Money for trading

Although there is no hard and fast rule for how much you should have in your account to start trading, many brokerages will set this amount for you.

My list of forex bonuses

For example, a brokerage may say that you need a minimum of $3,000 to open a margin account, the type of account you would need to make short sale trades or to purchase or sell options. bonds trade on a per bond basis, not in fractional amounts, and each bond has a face value of $1,000. Some trade for more or less than $1,000 depending on how the bond’s interest rate differs from the market rate. many dealers have a minimum order of 10 bonds, making the minimum order $10,000.

How much money do you need to start trading?

Stock trading is the act of buying and selling securities, whereby short-term strategies are employed to maximize profits. Active traders take advantage of short-term fluctuations in price and volatility. Casual investing involves buying and holding securities, with the investor focusing on long-term strategies to maximize wealth. Moving from casual investing to active trading is a big step.

Therefore, it is important to understand the implications of making the switch, such as paying larger commissions, which could wipe out your gains before you begin.

Key takeaways

- Trading focuses on short-term investing to generate maximum profits, while investing focuses on long-term investing to build wealth.

- Switching from casual investing to active trading can be complicated and can generate extra costs, such as increased commissions.

- There is no set amount required to begin trading as costs vary depending on the type of securities wanted.

- Some brokerages set a minimum amount to begin trading or to unlock margin or options trading.

Trading expenses

Commissions are likely to be the greatest cost you will assume as an active trader. Other expenses, such as software, internet, and training costs, could also be high, but they are dwarfed by the cost of commissions. A trader may make over 100 transactions per month, and the commissions will vary widely depending on the broker. Savvy investors shop around for the best software, execution speeds, and customer service, as well as favorable commission costs.

Brokerage requirements

Although there is no hard and fast rule for how much you should have in your account to start trading, many brokerages will set this amount for you. For example, a brokerage may say that you need a minimum of $3,000 to open a margin account, the type of account you would need to make short sale trades or to purchase or sell options.

For a good start, be sure to look out for account minimums at the brokerages you investigate. This number usually is set for a reason because it is in the brokerage's best interest to keep you trading for as long as possible to ensure that they continue to collect commissions.

These minimums often are put into place to reduce the risk of you burning up your entire account in just a few trades, or even worse, getting a margin call. In the case of the latter, you would have to deposit more funds into your account in order to keep your current position open.

Special considerations

The amount of money you need to begin day trading depends on the type of securities you want to buy.

Stocks typically trade in round lots, or orders of at least 100 shares. to buy a stock priced at $60 per share, you will need $6,000 in your account. A broker may let you borrow half of that money, but you still need to produce the other $3,000.

Options and futures trade by contract. A contract represents some unit of the underlying security. In the options market, one contract is good for 100 shares of the stock. These contracts also trade in round lots of 100 contracts per order.

You can buy less than the usual round lot for a security, but you will probably have to pay a high commission and receive poor execution of your order. Thus, the returns on each trade tend to be small, so make sure you have enough funds to trade your target asset optimally.

Bonds trade on a per bond basis, not in fractional amounts, and each bond has a face value of $1,000. Some trade for more or less than $1,000 depending on how the bond’s interest rate differs from the market rate. many dealers have a minimum order of 10 bonds, making the minimum order $10,000.

Commissions have traditionally been the biggest expense a trader has had to deal with, so when a brokerage is offering supposedly free trades, check carefully to see what the tradeoff is of no commissions.

Other things to look for

Many online brokerages are now shifting to commission-free trading. That means $0 cost to trade most stocks and etfs. This trend began with app-based robinhood and now has spread to big players like E*trade, TD ameritrade, and schwab.

Free trading means that these companies must make their money from other sources, so you should be on the lookout for how that may affect you. For instance, are these companies selling your order flow, in which case you may not be getting the very best price possible on your trades. Or are they selling your personal information and data for marketing purposes? Are they no longer crediting you with interest on your cash balances?

How do you make money trading currencies?

Investors can trade almost any currency in the world through foreign exchange (forex). In order to make money in forex, you should be aware that you are taking on a speculative risk. In essence, you are betting that the value of one currency will increase relative to another. The expected return of currency trading is similar to the money market and lower than stocks or bonds. However, it is possible to increase both returns and risk by using leverage. Currency trading is generally more profitable for active traders than passive investors.

Key takeaways

- It is possible to make money trading money when the prices of foreign currencies rise and fall.

- Currencies are traded in pairs.

- Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage.

- Exchanging currency is not a good way for passive investors to make money.

- It is easy to get started trading money at many large brokerages and specialized forex brokers.

Buying and selling currency explained

It is important to note that currencies are traded and priced in pairs. For example, you may have seen a currency quote for a EUR/USD pair of 1.1256. In this example, the base currency is the euro. The U.S. Dollar is the quote currency.

In all currency quote cases, the base currency is worth one unit. The quoted currency is the amount of currency that one unit of the base currency can buy. Based on our previous example, all that means is that one euro can buy 1.1256 U.S. Dollars. An investor can make money in forex by appreciation in the value of the quoted currency or by a decrease in value of the base currency.

How do you make money trading money?

Another perspective on currency trading comes from considering the position an investor is taking on each currency pair. The base currency can be thought of as a short position because you are "selling" the base currency to purchase the quoted currency. In turn, the quoted currency can be seen as a long position on the currency pair.

In our example above, we see that one euro can purchase $1.1256 and vice versa. To buy the euros, the investor must first go short on the U.S. Dollar to go long on the euro. To make money on this investment, the investor will have to sell back the euros when their value appreciates relative to the U.S. Dollar.

For instance, let's assume the value of the euro appreciates to $1.1266. On a lot of 100,000 euros, the investor would gain $100 ($112,660 - $112,560) if they sold the euros at this exchange rate. Conversely, if the EUR/USD exchange rate fell from $1.1256 to $1.1246, then the investor would lose $100 ($112,460 - $112,560).

Advantages for active traders

The currency market is a paradise for active traders. The forex market is the most liquid market in the world. Commissions are often zero, and bid-ask spreads are near zero. Spreads near one pip are common for some currency pairs. It is possible to frequently trade forex without high transaction costs.

With forex, there is always a bull market somewhere. The long-short nature of forex, the diversity of global currencies, and the low or even negative correlation of many currencies with stock markets ensures constant opportunities to trade. There is no need to sit on the sidelines for years during bear markets.

Although forex has a reputation as risky, it is actually an ideal place to get started with active trading. Currencies are generally less volatile than stocks, as long as you don't use leverage. The low returns for passive investment in the forex market also make it much harder to confuse a bull market with being a financial genius. If you can make money in the forex market, you can make it anywhere.

Finally, the forex market offers access to much higher levels of leverage for experienced traders. Regulation T sharply limits the maximum leverage available to stock investors in the united states. it is usually possible to get 50 to 1 leverage in the forex market, and it is sometimes possible to get 400 to 1 leverage. This high leverage is one of the reasons for the risky reputation of currency trading.

New forex traders should not use high leverage. It is best to start using little or no leverage and gradually increase it as profits and experience grow.

Disadvantages for passive investors

Passive investors seldom make money in the forex market. The first reason is that returns to passively holding foreign currencies are low, similar to the money market. If you think about it, that makes sense. When U.S. Investors buy euros in the forex market, they are really investing in the EU's money market. Money markets around the world generally have low expected returns, and so does forex.

The benefits of the forex market for active traders are usually useless or even harmful for passive investors. Low trading costs mean very little if you do not trade very much. Using high leverage without a stop-loss order can lead to large losses. On the other hand, using stop-loss orders essentially turns an investor into an active trader.

Getting started with forex

The forex market was once much less accessible to average investors, but getting started is easy now. Many large brokerages, such as fidelity, offer forex trading to their customers. Specialized forex brokers, such as OANDA, make sophisticated tools available to traders with balances as low as one dollar.

How to make money trading - 2 keys to success

How do you make money trading? Which assets are the best to start with? By the end of this guide, you'll have everything you need to know to get started trading. Our team at trading strategy guides understands that each asset class or instrument you’re trading (FX currencies, stocks, bitcoin, cryptocurrencies, commodities) comes with its own opportunities to make money.

There are many ways to skin a cat and there are different ways to learn how to make money trading. There are short-term trading strategies like the best short term trading strategy – profitable short term trading tips which will allow you to make money fast and there are long-term trading strategies like the MACD trend following strategy- simple to learn trading strategy which will allow you to make money in the long run. No matter which approach you adopt you’ll have to make sure you choose the trading strategy that fits your own personality.

How to make money trading will be the theme of this article.

The starting point to learn how to make money in general not just from trading is to have a strategy. It might be obvious, but there are many traders out there who are merely guessing when trading and not have a strict trading strategy.

Develop your edge and trading strategy

Our team at trading strategy guides has put a lot of time and effort into developing trading strategies with proven trading edges and trading strategies that work in different trading environments. The difference between trading with a strategy and trading without a plan is the difference between making money and losing money.

You can find plenty of evidence on our blog about what a good trading strategy should really look like, but more importantly, what you can really learn is how to make money trading.

Our trading strategies are suitable for trading multiple asset classes but are more focused on the forex currency market. However, from time to time we might focus on strategies that are particular to one instrument like our article on how to trade stock options for beginners – best options trading strategy.

How to make money trading

In order to make money on the forex market or any other market, all you really have to do is to buy low and sell high. Pretty simple wouldn’t you say?

Let’s take a look at an example: how much money can you theoretically make by trading forex currencies?

Let’s assume that you have a $10,000 account balance and the current EUR/USD exchange rate is 1.1500. In other words, for 1 euro you get 1.25 US dollars. You forecast that during the current trading session the EUR/USD exchange rate will rise and based on this forecast, you buy around €8700 for your $10,000.

Your forecast is correct! The EUR/USD exchange rate rises from 1.1500 to 1.1600. Being in the profit you decide to close the trade and exchange your €8700 back to $10,092. Your profit from this trade is $92.

Would it be possible to increase your profits? To learn how to make money or to maximize your trading potential, you can use leverage which can be up to 500 times more than your initial capital, which also increases your profit potential 500 times.

However, we have to keep in mind that leverage is a double-edged sword and while it increases the money you can make, it also means you can lose more money. The partial answer to the question: how to make money trading is through the use of leverage.

How to make money fast

We all love to make money, but unfortunately, life is too short and this begs the question: how do I make money fast? There is no correct answer as there are many approaches that can help you make money fast.

Being in and out of the market is the most common trading approach that can give you instant gratification and fast money. You can use our powerful scalping strategy simple scalping strategy: the best scalping system which can help you make money fast.

You can fine-tune the price at which you buy and sell forex currency pairs by using the most popular trading approaches like support and resistance trading.

You have to be disciplined and manage your risk. Money management is a key part to making money trading. Understanding the risk associated with trading and the reward that the market might provide to you can help you make money faster.

In conclusion, if you’re good at short-term trading and you have the specific trading profile, you have to be glued to the trading screen and constantly monitoring the market in order to make money fast.

Trading for a living: can it be done?

Our team at trading strategy guides thinks that you can certainly make a living by trading as we have seen many traders succeed. However, trading for a living is not easy. You need to be absorbed by the market and spend a lot of time and effort in understanding the particular instrument they’re trading.

On the flip side, if you don’t put any efforts whatsoever, then the probability to make money trading is diminishing.

The secret to how to make money and build your wealth is through COMPOUNDING!

Let’s get straight to the point and see how compounding can help you make money.

How to make money through compounding

The most important ally you have as a trader is compounding. You may have heard that albert einstein describes compound interest as “the most powerful force in the universe.” the force of compounding can produce pretty spectacular returns for traders.

But what exactly does compounding means and how it can help you make profits trading?

Basically, compounding means reinvesting your previous profits and using those profits to generate more profits. Compounding is a long-term trading strategy that can help you make more profits as time goes by.

We’re going to start with a $10,000 trading account, and on average our trading strategy produces a 10% return per month. This means that in 24 months or two years by reinvesting the previous profits through the power of compounding you end up with an amazing profit of $98,497.33.

Show me any other investment strategy that can do that.

If you want to have a detailed overview of the power of compounding and examine how to make money through reinvesting the previous profits, please take a look at the below figures which breaks down a list of the potential profits you can make each month:

We can easily see how each month our account steadily grows.

Because of the way compounding works, it’s the later months or years that really build your trading account in a big way. So, staying focused on the long-term is critical. If you reinvest all your profits and you make regular contributions to your portfolio, compounding will produce even more amazing results.

You don’t need to be an einstein to appreciate compounding.

Conclusion - how to make money trading

Learning how to make money trading is no easy endeavor. That said if you equip yourself with the right trading strategy and the right mindset great things can be achieved. If you want to learn how to make money fast you need to adopt a short-term trading strategy that will give you many more opportunities to make money. You may also be interested in the best forex trading strategies article.

The two keys to making money trading are leverage and compounding which will help you making money in forex trading.

In the end, the more trading skills you acquire, and the more discipline you exercise, the more money you’ll make. Remember, trading is not a "one size fits all" scenario, but hard work and dedication will ultimately pay off. If you want to learn about how to make money and discover the secrets behind the scenes of trading, don’t miss our previous article: how to profit from trading- make money trading today!

Please leave a comment below if you have any questions on how to make money trading!

Also, please give this strategy 5 stars if you enjoyed it!

(5 votes, average: 4.60 out of 5)

loading.

Stock trading: how to get started and make more money

Stock trading has become almost mandatory for anyone looking to build wealth today.

Several decades ago, stock trading was something done only by the rich on wall street. However, today with fast computers and online brokers, online trading has the lowest barriers to entry.

With the advent of online trading, anyone can register for an account with an online brokerage and buy and sell stocks within minutes.

What’s terrific about online trading is you can invest as much money you want into any publicly-traded company!

Think about it, any company you interacted with today, you can invest in. That daily breakfast hash you ordered from mcdonald’s today? Just buy MCD. Did you watch queen’s gambit for the second time on netflix? Just buy NFLX.

While other investments like real estate require you to put forth a down-payment and have an excellent credit score to obtain a mortgage, you don’t have to worry about any of this for stock trading. You’ll also have excellent liquidity without being tied down to any investments in the short-term and long-term.

With the ease of stock trading on the market, issues remain as many people tend to lose money in the market due to:

- A lack of education,

- Treating stock markets as a gambling arena, or

- They are merely falling for common trading scams.

But, don’t let this intimidate you. By educating yourself, you can start trading online today!

Throughout this guide, we will be going over various strategies you can use to keep your money safe and make it work for you.

What is stock trading?

Stock trading is the practice of buying and selling stocks to capitalize on short-term or long-term market events for a profit.

A company will issue shares of their company on the stock market, and these shares allow you to invest in their company – almost like crowdfunding.

There are various types of players in the stock market. There are day traders, swing traders, algorithmic traders, investors, and market-makers. Each of these players has their strategies in the market, but all have the same goal at the end of the day – make money.

Different types of stock traders in the market

Two traditional stock trading strategies are value investing and technical analysis trading.

Day traders typically like to perform technical analysis trading. They use charts and historical data to look at a stock’s price-volume action and trade based on market activity. These trades typically are short-term and can be bought and sold within minutes! Swing traders are similar, but they usually hold on to stocks for a slightly longer time frame, usually days or weeks.

Meanwhile, investors are the complete opposite. Think people like your grandpa. They tend to buy a stock and hold it for a long time. They usually rely on selling a stock when the company has been performing superbly over years and years, and it’s finally time to reap the profits.

The third type of trader is quantitative traders, an umbrella term for algorithmic traders and market-makers. With the rise of computers and the internet, quantitative trading involves understanding complicated financial derivatives. The complicated code and advanced trading software usually price these derivatives.

Many banks, hedge funds, and asset management firms rely on these quantitative trading methods, as they are heavily based on research to outperform the market.

Hence, how smart money gains its edge over retail investors.

Common money-making trading strategies

1. Value investing strategies

There is one single question to be asked about value investing.

Is the company’s intrinsic value less than the price it’s selling for on the stock market? If so, you should invest if the company is undervalued.

Value investing originated from some well-known titans in the financial industry. If you’ve heard of ben graham, warren buffet, or charlie munger, they have heavily endorsed value investing.

So, how does value investing work?

Investment choices are based on the fundamental analysis of a company. It’s essential to make sure the company generates revenue, not taking on too much debt, has good management in place, etc.

It’s how investing should be done, in my opinion.

However, with governments today printing more money than ever, stock prices have been driven to the highest ever, creating many overvalued companies. So, finding a company at a discount price has become extremely difficult.

For more details about value investing, read up on the intelligent investor, as it covers everything you need to know about valuing a company’s intrinsic value. Keep in mind, it is a bit of a difficult read, but many of the principles are incredibly timeless and have worked for decades.

2. Technical analysis trading

Active trading based on technical analysis is a strategy most day traders employ. Essentially, they use short-term trading signals based on charts and technical indicators to interpret market volatility.

Charting relies on understanding the price-volume action of a stock. Insights driven from these charts determine if they should buy or sell a particular stock. Have you seen pictures of people on wall street with dozens of computer monitors for their trading system? It’s because they have several screens open for many various trading indicators.

Technical analysis trading typically relies on you being glued to your monitors, as you need to be alert for any changes in the market. If negative market news comes out about a company you’re invested in, you need to be ready to sell.

There are many day-trading programs or courses out there, so you can invest in one and paper trade before day trading. However, understand it takes quite a bit of time and energy to become a professional day trader.

3. Financial derivatives trading (options trading)

Financial derivatives trading has always been a tool for companies to hedge their bets or generate profit. But in recent years, financial derivatives have become accessible for retail investors.

There are limitless financial derivatives out there, including options, futures, forward, swaps, etc.

The most common financial derivative traded is options. These financial derivatives generate a profit on top of your current stock trading strategies and reduce your risk, if necessary.

One strategy many retail investors employ is an option trade called covered calls.

Covered calls are a great way to pick up additional monthly profits as you are essentially selling insurance while holding onto your current stock investments.

To give you an example of how this works:

- Say you purchased a stock with a share price of $20.

- Additionally, you decide to sell a call option contract for $2 with a strike price of $25 and an expiry date at the end of this month.

The call option owner can essentially exercise their right to buy the stock from you at $25 at the end of the month.

Now, suppose at the end of the month, the stock value goes up to $27. Two scenarios can happen, the owner of the call option can

- Exercise the option, or they can

- Let the option expire worthlessly.

In most cases, the owner of the call option will exercise the option.

At that point, you will make $5 of profit off because you’re selling your stock to the call option owner at $25. However, you will miss out on $2 of profit since you sold the stock at $25 instead of $27. But, you will also receive $2 from selling the call option.

In the end, you will still make a profit of $7. Not bad, eh?

Trading options is an excellent way of generating additional income, as you are picking up a premium for holding the stock, and you can simply buy back the stock after the call option has been exercised.

There are many more financial derivatives strategies out there you can employ, but be sure to do your due-diligence as sometimes these derivatives can get a bit tricky!

4. Algorithmic trading

This trading strategy is extremely challenging to incorporate, as it requires a significant amount of individual research and time!

You have to build up the infrastructure to automate your trades, research mathematically proven strategies, backtest your trades for profitability, etc. Most people who employ this type of trading have extreme amounts of education and usually have a master’s or a ph.D. Degree.

Algorithmic trading utilizes statistical and mathematical methods to reduce risk and guarantee profitable trades based on mispricings or arbitrage opportunities in the market.

What’s unique about this type of proprietary trading method is that instead of speculating if your trade will make money, you’re using historical data to increase your future trades’ success.

Currently, big banks, hedge funds, and asset management firms focus on algorithmic trading. So it’s challenging for retail investors to get into this type of trading. Additionally, some over-the-counter (OTC) traded financial derivates are not readily available to retail investors.

However, many retail investors are self-motivated to learn this on their own. Books I recommend are:

- Options, futures, and other derivatives by john C. Hull

- Quantitative trading: how to build your own algorithmic trading business by ernest P. Chan

Interestingly enough, mindful trader, run by a stanford graduate, has released their stock trading alert program. Their program incorporates mathematical and statistical trading strategies. They claim a 146% median annual return, which has been backtested over 20 years.

So, this is an excellent way for you to get exposure to these types of strategies.

Rise of passive investing

In recent years, passive investing has become extremely popular for retail investors. With low investment fees and growing animosity towards banks and mutual funds, it’s no question the active investing industry was ripe for disruption.

Passive investing is a long-term investing strategy where you’re investing in diversified indexes or, at the very least, exchange-traded funds (etfs) that track indexes. These indexes consist of many stocks based on various criteria. For example, SPY is the most popular ETF that tracks the top 500 large and mid-size companies listed on the standard and poors 500 index.

If you can’t beat the market, you might as well invest in the market.

Furthermore, it has become increasingly popular to invest in etfs that target a specific trend or industry. For instance, some of my favorite etfs include:

- TAN: TAN is an ETF focusing on targeted exposure to solar power energy, making it potentially useful for betting on long-term adoption of this energy source or capitalizing on perceived short-term mispricings.

- BOTZ: BOTZ is an ETF focusing on investing in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence, including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

Many of these etfs have a prospectus that includes vital information such as:

- Investment strategy

- Investment objectives

- Risk factors

- Tax and legal information

- Diversification

Investing in these passive funds is a great way to put your money on auto-pilot and let it work for you without the need for learning about active trading.

Conclusion

Ultimately, there are many ways to trade stocks online. So, be sure to find a strategy that works for you and guarantees you profits during this period of wealth creation. However, I do recommend doing proper research before you invest in anything.

On a side note, there are many online brokers out there with many different trading platforms. Before you open a self-directed trading account, be sure to look for low fee brokers. Some popular brokers are TD ameritrade or charles schwab.

Money flow index

The money flow index (MFI) measures momentum in a security by showing the inflow and outflow of money into a security over time.

The indicator is synonymous with “volume-weighted RSI” as it integrates volume and mirrors the relative strength index (RSI) with respect to its mathematical formulation and categorical classification as a momentum oscillator. Both price and volume data are part of its calculation.

Calculation of the money flow index

The money flow index is standardized to a 0 to 100 scale. The indicator’s default setting is set to 14 periods and is usually applied to the daily chart, which is the most popular time compression among chartists. Volume is often not kept on charting software platforms below the daily level, so the MFI may need to be used on the daily time compression or higher (e.G., weekly, monthly).

Step one

Like some other indicators, the MFI relies on a calculation of the typical price. This is calculated as follows:

Typical price = (high price + low price + close price) / 3

(other indicators that use the typical price include the commodity channel index and keltner channels.)

Step two

After that, we calculate what’s called raw money flow (or simply money flow), which is a function of both volume and the typical price.

Money flow = volume x typical price

Step three

The next step involves the ratio between the positive and negative money flow. This calculation is equal to:

Money flow ratio = (N-day positive money flow) / (N-day negative money flow)

N will be equal to the number of periods the indicator is set to. If kept to the default settings, N will be 14.

Positive money flow is calculated by taking the sum of all the money flows on all the days in which the typical price of one day is above the previous day. Likewise, negative money flow is calculated taking the sum of all money flows on the days in which the typical price of one day is below the prior day.

Step four

With those three calculations, the money flow index can be found according to the following formula:

Money flow index = 100 – 100 / (1+ money flow ratio)

As aforementioned, this value will always come to a value between 0 and 100.

It should be noted that on many charting platforms volume data is not kept for currency pairs. Without volume, the money flow index will not plot on the charts accordingly.

Use of the money flow index

Traders who use volume in their analysis often look for divergences between volume and price. If volume is trending one way, while price is trending in the opposite direction, it could be a leading indication of an upcoming change in the direction of the market.

Many technical analysts believe that price follows volume. Therefore, if volume is trending down while the price trend is up, some traders will believe that price is likely to reverse trend to eventually match volume. Since the MFI integrates volume data into it, traders may attribute meaning to divergence between the direction of the indicator and price.

On the MFI, you can notice that there are green and red horizontal lines on the chart. The green line occurs at 80 while the red line occurs at 20. It is believed that when the MFI runs above 80 a security is “overbought” while when the indicator is below 20 a security is “oversold”.

Based on these two levels, traders would be biased toward long trades when a market is oversold and toward short trades when a market is overbought. Price reversals are, of course, based on the premise of mean reversion or distorted markets eventually working their way back to normality. If there is a divergence between the MFI and price and this favors the trade – e.G., market overbought, price trending up, but MFI trending back down – this is even better.

The MFI should nonetheless never be used on its own as a trade signaling mechanism, and would be used in conjunction with other indicators, tools, and modes of analysis to make better informed trading decisions.

Trade examples

The following provide some trade examples of how the money flow index might be used to identify potential trading opportunities. I have paired it with keltner channels, which is another price reversal indicator.

The MFI is used with a 14-period setting, while the keltner channels are set with a 20-period setting and a 3.0x average true range multiple. (the higher the average true range multiple the wider the bands will be, and therefore the more conservative the trade signals will be.)

Given that both the MFI and keltner channels are price reversal indicators, it doesn’t make sense to plot trend following indicators on the chart in conjunction with them (other than for perhaps general information).

The system

We can form a basic trading system around this.

Long trades will be taken when the following are true:

- Security is oversold based on the money flow index running below 20

- Touch of the bottom band of the keltner channels.

Short trades will be taken when the following are true:

- Security is overbought based on the money flow index running above 80

- Touch of the top band of the keltner channels

- When price touches the middle band of the keltner channels (a middle band can be plotted on this indicator by going into the settings on your charting software)

This is simply an example of a basic system that uses technical indicators only. It ignores price action, chart patterns, and fundamental analysis.

Money flow index + keltner channels work best on volatile securities

All of the following trade examples will be used on kinder morgan (KMI) stock. For the money flow index and keltner channels to initiate signals, the security needs to exhibit a sufficient amount of volatility.

Some assets, like short-term investment-grade/sovereign bonds and diversified stock indexes, rarely exhibit enough volatility to trigger signals when using the money flow index and keltner channels on the settings listed above.

One option is to simply relax the settings to trigger more signals. For example, one could use a smaller period on the MFI (e.G., 7-day, 10-day) to generate more signals or use a 25-75 band instead of 20-80 band for oversold/overbought readings. Moreover, on the keltner channels, one could also use a shorter period or lower the average true range multiple. The issue with doing this, however, is that if the criteria is relaxed too heavily, then the signals may become less statistically significant in terms of finding quality reversal points in the market.

With a volatile stock like KMI, one should be able to generate potential trade setups based on the stipulated criteria.

Trade #1

The first example is a long trade where we see both a move below 20 on the money flow index, denoting “oversold” and a touch of the bottom band of the keltner channels.

Here this trade ended up nailing the bottom of the ongoing down move. Trade entry is identified by the upward pointing green arrow. The touch of the middle band of the keltner channels represents the trade’s exit, which is defined by the white arrow. This trade made about a 4.2% profit.

Trade #2

This is a similar setup to the first where we are betting on a reversal in the trend. Price comes down to a point where it triggers an “oversold” reading in the MFI and a touch of the bottom band of the keltner channel. We enter at that point for about a 3% profit once the trade is exited on a touch of the channel middle band.

Trade #3

Here we get probably our best trade setup of the ones listed. It’s a short trade in the context of the broader downtrend.

Price came up to the point of being both overbought according to the MFI and touched the top band of the keltner channel. Once again, the trade was exited upon a touch of the middle band of the channel. This made a little over a 3% profit.

Trade #4

Here we took a third long trade. However, after a slight initial bounce, we did not get our exit signal (touch of the middle band). It fell a bit before eventually closing out according to this rule at a loss of 2.3%.

Overall, this system would have produced a net gain when aggregating the results of all four trades.

Conclusion

The money flow index is a momentum indicator that provides insight into how much money is flowing in and out of a security over time. It is designed for traders looking for points of price reversal in a market and would not be a relevant addition to a trend following system.

Charity trading: selling goods and services

When charities can trade, tax rules and when to trade through a separate company.

What trading is

If you want to sell goods or services, you will need to find out whether your activities are considered trading, and if they are, what type of trading you will be doing. Profits from some types of trading may be liable for tax.

Whether you are trading or not can depend on the number and frequency of transactions you make, among other factors. Selling donated goods, for example in a charity shop, is not considered trading so any profits would not be subject to tax.

Types of trading

There are two main types of trading for charities: ‘primary purpose’ and ‘non-primary purpose’ trading. These different types of trading have different tax implications.

Find out more about charity trading and tax from HM revenue and customs.

Primary purpose trading: selling to further your charity’s aims

Selling goods or services that directly further your charity’s aims as they are stated in your governing document is known as primary purpose trading.

Examples of primary purpose trading include:

- A care home charging to provide housing and care services for elderly people

- A charity for the disabled selling products made by its beneficiaries

- A charitable theatre selling tickets for its production

You might also sell goods or services that support your primary purpose trading – for example, selling food and drink to audience members in the café of a theatre. This is known as ‘ancillary trading’.

Profits from primary purpose and ancillary trading may be exempt from tax, but only if the profits are entirely used to support your charity’s aims.

Non-primary purpose trading: selling to raise funds

You can also sell goods or services purely to raise funds: this is non-primary purpose trading. This kind of trading has no direct link to your charity’s aims.

Non-primary purpose trading could include:

- Selling greetings cards or similar items

- A charitable theatre running a café that sells food and drink to members of the public, as opposed to audience members

Charities can carry out non-primary purpose trading if there is no significant risk that the charity could lose money from this venture.

Profits from non-primary purpose trading are usually taxable, even if they will be used to support the charity’s aims.

Mixed trading

Some trading activities may mix both primary and non-primary purpose trading. For example, a museum shop may sell books relating to an exhibition (connected to their aims), and some promotional pens (not connected to aims at all). By law, you must record these sales separately in your accounts if you mix trading types in this way.

How to protect your charity from losing money

All charities are exposed to risk if they are trading, but if your charity will be doing a substantial amount of trading, you may expose your charity to a greater risk that it could lose money. For example your business may fall out of favour, causing profits to turn into a loss. One way to reduce risk to your charity is to set up a ‘trading subsidiary’.

A trading subsidiary is a company that your charity controls. The law considers it to have the same legal status as a person. So a company, like an individual, can own land and enter in to contracts in its own name.

You must use a trading subsidiary for non-primary purpose trading where there’s a significant risk that your charity could lose money.

There are some additional costs involved in setting up a company and it will be regulated by companies house.

This way of operating can be complicated to set up. HM revenue and customs provides advice on tax issues and trading subsidiaries, and you may need to consult a solicitor or similar professional adviser.

What is forex trading and is it right for me?

There are very few investors who have consistently made massive fortunes over a while. Jim simmons, a quiet recluse, has been successful with smaller frequent trades in his medallion fund. On the opposite end of the spectrum is the brash george soros, who publicly “broke the bank of england” and made billions in a single forex trade on black wednesday.

Soros had been building a substantial short position in pounds sterling for months leading up to september 1992. He knew the rate at which the united kingdom was brought into the european exchange rate mechanism (ERM) was too high, their inflation was triple the german rate, and british interest rates were hurting their asset prices.

The british government failed to keep the pound above the lower currency exchange limit mandated by the exchange rate mechanism (ERM). It was forced to withdraw the pound sterling from the ERM, devaluing the pound. The estimated cost to the U.K. Treasury was £3.4 billion. Soros' fund profited from the U.K. Government's reluctance to raise its interest rates to levels comparable to those of other ERM countries or float its currency.

Everyone is familiar with investing in stocks, gold, or real estate. But forex trading has always been shrouded in mystery.

What is forex trading?

Forex trading refers to the foreign exchange markets where investors and traders worldwide buy and sell one currency for another.

You might have even participated in forex trading without even realizing it. Anytime I visit a foreign country, I exchange my U.S. Dollars for the local currency based on the prevailing exchange rate. In its simplest form, that is forex trading.

Currencies rise and fall against each other depending on various economic and geopolitical news. If you can buy low and sell high, you can make a profit in forex trading. Demand for particular currencies can be influenced by interest rates, central bank policy, GDP, and the country's political environment.

Because of forex's global nature, the markets trade for 24 hours a day, five days a week. Forex markets are the most liquid markets in the world.

Forex trading terminology

Forex markets have different terminologies and nuances for trading. Below is the list of most common terms.

Currency pairs

Traders frequently trade currencies by selling one currency and buying another. Forex trading always involves the exchange of currencies in pairs. You could have a EUR/USD pair for U.S. Dollars and euros. You can have similar pairs against the japanese yen or the australian dollar.

The major currency pairs are the four most heavily traded currency pairs in the forex market. Because of the massive liquidity, you can always trade them with the lowest spread. The four major pairs are EUR/USD, USD/JPY, GBP/USD, USD/CHF. Note that the U.S. Dollar is involved in every major pair because it is the world reserve currency.

The minor currency pairs don't include the U.S. Dollar and are also known as cross-currency pairs. For example, EUR/AUD and CHF/JPY.

The first currency in the pair is the base currency, and the second currency is the quote currency.

If you are bullish on the european union, you want to buy EUR and sell JPY. In this case, you would buy the EUR/JPY pair.

If you are bearish on the japanese yen, you want to buy USD and sell JPY. In this case, you would sell the JPY/USD pair.

The forex quote determines the price at which you do the buying and selling.

Forex quotes

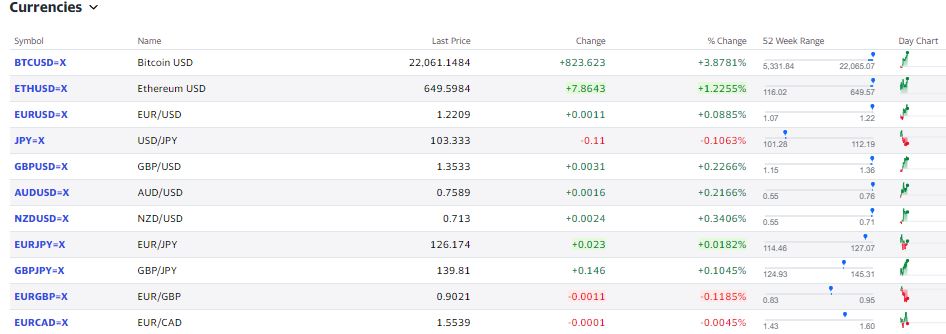

The EUR/USD is the currency pair, and the price is 1.2209. The price indicates that for every euro you sell, you could buy 1.2209 USD. The 52 week range indicates that in the last year, the price has fluctuated from 1.07 to 1.22. You make a profit when you sell a currency for more than what you paid for.

You might have noticed the forex quote has four places to the right of the decimal. The smallest price change that a given exchange rate can make is the pip. Most currency pairs, except japanese yen pairs, are quoted to four decimal places. After the decimal point (at one 100th of a cent), this fourth spot is what traders watch to count “pips.”

For example, if the EUR/USD moves from 1.2202 to 1.2205, we say the EUR/USD has increased by three pips.

Forex lot

Forex is traded in lot sizes. Standard lot = 100,000 units mini lot = 10,000 units micro lot = 1,000 units

A larger lot size involves more risk due to the amount of money involved. If you are starting, always trade in micro-lots.

Leverage

Forex traders often use leverage to juice up the returns. Since currencies trade in a small range, they want to amplify their gains. The challenge of leverage is that it cuts both ways. If you are right, then using a 50:1 leverage will increase your profits by 50 times. However, if you are wrong, then you lose 50 times more. For this reason, it is advisable to avoid using leverage when trading forex.

Can you get rich by trading forex?

Forex investors make money by deciding what currencies will rise and fall. Some traders swear by technical analysis and others will rely on fundamental analysis. Traders believe they know what direction the currency would move based on the latest news. The challenge with making money trading is that the same information is also available to everyone else, including professional investors.

An individual investor who is not involved with trading the forex market for a living would find it very hard to make money. You could get lucky once or twice. But eventually, your steak runs out.

The individual investor has no advantage over professionals who do this for a living. My four worst investments article highlights how easy it is to lose money when trading against professional investors.

Professional traders have powerful trading tools to take advantage of their online forex trading strategy. The trading platforms provide signals for automated trading and scalping. Forex scalping methods place trades for 1 to 10 minutes and close positions after gaining five pips. An algorithmic trading system combined with leverage enables the professional traders to day trade forex pairs better than individual investors.

If you want to grow rich and retire early, the best plan is to accumulate income-producing assets. Most stocks pay a dividend, or they increase in value like moonshot stocks. The rental property provides income in the form of rent and appreciating property prices.

Forex trading only makes money if you are right in the timing and direction of currency prices change. You cannot have a “buy it and watch it grow” approach with forex. If you wonder, “when can I retire” it is quite likely that forex trading won't help you.

Who does forex trading

Professional investors trade forex to make money. Trading is done in the spot market, where exchange rates are determined in real-time depending on the current economic and geopolitical factors.

Global companies actively trade forex as well in the futures market. They create a contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. The primary purpose is not speculation but as a hedge.

For example, infosys (NYSE: INFY) is a consulting company headquartered in india, but they have clients worldwide. They report results on the indian stock exchange. Since the indian rupee trades in a wide range against the U.S. Dollar, infosys would use the forex markets to hedge against currency risk.

Similarly, ARAMCO (SAUDI-ARAMCO) is one of the leading players in the petroleum and natural gas industry. It needs to hedge its commodity exports against price changes in U.S. Dollars.

Final thoughts on forex trading

Forex is part of our everyday life as a result of living in an interconnected global economy. Currencies usually trade in a tight band. If a currency suddenly depreciates, it could be an indicator of upcoming inflation or potential geo-instability.

It is tough to get rich with forex trading for individuals. You might lose all your investment. To be profitable, one needs a deep understanding of the macroeconomic fundamentals driving currency values coupled with technical analysis experience. And it would help if you traded on it before anyone else does. Proceed with caution if you decide to incorporate forex trading as part of your investment strategy.

Trading 212 guide for beginners

Trading 212 guide for beginners

First of all, what is trading 212? Here is my trading 212 guide for beginners. I will outline what trading 212 is and how you can get set up using it. Before you know it, you will own your first shares in a company or maybe you decide to start with an exchange-traded fund.

Trading 212 is a free or zero commission brokerage investment platform. Inside the mobile app or via their web app we can purchase and sell shares of individual companies or etfs if we choose.

Typically, in the past brokerages have charge heavy fees in order for you to purchase stock. Putting off new investors, especially those with a smaller budget.

Hargreaves lansdown, for example, charge up to £11.95 per trade. Investors with larger budgets are not concerned by this obviously. However, those of us with shallow pockets are.

That’s where trading 212 comes in and saves the day. Making it easy for a new investor with even the smallest of budgets to start their investment portfolio today.

Stick to the plan and follow along with trading 212 guide for beginners. It will ensure you have a smooth ride.

If you are just getting started into the world of personal finance and investing, I would look into getting a book or two to read. Here are my personal favourites I think everybody should read.

Want a nice way to track your investments and dividends? Checkout my dividend tracking spreadsheet

Trading 212 web app is now live. Giving us the ability to create and manage pies from a browser on a desktop computer. More room to manage your investments.

My trading 212 PIE library

UPDATED* trading 212 have now introduced a PIE library.

Now I can share my pies here they are. Note this will only work on mobile for now. Click the link and the PIE will be displayed withing the trading 212 app.

- ETF auto PIE

- FAANG++

- Food & drink

- US & UK healthcare

- PC pie

- Monthly paying REIT

- UK energy, mining & legal

- US solid dividend

My pies are working well. They have been broken down into small PIES as discussed shortly. Click the PIE link on mobile to see the PIE inside the trading 212 app.

Hopefully, we will soon be able to the same on a desktop. At least, for now, it’s mobile-only.

How to open A trading 212 account

Before you sign up for trading 212, make sure you sign up with a referral link to get a free share. Deposit just £1 to get the free share.

When you sign up you will likely be asked to fill in a W8-BEN form. You will want to sign this as it will reduce any withholding taxes on US-based dividends.

It’s a simple form to fill in and you just have to tick a few boxes. It will be dependant on your country of origin if you are asked to fill it in or not.

Once you have opened your account. You will want to download the trading 212 app from either the app store or the play store, dependant on if you use an iphone or android. I’m team android!

Now that you have your account and the app downloaded to your phone. The first thing you will want to do is fire up the app and deposit some money. For now, I recommend just putting £1 in to claim the free share.

To do this, simply click the three little horizontal bars on the bottom right corner of the app to bring up the settings. You will see a big deposit funds button. Choose this and add a suitable debit card or you can use google pay.

You may be able to use apple as well, but seeing as I’m team android you’re on your own with that one.

So, you have set up your account, linked your debit card or google pay, and deposited £1 or more is you choose. Now stop, wait a minute…

Trading 212 practice mode

Before we get carried away and the reason I recommend to just put £1 in for now is practice mode. Once again click the icon with three little horizontal bars.

Scroll all the way down and below the deposit funds button, you will see practice mode as a big green button. Hit it.

Practice mode will be your best friend. Especially for those of you that are a little nervous. In practice mode, you have £50,000 to have a play around with.

One day we will have that in our real accounts if we stick at it though.

We can use practice mode to get a feel for how things work inside the app. Go ahead and choose a couple of random stocks and buy some shares (it’s not real remember, so go crazy if you wish).

How to buy shares on trading 212

I’m going to start with coca-cola. Click the little magnifying glass to search.

You can search for anything you like.

Now we have found coca-cola – ticker symbol KO.

A ticker symbol is just a shorthand code used to identify different stocks on a stock exchange such as the NYSE new york stock exchange or the LSE london stock exchange.

Do not worry about the order types for now just use market order – it is the default anyway. I’m buying 50 shares how about you?

That’s £1826.13 at the current share price of $45.12. Trading 212 will handle the currency conversion for us. It will display in your local currency below the number of shares. Hit buy. Confirm the order.

Congratulations you just purchased your first 50 shares of coca-cola.

The order will execute within a few seconds normally.

Assuming the stock market the stock is listed on is open. Do not be alarmed if it takes 30 seconds or more – this is rare it’s normally a couple of seconds.

When you select a company it will say if the market is currently open or closed just below the buy and sell buttons.

Want a nice way to track your investments and dividends? Checkout my dividend tracking spreadsheet

How to sell shares on trading 212

Depending on your style of investing you may never want to sell your shares in real life with real money (that is me). However, for the purposes of this guide. Let’s go ahead and sell those 50 shares of coca-cola ticker KO.

You can now hit the little pie looking icon next to the magnifying glass.

This will show all of your holding in your portfolio.

Hopefully, some of you experimented a bit more and made a few purchases of different stocks and varying quantities, etc. Bravo if you did.

If not you will just see coca-cola and the 50 share we have.

Note it will display your total loss or gain in either red for loss or green for gain.

Seeing how coke is a major company it is unlikely if the shares have moved more than a couple of pounds either way.

In my case -£2.30 in the red. On our £1825 investment. Of course, we would never ever do this with real money on such a stock buy it then sell it straight away. Unless you know what you are doing obviously.

So, now we can click on coca-cola in our portfolio and from here we can hit sell.

It will give us the same window as when we bought them. Choose how many shares you want to sell and hit sell.

Confirm the sale with the send sell order button. You just bought then sold your first shares!

Do you want to get a free stock share worth up to £100?

Create a trading 212 invest account using this link www.Trading212.Com/invite/fma3scnl and we both get a free share! A free share to get you started on the dividend investing journey with me.

Trading 212 2FA 2 factor security

What I strongly recommend you do now is go back to the same menu with the three little horizontal lines. This time select the settings menu.

From here you will want to enable password lock. With a password lock, you can set a password along with an inactive time for it to trigger.

Personally I have it set to use my fingerprint with immediate for the timeout.

This will stop prying eyes from opening the app. If someone is looking at your phone or god forbid you to lose it.

Security is a high priority, that’s why I thought it best to include this section in my trading 212 for beginners guide.

Recently, trading 212 2FA or 2 factor authentication was released.

I have enabled it immediately as you should too. You will to download google authenticator to be able to use it.

Once enabled your trading 212 is now much more secure.

I hear the question a lot. Is trading 212 secure? Yes, even more so now that 2FA is can be enabled.

I did a dedicated post on how and why trading 212 is safe – go an have a read, it should put to bed any fears you have.

Treat practice mode as real money

Pretty easy to buy and sell shares within the trading 212 app right?

Indeed it is, I encourage you to have a play around in the app and or on the web app. Get comfortable with the buying and selling process, double-checking the amount is correct before committing.

Start using the practice money as if it were real money.

If you have a budget of £500 then only spend £500 of the practice money.

Use the practice account as long as you need it.

Before switching back over to real money. You do not want to accidentally buy 50 shares when you only meant to buy 5 for instance.

It’s pretty unlikely this would actually happen as you do have to confirm the orders – just pay attention to every real order and every practice order.

Now, are you ready to switch back over to real money? Take as long as you need.

Switch to real money

Once you are ready, hit the three little horizontal bars again and scroll down to switch to real money.

You should now be feeling confident in buying and selling shares. Deposit some real money and buy your first real shares! Exciting isn’t it.

Once again, just take it slow at first. You can always deposit more capital later – it is instant and there are no fees to worry about. So just dip your toes in the water for now.

Hold your horses though, a couple more things, trading 212 for beginners next section is of the utmost importance.

Want a nice way to track your investments and dividends? Checkout my dividend tracking spreadsheet

Check out my portfolio and posts on trading 212 growth investing, alongside my main goal of dividend investing.

Stock research

Now that you have a real-money funded account. You must do some research to determine what companies your wish to invest in.

Some great information on each company can be found within the trading 212 app its self.

Another great resource is seeking alpha. Whatever path you choose in your investment portfolio, whether you choose to base your portfolio on trading 212 dividend investing. Maybe a portfolio structured around exchange-traded funds or even a more growth-focused portfolio.

Doing research and evaluating the risk is a crucial part of investing and not to be missed.

New investors will often chase a high dividend yield but there is normally a good reason the yield is so high so be cautious.

Now you have read my trading 212 for beginners guide. You should be more confident in using the platform to its fullest, putting the basics of using trading 212 into action you will be an investing master in no time.

Trading 212 free share

Importantly, make sure you do sign up with the referral link to claim the free share. You can always enter my code in the promo code section of your app as well if you already signed up without claiming a free share. Fma3scnl

Sign up with the link below to get started now.

Do you want to get a free stock share worth up to £100? You only need to deposit £1 to get the free share!

We both get a free share!

Freetrade free share

Freetrade is a competitor of trading 212 that also runs the same free share promotion. The platform is nothing compared to trading 212 but you might as well put £1 in and grab the free share of them!

Invest in stocks and etfs commission-free. Sign up here with your email and get a free share worth up to £200 to get started.

Https://freetrade.Io/freeshare/?Code=2KMSDN703F&sender=qlkz36uf

Grab your free share while you still can. You may get lucky and get a £200 one.

I keep freetrade as a backup. Potentially I may use it when they have matured some. For now, though, do what I did and sign up just for the share.

None of the above should be used as financial advice, I am not a professional. Always do your own research.

How to start trading forex (4 steps)

Welcome to the world of forex. There might be many reasons why you are reading this article. It could be that your friend or acquaintance mentioned about how they trade and perhaps even make a living by trading forex. Whatever your reasons may be; this article will give you an overview of the forex markets and how to start trading forex … and perhaps make money for yourself.

Step 1. What is forex?

Step 2. Learn forex basics

Step 3: find a forex broker

Step 4: start trading

Step 1. What is forex?

Forex, or foreign exchange is an unregulated market, also known as OTC (over-the-counter) and is the biggest market with average daily turn-over that runs into billions. It is even bigger than the US stock markets. Although due to its OTC nature, no one can really give the correct numbers as to the forex turnover. But nonetheless, forex is indeed a big market and thus allows many market participants. From your neighborhood bank to specialized investment companies, to your friend; the forex markets always offers a piece of the action whoever you are and wherever you are (even from your home).

The basic concept of trading forex is very simple. You trade or speculate against other traders on the direction of a currency.

So, if you believe that the euro is going to rise, you would BUY the euro, or SELL the euro if you think the euro would fall. It’s as simple as that.

Step 2. Learn forex basics

Before you get ready to deposit your funds and start trading there are some important points you must understand, each of which are outlined below.

Forex brokers: in order to start trading forex, you will need to trade with the help of a forex broker. There are many forex brokers out there today who allow you to open a forex trading account for as little as $5. The forex broker is the one who facilitates your buy and sell orders and also allows you to research into the markets (also known as technical or fundamental analysis) to help you make more informed decisions… and of course allows you deposit more funds or withdraw your profits when you want to. ( click here to see our forex brokers rating )

Trading platform:you need a trading platform from which you can place your trades, which are then sent to the broker for settlement. Also, a trading platform is essential for you to conduct your technical analysis and also to see the current market prices. Most retail brokers offer the MT4 (short for metatrader 4) trading platform, which is free of cost. You can also open a demo trading account and practice trading with virtual money to gain the experience required before trading with real money.

Forex trading hours:while you might have heard that the forex markets never sleeps, it actually does. Firstly, you won’t be able to trade on weekends (saturday and sundays). But for the rest of the week, the forex market operates 24 hours a day. This is due to the fact that forex trading is global. At any point in time, you will always find an overlap of a new market session while the previous market closes. What time of the day or which market session you trade plays a big role if you are an intra-day trader or a scalper. This is another vast topic, which we will cover at a later stage. ( click here to learn more about forex trading hours . )

Now that you have a basic overview of the forex markets, here are some final pointers to remember before you start trading for yourself.

What is a pip?:pip is a measure of change in a currency pair’s value and is the 5 th decimal. For example, if EURUSD changes from 1.31428 to 1.31429, the change is denoted as 1pip (1.31428 – 1.31429 = 0.00001). When you trade, the more pips you make, the more profit you have. Ex: buying EURUSD at 1.31428 and selling (or closing your trade) at 1.31528 would give you 100pips in profit. ( read more about forex PIP )

Reading quotes: forex quotes are presented in a bid and ask price (both of which vary by a few pips and from one broker to another). The bid price is the price at which you can buy and the ask price is the price as which you can sell. So, a EURUSD quote would look like this 1.31428(bid)/1.31420(ask).

What is a spread?: spread is nothing but the difference between the bid and ask price. So in the above example, for 1.31428/1.31420, the spread would be 8 pips. ( read more about forex spread)

What is a leverage?: leverage is the amount by which you can request your broker to magnify (or increase) your trade value. Leverage is often quoted in ratios such as 1:50, which means that when trading on a 1:50 leverage, your $100 is magnified to $50000. Leverage is a big topic in itself and it is recommended to read this article to learn more. Leverage is important both in terms of making profits as well as managing risks and therefore, your trades.

What is a lot?: A lot is a unit by which you place your trade. In financial terms, a lot is also referred to as a contract. There are preset lots (or contract sizes) that you can trade. For example a standard lot is nothing but 100,000 units (known as 1 lot). ( read more about lot)

Reading charts: the ability to understand and read the charts is very essential to trading. Depending on your approach, you can choose between a line, bar or candlestick charts and trade accordingly (for example trading based on candlestick patterns). ( read more how to read forex charts)

Placing orders (how to buy and sell): in forex trading, it is possible to either buy or sell any currency pair. Most trading platforms, give you this option. You buy when you think that price will go up and you sell when you think that price will fall. There is a common terminology used in forex trading, which is buy low, sell high; which is an important point to remember. ( read more how to place orders with MT4 )

Order types: besides buy and sell, another point to remember the types of orders. There are two basic order types: market orders and pending orders. When you click on ‘buy’ or ‘sell’ you are basically buying (or selling) at the current market price. A limit order on the other hand tells the broker that you want to buy or sell only at a particular price. ( read more about types of forex orders)

Step 3. Find a forex broker

As mentioned, there are many forex brokers today and therefore it can get confusing on how to choose the forex broker that is right for you. To briefly summarize, remember the following points while choosing a forex broker:

- Look for a forex broker that is regulated

- See if the forex broker offers a minimum deposit amount

- What is the leverage that the broker offers

- What is the minimum contract size that you can trade

- Bonuses and the terms and conditions (see on our site list of forex deposit bonuses and forex no deposit bonuses)

- Deposit and withdrawal types as well as the terms and conditions

- Trading methods that are allowed by the broker

We can also help you choose a forex broker by reading our article how to choose forex broker

Step 4. Start trading

Finally, now that you have selected a forex broker to trade with it is recommended to first open a demo trading or a practice account. Most forex brokers offer unlimited demo trading account (but will be deactivated if not used for 30 days). This is a good way to get acquainted with the forex markets and also help you to understand your trading style (scalper or intra day trading, swing trading, etc) and approach (fundamental or technical analysis). You can search for various trading methods and systems or you can develop one yourself when you have a good understanding of technical or fundamental indicators.

Conclusion:

Forex trading is one of the most active and dynamic ways to trade the financial markets. At the heart of everything, it is the basic fluctuations in currency values which drives everything else. Learning to trade forex and understanding the forex markets can give a good foundation to trading other markets such as derivatives or equities.

So, let's see, what we have: active trading is quite different from casual investing and you might need more capital than you think. At money for trading

Contents of the article

- My list of forex bonuses

- How much money do you need to start trading?

- Trading expenses

- Brokerage requirements

- Special considerations

- Other things to look for

- How do you make money trading currencies?

- Buying and selling currency explained

- Advantages for active traders

- Disadvantages for passive investors

- Getting started with forex

- How to make money trading - 2 keys to success

- Develop your edge and trading strategy

- How to make money trading

- How to make money fast

- Trading for a living: can it be done?

- How to make money through compounding

- Stock trading: how to get started and make more...

- What is stock trading?

- Different types of stock traders in the market

- Common money-making trading strategies

- 1. Value investing strategies

- 2. Technical analysis trading

- 3. Financial derivatives trading (options trading)

- 4. Algorithmic trading

- Rise of passive investing

- Conclusion

- Money flow index

- Calculation of the money flow index

- Use of the money flow index

- Trade examples

- Conclusion

- Charity trading: selling goods and services

- What trading is

- Types of trading

- Primary purpose trading: selling to further your...

- Non-primary purpose trading: selling to raise...

- Mixed trading

- How to protect your charity from losing money

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Trading 212 guide for beginners

- Trading 212 guide for beginners

- My trading 212 PIE library

- How to open A trading 212 account

- Trading 212 practice mode

- How to buy shares on trading 212

- How to sell shares on trading 212

- Trading 212 2FA 2 factor security

- Treat practice mode as real money

- Switch to real money

- Stock research

- Trading 212 free share

- Freetrade free share

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

Contents of the article

- My list of forex bonuses

- How much money do you need to start trading?

- Trading expenses

- Brokerage requirements

- Special considerations

- Other things to look for

- How do you make money trading currencies?

- Buying and selling currency explained

- Advantages for active traders

- Disadvantages for passive investors

- Getting started with forex

- How to make money trading - 2 keys to success

- Develop your edge and trading strategy

- How to make money trading

- How to make money fast

- Trading for a living: can it be done?

- How to make money through compounding

- Stock trading: how to get started and make more...

- What is stock trading?

- Different types of stock traders in the market

- Common money-making trading strategies

- 1. Value investing strategies

- 2. Technical analysis trading

- 3. Financial derivatives trading (options trading)

- 4. Algorithmic trading

- Rise of passive investing

- Conclusion

- Money flow index

- Calculation of the money flow index

- Use of the money flow index

- Trade examples

- Conclusion

- Charity trading: selling goods and services

- What trading is

- Types of trading

- Primary purpose trading: selling to further your...

- Non-primary purpose trading: selling to raise...

- Mixed trading

- How to protect your charity from losing money

- What is forex trading and is it right for me?

- What is forex trading?

- Forex trading terminology

- Can you get rich by trading forex?

- Who does forex trading

- Final thoughts on forex trading

- Trading 212 guide for beginners

- Trading 212 guide for beginners

- My trading 212 PIE library

- How to open A trading 212 account

- Trading 212 practice mode

- How to buy shares on trading 212

- How to sell shares on trading 212

- Trading 212 2FA 2 factor security

- Treat practice mode as real money

- Switch to real money

- Stock research

- Trading 212 free share

- Freetrade free share

- How to start trading forex (4 steps)

- Step 1. What is forex?

- Step 2. Learn forex basics

- Step 3. Find a forex broker

- Step 4. Start trading

- Conclusion:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.