ask. When you buy a stock you pay the ask price, but when you sell the stock you receive the bid price. With actively traded stocks, the spread between bid and ask is very small, but with thinly traded stocks, the spread can be quite large. You can easily lock in a loss if your spread is too large.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

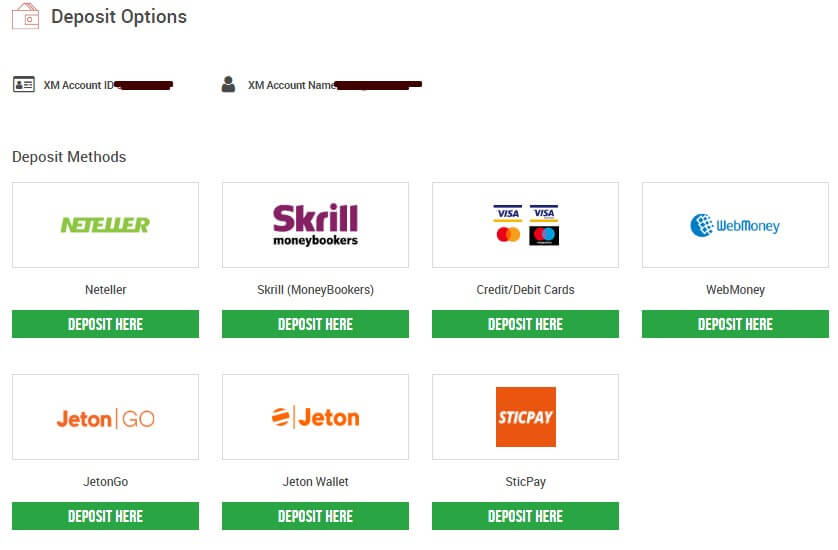

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

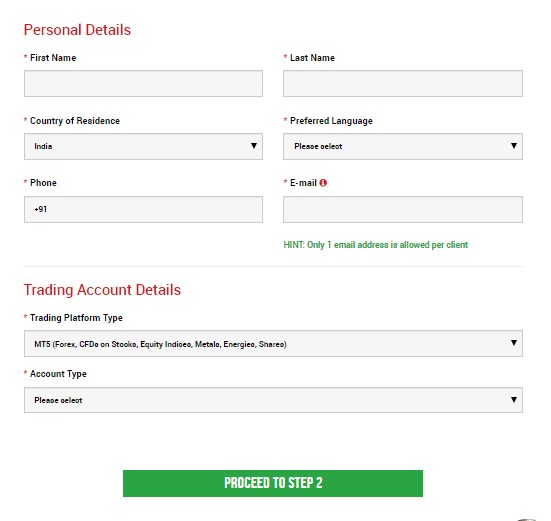

Step 2: filling the personal details

Fill all the box with accurate details

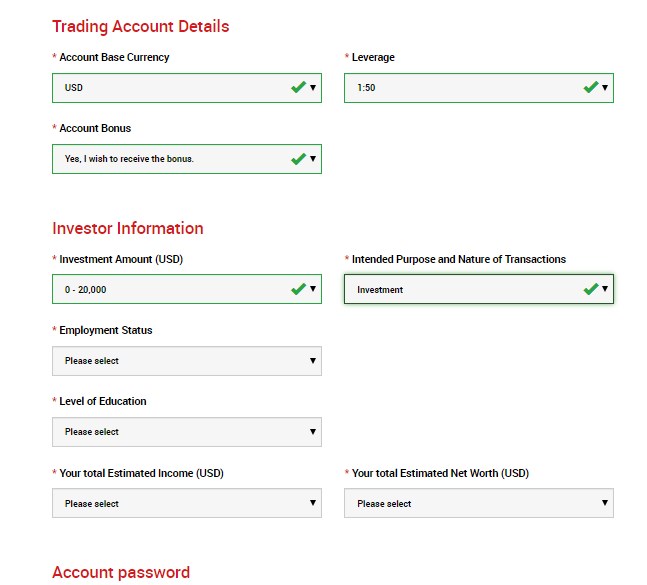

Step 3: investor information & trading account details

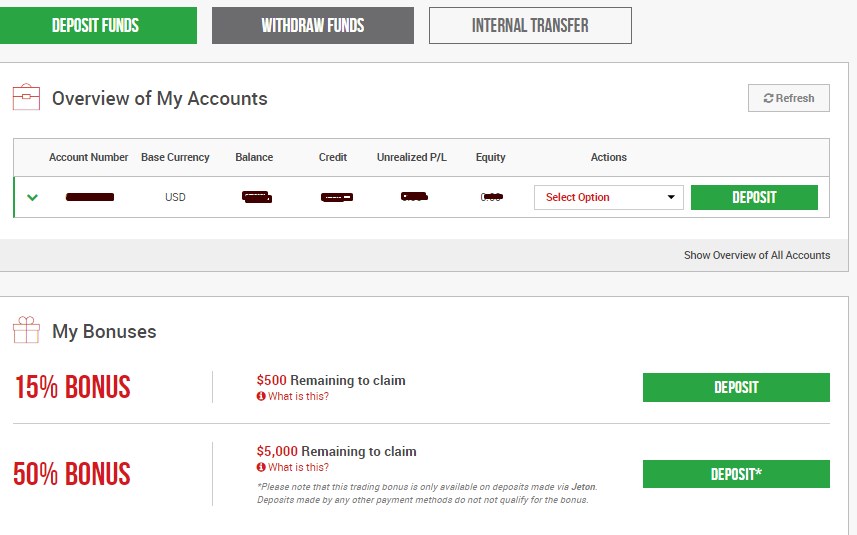

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

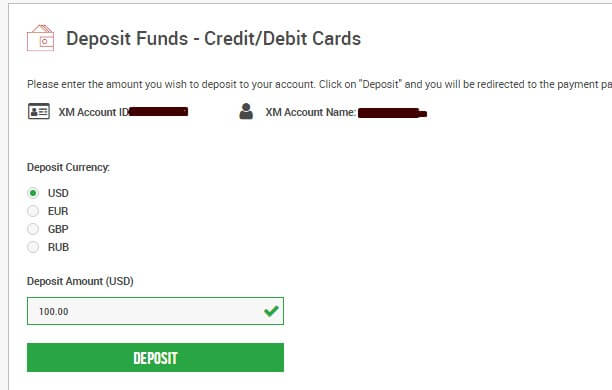

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

Stock trading with 100 dollars

My wife and I make extra money by trading stocks online. We started trading stocks as a side hustle when we needed to make extra money a few years ago. We had some luck early on while the market was making new highs every few months.

I think, at the time, everyone was making money by trading. We used our initial trading profits to pay off our student loan debt.

Unfortunately, our luck did not last, and we lost $15,000 trying to trade stocks over the next 6 months. It took three years of trial and error to finally settle on a swing trading strategy that worked consistently for us.

Stock trading is an exciting and potentially profitable way to work at home and escape your regular job.

We discovered many helpful training resources as we learned how to trade. We joined chatrooms, stock trading alerts services, and purchased training dvds to learn how to trade successfully. You can read reviews of these training resources on our stock trading review site, stockmillionaires.Com.

Stock trading can make you extra money

Short-term stock trading can be extremely profitable. We regularly make 10%—25% gains on our short-term trades. Last month we made thousands of dollars stock trading. We spent a total of an hour or two earning that money.

If you haven’t tried short-term stock trading, here are a few of the reasons that we love this money-making side hustle:

- You can start learning to trade with $100. Sure, your profits will only be a few dollars per trade, but it is best to begin slowly while you learn.

- Stock trading comes with unlimited earning potential. Some short-term traders are making millions of dollars per year trading from their couches.

- Trading stocks offers you flexible work hours. Trade as much or as little as you want to.

- Learning to trade stocks is like a rollercoaster—it is exciting, terrifying, and massively fun all at the same time!

I have tried many different ways to make money online. My wife and I have started many freelance businesses from blogging to freelance proofreading online.

We have found that stock trading has a steep learning curve to conquer, but it offers the most substantial potential income with the least amount of work. In many freelance businesses, you are directly exchanging your time for money—this is not the case with stock trading.

Short-term stock trading can be risky

Stock trading is a risky endeavor, but you can manage the risk with practice and experience. Stock trading is not gambling—success is not based on luck.

There are multiple ways to reduce the risk of losing money trading stocks. Learning to control your emotions during a trade is the first line of defense against losses.

Fear and greed are not your friends! These two emotions are probably responsible for more trading losses than any other factor. Trading stocks is a mental game, and failure to control your fear and greed is the fast track to the poor house in trading.

This article aims to give you an overview of how we make money stock trading online and how you can learn to do the same.

Stock trading versus long term investing

We rarely buy and hold a stock for more than a few weeks. Usually, we only own a stock for 1-4 days!

Investors will usually buy a company’s stock when they believe that the value of the company will continue to grow long-term, e.G., over the next few years. Trading is very different from investing.

Traders don’t care if the company has the potential to become the next microsoft or apple. Traders only care about making money from the price movement over a short time frame, which usually lasts for a few days.

Would you rather hold a stock for two years and make 20% or hold a stock for two days and make 20% profit? We do this every week, often making a 20% profit on a position overnight or over the weekend. This is the difference between a trader and an investor.

There are pros and cons to both investing and trading stocks. Active trading can lead to a lot more profits in a much shorter time. This is mostly due to trading more volatile stocks and compounding gains quickly.

The downside to short-term trading is that the risk is much higher. Short-term trades are usually highly volatile, and this can lead to dramatic losses if you are not careful.

Our five golden trading rules

A disciplined approach to short-term trading is essential. Here are the five golden rules that we do our best to follow:

- Always have a trading plan before you purchase a stock. Stick to the plan!

- Have patience with winning trades.

- Cut losing trades quickly. You cannot allow losing trades to negate the winning ones.

- Never trade with money that you can’t afford to lose.

- Never hold a trade through earnings even if you think that the earnings report will be good.

These are the five rules that we try our best to follow. My experience has been that if I break these rules, I will lose money on a trade.

Learning a stock trading strategy is not easy. There are many different approaches to trading stocks such as trading the news, betting against companies (shorting), day trading, and swing trading momentum stocks.

The strategies can become ridiculously technical with all kinds of crazy indicators and chart patterns.

TIP: consider a service like mindful trader to consistently make better swing trades.

We try to keep it as simple as possible and only trade the highest probability chart setups. Simple is easy if it works—and it has for us.

This article outlines the basics of our simple swing trading strategy. We have used this strategy to consistently make 5%—20% profits per trade (with a 60% winning percentage).

Our swing trading strategy

My wife and I swing trade stocks that cost less than $10 per share. Swing trades typically last between 1 and 4 days.

Investors that are looking for steady, low-risk growth tend to shy away from the penny stock markets.

These lower-cost stocks can provide many opportunities for quick profits, though, precisely because they do not have price stability or solid business fundamentals.

A blue-chip stock is extremely unlikely to double in value overnight. In contrast, I have lost track of how many swing trades that we have made have doubled in a day or two!

Most of the companies that we trade are frankly terrible companies. They are often small companies with no revenue, products, or cash. Often, they will be up to their eyeballs in debt. They are not companies we would ever buy and hold.

The price of these stocks is often manipulated, which makes the price action relatively predictable. This predictability allows us to make money by rapidly trading the short-term price action of the stock.

How to "predict" the price of a stock

The majority of the general public think that stock prices move randomly. Stock prices are not unpredictable because the price depends on people buying and selling.

People tend to be quite consistent in their actions. This translates to the generation of certain patterns in the stock price charts that occur over and over again.

Using price charts to predict where a stock price is heading is part of a system called technical analysis. Technical analysis is used by millions of traders to make money in the stock market.

It is not an exact science, and of course, the stock price is not guaranteed to actually go up when you think it is! The trick is in properly managing your trading and risk.

Through technical analysis, swing traders analyze how securities are trending and the most likely path of the market.

With this information, based on historical data and technical indicators, traders can determine key moments like resistance and support lines, and entry points and exit points.

The resistance line goes along the highest value of the stock before it started going down, while a support line is the opposite—it goes along the lowest value of the security before it began trending up.

Entry and exit points mark the most favorable times, according to the trader, for entering or exiting a trade, respectively.

Of course, many trading platforms automate much of the analysis part of trading. They also let traders set automatic orders such as stop-loss orders which trigger automatically at sell signals preset by the trader.

Nevertheless, you must understand how analysis works before you count on automated software. A full description of technical analysis is outside the scope of this article, but you can read more about it here if you are interested.

While technical analysis is the usual go-to method when swing trading, it is not the only way to locate smart trading opportunities.

Fundamental analysis, whereby you'd look at various company reports and filings to determine a company's health and potential, is also one of the many complementary tools that let traders make better decisions.

Trend trading strategy

There is a variety of trading strategies, and so it's best to try your hand at them to find the one or ones that work best for you.

Trend trading is one of the main ways that we make money stock trading. Basically, we look for a price chart that shows that a stock is consistently making higher prices—in other words, the stock is in an uptrend.

We look for strong uptrends in a stock and wait for the perfect purchase price. The idea is simple—we buy the stock with the anticipation that it will continue the trend (at least in the short-term). If it does what we expect, then we ride it for a few days and sell it for a profit. If it doesn’t, then we sell it quickly and move on to the next stock.

When a stock shows a strong and continuous trend, it is usually referred to as either a bear market or a bull market. Bearish markets refer to trends that are going downwards, i.E., the price is declining.

In bullish markets, the stocks are going upwards, i.E., the price is rising. When a rising stock is reversing its uptrend, it is doing a pullback, so it is starting a countertrend. A countertrend is also a declining stock which is beginning to ascend.

Let me show you an example of how this works and explain how you can do this as well.

The uptrending channel pattern

I want to illustrate the simplicity of trend trading by showing you one of the most straightforward chart patterns—the ascending channel pattern.

The channel pattern can be easily explained by plotting a chart and just drawing two straight lines to show what the price direction of the stock is. Check out the nice uptrend in the price of amazon stock over the last 9 months (below).

You can plot charts of any stocks like this for free at stockcharts.Com. You will have to draw in your own trend lines though unless you purchase a premium version of the software.

The amazon chart shows a nice uptrend where the price of the stock bounces between the two blue lines that I have added in. The top and bottom blue lines show the resistance and support, respectively. Active traders are monitoring these levels, anticipating when to buy and sell the stock and you can do the same!

There is a high probability that when the price of the stock falls to the blue support line, other traders will buy at these price levels, causing the cost of the stock to go back up. When you understand this simple concept, making money trading becomes a lot easier.

The opposite is true when the price of the stock increases to levels around the top blue line (resistance). Other traders will sell the stock at this point, and the pattern repeats. Do you see how there is a degree of predictability in stock prices?

These uptrending channel patterns also happen intra-day as well, which allows for trades that only take a few hours to work.

This is the main difference between swing traders and day traders—the former hold securities for a couple of days up to a couple of weeks; the latter hold them for no longer than a day.

Both trading styles, naturally, come with pros and cons; however, swing trading is more suitable for beginners given the fast-paced dynamic of day trading.

Short-term profits from the uptrending channel pattern

When you have identified an uptrending channel pattern, you can buy in at the support lines and sell at the resistance levels. You can sell part of your position and let the rest ride the uptrend until the trend breaks down.

These types of price patterns are not guaranteed to actually continue when you buy in. Sometimes they just break down. The amazon chart above is an excellent example of what can happen. In september the trend failed, and the price dropped dramatically.

This is where money management and discipline can make the difference—if you cut the loss quickly, then you will probably be successful.

If you hope that the price will come back up, then you will likely just lose money trading. It is better to sell for a small loss than risk a much bigger one—remember you can always buy back in if the trend is re-established.

Whether the stock is expected to move upwards or downwards, or in bullish or bearish manner, can be deducted through a value called simple moving average (SMA). SMA looks at the moving average performance of a security's closing price for a set period.

Always remember that these trends and patterns are just high probability trade setups—they don’t work all the time. Sure, they are likely to work. However, the real secret to making consistent profits is to hope for the best but plan for the worst.

If you had bought into amazon in september and stubbornly held your position, you would have lost 30% in 4 weeks.

Conclusions

We trade stocks using the simple trend pattern described above. We also use three simple chart patterns that are slightly more complex but still quite straight forward. Check them out if you want to learn more about how we make money consistently.

Stock trading has changed our lives for the better, and it is a fantastic way to make some extra money from home. It can be quite a passive income source, but the learning curve does take time, and it can be extremely hard work initially.

You can get started with a tiny amount of money (e.G., $100) while you practice and learn a good strategy. On top of that, you can adapt your swing trading strategies to trade with other securities such as forex, etfs, options, futures and commodities, thereby diversifying your portfolio.

Author bio

Russell barbour is an experienced stock trader and online entrepreneur. He lives in new york with his wife (maleah). Russell blogs about personal finance, stock trading, investing and side hustles that you can start to make extra money. When he is not working he enjoys rock climbing, mountain biking and swimming. You can follow him on social media:

so, let's see, what we have: you can buy stocks for 100 dollars. Consider the commissions and fees you'll have to pay to make your investment a good one. Avoid penny stock scams that can ensnare investors looking for cheap stocks. Consider the tax ramifications and other alternatives like mutual and index funds. At stock trading with 100 dollars

Contents of the article

- My list of forex bonuses

- Can I invest 100 dollars in the stock market?

- More articles

- How the stock market works

- Brokerages and commissions

- Stocks for 100 dollars?

- Penny stocks and OTC stocks

- Watching out for scams

- Mutual funds and index funds

- Stocks and your taxes

- Retirement plans and stocks

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- Can I invest 100 dollars in the stock market?

- More articles

- How the stock market works

- Brokerages and commissions

- Stocks for 100 dollars?

- Penny stocks and OTC stocks

- Watching out for scams

- Mutual funds and index funds

- Stocks and your taxes

- Retirement plans and stocks

- Can I invest 100 dollars in penny stocks?

- The lure of penny stocks

- Research companies

- Problems with scammers

- Market conditions

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- Fxdailyreport.Com

- How to start forex trading with $100

- Stock trading with 100 dollars

- Stock trading can make you extra money

- Short-term stock trading can be risky

- Stock trading versus long term investing

- Our five golden trading rules

- Our swing trading strategy

- How to "predict" the price of a stock

- Trend trading strategy

- The uptrending channel pattern

- Short-term profits from the uptrending channel...

- Conclusions

- Author bio

Contents of the article

- My list of forex bonuses

- Can I invest 100 dollars in the stock market?

- More articles

- How the stock market works

- Brokerages and commissions

- Stocks for 100 dollars?

- Penny stocks and OTC stocks

- Watching out for scams

- Mutual funds and index funds

- Stocks and your taxes

- Retirement plans and stocks

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- Can I invest 100 dollars in the stock market?

- More articles

- How the stock market works

- Brokerages and commissions

- Stocks for 100 dollars?

- Penny stocks and OTC stocks

- Watching out for scams

- Mutual funds and index funds

- Stocks and your taxes

- Retirement plans and stocks

- Can I invest 100 dollars in penny stocks?

- The lure of penny stocks

- Research companies

- Problems with scammers

- Market conditions

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- Fxdailyreport.Com

- How to start forex trading with $100

- Stock trading with 100 dollars

- Stock trading can make you extra money

- Short-term stock trading can be risky

- Stock trading versus long term investing

- Our five golden trading rules

- Our swing trading strategy

- How to "predict" the price of a stock

- Trend trading strategy

- The uptrending channel pattern

- Short-term profits from the uptrending channel...

- Conclusions

- Author bio

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.