Trading app with free real money

Besides the best free trading apps, we have also selected the best trading apps for charting, trading ideas, market data, news, and learning.

My list of forex bonuses

And now, let's see the best free trading apps in 2021!

Best free trading apps in 2021

Mobile apps became very popular. They make your life a lot easier. There is an app for everything now. You can buy flight tickets, book a hotel or trade on the stock exchange.

There are a lot of trading apps out there so, to save you time, we selected the best free trading apps for you. Apps providing free stock and ETF trading are gaining popularity, so it is worth taking a look at them if you don't want to spend fortunes on your trading fees!

What are trading apps great for?

Trading apps can be used for trading, learning, charting, finding trading ideas, and also for market data and news. Some of the apps offer all of these features, while others only a few. Don't worry, we have made trading app top lists for all of these features!

Trading apps are usually offered by financial companies such as online brokers or banks. These apps can be great add-ons to your web or desktop trading platform, but they can also be the flagship product of a company, for instance in the case of robinhood and freetrade.

We see trading apps as excellent complementary tools to web-based trading platforms and other financial portals. When you want to buy a stock, you can make fundamental or technical analyses on a computer more conveniently, but it's easier to follow the price of the stocks you've already bought through a trading app. You can also intervene faster via an app, when, for example, you quickly need to sell your stocks.

And now, let's see the best free trading apps in 2021!

| app | approves clients from | app score | US stock trading fee |

|---|---|---|---|

| robinhood | US | 5.0 stars | $0.0 |

| trading 212 | globally | 4.9 stars | $0.0 |

| merrill edge | US | 4.8 stars | $0.0 |

| TD ameritrade | US, china, hong kong, malaysia, singapore, thailand, taiwan, canada (through TD direct investing) | 4.8 stars | $0.0 |

| freetrade | UK | 4.7 stars | $0.0 |

Just to make it clear again: with these apps, you can trade stocks and etfs for free.

Besides the best free trading apps, we have also selected the best trading apps for charting, trading ideas, market data, news, and learning.

| Name | best apps | score |

|---|---|---|

| best apps for charting a nd trading ide as | ||

| tradingview | best app for charting | 5.0 |

| stocktwits | best app for trading ideas | 5.0 |

| best apps for market data and news | ||

| investing.Com | best app for market data | 5.0 |

| bloomberg | best app for market news | 5.0 |

| best apps for learning | ||

| invstr | best app for learning to trade | 5.0 |

| trading game | best app for learning forex trading | 4.0 |

Now, let's take a closer look at the best trading apps in 2021!

Inside robinhood, the free trading app at the heart of the gamestop mania

Robinhood’s free-trading revolution helped pave the way to the recent reddit mayhem on wall street.

The rise of robinhood means that the ability to buy stocks, on a whim, is now at everyone’s fingertips. Robinhood has opened investing up to the masses.

Rival online brokerages were forced to mimic robinhood’s zero-commission business model, and some joined forces just to survive.

Gone are the days when sophisticated trading strategies such as options trading and leverage are left to the rich guys on wall street. Free trading, coupled with reddit’s message boards, have leveled the playing field — for better or worse.

“there’s a cultural shift happening,” vlad tenev, robinhood’s co-CEO and co-founder, told CNN business in an interview conducted before the reddit mob teamed up to send gamestop, AMC and other stocks to the moon. (robinhood declined follow-up questions about the reddit phenomenon.)

“there’s a large group of people that think investing is this serious thing for only if you’re wearing a suit in front of your terminal,” said tenev, who was born in soviet-era bulgaria. “that’s kind of been the legacy school of thought.”

Wallstreetbets has shattered that notion.

‘the access is the biggest part’

The reddit community has captivated the financial world by teaming up to set off epic short squeezes that are hammering hedge funds and other firms. Gamestop alone has skyrocketed an unfathomable 1,500% this year.

The redditors have targeted companies that are popular among short-sellers, who bet that a stock will fall by borrowing the shares and selling them — with the hope of buying them back at a lower price and pocketing the difference. Short-selling is extremely risky because, in theory, the losses are infinite.

None of this would be possible without free trading and the availability of cheap borrowed money, which amplifies the bets.

“the access is the biggest part — easy, free, readily available,” jaime rogozinski, who founded wallstreetbets nine years ago, told CNN business’ julia chatterley on thursday. “they’re able to instantly get in there and participate and start using these sophisticated leverage tools that are able to exploit the asymmetry of money. They’re forcing the hands of the big guys.”

Tenev said that the old-school thinking that you need a suit to invest is “correlated with thinking that investing is mainly for wealthy people.”

“our approach is a little bit different, which is that you don’t have to be wealthy to do it,” the robinhood co-founder said. “you don’t have to have a ph.D in finance. You don’t have to pore through fundamental analysis, or technical analysis in particular and look at moving averages.”

Indeed, the wall street bets movement shows the impact that retail investors can have when they team up. Although some reddit users are placing their bets based on fundamental analysis, many are motivated by a populist desire to punish hedge funds and other elite investors.

Outlawing gamestop purchases

Robinhood has been the subject of criticism during the gamestop saga — from all sides.

Some see the episode as proof of how free trading, and rock-bottom interest rates, can backfire. In essence, the normal functioning of capital markets has been disrupted by an online mob.

At the same time, robinhood has angered the wallstreetbets community and others by restricting trades on highly volatile stocks this week.

First, robinhood, like other brokers, ramped up margin requirements on both gamestop and AMC to 100%, signaling a deep concern about the extreme volatility in the stocks.

Margin accounts allow investors to buy stocks and other securities with borrowed money. To guard against sharp selloffs, investors must maintain a minimum amount of equity as long as they hold onto the stock.

Robinhood went a step further thursday by banning users from buying gamestop, AMC, best buy, bed bath & beyond, nokia and other reddit darlings. Other brokers took similar steps.

Wallstreetbets trained their ire on robinhood, arguing it’s unfair that retail investors can’t buy these stocks but wall street can.

“so much for being on the side of the little guys like robinhood,” one user wrote. “just another shill brokerage paid off by the big players. I’ll be switching to another brokerage once this is over and I hope everyone here does too.”

Barstool sports founder dave portnoy slammed the decision in a series of tweets.

“either @robinhoodapp allows free trading or it’s the end of robinhood. Period,” portnoy said.

Both republican ted cruz and democratic rep. Alexandria ocasio-cortez promptly called for an investigation into the robinhood decision — an unlikely meeting of minds.

Hours after implementing the restrictions thursday, robinhood appeared to backtrack, saying it would resume limited buys on those securities starting friday.

“this was a risk-management decision, and was not made on the direction of the market makers we route to,” robinhood said in a blog post. “we’re beginning to open up trading for some of these securities in a responsible manner.”

The company said the move was made to keep robinhood in line with requirements it must adhere to as a brokerage firm, such as SEC net capital obligations and clearinghouse deposits.

“some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment,” it said in the post. “these requirements exist to protect investors and the markets and we take our responsibilities to comply with them seriously.”

During a thursday evening interview with CNBC, tenev added that the company drew on credit lines thursday as a “proactive measure” because clearinghouse deposit requirements dictate how much the company could allow customers to buy certain stocks.

“in line with our mission and what we want to do, we want to put ourselves in a position to allow our customers to be as unrestricted as possible in accordance with the requirements and the regulations,” he said. “we pulled those credit lines so we could maximize, within reason, the funds we have to deposit at the clearinghouses.”

Outages and tragedy

The reddit drama is just the latest in a string of controversies surrounding robinhood.

With its user growth skyrocketing, the app emerged as a pandemic winner. People stuck at home, some of them with stimulus checks to spend, discovered how easy it was to bet on stocks.

Robinhood was awarded an $8.6 billion in a round of funding in july — only to raise another $200 million at an even fatter $11.2 billion valuation in august.

But robinhood didn’t invest enough in the infrastructure needed to handle all the users flocking to the app. It suffered dozens of outages and disruptions in 2020, including one that prevented robinhood users from participating in an epic rally in early march.

In the interview, tenev said robinhood has made “huge improvements” in system resiliency and redundancy to minimize the risk of similar outages. Yet robinhood did suffer disruptions earlier this week during surging trading volume, according to downdetector.

Robinhood has also drawn scrutiny from lawmakers and regulators.

In june, the family of a 20-year-old college student said he died by suicide after confusion over an apparent negative balance of $730,000 on his robinhood account. The student was using the app to trade options and his family believed he was misled by robinhood’s interface.

Robinhood’s co-founders said they were “personally devastated by this tragedy” and in response announced a series of changes to its options offering and user interface.

‘tough but extremely rewarding’

Last month, regulators accused robinhood of luring inexperienced investors with gaming elements such as colorful confetti and other aggressive marketing techniques. Robinhood disagreed with the allegations.

The securities and exchange commission accused robinhood of deception over the app’s disclosures around payment for order flow, the practice where brokerages get paid to route trades through market makers such as high-frequency trading firms. Without admitting guilt, robinhood agreed to settle the SEC case with a $65 million fine.

To deal with its regulators, robinhood has beefed up its management team, including by hiring former compliance executives from fidelity and wells fargo and by naming former SEC commissioner dan gallagher its chief legal officer.

“it was tough,” tenev said of 2020, “but extremely rewarding to work through these challenges and make it through the other side. We’re much stronger as a company than we were at the beginning of 2020.”

That’s good, because the past few weeks suggest 2021 won’t be a walk in the park either.

– clare duffy contributed to this report

5 trading apps with free bonuses

Who doesn’t love a great bonus? We do. We’ve complied the best trading apps with free bonuses so that you can start your trading off with a bang.

Let’s have a look at the best free bonus trading apps.

1. Moomoo

Best for: US stock traders & investors

Bonus: 3 free stocks (up to $1,250)

Moomoo offers a great free bonus offer for new registrations. You can grab 3 free stocks valued up to $1,250.

2. Currency.Com

Best for: crypto traders

Bonus: up to $100

Currency.Com is a free, regulated trading app which gives you a random bonus of up to $100 USD value when you sign up, complete verification and make a deposit.

3. Coinbase

Best for: cryptocurrency enthusiasts

Bonus: $10 free bitcoin

Free bitcoin? Why not! Coinbase offers a $10 free bitcoin bonus offer to new registrations who use an invite link to sign up. The bonus is deposited into your coinbase account.

You have to trade at least $100 of cryptocurrency to get the $10 bonus. After you get the bonus, you can trade it or withdraw it to your bank account or paypal.

4. Webull

Best for: US traders

Bonus: 2 free stocks (up to $1,400)

Webull is a popular alternative commission trading app. When you deposit any amount, you will get 2 free stocks worth up to $1,400 – cool right? The difference between this bonus is the value – it’s up to a huge $1,400. Will you be lucky? Find out by grabbing your free stocks today.

You can sell the free stocks and withdraw them directly to your bank account.

Best for: anyone

Bonus: free VPN

XM is one of the world’s leading CFD trading apps. They’re currently running a neat promotion which gives you a free trading VPN – don’t miss out on it! Sign up for a free XM account today.

Summary

There are a ton of awesome free bonuses on trading apps, it’s hard to choose the best ones, but these are our personal favourites.

There’s no limit to how many bonuses you can redeem you can get, so why not try them all?

Here’s our final roundup of the best free bonus trading apps.

- Currency.Com: best overall

- Moomoo: best for advanced traders

- Coinbase: best for cryptocurrency traders

- Webull: best for US traders

- XM: best for everyone

Have you seen any other awesome free trading bonuses? Let us know in the comments!

About us

Trading apps is your trusted guide to the world of trading on mobile applications. We test and review hundreds of trading apps to bring you the best. Learn more about us on our ‘about‘ page.

Best free broker apps

Sarah horvath

Contributor, benzinga

Jump straight to webull! Now open to ALL stocks.

Anyone from online brokers to robo advisors offer free stock trading for new account holders. And now, with robinhood finding wild success, you’ll find another new class of online brokerages looking to compete in the free stock trading world. With new brokerages and free stock trading promotions popping up, they can be hard to keep track of.

Every month, benzinga hunts down where you can trade for free and puts the brokers in the list below. You can check back on the 1st of each month for more exclusive deals, promotions and other opportunities for free trades. If you’re looking for a new brokerage, it’s also worth it to check out benzinga’s picks for the best online brokers to compare services, fees, and other features.

Best free stock trading brokers and apps:

- Best for active stock traders: tradestation

- Best mobile brokerage: webull

- Best for day traders: TD ameritrade

- Best mobile app: moomoo

- Best for all levels: charles schwab

- Best for retirement savers: E*trade

- Simplest platform: vanguard

- Best for access to foreign markets: interactive brokers

- Best for passive traders: M1 finance

- Best for free trades: firstrade

- Best for beginners: robinhood

Best free broker apps:

Commissions

Account minimum

Best for

1. Tradestation

Signing up for an account with tradestation is intuitive and simple. You’ll begin by choosing the type of account you want, entering a little personal information, answering a few questions about your experience level and agreeing to the company’s terms of service.

A tradestation representative will review your application and open your account. As soon as your account is open you can begin funding your account and making trades.

If you’re new to trading, you’ll love tradestation’s simulated trading tool. Its simulated trading tool allows you to practice entering buy and sell orders, using tradestation’s suite of charting and analysis tools and using your trading strategy without risking any of your own money. Though it was originally aimed at professional investors, tradestation now offers a wealth of education options that brand new traders can understand and use.

Tradestation offers traders a variety of affordable equity and contract trading options. You can currently trade stocks, bonds, mutual funds, etfs, futures, options and cryptocurrencies on tradestation’s platform. For each asset, you can use tradestation’s comprehensive platform to inform your trades and screen by your chosen set of indicators.

Commissions

Account minimum

Best for

2. Webull

Webull is a mobile app-based brokerage that features commission-free stock and exchange-traded fund (ETF) trading. It’s regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA).

Webull offers economic calendars, ratings from research agencies, margin trading and short-selling. Its intuitive trading platform is complete with technical and fundamental analysis tools. Its a solid option for active intermediate and advanced traders.

You’ll enjoy commission-free trading for more than 5,000 different stocks and etfs. There are no maintenance or software platform fees, and no charge to open or maintain an account.

Commissions

Account minimum

3. TD ameritrade

TD ameritrade offers the best of both worlds. On one hand, 0-commission trading and a vast library of educational articles and videos make TD ameritrade ideal for a new investor’s first brokerage account. On the other hand, technology like the thinkorswim platform gives accomplished traders the tools needed to pull off labyrinthine options trades or sell livestock futures at 3 a.M.

TD ameritrade has developed a user-friendly platform and tries to appease investors of all shapes and sizes. From account signup to trade execution, the process is smooth and painless. New accounts can be opened in minutes and a variety of different options are available, including retirement vehicles like roth iras and custodial accounts like UTMA/UGMA and 529 plans.

TD ameritrade has several ways to get in contact with their support staff. The easiest way to get in touch is via phone. Ameritrade offers 24/7 phone support for both new and existing clients. Finding an exact email address is difficult though — you’ll just be directed to a form located on the website, which means a back-and-forth email conversation is difficult. Text support is also available, but live chat options only occur during normal working hours.

Commissions

Account minimum

Best for

4. Moomoo

Moomoo’s powerful app, complete with an intuitive investing platform, isn’t just for first-time investors. In fact, you can get level 2 market data, charts and technical indicators, 3rd-party ratings and insights, capital flows, graphs and more.

Don’t miss out on conditional alerts, its customizable stock screener and more. It’ll improve your trading experience. Don’t miss out on moomoo’s great deals on U.S stocks, adrs, etfs and options. Learn more.

Commissions

Account minimum

Best for

- 3 trading platforms perfectly in sync makes matching your platform to your skill level a snap

- Excellent futures trading education for new traders

- $0 account minimum means anyone can start trading

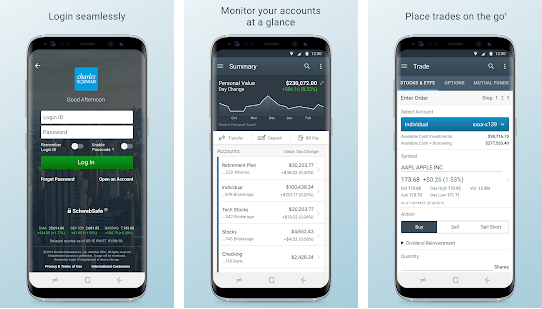

5. Charles schwab

Charles schwab’s primary desktop trading application, streetsmart edge, is a customizable trading platform you can use to chart, track and place informed trades. The platform is responsive, updating market data on a second-by-second basis. Streetsmart edge is completely customizable.

You can set individual stocks, funds or watchlists to populate immediately when you load up your app. You can also customize your layout by dragging and dropping different windows into specific areas of your screen.

Charles schwab offers traders both online and in-app education tools you can use to improve your trading strategies and learn how to more effectively save for retirement. Let’s take a look at 3 unique education tools offered by charles schwab

Charles schwab offers you full access to the U.S. Stock market, allowing you to buy and sell over 11,000 stocks and 2,000 etfs with no commissions. Charles schwab’s smartstreet edge includes a number of screening tools, including average expert rating, daily movement, average daily trading volume, price, beta rating and much more.

In addition to U.S.-based equities, traders can also invest in 30 foreign markets and a separate set of screening tools are available for foreign and developing markets. Charles schwab also offers access to over 3,000 mutual funds — though few funds come with $0 commissions.

Commissions

Account minimum

Best for

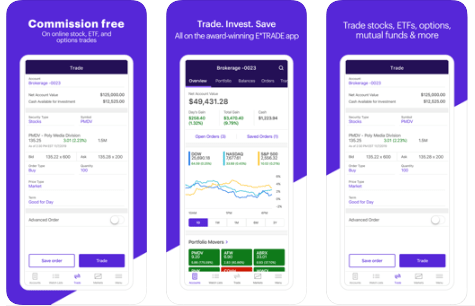

6. E*TRADE

E*TRADE leverages multiple platforms, 2 different mobile apps and a variety of account types and financial services to provide an inclusive brokerage experience. Most brokers aim their platform toward a specific type of investor, but ETRADE offers a little something for everyone. Does this overburden the trading system? Not at all.

E*TRADE offers 3 main avenues for providing clients with research and education to improve not only their trading acumen, but to better understand investing and markets. E*TRADE will walk you through the process of trading on their platform in a way no other broker does.

Stocks, etfs, and (most) mutual funds are free to trade on E*TRADE, but that doesn’t stand out much anymore. Mutual fund and ETF screeners are also free, even if you don’t have an E*TRADE account. Search through over 2,300 etfs and 9,000 mutual funds, sorted by asset allocation, leverage, expense ratio, morningstar rating and more.

Use the advanced search feature to look for securities based on risk profiles and technical indicators. E*TRADE’s standard E*TRADE mobile app and power E*TRADE are free to clients on both ios and android, but they serve different purposes. E*TRADE web mobile is aimed at the buy-and-hold, “set-and-forget-it” type of investor, while power E*TRADE mobile seeks out the day trading and derivatives crowds.

Commissions

Account minimum

Best for

- Retirement savers

- Buy-and-hold investors

- Investors looking for a simple stock trading platform

7. Vanguard

Vanguard was the 1st to offer low-commission trading on inexpensive index funds based on consumer-friendly investment principles. Day traders might not find vanguard’s old-school style appealing, but retirement savers, buy-and-hold investors and companies that seek employer-sponsored programs might want to take a gander.

Vanguard is the right place to be if investing is new and scary to you. The company offers a host of step-by-step guides to inform and educate clients about proper investment practices. Vanguard takes its fiduciary duty very seriously — you won’t be pushed into expensive investment products that benefit a salesperson more than you.

Vanguard offers a wealth of education and research materials, including some of the most in-depth reports on retirement planning you’ll find. Vanguard has the process down pat — an automated system asks about your retirement goals and makes suggestions pertinent to your situation. (in a way, vanguard was the first robo-advisor.)

Vanguard’s customer service reps are helpful and dedicated to serving clients. However, vanguard’s contact methods are a bit outdated. Email support can only be reached with an active account and phone support is only available during the week, from 8 a.M. To 8 p.M. Text and chat support options are also unavailable. Vanguard’s ahead of the curve in so many ways — but its customer support structure could use a facelift.

Pricing

Account minimum

Best for

- Access to foreign markets

- Detailed mobile app that makes trading simple

- Wide range of available account types and tradable assets

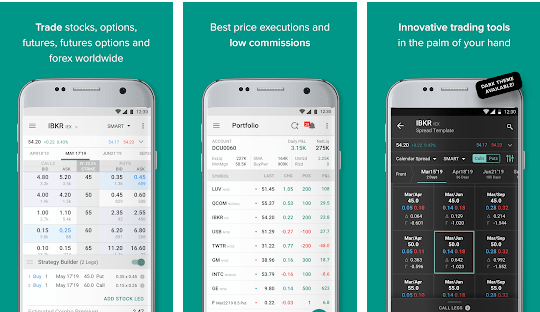

8. Interactive brokers

Interactive brokers (IBKR) is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. With access to over 125 global markets, you can buy assets from all around the world from the comfort of your home or office. Options, futures, forex and fund trading are also available — and most traders won’t pay a commission on any purchase or sale.

IBKR is geared primarily toward experienced investors. The platform offers limited assistance and can be a challenge for new users to become acclimated to. The broker’s tiered pricing strategy can also be frustrating for traders who focus on hourly or daily price movements.

IBKR has always been a top choice for professional brokers, but its new IBKR lite accounts can appeal to new investors looking to test the waters of trading. However, IBKR still maintains its host of professional tools and charting software. Outside of its trading platform, interactive brokers offers a wide range of educational tools and resources you can use to learn more about trading. Let’s take a look at a few of the free resources it offers to help you learn more about the markets.

Interactive brokers offers trades full access to the U.S. Stock market on both its pro and lite platforms. You can even access stocks listed on european and asian stock exchanges to buy and sell foreign securities. Most traders will pay $0 on all of their commissions, but high-value pro account holders may pay a fraction of 1 cent per share.

Commissions

Account minimum

Best for

- Don’t want to take an active role in portfolio management

- Need a large amount of hand-holding when it comes to selecting investments

- Want the option to invest in a socially responsible portfolio

9. M1 finance

M1 finance uses pies, which allow you to show your holdings as slices of a pie. All you need to do is assign a percentage to each slice, fund your pie and you have a portfolio of stocks. You also have the option to take advantage of M1’s ‘expert pies’ feature.

M1 finance has an in-house asset management team for those who prefer to invest passively but maximize returns. This feature is great for investors who are transitioning from a robo-advisor.

M1 really introduces something more than passive investing and other brokers might adopt the same or similar concept. Its strategy is based on a vision of its founder, who believes that in the future customers are not going to compare brokers based on fees. Instead, they are going to compare platforms. If this vision becomes a reality, investing is going to become more approachable and a lot more fun for retail investors.

It is difficult to diversify small accounts if you are trading with brokerage firms that allow only whole shares investing. M1 finance offers fractional shares investing. When you receive a dividend or when you add a small amount of money to your account, you don’t have to wait until you have enough to buy a whole share. M1 allows you to put your money to work immediately.

Commissions

Account minimum

Best for

- New traders looking for a simple platform layout

- Native chinese speakers seeking research and education tools in chinese

- Mobile traders who needs a secure and well-designed app

10. Firstrade

Firstrade’s platform offers the following:

- Manage and trade from one screen

- Adjustable layouts

- Customizable widgets

- Advanced technical charting

- Helpful graphs

- Position simulator

- Guides and podcast available for education purposes

You can monitor your portfolio’s performance easily with the firstrade mobile trading app, which offers a more dexterous option compared to a desktop. You’ll be exposed to a touch ID screen for ios devices, equity ratings and fundamental data, advanced charts, comprehensive dashboard and improved research and trading interface.

Firstrade offers varied customer service options, including live chat with a registered customer service representative monday through friday, 8 a.M. To 6 p.M. ET, or you can use the firstrade chatbot (named sammi), which is available 24/7.

Commissions

Account minimum

Best for

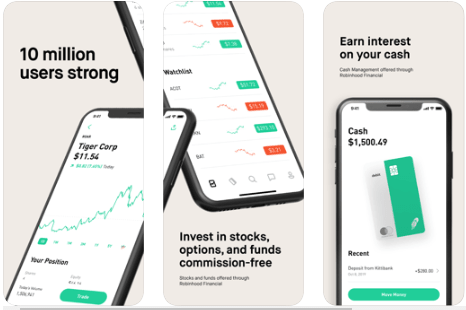

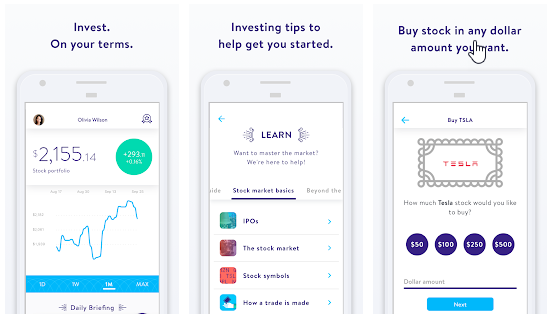

11. Robinhood

Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. Though its trading options and account types are limited, even an absolute beginner can quickly master robinhood’s intuitive and streamlined platform. On the other hand, more advanced traders might be frustrated by robinhood’s lack of technical analysis tools, a feature that’s now nearly universal across other platforms.

Robinhood only offers basic research tools. Though the brokerage has been making an effort to improve its options in recent months, the level of fundamental and technical analysis tools still pale in comparison to almost every other competing broker.

Robinhood gives traders access to the U.S. Equity markets, so you can buy and sell over 5,000 individual stocks and etfs. You can also buy and sell over 250 stocks listed on foreign exchanges — though the platform doesn’t give you access to full foreign markets like some competitors. All trades are made with $0 commissions, whether you’re using robinhood gold or a standard robinhood account.

One of robinhood’s strongest assets is its mobile app. Like the desktop platform, robinhood’s mobile app is streamlined, so even new traders can quickly buy and sell on the go.

Every commission-free stock trading broker app

With robinhood’s ever-increasing popularity, you may be curious where else you can trade stocks for free. Luckily, there are a number of new online brokers and robo advisors that offer free stock trading.

Robo advisors, like acorns and wisebanyan, offer managed accounts with zero commissions and low account minimums. These may be a great option for you if you’re looking to venture in the investing world and have goals, but might be too intimidated to pick your investments.

Other online brokers that offer self-directed trading accounts, like webull, M1 finance, firstrade and matador, give you the power to make their own trading decisions. These brokers aren’t bare-bones, either. They’re equipped with news feeds, great mobile experiences and investor education.

All free stock trading promotions for new account holders

While some brokers are completely free, a number of larger, more traditional online brokers offer free trades through other means. These free trades or cash bonuses through promotions for new customers or commission-free electronic funds transfers (etfs) for the life of the account.

The 1st offer is free stock trading for new account holders. The free stock trading windows will last anywhere from 2 to 6 months. While the free trading period doesn’t last forever, it can help users learn the platform, take time to absorb educational content and get more comfortable executing trades. After the period is up, account holders will be charged the standard commission rates.

Some brokers may even offer cash bonuses for initial deposits. Some brokers like ally invest will offer up to $3,500 for a large deposit. The bigger your deposit, the higher the cash bonus. The bonuses are usually deposited directly into your account.

Outside of the 2 offers above, many brokers offer commission-free etfs from ishares, wisdom tree and other popular ETF providers. In some cases, ETF fees can be as high as $20, so the savings can make a serious impact over time.

Turn to webull

0 commissions and no deposit minimums. Everyone gets smart tools for smart investing. Webull supports full extended hours trading, which includes full pre-market (4:00 AM - 9:30 AM ET) and after hours (4:00 PM - 8:00 PM ET) sessions. Webull financial LLC is registered with and regulated by the securities and exchange commission (SEC) and the financial industry regulatory authority (FINRA). It is also a member of the SIPC, which protects (up to $500,000, which includes a $250,000 limit for cash) against the loss of cash and securities held by a customer at a financially-troubled SIPC-member brokerage firm.

Inside robinhood, the free trading app at the heart of the gamestop mania

Robinhood’s free-trading revolution helped pave the way to the recent reddit mayhem on wall street.

The rise of robinhood means that the ability to buy stocks, on a whim, is now at everyone’s fingertips. Robinhood has opened investing up to the masses.

Rival online brokerages were forced to mimic robinhood’s zero-commission business model, and some joined forces just to survive.

Gone are the days when sophisticated trading strategies such as options trading and leverage are left to the rich guys on wall street. Free trading, coupled with reddit’s message boards, have leveled the playing field — for better or worse.

“there’s a cultural shift happening,” vlad tenev, robinhood’s co-CEO and co-founder, told CNN business in an interview conducted before the reddit mob teamed up to send gamestop, AMC and other stocks to the moon. (robinhood declined follow-up questions about the reddit phenomenon.)

“there’s a large group of people that think investing is this serious thing for only if you’re wearing a suit in front of your terminal,” said tenev, who was born in soviet-era bulgaria. “that’s kind of been the legacy school of thought.”

Wallstreetbets has shattered that notion.

‘the access is the biggest part’

The reddit community has captivated the financial world by teaming up to set off epic short squeezes that are hammering hedge funds and other firms. Gamestop alone has skyrocketed an unfathomable 1,500% this year.

The redditors have targeted companies that are popular among short-sellers, who bet that a stock will fall by borrowing the shares and selling them — with the hope of buying them back at a lower price and pocketing the difference. Short-selling is extremely risky because, in theory, the losses are infinite.

None of this would be possible without free trading and the availability of cheap borrowed money, which amplifies the bets.

“the access is the biggest part — easy, free, readily available,” jaime rogozinski, who founded wallstreetbets nine years ago, told CNN business’ julia chatterley on thursday. “they’re able to instantly get in there and participate and start using these sophisticated leverage tools that are able to exploit the asymmetry of money. They’re forcing the hands of the big guys.”

Tenev said that the old-school thinking that you need a suit to invest is “correlated with thinking that investing is mainly for wealthy people.”

“our approach is a little bit different, which is that you don’t have to be wealthy to do it,” the robinhood co-founder said. “you don’t have to have a ph.D in finance. You don’t have to pore through fundamental analysis, or technical analysis in particular and look at moving averages.”

Indeed, the wall street bets movement shows the impact that retail investors can have when they team up. Although some reddit users are placing their bets based on fundamental analysis, many are motivated by a populist desire to punish hedge funds and other elite investors.

Outlawing gamestop purchases

Robinhood has been the subject of criticism during the gamestop saga — from all sides.

Some see the episode as proof of how free trading, and rock-bottom interest rates, can backfire. In essence, the normal functioning of capital markets has been disrupted by an online mob.

At the same time, robinhood has angered the wallstreetbets community and others by restricting trades on highly volatile stocks this week.

First, robinhood, like other brokers, ramped up margin requirements on both gamestop and AMC to 100%, signaling a deep concern about the extreme volatility in the stocks.

Margin accounts allow investors to buy stocks and other securities with borrowed money. To guard against sharp selloffs, investors must maintain a minimum amount of equity as long as they hold onto the stock.

Robinhood went a step further thursday by banning users from buying gamestop, AMC, best buy, bed bath & beyond, nokia and other reddit darlings. Other brokers took similar steps.

Wallstreetbets trained their ire on robinhood, arguing it’s unfair that retail investors can’t buy these stocks but wall street can.

“so much for being on the side of the little guys like robinhood,” one user wrote. “just another shill brokerage paid off by the big players. I’ll be switching to another brokerage once this is over and I hope everyone here does too.”

Barstool sports founder dave portnoy slammed the decision in a series of tweets.

“either @robinhoodapp allows free trading or it’s the end of robinhood. Period,” portnoy said.

Both republican ted cruz and democratic rep. Alexandria ocasio-cortez promptly called for an investigation into the robinhood decision — an unlikely meeting of minds.

Hours after implementing the restrictions thursday, robinhood appeared to backtrack, saying it would resume limited buys on those securities starting friday.

“this was a risk-management decision, and was not made on the direction of the market makers we route to,” robinhood said in a blog post. “we’re beginning to open up trading for some of these securities in a responsible manner.”

The company said the move was made to keep robinhood in line with requirements it must adhere to as a brokerage firm, such as SEC net capital obligations and clearinghouse deposits.

“some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment,” it said in the post. “these requirements exist to protect investors and the markets and we take our responsibilities to comply with them seriously.”

During a thursday evening interview with CNBC, tenev added that the company drew on credit lines thursday as a “proactive measure” because clearinghouse deposit requirements dictate how much the company could allow customers to buy certain stocks.

“in line with our mission and what we want to do, we want to put ourselves in a position to allow our customers to be as unrestricted as possible in accordance with the requirements and the regulations,” he said. “we pulled those credit lines so we could maximize, within reason, the funds we have to deposit at the clearinghouses.”

Outages and tragedy

The reddit drama is just the latest in a string of controversies surrounding robinhood.

With its user growth skyrocketing, the app emerged as a pandemic winner. People stuck at home, some of them with stimulus checks to spend, discovered how easy it was to bet on stocks.

Robinhood was awarded an $8.6 billion in a round of funding in july — only to raise another $200 million at an even fatter $11.2 billion valuation in august.

But robinhood didn’t invest enough in the infrastructure needed to handle all the users flocking to the app. It suffered dozens of outages and disruptions in 2020, including one that prevented robinhood users from participating in an epic rally in early march.

In the interview, tenev said robinhood has made “huge improvements” in system resiliency and redundancy to minimize the risk of similar outages. Yet robinhood did suffer disruptions earlier this week during surging trading volume, according to downdetector.

Robinhood has also drawn scrutiny from lawmakers and regulators.

In june, the family of a 20-year-old college student said he died by suicide after confusion over an apparent negative balance of $730,000 on his robinhood account. The student was using the app to trade options and his family believed he was misled by robinhood’s interface.

Robinhood’s co-founders said they were “personally devastated by this tragedy” and in response announced a series of changes to its options offering and user interface.

‘tough but extremely rewarding’

Last month, regulators accused robinhood of luring inexperienced investors with gaming elements such as colorful confetti and other aggressive marketing techniques. Robinhood disagreed with the allegations.

The securities and exchange commission accused robinhood of deception over the app’s disclosures around payment for order flow, the practice where brokerages get paid to route trades through market makers such as high-frequency trading firms. Without admitting guilt, robinhood agreed to settle the SEC case with a $65 million fine.

To deal with its regulators, robinhood has beefed up its management team, including by hiring former compliance executives from fidelity and wells fargo and by naming former SEC commissioner dan gallagher its chief legal officer.

“it was tough,” tenev said of 2020, “but extremely rewarding to work through these challenges and make it through the other side. We’re much stronger as a company than we were at the beginning of 2020.”

That’s good, because the past few weeks suggest 2021 won’t be a walk in the park either.

– clare duffy contributed to this report

14 best stock trading apps of 2021 (android & ios)

Try the digital way of stock marketing with stock trading apps. Stock trading has always piqued interest among investors since the time the stock exchange came into existence in the late 16th century.

However, earlier, the way of stock trading was via a middleman called stockbroker. The involvement of the stockbroker incurred hefty charges upon the investors in the form of commission payments to the broker.

With the digitalization of the stock industry, the way of stock trading has been revamped, eliminating the need to depend on the broker to conduct the stock business. The article ahead will talk about the 14 best online trading and investment apps to help you stay on top of global markets.

List of best stock market apps in 2021

Stock investment apps can differ as per the target audience. They can be designed either for beginners as well as for the banking sectors. Below is a curated list of the top stock trading apps to help you analyze market trends and make better investments.

1. Robinhood – investment & trading, commission-free

This is an ideal stock trade app as it is available free of cost to track the stocks independently. The app was launched even before the website came into effect. You don’t need to pay commission to anyone if you use this app.

Key benefits:

- You can look for your stock and then input your trade details and that’s all you need to do to get started with the app.

- You can’t deal with mutual funds or bonds on this app as it only supports stocks and etfs (exchange-traded funds).

- Recently, it started supporting bitcoins too.

- With the premium version of this online trading app – robinhood gold account, you can unlock other trading options like margin trading and extended trading hours.

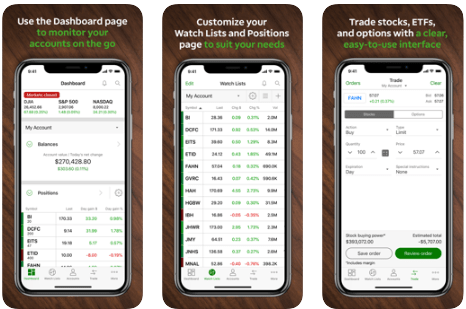

2. TD ameritrade mobile

This application can be considered among the best stock market app for iphone due to the excellent features with which it provides great user experience to the traders. This iphone app is a product of the most prominent stock trading firm in the US.

Key benefits:

- The TD ameritrade app is the most fundamental app of this firm.

- This app can help you with charts, technical indicators, market trends, and stock analysis.

- You also get to customize your dashboard, screens, etc.

- You can set customized market alerts and even receive personalized advice regarding your investments.

- The snap stock feature helps you acquire knowledge about a company with the help of the product barcode.

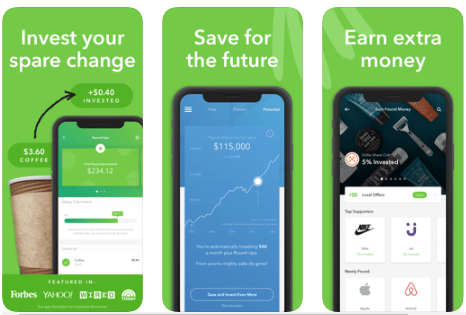

3. Acorns – invest spare change

If you are just stepping into the world of the stock market and have absolutely no idea where to start, then this is the best stock trading app for beginners.

Key benefits:

- With this app, you can invest selectively in etfs.

- You can get started by linking your bank account and then, let the app analyze your expenditure and savings.

- Post this; the app can automatically transfer the remainder of your sum into the acorns account and helpfully build up your stock and bonds portfolio.

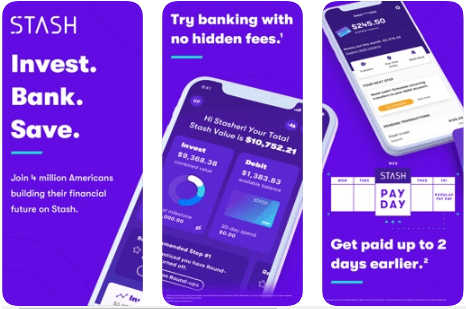

4. Stash: banking & investing app

This is another best place for beginners as it lets you learn about the stock market alongside growing your stock investments with the app.

Key benefits:

- You can get started by investing as little as $5. Investments are majorly into etfs and single stocks.

- There are many articles available to educate you about the stock market.

- The app has an exclusive feature which is the built-in ‘investment coach’ to help you with the investments.

5. E*trade mobile

This is an excellent android stock market app, as they have been in business long enough. They also own the optionshouse, which has its own trade supporting app.

Key benefits:

- Once you have installed the app on your android or ios device, you can then monitor the performance of your investments.

- You can also utilize the app to invest in stocks, etfs, mutual funds, and many more trade options.

6. Schwab mobile

This is exclusively designed for the banking sector as the all-in-one iphone and android app for stock trading. If you indeed hold a schwab account or are involved in investments with this bank, then this is the ultimate app for you.

Key benefits:

- Other than managing your investments, money transfers, and deposits, you can monitor your trade portfolio’s performance.

- Additionally, you can pay bills with this application. Hence, this is the app to fulfill all your banking needs.

- You can also examine the international market data with the help of this app.

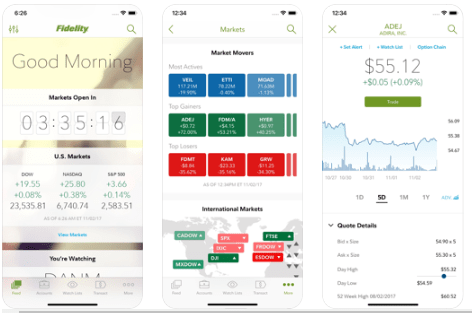

7. Fidelity investments

This application for stock marketing can be extremely beneficial for those who have fidelity investments. They have gained several accolades like – best overall online brokers, best for beginners, best for international trading, and many more.

Key benefits:

- The app has extensive features like recognia technical events and trefis stock valuation.

- The trade execution engine helps investors save more on stocks but the minimum investment should be on 500 shares or more.

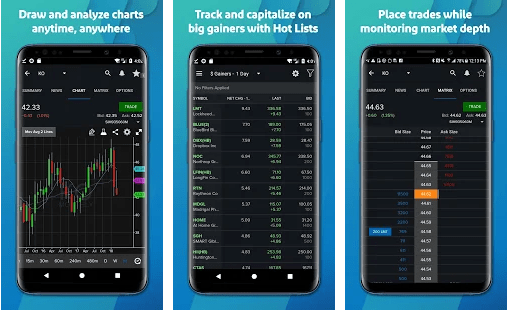

8. Tradestation

This is a preferred app for active stock trades. This app uses active traders like per share/per contract and unbundled pricing plans.

Key benefits:

- This app offers a flat-fee plan and tsgo plan which don’t require any commissions.

- The app uses sophisticated analytical tools.

9. IBKR mobile

This is the best trade app for stock investments. You get advanced tools and a variety of investment plan options.

Key benefits:

- With this app, investors and traders can undertake international trade easily.

- The app has low commission charges.

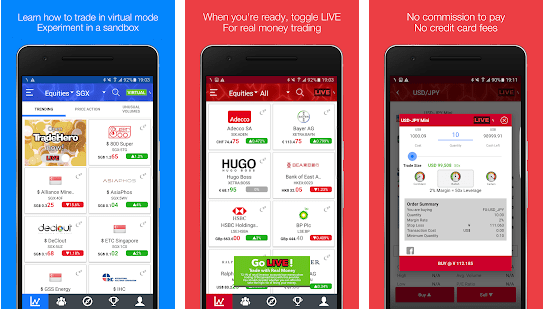

10. Tradehero

This android stock market game app lets you trade a $1,00,000 portfolio at actual stock prices but at the same time, since there is no real-time investment, therefore you bear no financial risk.

Key benefits:

- The app can be used with a promo code.

11. Stockpile

This is the best web-based stock market application for teens. You can not only undertake stock transactions with this app but also gift single shares of stock.

Key benefits:

- You can purchase fractional shares of expensive stocks of larger firms like google, berkshire hathaway, etc.

12. Webull – stock market tracking & free stock trading

The next best mobile trading app on this list that you can use for free U.S. Stock trading is called webull. It also helps you obtain real-time information about global stock markets to make better trading and investment decisions. Let’s have a look at some of its notable features.

Key benefits:

- It’s a free stock trading app, with no additional or hidden charges included.

- Webull provides you with in-depth stock insights of SENSEX, BSE, NIFTY, etc.

- Helps you provide the latest market news with 24*7 updates on major global companies and events.

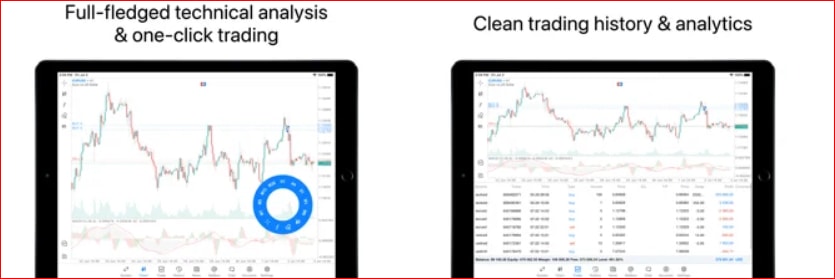

13. Metatrader 5

Metatrader 5 is a decent stock trading app of 2021 that services on both the ios as well as the android platforms. Designed to look after CFD trading and handle stocks well, this one is an app that is not limited to one broker.

- You can access this app with a set of advanced features and multiple technical indicators that take some weight off your shoulder.

- This stock trading app is covered with a powerful trading system and it renders all types of trading operations.

- It offers a chat feature alongside the push notifications, alerts and financial news.

14. Plus 500

Plus 500 rests among the best stock trading apps in 2021 that features noteworthy forex and CFD broker services. This one is neatly structured and super easy to navigate. If you are willing to up the level of your trading, plus 500 one is worth a shot.

- You can easily trade the CFD stocks and shares using this tool on your phone.

- This stock trading app offers real-time trading on major stocks and sends the price alerts.

- It is designed with a clean and intuitive user interface that makes the CFD stock trading less tangled.

To sum up: best stock market apps for trading & investment (2021)

These were some of the best stock trading apps you can use in 2021. Each of the above-listed stock analysis apps can help you significantly conduct your day-to-day investments in the stock market without having to depend on anyone.

From the point of beginners, you can make money by taking small baby steps in the field of trade and commerce. You can buy individual stocks and also opt to invest in low-risk mutual funds. You can also ideally invest in treasury securities. The primary stock trading apps can be of immense help, in the beginning, to understand the stock market correctly.

From the perspective of development, it is essential to focus on the target audience, the app platform, and the features to design the app accordingly.

Best stock trading apps

Leading software analyst in fintech, crypto, trading and gaming. An active trader and cryptocurrency investor.

Disclosure:

We may receive compensation when you click on links. Neither our writers nor our editors get paid to publish content and are fully committed to editorial standards .

Following the expansion of online businesses, people are given an opportunity to try themselves in just anything they are interested in. In case you’ve always wanted to be a stock trader but starting this type of business was too expensive and required a lot of effort, now it’s the right time to start earning with great and easy stock trading apps you will learn about in this article.

Best stock trading apps

Warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 71-89% of retail investor accounts lose money when trading cfds. Also some parameters like margin can be volatile according to market trends.You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Warning. 71% of retail investor accounts lose money when trading with etoro. You should consider whether you can afford to take the high risk of losing your money.

Plus500

Plus500 is a recognized by its comprehensive trading screen with detailed information about past and current positions of the stock. The app is very rich visually and includes expansive charts. The fees and commissions are affordable and variable so investors of all skill levels should try it out.

How it works: plus500 is a proprietary platform with a strong focus on technical analysis and stock trading. The app allows the users to multitask within the program; trading in several markets and tracking the real-time quotes.

Cool features: demo account, risk management, a variety of trading assets, E-mail alerts, mobile alerts, guaranteed stop loss, available for all mobile OS.

User tip: integrate all your trades in several financial markets by using the same screen of the plus500 app.

Business model: €100 minimum deposit for standard funding methods / €500 minimum deposit for bank. €10 inactivity fee.

Risk warning: 76.4% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Etoro

With millions of installs and leading positions in finance category of both app stores (google play / app store), etoro is an online trading platform that fits in a hand and is always with you. With over 2,000 financial instruments, etoro mobile app offers access to the same features as the web portal.

How it works: open an account and trade stocks, cfds, cryptoassets, indices, etfs, etc. Aided with real-time data, analytical tools and stop-loss on account, traders build up their portfolio. You may also find etoro among top CFD platforms to know more.

Cool features: virtual (demo) account with $100K for beginners to practice, insights from experts and community, 1-click trading, offline trading for selected orders.

User tip: when not sure where to start, make use of copytrader feature, replicating bids and investments of a specified trader. Also, don’t skip setting a stop-loss, a minimum sum on account, not to lose money.

Business model: free to install, minimum initial deposit for US clients is $200 (for australian – $50), withdrawal fee, inactivity fee.

Warning. 71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Capital

A web platform and a mobile app, capital.Com is a top global and free stock trading app with 788,000+ active users and counting. Even beginner traders can use it and learn without risks – via a demo account to practice commodity trading, cryptocurrency trading, CFD trading, stock exchange. There are standard, plus and premier accounts in 2 tiers (retail, professional).

How it works: a user opens an account of choice on capital.Com (web or mobile), makes a deposit is US dollars/UK pounds/euros/polish zloty ($20 minimum), trades on any of global markets, makes profits or loses on trading, withdraws funds whenever he wants. Capital com is registered in the england and wales and is regulated by the FCA (license number 793714). And capital com SV investments is regulated by cysec under license number 319/17.

Cool features: 75 technical indicators, free demo account, no commission on day trades, 1:200 maximum leverage, stop-loss option, crypto-trading (bitcoin, ripple, ethereum), over 3000 markets, forex, trading guides and webinars.

User tips: you may set a stop-loss to prevent negative balance. Withdrawal of funds into a credit card may actually take 2-3 business days or more, depending on user’s bank operations.

Business model: 20 EUR/USD/GBP minimum deposit, or 250 EUR via wire transfer, spreads.

Warning: cfds and spread bets are complex instruments and come with a high risk of losing money rapidly because of the use of leverage. Around 75 % of retail investor accounts lose money when trading cfds and spread bets with this provider.

Robinhood

Free, basic, simple to use and of the best stock trading apps. Apart from the standard plans, the app offers premium memberships for golden features. The absence of commissions makes it extremely suitable for new investors.

How it works: after signing up and making a deposit, you can search for a specific firm within the app search bar and, similarly to all the trading platforms, monitor the flux of the company’s revenues and invest accordingly.

Cool features: no minimum investment, no maintenance fee, no commissions. Scheduled deposits, company watch list, day-trade tracking, advanced order support. Newly added feature robinhood instant allows you to access the deposits (under $1000) instantly instead of typically waiting for three business days.

User tip: deposit your funds immediately so you can catch a great deal once it appears. Have patience. If you see a growing potential of your stock, do not rush to sell it and lose money before even gaining it.

- Robinhood gold (large amount of instant deposit, after-hours trading, credit line)

- Cryptocurrency trading (bitcoin, litecoin, dogecoin, etc)

Business model: free app, no commissions. Although it may seem too good to be true, robinhood actually offers an opportunity to earn without taking any commissions from you and that’s the key component of the app’s official advertisement campaigns.

TD ameritrade mobile

Toronto-dominion bank’s app is ideal for advanced traders and inclusive simplified features for the beginners and training for investors. The software enables easy external money transactions and can be used on four different platforms.

How it works: download the TD ameritrade mobile app from the store and register an account (in case you haven’t registered on tdameritrade.Com). With $0 account minimum, start investing and monitoring the stock market by remaining logged into your application.

Choose the initial investment amount and start earning money by trading. Advanced:

- Retirement account (traditional, roth, or rollover IRA)

- Education accounts (tax-free coverdell, UGMA/UTMA accounts, 529 plans)

- Specialty accounts (advanced features)

- Managed portfolios

- Margin trading

Cool features: transferring the funds between TD ameritrade and external accounts, $0 account minimum, taxable brokerage account, in-depth account monitoring, price alerts, charts with indicators, customization of screens and lists, news and research, back testing, earning calendars.

User tip: you can track the real-time quotes on your apple watch, without using your smartphone. TD ameritrade has four different platforms; web platform, trade architect, thinkorswim, and TD ameritrade mobile app. Although you can use all of them, you must know the difference.

Business model: $0 minimum stock.

E*trade

Stock trade app suitable for skilled traders with large investments and profitability. The app is available on all mobile OS systems and a web platform. It offers powerful monitoring and analyzing tools.

How it works: investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without interacting with the broker directly. To start trading, you need to invest the minimum of $500 as a deposit.

Cool features: margin analyzer tool, margin calculator tool, both updated frequently. Advanced customer service, 24×5 trading on most active etfs. Real-time news and quotes, bar code scanner, comparison and performance charts, the customization of watch lists, voice recognition system.

User tip: click the complete view page to see all your assets and E*trade account on one screen. It will also show you the investments overview. Analyze the data as fondly as you need and extract all the relevant information.

Business model: $500 minimum investment. In order to buy the stocks, you must pay $6.95. The price decreases to $4.95 in case you make over 30 trades per quarter. Other plans are brokerage accounts, retirement accounts, managed portfolios, small business retirement accounts. The app is known as the one with the highest fees in comparison to their rivals.

Fidelity

Low-commission stock trading app. Users can customize most aspects of the software, including its appearance and functionality. Upon registration, you can adapt your features depending on your skill level.

How it works: upon registration, you must complete a questionnaire that will let this stock trading app determine your goals and investment methodology. Fidelity app provides you with etfs and mutual funds you can use for your investments.

Cool features: personalized feed, account review, and management, customizable alerts, adjusted tax schedule, ability to pay bills automatically, deposit money to the roth or traditional IRA. By connecting fidelity to echo, the voice response device by amazon, you can get any answer about the stock changes immediately.

User tip: find feed preferences and adjust your feed according to your needs. Use the learning center and select the financial area of your interest. Keep learning and listening to qualified sessions that will expand your trading knowledge.

Business model: $4.95 registration. Over 90 commission marked as “free” etfs that aren’t exactly free as you must pay the expense ratio between 0.10% and 0.50% of the total balance you invested.

Sigfig

Sigfig is a stock trading app with a well-organized asset management and simplified, easy-to-track portfolio. Due to a moderately high account minimum in comparison with other low-cost apps, this program is more suitable for experienced traders.

How it works: sigfig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD ameritrade, fidelity or charles schwab. It monitors and enhances the portfolio of the user, balances the investments and reduces the fees.

Cool features: add-on app, third-party account sync, free adviser, advanced portfolio tracker. Sigfig automatically reinvests your dividends; automatically rebalances the funds on all the accounts for free.

User tip: you cannot manage your credit card on sigfig. In case you want to associate different financial accounts apart from the ones registered at its partners’ platforms (TD ameritrade, fidelity or charles schwab), you will not be allowed to.

Business model: 2,000 account minimum. Manage your first $10,000 for free. After passing the limit of $10,000, the annual management fee is 0,25%. The fee for diversified income portfolio is 0.50%.

Stash

Undemanding app for new, inexperienced investors seeking for the best way to start their trading career. Each user has the ability to own a retirement and standard account at the same time, on the same platform. Stash is very popular worldwide because it offers a range of flexible investing options.

How it works: similarly to sigfig, stash isn’t a direct manager of the registered accounts. However, you can link it to your bank account and invest in a wide range of stocks and funds – over 3.000 listings. Literally 1 cent is enough to start trading. Dowload the app, set it up, choose a plan, make a deposit and start investing.

Cool features: retirement and custodial accounts, partitions – to allocate funds in a smart way, auto-stash suit – including scheduler to set aside certain amount of income, save on round-ups, etc.; retirement calculator, personalized financial recommendations, portfolio diversification analysis.

User tip: make use of $1/month pricing plan to try out all the basic actions as a beginner. Instead of using several apps to monitor and manage your finances, you can open a retirement account on stash at the same time as operating your regular account.

Business model: $1 monthly fee for accounts under $5,000, 0,25% annual fee for accounts over $5,000. Stash retire ($15 account minimum), custodial accounts (available for users under the age of 18, registered by the custodian).

Stockpile

This is an extremely rare stock trading app with the ability to provide small purchases with the gift cards. The whole company is based on fractional shares and does not require large investments. Stockpile is primarily created for new investors, including children.

How it works: stockpile offers “fractional shares”, minimized stocks (instead of buying a whole share, user can buy 0.10 of it) and enables the users to invest in household-name companies. To complete the process, user must purchase a gift card and exchange it for the stock.

Cool features: gift bundles, wish list, redeem for retail, credit card funding, physical gift cards validity. Ios and android stockpile app has all the features of the web stockpile version.

User tip: this stock trading app developed an expert learning system. Access its affordable education courses and learn everything about investing. E-gifts cost less than physical cards.

Business model: 0% minimum investment. Taxable and custodial accounts, $0.99 fee per trade, $2.99 fee for the first gift card stock, $0.99 fee for every extra stock.

Schwab mobile

Schwab mobile (charles schwab) is one of the leading stock trading apps, created for investors of all skill levels. The app design is very simple, making it easy for first-time users. It also includes a long list of advanced features for experienced investors, making it appropriate for every trader.

How it works: schwab has over 4,000 mutual funds and 250 etfs, both are transaction and commission free. The app has an exceptional industry research and is marked as highly efficient.

Cool features: advanced industry research, available on web and mobile platforms, custom layouts, news and analysis, watch list, real-time quotes, association with apple pay.

User tip: stick to funds found on the schwab’s no-transaction-fee list. In case you want one that you cannot find on the mentioned list, you will need to pay $76 for it.

Business model: 0% service fee / $1,000 account minimum. $4,95 trade commission, $100 gift for the first-time users, $76 fee for the transaction fund off the list.

Acorns

Acorns is a user-friendly investment app associated with the bank account of the user. It automatically saves minor percentage off your daily credit/debit card purchases in your portfolio. Due to the simplicity and basic features, it is recommended for the first-time investors.

How it works: with the “round-up” system, acorns monitors your bank account and keeps the minor changes from your purchase until saving $5 into your investment portfolio; then, it invests automatically to a certain portfolio you previously chose.

Cool features: quick deposit options, no minimum investments, “potential” tab that allows the user to see the growing potential, round-up multiplier.

User tip: by recommending the app, you receive $5 per every registered person. At the beginning, do not constantly check the app and monitor every spent dollar. Keep purchasing with your linked credit card/s and get surprised by the amount acorns collected for you.

Business model: $1/month for users with the total balance under $5.000. 0.25%/year for users with the total balance equal to and over $5.000. The better the portfolio, the less affected you will be by the fees.

Wealthfront

If you are an investor seeking automated investing and moderately low fees, wealthfront is surely worth a try. The app has an integrated tool that creates the best strategy to help you achieve a certain goal. Although you can create a diversified portfolio, wealthfront does not support fractional shares.

How it works: after registering, setting your goals and risk assessment, wealthfront classifies the money you invested into etfs (exchange-traded funds) and acts as your expert financial adviser.

Cool features: portfolio review, tax location, index funds, automatic re-balancing, smart beta, risk parity. Path – saving system helps you set the goals and save efficiently towards achieving them.

User tip: in case you need advice and answers to some questions you cannot find in wealthfront’s FAQ, visit the official web blog of the company where you can find many interesting, educational posts and tips.

Business model: free registration / $500 account minimum. $250 minimum withdrawal, %0,25 annual fee for accounts with total balance over $5,000. Portfolio line of credit for accounts with total balance equal to or over $100,000.

5paisa

Extremely popular indian app for users of all skill levels. It is great for first starters as it offers a no-fee first year upon registration. 5paisa is a low-cost stock trading app with robo-advisory and online share market, including most features the leading financial apps provide.

How it works: standard stock trading apps where you need to send an application and wait for a few hours until getting approved. Afterward, you can invest in stock of your preferences and use integrated tools of 5paisa to monitor all your finances.

Cool features: demat account, immediate transfer of the funds, quick order, auto-investor, real-time quotes, synced watch list, exceptional charting.

User tip: do not rush with big investments in small-sized and middle-sized companies even when the offer seems very attractive. Do your research and if the firm actually seems stable, invest. If not, it is better to prevent a failure than deal with consequences.

Business model: first free year / free mutual fund account. Annual $400 ($5,80) membership / 18% GST for individual users. Annual $1,000 ($15) membership / 18% GST for non-individual users. $10 ($0.15) per trade.

Trading 212

Another globally recognized app with enormous trade possibilities for active traders, trading 212 merges with all the major markets. The system emphases educational programs and apart from the mobile platform, you can access it from the web as well.

How it works: as a new user, you can try a demo account that will help you learn about this stock trading app and get familiar with it. Trading212 uses a segregated tier-1 bank account for all the money of their users.

Cool features: user-friendly app, content-rich educational program, automated trading, web and mobile platform, trading signals, market analysis, chart monitoring, one-click execution.

User tip: after winning once or repeatedly, do not start increasing the size of your trade rapidly. Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. Balanced investment is the key of the success.

Business model: minimum deposit $150 (€100, £100). 1:200 maximum leverage, monthly reward of 10 commission-free deals. After the spent 10 commissions, each commission varies from 1.95 ($, €, £) + 0.05% to 1.95 + 0.08%.

So, let's see, what we have: get the best free trading apps of 2021. Compare fees, platforms and all pros and cons at trading app with free real money

Contents of the article

- My list of forex bonuses

- Best free trading apps in 2021

- Inside robinhood, the free trading app at the...

- ‘the access is the biggest part’

- Outlawing gamestop purchases

- Outages and tragedy

- ‘tough but extremely rewarding’

- 5 trading apps with free bonuses

- 1. Moomoo

- 2. Currency.Com

- 3. Coinbase

- 4. Webull

- Summary

- About us

- Best free broker apps

- Best free stock trading brokers and apps:

- Best free broker apps:

- Commissions

- Account minimum

- Best for

- 1. Tradestation

- 2. Webull

- 3. TD ameritrade

- 4. Moomoo

- 5. Charles schwab

- 6. E*TRADE

- 7. Vanguard

- 8. Interactive brokers

- 9. M1 finance

- 10. Firstrade

- 11. Robinhood

- Every commission-free stock trading broker app

- All free stock trading promotions for new account...

- Inside robinhood, the free trading app at the...

- ‘the access is the biggest part’

- Outlawing gamestop purchases

- Outages and tragedy

- ‘tough but extremely rewarding’

- 14 best stock trading apps of 2021 (android & ios)

- List of best stock market apps in 2021

- 1. Robinhood – investment & trading,...

- 2. TD ameritrade mobile

- 3. Acorns – invest spare change

- 4. Stash: banking & investing app

- 5. E*trade mobile

- 6. Schwab mobile

- 7. Fidelity investments

- 8. Tradestation

- 9. IBKR mobile

- 10. Tradehero

- 11. Stockpile

- 12. Webull – stock market tracking & free stock...

- 13. Metatrader 5

- 14. Plus 500

- To sum up: best stock market apps for trading &...

- Best stock trading apps

- Disclosure:

- Best stock trading apps

- Plus500

- Etoro

- Capital

- Robinhood

- TD ameritrade mobile

- E*trade

- Fidelity

- Sigfig

- Stash

- Stockpile

- Schwab mobile

- Acorns

- Wealthfront

- 5paisa

- Trading 212

Contents of the article

- My list of forex bonuses

- Best free trading apps in 2021

- Inside robinhood, the free trading app at the...

- ‘the access is the biggest part’

- Outlawing gamestop purchases

- Outages and tragedy

- ‘tough but extremely rewarding’

- 5 trading apps with free bonuses

- 1. Moomoo

- 2. Currency.Com

- 3. Coinbase

- 4. Webull

- Summary

- About us

- Best free broker apps

- Best free stock trading brokers and apps:

- Best free broker apps:

- Commissions

- Account minimum

- Best for

- 1. Tradestation

- 2. Webull

- 3. TD ameritrade

- 4. Moomoo

- 5. Charles schwab

- 6. E*TRADE

- 7. Vanguard

- 8. Interactive brokers

- 9. M1 finance

- 10. Firstrade

- 11. Robinhood

- Every commission-free stock trading broker app

- All free stock trading promotions for new account...

- Inside robinhood, the free trading app at the...

- ‘the access is the biggest part’

- Outlawing gamestop purchases

- Outages and tragedy

- ‘tough but extremely rewarding’

- 14 best stock trading apps of 2021 (android & ios)

- List of best stock market apps in 2021

- 1. Robinhood – investment & trading,...

- 2. TD ameritrade mobile

- 3. Acorns – invest spare change

- 4. Stash: banking & investing app

- 5. E*trade mobile

- 6. Schwab mobile

- 7. Fidelity investments

- 8. Tradestation

- 9. IBKR mobile

- 10. Tradehero

- 11. Stockpile

- 12. Webull – stock market tracking & free stock...

- 13. Metatrader 5

- 14. Plus 500

- To sum up: best stock market apps for trading &...

- Best stock trading apps

- Disclosure:

- Best stock trading apps

- Plus500

- Etoro

- Capital

- Robinhood

- TD ameritrade mobile

- E*trade

- Fidelity

- Sigfig

- Stash

- Stockpile

- Schwab mobile

- Acorns

- Wealthfront

- 5paisa

- Trading 212

- Contents of the article

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.