Instaforex spread list

There may be additional fees that are not mentioned in this article and traders will need to verify with instaforex regarding additional fees before opening an account.

My list of forex bonuses

- Standard account – minimum deposit of US dollar 1, spreads from 3 pips, zero commissions and leverage of up to 1:1000

- Eurica account – minimum deposit of US dollar 1, spreads from 0.0 pips, commissions from 0.03% to 0.07% and leverage of up to 1:1000.

- Standard account – minimum deposit of US dollar 1, spreads from 3 pips (and higher), zero commissions and leverage of up to 1:1000.

- Eurica account – minimum deposit of US dollar 1, spreads from 0.0 pips, commissions from 0.03% – 0.07% and leverage of up to 1:1000

Instaforex fees and spreads

Instaforex fees and spreads

Instaforex fees spreads and commissions start from 0.03% – 0.07% and spreads from 0.0 pips.

Instaforex has a low and incredibly competitive spread when compared to what other brokers offer by offering a spread list which starts from 0.0 pips with zero commissions depending on the account the trader uses.

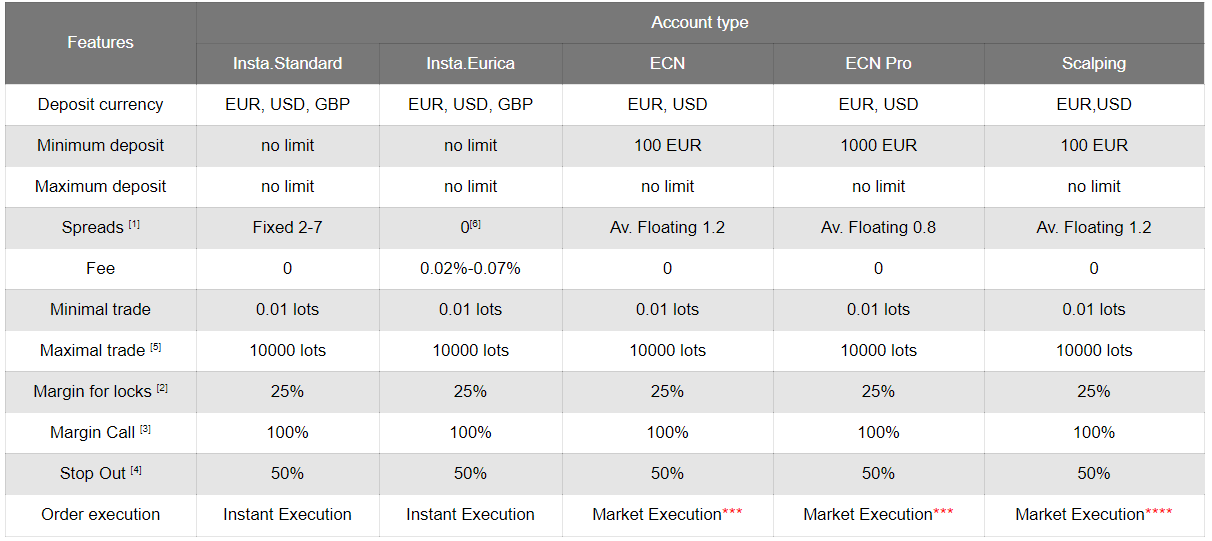

Instaforex trading fees are according to the type of account that the trader chooses and the options along with the spread list, leverage, minimum deposit required, and commissions are as follows:

- Standard account – minimum deposit of US dollar 1, spreads from 3 pips, zero commissions and leverage of up to 1:1000

- Eurica account – minimum deposit of US dollar 1, spreads from 0.0 pips, commissions from 0.03% to 0.07% and leverage of up to 1:1000.

- Standard account – minimum deposit of US dollar 1, spreads from 3 pips (and higher), zero commissions and leverage of up to 1:1000.

- Eurica account – minimum deposit of US dollar 1, spreads from 0.0 pips, commissions from 0.03% – 0.07% and leverage of up to 1:1000

The difference between the account types is that the insta accounts have a minimum lot size of 0.01 lots and a maximum of 1000 lots whereas the cent accounts provide traders with the minimal trading volume possible (US dollar 0.1) and is ideal for practicing trading.

The minimum deposit that instaforex requires to open an account is US dollar 1 which substantially lower than what other brokers require when traders open an account.

Other fees

Traders should note that certain financial instruments can only be traded during a certain time of the day, especially when considering different time zones, and additional fees may be charged should they hold these positions after they have closed.

Traders should always note that overnight fees, otherwise known as swap fees or rollover fees, may be charged for positions held open for longer than a day.

There is no indication of whether instaforex offers the option of an islamic account to traders who are of muslim faith and who operate under the sharia law.

Instaforex does not offer traders with spread betting and therefore spread betting fees are not applicable to this broker.

Broker fees

Instaforex does not charge any deposit fees or withdrawal fees, but withdrawals may be subjected to commissions charged by the payment provider traders use when withdrawing funds from their trading account.

There is no indication of whether instaforex waives any additional broker fees such as inactivity fees or fees pertaining to account maintenance and management.

There may be additional fees that are not mentioned in this article and traders will need to verify with instaforex regarding additional fees before opening an account.

Pros and cons

| PROS | CONS |

| 1. Tight and competitive spreads | 1. None noted |

| 2. Low minimum initial deposit amount | |

| 3. Fixed commissions on trades | |

| 4. Low commissions when compared to other brokers |

How many instruments can I trade with instaforex?

You can trade the following instruments:

- Forex

- Metals

- Indices

- Stocks

- Oil and gas

- Commodity futures

- Cryptocurrencies

Which platforms are supported by instaforex?

Instaforex provides the following popular trading platforms:

- Metatrader 4

- Metatrader 5

- Multiterminal

- Instaforex webtrader

- Instatick trader

Does instaforex offer leverage?

Retail clients have access to leverage of between 1:1 and up to 1:1000 regardless of the account the trader uses.

What spreads can I expect with instaforex?

Spreads from as little as 0.0 pips.

Does instaforex charge commission?

Commissions of between 0.03% to 0.07% are charged when using the insta.Eurica and cent.Eurica accounts.

Is instaforex regulated?

Yes, instaforex is regulated by the highly reputed by cysec in cyprus, FCA in saint vincent, and BVI FSC.

Is instaforex a recommended forex trading broker for experts and beginners?

Yes, instaforex is suitable for both beginner and expert traders.

FAQ (domande poste di frequente)

Seleziona la sezione desiderata:

All'atto della ricarica, la compagnia stessa trattiene qualche commissione?

La società non applica alcuni commissioni per il deposito di denaro sul conto di trading del cliente. Tuttavia, i sistemi di pagamento possono addebitare commissioni. Al fine di migliorare le condizioni commerciali, instaforex compensa tutte le commissioni di deposito dei suoi clienti.

Qual'è l'importo minimo del prelievo?

Informazioni sull'ammontare minimo di prelievo puoi trovare nei costi e commissioni.

Qual'è la somma minima di deposito?

Informazioni sull'ammontare minimo di deposito puoi trovare nei costi e commissioni.

Quali misure devo prendere in caso di perdita di alcune informazioni e impossibilità di utilizzare gli stessi dettagli sia per il prelievo che per il deposito?

Per modificare i dettagli nel sistema di pagamento è necessario compilare il modulo F1 e inviare la copia scannerizzata del tuo ID su support@instaforex.Eu.

Perchè instaforex impiega un lotto da 10000 invece di uno standard da 100000?

Un lotto di 10000 non standard rende il prezzo del pip pari a $ 0,01 nel trading del lotto 0,01, cioè il minimo. Consente ai titolari di conti di trading di $ 5.000 - $ 10.000 di controllare i propri rischi in modo efficace. Allo stesso tempo, la misura del lotto 10.000 rende facili i calcoli di prezzo del pip:

Operazione a 0.01 lotti instaforex = $0.01 prezzo del pip

operazione a 0.1 lotti instaforex = $0.1 prezzo del pip

operazione a 1 lotto instaforex = $1 prezzo del pip

operazione a 10 lotti instaforex= $10 prezzo del pip

operazione a 100 lotti instaforex = $100 prezzo del pip

operazione a 1000 lotti instaforex = $1000 prezzo del pip

La facilità dei calcoli e la possibilità di combinare tre livelli del trading forex in un unico conto di trading rende i lotti di instaforex innegabilmente vantaggiosi per le condizioni di trading su instaforex.

Perchè non riesco a vedere tutti i simboli al market watch?

Il numero di simboli che vedi è regolabile nelle impostazioni della tua piattaforma. Per vedere più quotazioni, fai clic con il tasto destro sulla finestra market watch e seleziona "mostra tutti i simboli"

E' possibile che gli spreads aumentino mentre sono in corso nuovi eventi?

Instaforex non aumenta mai gli spreads nel corso di nuovi eventi. Ogni trader può essere sicuro del fatto che i termini di trading resteranno costanti anche nel corso di nuovi eventi.

Possono rivolgermi ai consulenti? Sono presenti restrizioni?

Non sono presenti alcune restrizioni nel rivolgersi ai consulenti.

E' possibile per un trader entrare in possesso del denaro della compagnia?

No, ciò è impossibile. Se in fase di trading un trader perde più di quanto dispone sul conto trading, la compagnia è tenuta a ripristinarlo a 0.

C'è qualche differenza tra trading demo e quello reale?

Non c'è nessuna differenza in termini di condizioni e specificazioni dello strumento di trading. Il trading con i conti demo è identico al trading con i conti reali, tranne l'indisponibilità delle opzioni di deposito e prelievo per i conti demo.

Qual'è la somma minima di deposito?

Informazioni sull'ammontare minimo di deposito puoi trovare nei costi e commissioni

Perchè le coppie valutarie EUR/GBP, EUR/CHF hanno uno spread fluttuante?

Lo spread fluttuante è uno strumento comune utilizzato dai maggiori broker internazionali. Lo spread fluttuante viene applicato per un numero di strumenti di trading, tra cui EUR / GBP, EUR / CHF. Spread è il compenso del broker per la transazione, determinato dalle condizioni di mercato in cui opera la società. In connessione con l'aumento degli spread delle controparti e sullo sfondo di bassa volatilità, lo spread è stato trasferito a uno stato fluttuante. Puoi trovare informazioni su tutti gli strumenti per i quali viene applicato uno spread fluttuante sulla pagina delle specifiche.

Ho dimenticato la password del trader o il codice PIN (oppure desidero cambiare la mia password trader o il codice PIN). Cosa devo fare?

La password del trader può essere modificata nell'account del cliente o nelle impostazioni della piattaforma metatrader.

È inoltre possibile modificare la password di trader rivolgendosi all'assistenza clienti fornendo le seguenti informazioni: numero di conto, password del telefono e una nuova password di trader (lettere latine, da 6 a 12 simboli).

Se hai dimenticato o perso la password del telefono, contatta l’assistenza clienti via e-mail support@instaforex.Eu, allega una copia scannerizzata del tuo ID/patente di guida e descrivi la situazione fornendo il numero di conto. La password del tuo telefono verrà recuperata o modificata a tua discrezione.

Per recuperare/modificare il codice PIN, è necessario inviare un'e-mail su support@instaforex.Eu con le seguenti informazioni: numero di conto di trading, nuovo codice PIN (figure o cifre e lettere) e una copia scannerizzata del tuo ID/patente di guida allegata.

Posso aprire più conti di trading intestati ad un solo nome?

Sì, puoi. Non ci sono restrizioni sul numero di conti reali e demo aperti sotto lo stesso nome.

È vero che posso negoziare massimo 8 lotti su metatrader?

No, puoi digitare un qualsiasi numero di lotti (fino a 10000).

Dove posso verificare il mio account?

Puoi verificare il tuo conto nell’account del cliente -> profilo.

Quanto tempo occorre per la verifica dell'account?

Per la verifica dell'account possono occorrere fino a 72 ore lavorative.

Quali documenti sono richiesti per la verifica dell'account?

L'elenco dei documenti accettati come verifica è disponibile sulla pagina verifica dell'account.

Qual'è la misura minima/massima della copia di un documento scansionato accettato per la verifica?

Il documento scannerizzato deve essere di alta qualità in modo che tutte le informazioni possano essere chiaramente visualizzate e lette. Tuttavia, dimensione massima del file non deve superare i 10 MB.

Mentre cercavo di caricare il documento si è verificato un errore. Cosa devo fare?

Se ricevete un messaggio di errore ed il vostro documento non riesce a caricarsi, siete pregati di inviare dettagliate informazioni sull'errore a support@instaforex.Eu, specificando il numero del vostro account ed allegando gli screenshot della pagina dell'errore. Potete inoltre tentare di verificare il vostro account impiegando un altro browser internet.

Quanto guadagnerò se inizio ad operare sul mercato FOREX con un deposito minimo?

Ciò dipende totalmente dalla tua esperienza, conoscenza e abilità. Il trading sul forex è molto rischioso e dovresti valutare il tuo livello di professionalità.

Cosa significano livello di supporto e resistenza?

Il livello di supporto è un livello inferiore al tasso attuale, dal quale è possibile una svolta verso l'alto.

Il livello di resistenza è un livello inferiore al tasso attuale, dal quale è possibile una svolta verso il basso.

Cos'è uno trailing-stop?

Quando emettete un trailing-stop (ad esempio di Х punti), avviene quanto segue: il terminale non intraprende alcuna azione fin quando la posizione non risulterà essere in profitto di Х punti (l'entità indicata del trailing-stop). Dopodichè il terminale emette uno stop-loss alla distanza di Х punti dall'attuale prezzo (in questo caso, al livello di pareggio). Nel ricevere la quotazione nella quale la distanza tra l'attuale prezzo e lo stop-loss emesso eccede Х punti, il terminale invia un ordine di modifica dello stop-order ad una distanza di Х punti dall'attuale prezzo. Cioè, lo stop-loss segue "" l'attuale prezzo ad una distanza di Х punti. In questo modo, il trailing-stop rappresenta un determinato algoritmo di gestione dell'andamento dello stop-loss – «sulla scia del prezzo e del profitto». Attenzione! Il trailing-stop funziona solamente quando il vostro terminale di trading è stato avviato ed è connesso al nostro server tramite internet.

Cosa significa la cifra di utile o la cifra del movimento del prezzo?

Pla cifra di utile è un utile pari a 100 pips. La cifra del movimento del prezzo rappresenta il movimento in 100 pips. Anche i prezzi arrotondati di riferiscono a cifre. Ad esempio: "EURUSD oltrepassa la diciassettesima cifra"significa che il tasso ha oltrepassato il livello di 1.1700.

Quali sono gli orari di lavoro della borsa valori?

Le sessioni di trading vengono aperte di domenica alle ore 22:00 (GMT+00) e vengono chiuse di venerdì alle ore 22:00 (GMT+00).

Instaforex

Instaforex is a broker with more than 12 years of experience, giving traders the confidence that they trade in a safe and trustworthy environment. This global brand offers its customers forex and CFD trading, allowing them to resort to a number of trading instruments.

The trading brand has earned itself more than 7 million customers worldwide, with many of them appreciating perks like fast order openings, 24/7 support, and a handful of useful functions. The broker is constantly evolving to offer its customer easier and more innovative trading.

Instaforex provides an MT4 trading platform, which is easy to use and allows traders to dive into fast and secure trading. To enable its customers to be always on top of their trading, instaforex also provides dedicated android, ios, and windows applications. That way even trading on the go is a piece of cake.

Those who are new to trading will have the chance to open demo accounts and learn more about the specifics of successful trading. Once you are ready to trade real money, you will be able to choose from different fast and secure payment solutions for your deposits and withdrawals at instaforex.

Regulations

There are multiple reasons why so many traders around the world have chosen to trust instaforex. One of the many benefits that the broker is offering is a safe and fair trading environment. As it is a global trading brand, instaforex is properly regulated so that it can offer its services to traders all around the world.

Instant trading ltd. Is the company that operates instaforex and it is regulated and licensed by the british virgin islands financial services commission. For traders based in european countries, instant trading EU ltd. Is licensed by the cyprus securities and exchange commission. Since cyprus is a member of the EU, cross-border regulations between EU countries fully apply.

Instant trading EU ltd. Is also registered with the regulatory bodies in austria, bulgaria, croatia, czech republic, denmark, estonia, france, germany, greece, hungary, ireland, italy, latvia, lithuania, luxemburg, malta, the netherlands, norway, poland, portugal, romania, slovakia, slovenia, spain, sweden, and the united kingdom. The company is part of the investor compensation fund, under the investment firms law of 2002, and the establishment and operation of an investor compensation fund. This ensures that customers of the broker can feel safe whenever they are trading real money at instaforex.

Trading instruments

Forex

When it comes to forex trading, this broker will offer a large number of assets to trade. As you head to the forex section with trading instruments, you will come across over 100 currency pairs you can trade. The spreads are floating, with some exotic currency pairs having higher margins. Members of instaforex can be pleased to know that the average spread can be reduced to just 0.8 pips. Of course, the spread and leverage will depend on the type of account you have decided to open as a member of instaforex.

One of the biggest advantages of trading with instaforex is that it offers a large number of currency pairs that you can trade. Those include popular pairs like EUR/USD, GBP/USD, USD/CAD as well as a number of exotic pairs like USD/DKK, USD/NOK, USD/ZAR, and many more. The minimum deal size starts from 0.01 pips, while the minimum pip price can begin from $0.01. As for the margin, it starts at $0.10. There is also the opportunity to swap, with both swap long and swap short available for certain account holders.

Stocks

If you want to trade stocks, you will be able to do that with any instaforex account. If you head to the section with stock assets, you will see more than 80 instruments that you can trade. Instaforex is offering its customers the chance to trade the stocks of major US and european companies in the form of cfds.

Since all of the stocks available at instaforex are offered as cfds, this allows traders to make use of leverage and enjoy a profit no matter whether the market enjoys an increase or a drop in shares. The list of instruments includes major reputable companies such as apple, walt disney, and facebook, to name a few.

The minimum lot size for all cfds is 0.01 lot, with a minimum margin of $0.10 and leverage for CFD trading 1:5.

Indices

Traders will also have the chance to add indices in the form of cfds to your instaforex portfolio. Among the instruments you will find under this section, there are SPX500, UK100, DAX30, and other major indices.

No matter which type of account you choose to opt for, the spread for indices is 0, while the leverage is 1:20. The fee per lot for indices is $10. While the buy-swap for all instruments is -0.1 and the sell-swap is -0.2, this is not the case with indices. Buy-swap for indices #SPX, #NDU, #COMPQ, and #FTSE is -3%, while the sell-swap is -1%. The buy-swap for #DAX is 0.23%, while the sell-swap is -0.47%.

Precious metals and oil

Customers of instaforex will also have the opportunity to trade with precious metals, including gold spot, silver spot, gold spot (500 oz), and palladium spot. Unfortunately, the list of instruments under this category is very limited.

The minimal lot size for metal is 0.01 (1 ounce), while the minimum margin is $0.10. The leverage for gold is 1:20, while the leverage for silver and palladium is 1:10. If you select a metal to trade, you will also see charts with the live price of the precious metal and the current dynamic of the metal’s futures. This will help you make the right decision and pick whether to invest in certain metal on forex or pass on the opportunity.

You can also trade crude oil or natural gas if you are a customer of instaforex. The tick cost for both of the commodities is $10 and there is also a commission of $30 that needs to be paid.

Cryptocurrencies

As a customer of instaforex, you will also have the chance to trade a small number of cryptocurrencies. This type of trading is also done in the form of cfds and allows traders to make use of leverage and they do not need to own the underlying asset. The cryptocurrencies that are offered by instaforex include bitcoin cash, bitcoin, ethereum, litecoin, and ripple.

Instaforex offers crypto analytics and other types of information that can be useful for those who decide to trade cryptocurrencies. This is definitely not an instrument that is suitable for all types of traders and it is best to trade cryptocurrencies only you are well educated on the specifics of trading this type of asset.

Trading platforms

Platforms

PC / MAC

Smartphones

Tablets

Instaforex utilizes the most common trading platform, which is metatrader 4. This is why many traders will have an easy experience when they decide to join this broker and start trading. Instaforex offers several popular methods to trade, allowing its customers to pick a platform that will enable them to enjoy a smooth and easy trading experience.

Metatrader 4

The metatrader 4 platform offers various perks that many traders will appreciate. It includes 9 timeframes and provides a number of tools that allow you to do technical analysis. On the MT4 platform, you will also be able to read financial market news that covers the latest changes on forex, stock, and other markets. This can be very helpful as it allows traders to keep track of the assets that are worth trading.

One of the best features of the MT4 platform is the algorithmic (automated) trading. It allows you to develop trading robots and technical indicators that may allow traders very successful trading sessions. In addition to that, the platform also allows numerous free indicators and tools that can be used for forex trading.

The MT4 platform also supports the trailing stop feature that can be very useful. These trailing stops are attached to traders’ open positions. To make use of this function, however, you must keep the MT4 platform open.

Many traders enjoy the perks that MT4 is offering as it is also a very secure platform. To protect the data that is transmitted during trading, the platform utilizes 128-bit encryption. The MT4 platform will also allow you to enable the one-click trading function. As the name of the feature suggests, you can quickly make an order without having to go through a secondary confirmation.

You can download the MT4 platform on your desktop device or you can install the dedicated android/ios application on your mobile device. Whichever method of trading you prefer, you will always be able to trade in the most convenient time and place.

Functional multiterminal

This type of trading platform is intended for traders who manage several instaforex accounts at once. If you are a trader who manages the accounts of different investors, you will be able to easily handle different portfolios thanks to the multiterminal.

This platform’s interface is similar to the MT4 client terminal one and it allows traders access to different tools. You can install this software on desktop devices that run on windows 7 or higher. This platform is extremely easy to use and even those who are new to it will be able to quickly learn how to handle several accounts at once.

Webtrader

The webtrader platform is suitable for different types of traders and it can run smoothly on all major browsers and operating systems. It supports different languages and just as the downloadable MT4 platform, it grants access to different tools.

The webtrader offers 9 timeframes and it also supports the one-click trading function. Advanced analysis tools are also available, allowing traders to develop indicators that will help them enjoy successful trading sessions. The browser-based platform is also very secure, utilizing the latest protection software to encrypt the data that is constantly shared by instaforex users.

Payment methods

To allow traders to handle their funds in the most convenient way, instaforex accepts various payment methods for both deposits and withdrawals. Most deposit options will impose no surcharges and will allow you to instantly top up your account and start trading right away. One thing you should keep in mind when you request a withdrawal is to use the same currency you did for your deposit. The minimum deposit amount is $1 or the equivalent in another currency. There are no limits on minimum withdrawals as you can always request to cash out any remaining amount in your balance.

You can resort to credit/debit cards issued by visa and mastercard and the deposit will be processed within 24 hours. This method is easy to use and secure but it will require providing your card details when you initiate your first deposit. You may choose to save your card information so you do not need to enter the same details every time you make a deposit or request a withdrawal. While instaforex will not charge any fee for your payments via a credit/debit card, you might want to check the policy of your banking institution as it may impose fees for your payments from and to the broker.

If you do not feel comfortable exposing your card details, you can also resort to another payment option to handle your transactions at instaforex. The broker supports payments via different e-wallets and you can choose from services such as neteller, skrill, qiwi, payco, or yandex.Money. Topping up your account via an e-wallet is a lot faster compared to credit/debit card transactions. Neteller and payco users will be able to deposit instantly, while qiwi deposits require about 15 minutes to be processed. Yandex.Money deposits may take up to 3 hours, while skrill will allow you to top up your account within 24 hours.

It is also possible to resort to bank transfers when you wish to deposit to your instaforex account or withdraw your funds. This is a very secure method as you will be working with the banking institution you know and trust. You should, however, check with your bank if there will be any commission you need to pay when you use this solution for your payments at instaforex. Keep in mind that payments via bank transfers are slower and it may take up to 4 days to top up your account.

It is also possible to handle your payments at the broker via cryptocurrencies such as bitcoin, litecoin, and tether. These methods will allow you to deposit within 3 hours and your transactions will not incur any surcharges.

Account types

You will have the chance to open either a demo account at instaforex or create a real-money account if you are experienced in trading. There are several different options for live trading accounts but all of them share several benefits that everyone could enjoy.

No matter the type of account you choose to create with your real money, you will have access to several assets. These include currencies, stocks, indices, metals, oil and gas, commodities, and cryptocurrencies. You will also enjoy no limits on maximum deposits and a swap-free option upon request. All types of accounts will also grant access to the metatrader 4, mobile trader, and webtrader platforms.

Demo account

If you are a beginner, instaforex will still be a great trading broker option for you. It will allow you to open a demo account that will enable you to trade with virtual money. You can start trading with virtual $/€100,000 once you set up your demo account. It will give you the confidence to trade forex with ease and enjoy many successful trading sessions once you get the knack of forex trading.

The conditions that apply to the demo account at instaforex are very similar to those that apply to the real accounts. The only difference is that you will be trading with virtual money and will not risk any of your real funds. This will give you the needed insight that will help you trade real money later on.

Insta.Standard account

The first type of real account that you can create at instaforex is called insta.Standard. It supports deposits in USD, EUR, and GBP. If you opt for this type of account you will have no minimum deposit requirement to meet and you can also enjoy no limit for the maximum amount you can upload to your instaforex balance.

This account type will incur no fee and you will be able to make use of 280 trading instruments. The minimum spread for the insta.Standard users is 2, while the minimum trade amounts to 0.01 lots. For deposits over $100,000, the minimum trade amount may be 1 lot. The maximum trade will be 10,000 lots for instant.Standard users.

The advantages of this account include fixed spreads and no surcharges for forex symbols. All types of trading, including micro, mini, and standard trading will be available for instant.Standard account holders. The forexcopy system will also be available, allowing you to copy successful traders and make the same trades as them. Traders who opt for this type of account will also enjoy instant order opening, which is yet another great perk.

Insta.Eurica account

This type of account will also allow you to make deposits in USD, EUR, and GBP. Traders who opt for an insta.Eurica account will have no minimum for deposits and will enjoy fixed commissions and no spreads for forex symbols. The minimum fee for this type of account is 0.02%, while the minimum and maximum trade are respectively set at 0.01 lots and 10,000 lots.

Those who open an insta.Eurica account will have access to all 280 instruments that instaforex is offering. They will also enjoy instant execution of orders and will have access to micro, mini, and standard trading. Another advantage that you will enjoy if you resort to this type of account is a bid price that will be the same as the ask price.

ECN account

The next type of account you can open at instaforex is ECN. Although it is still a great option for different players, it comes with several restrictions. You will be able to make deposits only in EUR or USD and the least amount you are required to deposit is €100. The minimum spread will be 1.2 but you will not be charged any fees for forex symbols.

The minimum trade amounts to 0.01 lots, while the maximum is capped at 10,000 lots. One downside of this account is that you will not have access to all trading instruments but you will still be able to use 170 of them. These include forex, commodities, metal, indices, cryptocurrencies, and cfds. Traders who opt for this type of account will enjoy market execution of orders, which is one of the most basic types of trade execution.

ECN pro account

As the name of this account suggests, it is more suitable for experienced traders. It allows deposits in EUR and USD, with the minimum deposit starting from €1,000. Those who opt for this type of account will enjoy low floating spreads of 0,8 and no fees on forex symbols. Similarly to the other trading accounts, the minimum and maximum trades are established respectively at 0.01 lots and 10,000 lots.

If you decide to open an ECN pro account, you will be granted access to 170 trading instruments, including forex, commodities, metals, indices, cryptocurrencies, and stock cfds. This account offers market execution of orders and the best part is that traders will enjoy VIP customer support.

Scalping account

This is the last type of account that instaforex is offering its customers. It is suitable for experienced traders and it is best used for short-term deals. If you opt for a scalping account, you will be able to top up your balance in EUR or USD. The minimum for deposits is €100 and traders will enjoy floating spreads with the minimum spread starting at 1.2. If you opt for this type of account, you will pay no fee for forex symbols.

For customers who open a scalping account, the minimum trade is set at 0.01 lots, while the maximum is established at the amount of 10,000 lots. If you are using this type of trading account, you will be granted access to 170 instruments and will enjoy a market execution of orders.

Support

Whenever you need help with your account or any other aspect of your trading experience at instaforex, you will be able to contact the support team of the broker and resolve any issue in no time. To fit the preferences of every customer, the brand has made sure that there are various contact options that one can resort to.

If you head to the official website of instaforex, you will be able to instantly reach a support agent via the live chat feature. The broker’s representatives will be available around the clock to help you with any issue you might be experiencing. If the matter is not that urgent or you do not feel like chatting with an agent, you can also send your inquiries via an email at support@instaforex.Eu if you are based in europe. For customers who reside in a non-european part of the world, the email address to use is suport@instaforex.Com.

You can also request a callback by providing your phone number and one of the instaforex agents will get in touch with you as soon as possible. If you are on the move, you can also try several messaging apps to contact the support team of the broker. You can use viber, skype, whatsapp, telegram, or facebook messenger to speak to a support agent.

Conclusion

It cannot be denied that instaforex is one of the leading brokers and there is a reason why more than 7 million traders around the world have decided to use its trading platform. Both newbies and expert traders can benefit from the numerous trading instruments that instaforex is offering. Having enough payment solutions to choose from and being able to solve any issue in no time thanks to the support team are also among the many reasons why so many traders trust instaforex.

Instaforex review and ratings

Company information

Instaforex group includes 3 related companies.

Instaforex CY - located in cyprus, regulated by the cyprus securities and exchange commission (cysec).

Instaforex BVI - located in the british virgin islands, regulated by the BVI financial services commission (BVIFSC).

Instaforex SVG - legally registered entity located in saint vincent and the grenadines, but not regulated by any government agency.

Be aware, CY company has some trading restrictions because of the european securities and markets authority (ESMA) influence.

At the same time, SVG company accepts european traders, so one can open a trading account there.

Availability

Instaforex group accepts clients from all over the world, excluding USA and some third-world countries.

Distinctive features

- Simple registration and verification process.

- Copy-trading service (forexcopy) offered for the clients.

- Binary option contracts available for trading.

- Own pool of PAMM trading accounts.

Trading instruments

Forex broker offers the following underlying assets for FX trading.

| 110+ currency pairs | based on major and minor world currencies. |

| 5 crypto pairs | based on bitcoin, bitcoin cash, ethereum, litecoin and ripple. |

| 7 indice cash cfds | based on baskets of different blue-chip stocks and US dollar index. |

| 7 indice futures | based on baskets of different blue-chip stocks and US dollar index. |

| 5 metal spot cfds | based on gold, silver, platinum and palladium. |

| 3 metal futures | based on gold, silver and copper. |

| 7 energy futures | based on crude oil (WTI, brent), heating oil, gasoline and natural gas. |

| 14 soft futures | based on wheat, soybeans, soybean oil, soybean meal, corn, orange juice, lumber, cocoa, coffee, cotton, sugar, live cattle, lean hog, feeder cattle. |

| 90+ stock cfds | based on shares of US companies. |

Forex broker offers the following underlying assets for binary options trading (visit binary.Instaforex.Com)

| 20+ currency pairs | based on major and minor world currencies. |

| 1 crypto BO | based on bitcoin. |

Comprehensive review

Instaforex is a large and global online brokerage established in 2007. Although the team and top management is mainly russian, the broker is today registered and regulated in several offshore jurisdictions around the world, including the EU jurisdiction of cyprus. It offers very high trading leverage of up to 1:1,000 in the entities regulated outside of europe, which fortunately also accept european traders.

Instaforex maintains a large number of so-called introducing brokers around the world. These are independent companies that receive commissions for all trading activity generated by the clients they introduce to the broker. Currently, instaforex claims it has 260 such offices spread out around the world, providing a steady flow of new clients to the broker.

The broker offers a special “forexcopy system” where inexperienced traders can choose to automatically copy the trades made by more experienced traders with good track records. The traders to follow can be chosen based on 20 searchable criteria, and the copy-trading set-up can be cancelled at any time.

Another unique benefit with instaforex is the large video library available on its website as part of its “instaforex TV” initiative. Here, traders can watch interviews with leading trading experts from around the world, technical analysis gurus, and others to get inspired and learn more about profiting from forex and other financial markets.

The trading instruments offered by instaforex include all the usual things, plus a few extras. The selection of forex pairs is particularly good with this broker, with more than 110 currency pairs available to choose from, which is far more than most other brokers. In addition, the broker offers cfds based on the stocks of more than 90 american companies, 5 cryptocurrency pairs, as well as commodities and stock indices cfds.

In contrast to many other brokers these days, instaforex also offers binary options based on a variety of underlying assets for traders who prefer that method of trading.

In order to trade binary options, however, clients will need to use the instabinary platform. This is a web-based trading platform that runs directly in the user’s web browser window, which means there is no need to download any software. The platform is developed by instaforex to meet the needs of binary options traders in particular, and comes with nice and clean charts for easy trading.

Another trading platform developed by instaforex is webifx. This platform also runs directly in the trader’s browser, and can be used to trade both forex and cfds on a range of assets. The platform is well-designed, with a minimalistic and simple look, and with charts from the popular charting service tradingview.

In addition to these trading platforms, the metatrader 4 (MT4) platform is also available for traders who prefer to stick with this classic trading platform which has stood the test of time in the retail trading community.

Instaforex offers four different account types for clients to choose from based on their individual needs:

– insta.Standard account, with wide spreads and no commissions

– insta.Eurica account, with no spreads and commissions from 0.03%-0.07%

– cent.Standard account, designed for new traders and with wide spreads

– cent.Eurica account, for new traders with tight spreads and commission-based trading

Lastly, customer service is available 24 hours a day, with local phone numbers for nine countries, as well as through popular apps like telegram, whatsapp, skype, and others channels.

Instaforex spread list

Considering that spread is a trading cost, the lower the spread, the better it is for traders. However, spread information among brokers is not easy to get, as not every broker transparently publishes their spreads data.

However, traders can still choose their ideal brokers by the type of their spreads. The most two popular types of spread are fixed and variable. The pros and cons between the two spreads can vary for every trader. In this case, interactive brokers provides their pricing with fixed while instaforex offers fixed.

Interactive brokers vs instaforex: who hosts the best trading platform?

The trading platform is essential as you can't execute a trade without it. Additionally, trading platforms provide price charts and an assortment of analytical tools to help traders with their strategies.

To support their clients, interactive brokers enables trading with web trader (sersart), FX-trader, trader workstation. The offer is supported with browser-based platform, one-click trading, trailing stop, pending orders. In comparison, instaforex provides trading with metatrader 4, metatrader 5 with the support of mobile trading, one-click trading, trailing stop, pending orders.

Is interactive brokers or instaforex better in providing the trading instruments?

It is widely known that forex brokers offer other trading instruments other than currency pairs. The offer gives interesting choices for traders to explore other markets that may be proven beneficial for them and to diversify their trading portfolios.

In this case, interactive brokers supports trading with forex, gold & silver, CFD, stocks, options, futures, bonds, ETF, cryptocurrencies, while instaforex presents the ability of trading with forex, gold & silver, CFD, binary options, cryptocurrencies.

In conclusion, deciding the better broker eventually comes down to your consideration. If you are an active trader, it is better to choose a broker with a variable spread that is generally lower than the fixed one. For the trading platform, metatrader 4 is the standard choice for every trader. But if you want to have a different experience with a more advanced platform, choose the broker that provides alternative platforms. The same goes for trading instruments; if you want to try delving into different markets, seek for a broker with more options on trading instruments.

Looking for more references? Here are other comparisons related to interactive brokers and instaforex:

To add more insights in your exploration, we have gathered the most popular broker comparisons in our site, chosen by our visitors:

INSTAFOREX review 2020

Review contents:

- About INSTAFOREX;

- INSTAFOREX regulation status;

- Account types at INSTAFOREX;

- Money withdrawal;

- Payment methods;

- Trading conditions at INSTAFOREX;

- Online education;

- INSTAFOREX customer service;

- INSTAFOREX review conclusion.

About INSTAFOREX

INSTAFOREX started making its first steps in the trading market in 2001. Ever since, the company tries to provide the best service to its clientele. Trading conditions at the company correlate with fundamental trends in the industry. Also, INSTAFOREX strives to comply with the highest quality standards.

INSTAFOREX is very active in sports and supports both prominent athletes and other sports teams.

Here is a brief list of all the things that INSTAFOREX offers its clients.

- 200+ trading instruments – INSTAFOREX offers its clients spot instruments, gold, silver, futures, dow jones industrial average, cfds on indices S&P 500, NASDAQ composite, FTSE 100, nikkei 225, hang seng index, euronext 100, DAX 30, US dollar index and other instruments.

- Crypto – INSTAFOREX offers crypto analytics, fresh news covering main events, and everything that would be useful while trading cryptocurrency.

- Market analysis – this section contains new forecasts, statistics, reviews, and fundamental forex broker analysis.

- INSTAFOREX deposit and withdrawal – INSTAFOREX offers a range of options for making deposits and withdrawals to and from clients’ accounts.

- Customer support – INSTAFOREX clients have access to round-the-clock technical support via e-mail, telegram, skype, viber callback service, and live chat on working days. All client inquiries are taken with a personal touch and by the dedicated manager.

- Team of professional traders – every day, our staff works so that every client gets the expected level of service and has an opportunity to solve existed problems quickly and productively.

- Forex copy system – INSTAFOREX offers a unique system of where a client can copy deals of professionals, trade, and learn at the same time. Users are free to choose a trader based on 20+ criteria and automatically copy his or her deals. However, the client’s deposit remains on the account, and the client can cancel an agreement at any moment.

INSTAFOREX regulation status

Every honest broker needs official approval for its trading activities and products. INSTAFOREX is no exception, as it tries to appease its customers and be as accurate and truthful as it’s possible.

Besides, the cyprus securities and exchange commission (cysec) regulates instant trading eu ltd. Moreover, if you want to search for the official license, here is the registration number 266/15.

Also, instant trading eu ltd is a member of the investor compensation fund. Also, the funds serve its members and clients and try to protect eligible retail clients by paying compensation. In the case of company/brokerage’s failure to repay funds, the investor compensation fund helps out.

Besides, a license of this level guarantees trades’ security and transparency for all instaforex clients.

Account types at INSTAFOREX

INSTAFOREX offers account types that were developed by the INSTAFOREX dealer department specialists.

There are two account categories: standard and eurica. Mostly, trading accounts’ types differ by the method of accounting spreads and commissions.

Instaforex offers diverse types of trading accounts.

Traders pick one report that suits them. Clients have access to every trading symbol and tool available.

To create the best trading environment for traders and, whatsoever, offer them the best trading experience.

Here are all the INSTAFOREX account types that we found on the company’s website.

1. Insta-standard trading accounts

In the first place insta.Standard accounts are high for all types of traders, as they allow a trade to be settled with no fees and with the classical spread. However, the main advantage of this account type is that the trader can change the trading leverage, and a deposit size is made convenient for clients.

The features of the account allow trading with micro forex, the minimum deposit USD 1-10. Also, other deposits are mini forex – the minimum deposit is USD 100 and the standard forex- minimum deposit USD 1000.

INSTAFOREX account, the minimum trade volume is 0.0001 for the lot price of 0.1 US cents. INSTAFOREX also created a maximum deposit limit for beginners, so they do not risk too much upon registration.

2. Insta-eurica trading accounts

The insta.Eurica’s account does not require any spreads to be paid momentary at opening a trade. The reason is that the BID is always equal to the ASK price. However, the offered rate runs higher than the BID price by half of the standard spread.

The platform is MT4, and the account is recommended for beginner traders as well.

The minimum deposit is USD 1, with an unlimited maximum deposit. However, the fees vary from 0.03%-0.07%. The smallest trade amount is 0.01 of the lot, with 10,000 being the maximum. The trader can choose leverage from 1:1-1:1000. Further comparison details list will be provided in the picture at the end of this section.

3. ECN trading account

ECN accounts are suitable for all categories of traders. These types of accounts have no commissions, only spreads are charged. However, this account gives access to all trading instruments. Also, traders get to pay a free-range per every deal that is 1.2 pips on average.

The main advantage of this account type is its flexibility. The ECN account differs from insta.Standard and eurica by the execution type. This means that during market execution, the deals are opened and closed in any case.

ECN trading account offers:

- Micro forex mode with a margin from 1 to 10 USD

- Mini forex mode with a margin from 100 USD

- Standard forex mode with a margin from 1,000 USD

4. ECN pro trading account

The ECN pro account is more convenient for experienced traders who are used to working with significant sums and minimal spreads. The minimum deposit required for trading on the ECN pro account is 1,000 EUR.

ECN pro differs from insta. Standard and insta.

Eurica accounts for the execution type. Market execution is applied instead of instant performance. The clients will get access to all trading instruments, and traders pay a floating spread per every deal that is 0.8 pips on average.

5. Scalping trading account

The scalping account type has features like commission-free trading, comprising market execution, as well as floating spreads.

The scalping account is perfect for traders who employ the classic scalping strategy on the currency market. This strategy implies the opening of short-term deals that are closed once a small profit of several pips is achieved.

Minimal trade size

The size limitation of the minimum trade equals to 1 lot (USD 1 per pip) for accounts of standard and eurica types with the balance over USD 100,000 or its equivalent in other currencies.

INSTAFOREX demo account

INSTAFOREX offers demo accounts as well. Also, the client can train his or her skills on a demo trading account before deciding to commit real money to INSTAFOREX.

It is perfect for novice level traders who want to gain experience in trading. In fact for beginner traders who do not wish to invest one dollar into their accounts, this is a great option.

Money withdrawal

INSTAFOREX works with, as they say on the website, reliable, efficient, and trusted payment systems. The withdrawal methods are secure, and as the company states, INSTAFOREX doesn’t charge fees.

Also, as part of the broker’s commitment to creating the best possible trading experience, INSTAFOREX reimburses deposit costs that the clients incur. Moreover, withdrawal fees vary depending on the payment method.

However, any deposit or withdrawal fees reimbursed by INSTAFOREX may be incurred by the client in the event the company determines that the client has failed to meet any of the required conditions.

These events include, among others, illegal activity, no trading activity, etc.

Payment methods

The payment options are quite large. See the list below:

- Credit/debit cards – processed within 24 hours with a fee

- Bank transfers – processed within 2-4 business days, some fees might apply

- Payco – instant deposit with no fees

- Skrill – 24-hour process, no fees

- Epayments – 24-hour process, no fees

- Neteller – immediate deposit, no fees

- Unionpay – only for chinese residents, no fees

- Wechat – no fees, direct deposit

- Alipay – no payments, instant deposit

- Zotapay – no fees, immediate deposit

- Carta bleue – france residents, no fees

- Cartasi – italian residents, no fees

- Dankort – denmark residents, no fees

Trading conditions at INSTAFOREX

INSTAFOREX only offers to trade with the MT4 platform. Though MT4 is one of the most versatile platforms available, it is still quite a limiting list.

Moreover, the platform is available for download on desktop and mobile. INSTAFOREX only offers the essential MT4 functions, so not nexgen or anything more advanced is available. These are the specs provided by the INSTAFOREX MT4:

- Virtual trading (demo)

- Desktop, windows only

- Web platform

- Social trading

- Also charting indicators, 51 total

- Up to 31 charting drawing tools

- Watchlist, seven total

- Their mobile app offers these functions:

- Android app

- Apple ios app

- Charting, draw trend lines

- Trading forex, cfds

- Alerts

- Watchlist

- A total amount of 30 charting indicators

- Charting, multiple time frames

Online education

For beginner traders, INSTAFOREX offers educational online materials as well as courses.

In addition, INSTAFOREX offers beginner level online trading courses. The user will have to register, open a trading account, fill in the registration form, and then proceed to the training course.

The educational program consists of these topics:

- Detailed information on technical and fundamental analysis that is crucial for predicting price changes;

- Introduction to forex broker types and basic technical concepts;

- Mathematical analysis (technical indicators);

- The full course on metatrader 4, the most popular and convenient trading platform;

- Ready-made training with guidelines on how to make a trade;

- Introduction to graphical analysis;

- An essential insight into the psychology of the market and its participants’ trading behavior;

INSTAFOREX customer service

The customer service at INSTAFOREX is available 24/7. Also, the client can get in touch with them through chat, phone, or email. Their support is quite strong. INSTAFOREX must have had a great team to get everything in control.

INSTAFOREX review conclusion

In conclusion, INSTAFOREX is anything but disappointing. Overall, the offers and features are satisfying and pleasant to use.

However, as previously mentioned, the main drawback of the broker is it lacks third-party services and research tools.

Moreover, education primarily includes a variety of very basic articles (text only) on forex trading, a glossary, and videos.

- Economic calendar,

- Currency pairs or social sentiment,

- Delkos research,

- Recognia (trading central),

- Autochartist,

- Weekly webinars,

- Top-tier sources (forex news),

- Daily market commentary.

Instaforex only has a metatrader4. That means that it offers the platform of MT4 suite from metaquotes software corporation. The corporation is a developer of the widely popular MT4 platform and MT5 platform for web, desktop, and mobile.

Metatrader4 is standard. On the surface of the platform, it varies from broker to broker. When it comes to the available execution method, features, administrative areas, trading commissions, and spreads, there can be significant differences on how the platform is set up.

Sadly, the metatrader platform (branded as instaforex) comes with only the default services, for instatrader clients. Moreover, as already mentioned, there are no other third-party plugins or platforms provided to traders.

Because instaforex is a metatrader-only broker, android and ios versions of the MT4 mobile app comes standard. Thus, they are both available for download from android playstore and apple itunes store.

Is it the right broker?

The broker is FCA licensed. Nevertheless, it is not FCA regulated and authorised. Since it has a cysec (cyprus) license, instaforex is passported through to the united kingdom. Thus, it means that it can accept residents of the united kingdom.

Even so, it still has to receive a formal license of FCA. Of course, this impacts trustworthiness negatively.

Instaforex has been in business since 2007. It offers a website that is well designed. Moreover, it is full of ads sponsorship for suggesting that instaforex is a reputable, trustworthy forex broker. Besides, we made research and it does not support the claims of the broker.

Frankly speaking, instaforex only provides its clients with the default experience of metatrader.

All in all, first think and carefully conduct your own research. Then decide if you want to trade on instaforex.

Thank you for taking the time to read our INSTAFOREX review. We hope it was helpful!

Instaforex MT4: A guide to the instaforex trading platform

The instaforex trading platform metatrader 4 (MT4) is undoubtedly one of the best in the forex community, and has won the hearts and minds of traders all over the world. There are versions suitable for IOS, mac and windows systems plus added extras for windows that include multi-terminal use and a forex rates reviewer. The trading platform also has a user-friendly interface, so it’s perfect for novices as well as experienced traders. Additional tools provide technical analysis and regular market updates. Is this the best forex trading platform available at the moment?

- Easy to use

- Comprehensive analyses

- Attractive instaforex bonus system

- Impressive leverage

Ease of use and accessibility

MT4 is famed for being a flexible platform for trading and straightforward to operate. It can be used to close deals, test trading strategies and analyse quotes, with the benefit of a wide range of handy instruments. Whether a trader wants to use hedging to offset potential losses or gains or last in first out (LIFO), their preferred method is supported. Alternative platforms such as MT5 don’t support hedging and instead use FIFO as the default position. MT5 also imposes more system requirements on a PC than MT4, and takes more RAM.

Traders from across the globe can access the MT4 platform and all of the data in their chosen language, so it’s highly accessible to everyone. As well as a trailing stop, traders are permitted to send:

- Two market orders

- Four pending orders

- Two execution modes

- Two stop orders

In terms of reading charts, MT4 provides preset templates and allows traders to simplify these by editing styles and colours. Any unwanted features can be deleted, while additional information on trading is easy to access. Due to its popularity, there is a lot of online information and even trading examples that have been created and provided by the instaforex MT4 developers.

Best forex broker

When considering a forex broker, it makes sense to compare and contrast the advantages and drawbacks of each one by undertaking a broker comparison, including how the trading software stacks up. MT4 is the most popular type of software and is available from instaforex for a wide range of devices, including mobile ones.

Customer service is another important element as traders prefer a broker environment that is supportive, and again instaforex offers courteous and convenient contact with staff by phone, email and live web chat 24/7. Company representatives can communicate in arabic, english, indonesian, malay and russian.

Other brokers may require initial deposits in the region of $200+ dollars, such as easymarkets (bonus 50 per cent) and XTB online trading (up to 30 per cent rebate), whereas instaforex accepts as little as $1 for its standard account, with leverage of 1:1000 and a bonus of 250 per cent. There is also a demo account that allows traders to practice before they commit to online deals.

Experienced traders at instaforex can join an affiliate programme, while newcomers benefit from a welcome bonus of 250 per cent of their first deposit. There are a range of other bonuses and benefits available according to a trader’s status, so this is a broker that likes to be generous to their clients.

Multiple award winner

Everyone likes to be rewarded for their success and business awards are particularly treasured in any field that is highly competitive, including among financial institutions. As an international brokerage, instaforex has achieved awards in all the key segments related to its work, displaying top-quality service, a safe and secure system, stability and a professional, innovative approach. The impressive selection of services, benefits and offers provided by the company has been noted by business magazines and special project organisers consistently. There is a very long list of awards since the company was set up in 2007, and among the most remarkable are the ‘best broker’ awards received in recognition of the company’s performance in asia, UK and eastern europe, plus specific awards for CIS, social trading and retail forex. As technology has continued to develop, there has also been recognition of the company’s web trading and the versatility of its mobile app.

The mobile app success is a particular source of pride as it enables users to trade forex no matter where they are – meeting with friends or colleagues, on holiday or during a business trip. Traders can also access demo accounts from their smartphones. At present, forex apps are only available for android smartphones.

The instaforex range of bonuses

Users of the instaforex trading platform have the option of benefiting from a very wide range of bonuses of different sizes, with varying ways of crediting an account and a number of options to use them in trading. There are no restrictions on withdrawing profits made from bonuses, and the bonus system is presented clearly and without ambiguity. This helps clients assess which is their preferred bonus to suit the amount of their deposit and their trading strategy. The key bonuses to note are:

- The 100 per cent LFC partnership bonus

- The 55 per cent bonus

- The 30 per cent bonus

- Instaforex club bonus

- Chancy deposit

Instaforex has launched a new campaign in partnership with liverpool football club. This 100 per cent bonus cannot be used for investments or withdrawn. However, any profit made on it is available for withdrawal and there is no upper limit. The 55 per cent bonus is payable on every deposit in a trader’s account. At this level, dealers can make major deals, and it’s available to all instaforex clients no matter when they registered with the instaforex MT4 trading platform. There is no limit to the maximum amount. The 30 per cent bonus works in the same way and can be invested in PAMM accounts.

Special club bonuses and PAMM accounts

Any instaforex review would be incomplete without mention of the extra features, such as the bonus specials that members of the instaforex club can add to the 30 per cent bonus. These are dependent on withdrawals from and deposits to an account, with a maximum available of 40 per cent. The chancy deposit is an in-house scheme involving traders who top up their accounts to $3,000. This allows them to participate in the campaign, which has an annual prize pool of $50,000. Clients have won a total of more than $338,000.

The instaforex PAMM system allows clients to invest in forex projects. Every instaforex trader can accept investments from other traders or invest funds in PAMM accounts, at which point they become shareholders. There are therefore two categories of users:

- Clients who registered their accounts as investors in the PAMM system – they take part of the profit made by traders in proportion to their level of investment.

- Clients who registered their accounts as traders with the PAMM system.

Users of the PAMM system by instaforex automatically have control of, and receive a report on, all returns, operations and shares. A trader can accept an unlimited number of investments, and there is no cap on the amount or on the number of investors. Investors can decide what share of a trader account they wish to have and invest their funds accordingly.

Take this quick quiz to help us find the best path for you

Forex trading platform comparison

The best combination of trading platform features are those that help traders to quickly analyse the financial markets and place their trade orders promptly. Most brokers have bespoke trading platforms, and there are also independent ones, which are probably more suitable for experienced traders than new ones. When making a choice, traders should seek information such as historic and current market data as well as visual aids such as charting. In addition, the facility to execute a trade immediately is an important bonus and automated trading ensures that this can be done instantly.

As an example, algotrader software makes this possible and is available for trades in the options, stocks, forex, futures, options and commodities markets, while the ninja trader online trading platform aims to directly support day traders interested in the options, stocks, forex and futures markets. Metatrader 4 and 5 facilitate live access to global trading markets and are a favourite for trading in forex. It is also commonly used for online trading in the futures and CFD markets.

Instaforex makes MT4 and MT5 available free of charge and does not charge traders any fees for depositing money to their trading account. Transaction amounts are simply charged with a commission either by a payment system or by a bank for both credits and debits.

Some trading features at instaforex

The leverage at instaforex is usually substantial – 1: 1000. The average spreads are approximately 1.6 pips, though there are others. Traders are free to choose from an impressive array of assets, including 107 currency instruments, trades on silver and gold, futures cfds and 34 US stocks cfds. Hedging and scalping are permitted at instaforex. There is also a free training course available for traders.

There is a wide range of expert analyses available for a number of topics daily, including the digital currency bitcoin, and instaforex analytical reviews keep traders fully aware of market trends. The demo account is fully functional and uses the professional metatrader 4 platform.

Those traders who use trading systems that do not allow for swaps are able to make use of the swap-free service. Sometimes, this is the case because certain clients are not able to use swaps due to their religious beliefs. Instaforex also provides its clients with the option to open a segregated account, and this means that traders will hedge their capital from risks or unexpected action related to the activities of the company. In effect, the segregated account funds that belong to the trader are kept separately from the company funds.

Forexcopy system – what it is and what it does

Forexcopy is a service that allows traders to duplicate orders of other successful traders even when they are away from their particular trading terminal. In just a few minutes, a trader is able to choose someone who has made successful trades and then select automatic copying of the chosen trader’s activity. This can be reciprocated should other traders want to do likewise and copy trades.

Forexcopy is a remarkably reliable system as the follower is always in complete control of the activity. It is possible to customise the settings and to cancel copied orders manually if they appear to become potentially unprofitable.

Beginners, in particular, find this system advantageous as it can help them to make money more easily. Deposits to start copying can be as low as $10, with the trader who is following always being in complete control of their own account. As there is an option to follow several traders, beginners are able to minimise their personal risks.

Besides its own traders, instaforex is proud of its record of supporting charitable organisations and volunteers. It uses funds to help individuals as well as partners involved in education and medicine, for example, in various parts of the world.

Instaforex MT4: a platform for all seasons

Despite the arrival in 2010 of metatrader 5, it is quite likely that metatrader 4 will not be relinquished by traders just yet. It has become a very familiar trading platform, even a classic, and has a firm fan base of traders who are used to how it works and who have had success with it.

In fact, 98% of all clients at instaforex choose the instaforex trading platform for their trading activities and select MT4 because it is known and celebrated as being reliable and efficient. In addition, some of the most popular instaforex services received are only available via MT4. These include bonuses, the PAMM system and the forexcopy system. With its wide range of functions, MT4 allows users to follow the trading strategy they prefer. All of this conspires to establish the instaforex meta trader 4 as one of the most utilised on the market, and one that we certainly have not seen the last of.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

So, let's see, what we have: an up-to-date breakdown of instaforex brokers fees, spreads commission, available leverages. Make an informed decision before opening your trading account. (2020) at instaforex spread list

Contents of the article

- My list of forex bonuses

- Instaforex fees and spreads

- Instaforex fees and spreads

- Other fees

- Broker fees

- Pros and cons

- How many instruments can I trade with instaforex?

- Which platforms are supported by instaforex?

- Does instaforex offer leverage?

- What spreads can I expect with instaforex?

- Does instaforex charge commission?

- Is instaforex regulated?

- Is instaforex a recommended forex trading broker...

- FAQ (domande poste di frequente)

- Instaforex

- Regulations

- Trading instruments

- Trading platforms

- Payment methods

- Account types

- Demo account

- Insta.Standard account

- Insta.Eurica account

- ECN account

- ECN pro account

- Scalping account

- Support

- Conclusion

- Instaforex review and ratings

- Company information

- Availability

- Distinctive features

- Trading instruments

- Comprehensive review

- Instaforex spread list

- Interactive brokers vs instaforex: who hosts the...

- Is interactive brokers or instaforex better in...

- INSTAFOREX review 2020

- About INSTAFOREX

- INSTAFOREX regulation status

- Account types at INSTAFOREX

- 1. Insta-standard trading accounts

- 2. Insta-eurica trading accounts

- 3. ECN trading account

- 4. ECN pro trading account

- 5. Scalping trading account

- INSTAFOREX demo account

- Money withdrawal

- Payment methods

- Trading conditions at INSTAFOREX

- Online education

- INSTAFOREX customer service

- INSTAFOREX review conclusion

- Instaforex MT4: A guide to the instaforex trading...

- Ease of use and accessibility

- Best forex broker

- Multiple award winner

- The instaforex range of bonuses

- Special club bonuses and PAMM accounts

- Take this quick quiz to help us find the best...

- Forex trading platform comparison

- Some trading features at instaforex

- Forexcopy system – what it is and what it does

- Instaforex MT4: a platform for all seasons

Contents of the article

- My list of forex bonuses

- Instaforex fees and spreads

- Instaforex fees and spreads

- Other fees

- Broker fees

- Pros and cons

- How many instruments can I trade with instaforex?

- Which platforms are supported by instaforex?

- Does instaforex offer leverage?

- What spreads can I expect with instaforex?

- Does instaforex charge commission?

- Is instaforex regulated?

- Is instaforex a recommended forex trading broker...

- FAQ (domande poste di frequente)

- Instaforex

- Regulations

- Trading instruments

- Trading platforms

- Payment methods

- Account types

- Demo account

- Insta.Standard account

- Insta.Eurica account

- ECN account

- ECN pro account

- Scalping account

- Support

- Conclusion

- Instaforex review and ratings

- Company information

- Availability

- Distinctive features

- Trading instruments

- Comprehensive review

- Instaforex spread list

- Interactive brokers vs instaforex: who hosts the...

- Is interactive brokers or instaforex better in...

- INSTAFOREX review 2020

- About INSTAFOREX

- INSTAFOREX regulation status

- Account types at INSTAFOREX

- 1. Insta-standard trading accounts

- 2. Insta-eurica trading accounts

- 3. ECN trading account

- 4. ECN pro trading account

- 5. Scalping trading account

- INSTAFOREX demo account

- Money withdrawal

- Payment methods

- Trading conditions at INSTAFOREX

- Online education

- INSTAFOREX customer service

- INSTAFOREX review conclusion

- Instaforex MT4: A guide to the instaforex trading...

- Ease of use and accessibility

- Best forex broker

- Multiple award winner

- The instaforex range of bonuses

- Special club bonuses and PAMM accounts

- Take this quick quiz to help us find the best...

- Forex trading platform comparison

- Some trading features at instaforex

- Forexcopy system – what it is and what it does

- Instaforex MT4: a platform for all seasons

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.