How to open account in forex trading

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

My list of forex bonuses

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

Fxdailyreport.Com

So you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is much puff about it online.

But how exactly can you get started with forex trading?

Decide on the best forex broker

This is the first and most important step in opening any forex account. You can choose the best forex broker by looking for such factors as the credibility of a broker, their trade execution, low spreads, regulation, trading platforms and styles, account types, and leverage options, among other factors.

However, deciding on the best broker doesn’t stop here. It is extremely important that you play with multiple forex demo accounts offered by different brokers. Opening demo accounts with various trading platforms will give you the chance to learn forex trading properly before investing your hard-earned money. Again, you should consider making paper trade until you start making consistent profits before committing real money. Often, newbies jump into the forex trading market and end up losing significant amounts of capital because of leverage.

So, again, it is strongly advisable to open multiple demo accounts with different brokers before opening a live account. This will not only help you choose the best broker, but it will also help you get ready for real trading.

After choosing your forex broker, the next thing is often a standard bureaucratic process which is just like opening an account at a bank:

Choose your preferred forex account type

You will be required to select your preferred forex trading account. There are 3 major types of forex trading accounts-the mini, standard, and managed accounts. Each has its pros and cons. You will need to choose your account type depending on such factors as your tolerance risk, how much time you will have to trade daily, and your size of starting investment, etc.

Standard accounts are the most common. Since they need sufficient up-front capital for you to trade on full lots, many brokers often offer better perks and more services for investors with a standard forex account. However, most forex brokers require a standard account to have at least $2,000 or sometimes $5,000-$10,000 as the starting minimum balance.

Mini trading accounts allow investors to make transactions by using mini lots. You can open this type of account with as low as $250-$500, with leverage of, sometimes, up to 400:1. However, it comes with relatively small rewards.

In managed accounts, the broker (or hired account manager) makes the buy and sell decisions. You will set your objectives (like your profit goals, and risk management) and your account manager will work to meet the objectives. This account type requires large minimum deposits.

Again, regardless of the type of account you decide to open, it is wise to begin free demo accounts first to familiarize yourself with various trading aspects.

Registration

You will be required to give a lot of personal information during the forex account registration process. Various countries have different regulations on forex trading to protect investors, and so brokers will ask you for some personal information to comply with the law. Here is what is typically required;

• your name

• contact information-your address, phone number, and email

• date of birth

• tax ID or social security number

• your national ID number

• employment status

• the type of currency you want to use

• net worth

• annual income

• country of citizenship

• your trading account password

• trading experiences and objectives, etc.

It is highly unlikely to find a broker that does not ask for this information, and in case you find one, be suspicious.

After giving all the required information for processing, the broker will typically require you to send them some verification documents like copies of your national ID, and perhaps a utility statement so that they can verify your address and name.

In the final steps opening a forex account, you should see risk disclosures (which you need to take very seriously). Forex trading can be a very dangerous business, and brokers are required to remind you this.

Activate your account and start trading

After your broker has received the required paperwork and information, you will receive an email directing you on how to complete your account activation. After completing this step, you will receive another email with instructions on funding your forex account, your username, and password.

Then all that is left is just logging in to your account and start trading!

How to open a forex trading account

What is needed and why

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

Artifacts images / digital vision / getty images

Forex trading sounds like an exciting financial opportunity to those who hear about it for the first time. The possibility of trading large sums of leveraged money sparks the imagination, but most who find the prospects of this market attractive will soon find they are surrounded by online hype and hyperbole.

The reality of trading is quite different from the sales pitches most people hear. That's because it is hard to be consistently profitable and most traders lose money in the early stages of their experience.

What is not hard, however, is actually opening a brokerage account. Choosing a brokerage is more meaningful if a beginner has actually tried out several different forex demo accounts.

Typical requirements to get started

The first thing you'll do is set up an account with a forex broker. You'll need to provide a good deal of personal information to get your account set up, including the following:

- Name

- Address

- Phone number

- Account currency type

- A password for your trading account

- Date of birth

- Country of citizenship

- Social security number or tax ID

- Employment status

You will also need to answer a few financial questions, such as:

Industry compliance

You might wonder why forex brokers want to know all of this information. The simple answer is to comply with the law. The environment surrounding forex trading has a comparatively low degree of regulation, but in recent years, more regulations have been put in place to provide some degree of protection or assurance to account holders. Additionally, forex brokers need to ask these questions to protect themselves from the risk of loss. They want to make sure customers who overleverage themselves will still be able to pay back any unexpected losses.

It's unlikely that you will find any broker willing to open your trading account without requiring these questions to be answered. If you do happen to find one that isn't asking many questions, you should be suspicious. If you are ever feeling wary about a particular broker, you can look them up through the national futures association to find out their status.

Forex trading and risk

During the final steps of opening your account, you will see risk disclosures. Please take these seriously. Forex is a difficult business for beginners. It tends to eat them for dinner if they aren't careful. There are more losers than winners on average. The broker is required to remind you of the forex risks.

Once you've turned in all of your information to be processed, the broker will verify it and typically ask you to send in some verification documents such as a government-issued ID, and maybe a utility statement to verify your name and address. The back and forth process can slow down the process by a day or two, but it's nothing to concern you.

Once your information is verified, you can fund your account and begin trading. One piece of advice that I like to give to all new traders is not to put any money in the account that you cannot afford to lose.

It seems like obvious advice, but some people start off feeling like they know more than they do, and take unnecessary risks. Start with a fair amount of money and trade small. Nothing can prepare you for the emotions that you feel when your money is truly at risk, so go slow in the beginning.

Forex should be boring

Forex seems very exciting, but in reality, it should be boring and cut and dried. If you feel a great deal of anxiety when making trades, be careful. It's common to either get too wound up from your winning trades or become a destructive trader from your losing trades.

Learning to make trades using research and systematic logic will serve you much more than relying on emotion to guide your trading. Forex should feel like simple, methodical decision-making with precautionary steps in case of failure. While that might sound boring to you, you will survive much longer if you approach that market that way.

Keep your cool

If you find yourself feeling like you are making common forex mistakes and just generally feeling frustrated, stop trading, and review the basics again. Forex trading is one of those industries where occasionally you have to re-evaluate your methods to make sure you are achieving your goals. Try not to get too frustrated and keep your approach scientific and unemotional.

Forex trading account – how to open trading account

“disclosure: some of the links in this post are “affiliate links.” this means if you click on the link and purchase the item, I will receive an affiliate commission. This does not cost you anything extra on the usual cost of the product, and may sometimes cost less as I have some affiliate discounts in place I can offer you”

One of the first steps in forex trading is opening a forex trading account. Account gives you entrance into trading world where you will be one of the traders on the biggest market.

" data-medium-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" data-large-file="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" loading="lazy" width="259" height="244" src="https://getknowtrading.Com/wp-content/uploads/2018/11/forex-account.Png" alt="forex trading account" />

I will show you what you need to do to open account with broker.

How to open trading account

In order to continue you need to have broker. If you do not have broker even then you can continue to inform yourself about opening an account. It is not bad to know more if you want.

To open trading account, demo or real, necessary steps are:

- Selecting trading account type

- Registration

- Activating trading account

This is global overview but I will get into more details further in this text. Be sure to open first demo account and then after demo trading, real account.

Choosing trading account type

This post is about opening real account. If you are looking how to open demo account check this:

Step by step guide: admiral markets demo account

When opening account, real account, you need to decide which type you want to open. Brokers offers a lot options for any trader and before deciding please read as much as you can so you do not get scammed.

Broker can offer you few account types:

- Business

- Personal

- Managed

- Managed

- Spot

- Futures

- Forwards

Managed account

Some brokers have account where you can deposit money and then let broker to trade for you. These kind of accounts are known as managed account. If you want to trade on forex market by yourself then do not choose this account type.

By the way they charge fees through profit they make on your account and there is minimum amount on deposit which can be different by brokers. Deposit amount is mostly several thousands dollars which can be to high for individual investor.

Be sure that you open forex spot account and not one of the other accounts like futures and forwards.

Trading account size

Between account sizes you will need to choose small or large accounts. Small account is for trader with small amount of invested money. Large account is for trader with high amount of invested money.

Small accounts with every pip move will bring you smaller profit but also small loss if market moves against you. At start it is best to have small loss if you make a bad trade. In time how your progress through forex market you can deposit more money and have large account. With large account every pip move will bring you more money on your account.

For beginners it is recommended to use small account until they master trading and afterwards they can continue on the larger accounts. This way they will protect heavily earned money from fast losing on forex market.

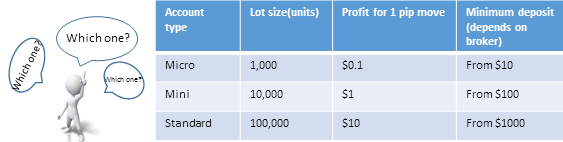

During account opening process sometimes you will encounter three types of account that broker offers you. They are:

- Mini account

- Micro account

- Standard account

There is difference between them as their name suggest it but in general there is no to much complicated differences.

What is micro account

Micro account is account mostly intended for novice traders but it is not mandatory that he is novice.

This account requires smaller amount of deposit and that is between $10 – $250. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $1,000 on the market. Every pip move gives $0.1 difference on trading account. If trade goes in your favor you will earn $0.1 and if trade goes against you then you lose $0.1.

As you can see 1 pip move does not bring a lot profit or loss. If you open a trade and wait until market moves in one direction for 100 pips then this amount will be $10. $10 can be a lot if you have invested $50 on your trading account.

If you are able to invest more money on you account it is best to do it because this way you will avoid possible margin call. With higher amount on the account you will have wide space to trade if trade becomes a bad trade.

Margin call happens when you have bad trade active and without enough money to sustain further loss. When critical level is reached broker automatically close your trade.

What is mini account

Similar to micro account mini account is for traders who wants to invest money in range from $100 – $500. It is a little bit higher then micro account but it gives you possibility to earn $1 with every pip move.

Every trade/contract that you open you control $10,000. Every pip move gives $1 difference on trading account.

It is 10 times more than micro account and for new traders this is more then enough. Same as for micro account here is better to have larger amount of money on account.

What is standard account

Standard account is account mostly intended for experienced traders but it is not mandatory. Novice traders sometimes use standard account for trading.

This account requires larger amount of deposit and that is from $1000 and above. Minimal deposit depends on the broker with which you have trading account open.

Every trade/contract that you open you control $100,000. Every pip move gives $10 difference on trading account.

Which account to open

Micro, mini or standard account depends on you and your preferences. Do you want to earn more money with 1 pip move or less money with 1 pip move.

Forex account – micro, mini and standard

Those who have more money and know how to trade they will go for standard account. For novice it is the best to go with mini account. With every pip move novice will earn $1 which is a good profit.

Advantage that you can have with mini account over standard account is when you have high amount invested on trading account you can open several trades. If you have 10 orders on mini account it is same as you have 1 order open on standard account.

On mini account each trade gives you $1 for pip move. If something goes wrong and your margin starts to become red you can close one of orders and rest of them leave open. This way your margin will not be overloaded and you will stay in the game with other orders. If market moves in your direction open orders will bring you profit.

As a conclusion mini account gives you more flexibility in trading over standard account but enough profit for 1 pip move. Choose wisely which account is best for you and your trading preferences.

Leverage

Another thing to watch out when choosing account is leverage on that account. Leverage is ability to control large sum of money using small amount of your invested money.

You can choose different leverage like from 1:50 up to 1:500. This is different from broker to broker. 1:50 means that with one 1$ you can control $50 on the market. Broker lends you rest of the money so you can trade on the market and make more money. But also lose more money if market goes against you.

After you have decided which account you want to have, personal/business or small/large you need to decide to open

- Live or

- Demo account

As said earlier, for beginners it is best to open demo to test and later on to open live account. On demo account you should at least learn how to open and close a trade.

From my experience I can tell you that I have started immediately with live account because demo account could not give me what I wanted and that is – live experience.

Registration

When registering real/live account you will need to do some paper work in order to open it. Those papers could be

- Your ID number

- Utility bill not older than 3 months with your personal address on it, so they can verify that it is really you and data you have provided are accurate

They need this information to comply with the law. Regulatory agencies wants to protect you so they have set requirements for broker to open an account for you. If you are not required to give them these information’s you should be suspicious because that is minimum what they should ask you to provide.

During registration broker could ask you several information about your trading experience, your trading intentions or how much you will invest. They like to get know you(KYC – know your customer) and your trading intentions.

Please read all what is written in their documents so you are familiar with all costs that can arise, if there is any. Also, pay attention when depositing money over wire transfer how much does bank charge for their services.

Trading account activation

When registration of your live account is done you will receive confirmation mail with account details. Information that trader receives in e-mail can be different because not all forex broker sends same e-mail.

- Account number

- Password for trading platform

- Server on which to connect

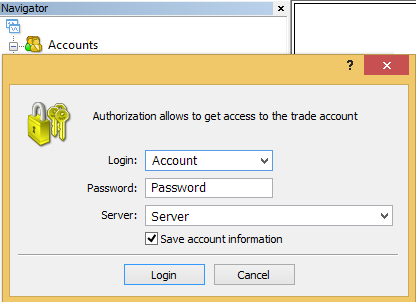

In order to activate trading account open your trading platform and follow further steps.

In the MT4 platform right click on the “accounts” menu which is located under “navigator” menu. After right click you will select “login to trade account“.

Use those information’s and enter them into new window that appears, like the picture below this text.

If everything is fine with data entered your trading platform will start to show you real information about trading pair price. If not, you will hear sound that indicates you have entered incorrect data.

Possible cause you did not connect to trading platform with information from broker is:

- Wrong login data – check information from broker

- Wrong trading platform – use platform from your broker

- No internet access – check can you open some other website in your browser in order to verify is internet connection ok

If you have entered all data as shown above and you have tested possible source of the problem and even then you are not connected then please call broker support.

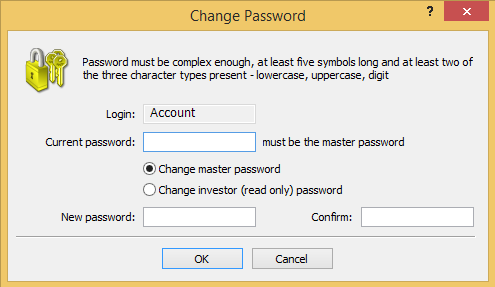

Password change

Password is possible to change immediately after you login into trading account. You are not obligated to leave same password you have received from your broker. You can change it to your desired password where you need to fulfill certain requirements.

Go into MT4 menu “tools” and select “options” with which you will open new window.

“tools” menu for trading account password change

In “options” window under tab “server” you will see option to change password. All other parameters you can leave as they are.

Change trading password under tab “server”

Select “change” and window “change password” will appear where you need to enter new password details. Enter your current password you have received from broker and enter new password. There is 2 places where you need to enter password, “new password” and “confirm“.

Trading account password change

Please pay attention to fulfill all necessary conditions for new password.

- At least five symbols

- At least two of the three character lowercase, uppercase and digit

After all above is done you will have account on MT4 platform ready for trading. If you are using real account then you will need to fund it with real money.

Transfer of real money on the trader account is done in trader room. I cannot show you steps because trader room is different on each broker. But mostly they have instructions how to transfer money from your credit card or bank account or any other possible channel.

FREE 5 day email course

Email course is for beginners who do not know to much about forex trading but wants to know

- What is forex

- What is trading and where to start

- What is metatrader 4

- How to setup charts on metatrader 4

- How to open and close order in metatrader 4

After you are done you will know how to use FREE trading platform to activate order by selecting currency pair on the forex market and make money.

- Trading platform?

- Activate order?

- Select currency pair?

- Make money?

To much strange words? Get them clear and start trading!

Frano grgić

A forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the first choice for traders and beginners. Market analysis is featured by forex factory next to large publications like dailyfx, bloomberg. Getknowtrading is becoming recognized among traders as a website with simple and effective market analysis.

BETA TESTERS WANTED

This is opportunity to be one of the first people to:

On online course about how to start trading

Join if you want to be part of and learn while testing

Categories

Forex signals

FREE PDF's

What is leverage?

How to calculate pip value?

What is margin?

What is lot?

How long demo trade?

0 comments

Disclaimer: any advice or information on this website is general advice only – it does not take into account your personal circumstances, please do not trade or invest based solely on this information. By viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by get know trading, it’s employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to buy/sell futures, spot forex, CFD’s, options or other financial products. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

High risk warning: forex, futures, and options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How to open a forex trading account

The forex market is as old as the advent of currencies and has grown to become the largest financial market in the world. But, surprisingly, trading in the currency market hasn’t been very accessible to the general public for most of its history.

However, this has changed ever since the arrival of the internet and retail forex brokerages have popped up to facilitate trading. Nowadays, opening a forex trading account is no more different than opening a bank account. However, before one starts trading, it is important to be aware of some information that can ensure that your trading experience remains secure and successful.

Find the right broker

Finding the right broker in the market is perhaps the all-important first step that you are going to take. Since currency trading is decentralized and not-so-well regulated, it is highly recommended that traders research the broker’s reputation thoroughly before taking the plunge.

This can easily be done by verifying a broker’s history with the national regulatory agencies. Furthermore, it is also advisable to know about the services that a broker offers. Some may provide basic brokerages while others may provide sophisticated trading platforms and resources for analysis that assist in well-informed trading decisions.

You should also look to compare any fees or commissions that brokers may be charging for their services. When ascertaining the profitability of trading, these extra costs can become quite important for the trader.

Information required for account creation

Once you have decided upon a broker, you will be required to provide a variety of personal information to set up your trading account.

These may include the following:

- Name

- Country of citizenship

- Date of birth

- Address

- Phone number

- Currency type for account

- Tax ID or social security number

- Employment status

Along with these, you may also be required to answer a few financial questions.

- Trading experience

- Annual income

- Trading objectives

- Net worth

Choose the account type

When you’re all set to open an account, you will have to decide exactly which trading account type you want. You can choose either a personal account or a corporate (or business) account. One had to choose amongst ‘standard,’ ‘mini,’ and ‘micro’ accounts in the past.

But, since traders allow one to trade custom lots, this isn’t a problem anymore and is great news for those beginners who have only a small capital amount. It also keeps things flexible for traders as they won’t be necessitated to trade any more than they are comfortable with. Plus, you must always remember to read the fine print of your agreement.

Many application forms will have the option of a ‘managed account,’ which is good if you want the broker to trade for you. But, if you’re not looking to give the reins to someone else, you should be wary of this. Besides, a managed account demands big capital, somewhere north of $25,000. On top of that, the managing person may also take a cut out of your profits.

Industry compliance

One might be driven to wonder why brokers require so much information to open a trading account. The reason is that they have to abide by the law and be industry compliant. Ever since forex went retail, it has some regulations, which have been put in place to keep traders from harm and offer some protection.

As such, you won’t find many brokers ready to open an account without warranting all this information. If, however, you come across a broker that doesn’t require such information, be wary of them.

Registration

There might be some paperwork that you are required to submit to successfully open your account and the forms that you provided will vary depending on your broker. Soft copies of the same will be provided to you, which you can view and print at your pleasure.

Furthermore, be aware of the affiliated costs that you might have to pay, such as charges for bank transfer applied by your bank. Some banks actually may cost a lot, which might take a big bite out of your trading capital and may surprise you later.

Activate the account

As soon as the broker receives all the required paperwork, you should be greeted with an email providing the necessary instructions for activating your account. Once you have gone through the steps, a final email will be sent to you providing everything from username and password to detailed instructions that will assist you in funding your account.

Now, you can log in and begin trading. However, if you are just starting out, you would be better off trying your hand on demos. This will help you get the hang of the trading strategies and get familiar with simulated market conditions before you risk your account capital on live trading.

Summary

The procedure of opening and setting up a forex trading account isn’t too dissimilar from opening any other type of financial account. You will be required to do your research beforehand to ensure that your broker is reputable, provide the relevant information necessary for the process, choose an account type depending on your goals, register, and finally activate your trading account.

Once you have begun, you should be able to trade round the clock at your pleasure. It is highly advised that you read all the conditions in the documents provided by your broker carefully and are aware of any terms and conditions that might be associated with your trading account activity.

Though trading on a live account shouldn’t be your first experience with trading, as long as you approach trading with a scientific and stoical mindset. Use proper risk management, remain vigilant, and you should be well on your way to a successful forex trading career.

How to open a forex trading account?

What is currency trading

or forex trading?

How to open a

forex trading account?

How does leverage

work in forex trading?

The top 10 tips for

forex trading in india

The top forex trading

strategy

What are currency

derivatives?

How to start currency

trading in india?

Which is the best forex

trading platform in india?

How to open a forex trading account?

The first step for maximising profit in currency trading is to open a forex trading account with the best forex broker.

Forex trading is an act of buying and selling currency pairs like USD/INR, GBP/INR and others to make profits or hedge businesses.

In india, currency trading is allowed via registered brokers only, like samco and trading takes place on NSE, BSE and MCX-SX platforms.

The global forex market has a daily turnover of 6.6 trillion US dollars, making it the most liquid and opportunity-rich market to create wealth.

However, in india, forex trading is still in the nascent stage, but is slowly getting popular as more and more individuals discover the potential for wealth creation in forex trading.

Before we elaborate on how to open a forex trading account with the best forex broker in india, let us first understand:

What is the difference between a forex trading account and a forex demat account?

Why do you need a forex trading account?

What are the benefits of opening a forex account with the best forex broker in india?

How to open a forex trading account with samco?

What is the difference between a forex trading account and a forex demat account?

Let’s say you bought 1 share of reliance industries at rs 2,000/share. Now two things can happen:

- You can sell the 1 share by the close of the trading hour (3.30 pm) in profit or loss, or

- You can hold the share for the long-term (1 month / 1 year / 5 year etc.)

If you choose option (a) you are doing intraday trading i.E. Buying and selling on the same day and therefore you only need a trading account. You do not need a demat account.

On the other hand, if you want to get a ‘delivery’ of the 1 reliance share, then you will need to compulsorily have a demat account.

| Intraday trading (buy today - sell today) | only trading account is required |

| delivery trading (buy for long-term) | trading + demat account is required |

In case of forex trading, since you are trading in futures and options contracts and are not allowed to take delivery, you only need a forex trading account.

Why do you need a forex trading account?

You need a forex trading account to buy and sell currency futures and options contracts on NSE, BSE or MCX-SX. Without a forex trading account from a registered forex broker like samco , you cannot participate or become rich in the 6.6 trillion US dollar forex market.

What are the benefits of opening a forex account with the best forex broker in india?

Samco securities is india’s fastest growing discount broker, with more than two decades of experience in wealth creation through its products in the stock market, currency or forex market and commodities market.

With an experience of more than two decades, samco truly provides the best forex trading account in india with benefits such as:

The most critical aspect of profit maximisation in currency trading is leverage. While many brokers shy away from providing high leverages to their clients, samco provides leverage as high as 100x in intraday.

So, if you only have rs 10,000 in your trading account, samco will allow you to trade in currency contracts up to rs 10 lakhs!

Margin is the minimum amount of money that a client needs to maintain as a safety deposit with the broker to trade in the desired currency contracts. Samco provides high leverage on low margins. You can check the margin requirement here.

High leverage + low margins = profit maximisation.

In forex trading, low transaction costs are critical. Most traditional brokers charge huge brokerages between 3-20 pips, but samco charges a flat fee of rs 20/trade irrespective of the trade size.

Samco understands the value of split second decisions when it comes to currency trading and therefore it offers currency transactions at lightning speed.

With samco’s best forex trading account, you can trade 24/7, on the go, from the comfort of your home,or the discomfort of the mumbai local!

Apart from the 24/7 on the go transaction facility at a lightning speed, we also provide a call and trade facility wherein the clients can call and place their orders.

Samco provides access to all currency contracts, in standard lot sizes to ensure a one-stop-solution for its valued clients.

| Contract | lot size |

|---|---|

| USD/INR | 1 lot size = 1,000 units |

| EUR/INR | 1 lot size = 1,000 units |

| GBP/INR | 1 lot size = 1,000 units |

| JPY/INR | 1 lot size = 1,00,000 units |

With access to a 6.6 trillion US dollars market, there is ample liquidity in the forex market for wealth creation.

How to open a forex trading account with samco?

One of the reasons why samco is considered to be the best forex broker in india, is because it provides a truly online-no-paper-5-minute account opening facility. And we mean track-us-on-a-stop-watch-5-minutes!

Step 2: fill in the below details and click on sign up for free!

Step 3: in the next screen, you will see the option to set your id and password. Select a secured password and click “submit and proceed”

Step 4: fill in your PAN number, and date of birth and click next

Step 5: mention your annual income and occupation detail and click “next”

Step 6: in the next window, verify using OTP or google socials as per your preference

Step 7: in the next window, enter the below details and click “submit”

- Bank account number

- IFSC code

- Bank name

- Branch address (will be generated automatically)

- Account type

Step 8: samco will transfer a small token amount in your account. Check your bank statement and then in the next window mention the token amount received and click “submit”.

Step 9: in the next screen, select the segments you wish to trade in (we would recommend to select all the segments, as you never know where the next million dollar opportunity arises from! So, be ready) and click “next”

Step 10: upload your income proof and signature and click “submit” (simply take a picture from your phone and upload!)

Income proof: you can provide any one of the following:

- 6 months bank statement

- 3 months salary slip

- Last financial year ITR

- Last financial year form 16

- Demat statement of existing demat account

Step 11: in the next screen, verify the following and click on “E-sign using aadhaar OTP”

Step 12: on the next screen, click on “I agree”. If you want to review your application, click on “view” and download the pdf of your application and ensure that all details are correct and then click “I agree”.

Step 13: on the next screen, enter your aadhar number and tick mark the checkbox for “ I hereby authorize NSDL e-governance infrastructure limited (NSDL e-gov)” and click on “send OTP”

Step 14: on the next screen, input the OTP received from NSDL and click on “verify OTP”

Step 15: after successfully inputting the OTP, you will be the proud owner of the best forex trading account in india.

As a final step, you will receive a power of attorney on your email, which you can sign digitally and send on kycsupport@samco.In.

You can also connect with our skilled customer service team on 022-2222-7777 and get your questions answered.

With the best forex trading account in india and the most skilled customer service team, currency trading cannot get any easier than this.

You can now start trading and making big bucks in the forex market using our top forex trading

strategies.

Within 5 minutes you can open a truly non-paper hassle-free forex trading account with samco - the best forex broker in india and start creating wealth.

How to open a forex trading account?

After selecting a good forex broker the next step is to open an account. The process of opening an account with a forex online broker is usually done in 3 simple steps:

- Selecting the type of account (brokers usually offer 3 types: micro, mini and standard accounts)

- Registration

- Account activation

Before starting to invest with the money that has cost you so much to earn, it is a good idea to consider opening a demo account first. In this way you can even open several demo accounts in different brokers (demo accounts are free) and thus test and evaluate different platforms before deciding which one best fits your needs.

Types of trading accounts

When you are ready to open a real account, you have the option to open an account in your name or on behalf of your company. You must also decide if you want to open a “ standard ” account or a “ mini ” or even “ micro ” account. Beginning traders or with trading accounts with a very small capital, should always start by opening a “mini” or “micro” account. Only experienced traders with more capital should open a standard account.

Some brokers even offer what are known as cent accounts , which have minimum deposits from $1 and minimum transaction sizes from 0.0001 lots onwards.

Read the contracts

Some brokers offer “managed accounts”, but in these cases you usually need a minimum capital starting at € 25,000 / initial deposit and the idea is to learn to do it yourself. In cases of managed accounts, the broker will also want a portion of the profits.

Registry

To register you must fill out a registration form with your personal data. Most regulated brokers will also ask you for some required documents such as proof of identity (copy of ID, passport or driver’s license), proof of residence address (bill for electricity, water or telephone services in your name that show your address) and sometimes also some document that proves that you are the owner of the payment option that you are going to use to deposit/withdraw funds. These documents are requested to comply with regulations of the regulatory bodies such as cysec or FCA on customer safety and against money laundering.

Activation of the trading account

Once the broker has received all the required paperwork, y ou should receive an email with the instructions to complete the activation. Once these steps are completed, you will obtain a final email with the username, password and instructions to transfer initial funds to your account.

Then, it is only necessary to log in to the trading platform and start trading in forex. Really simple right?

We strongly recommend that you take your time to learn to invest by following the items you have at your disposal for free in our forex course before you start risking your real money.

Because if you do not do it and start trading without the necessary knowledge, you will probably lose all the money in your account long before you think!

How to open account in forex trading

- Home

- /

- How to open A forex trading account, one should use margins or not check here

How to open A forex trading account, one should use margins or not check here

How to open A forex trading account, one should use margins or not check here: the foreign exchange market is one of the oldest markets and over a span of years, it has grown into the worlds most populous trading market.

Foreign exchange market has the most liquidity and highest numbers of buyers and sellers, making it easy to enter and leave the market at any time, without having to wait.

The procedure of opening a forex trading account account in the foreign exchange market is almost the same as the procedure of opening a bank account.

Although before opening an account it’s always helpful to have relevant information about the market, about its security and reliability.

Ere opening your account you must have a list of things you need, to do so. The first thing to consider is finding a broker.

We have created this webpage, to provide you with every possible update regarding forex trading market, but right now we are dealing with the common frequently asked question, that is how to open A forex trading account? So, check here and do open a trading account to earn infinite.

How to open A forex trading account?

Finding an appropriate broker is one of the most important and the initial step for opening a forex trading account.

You cannot enrol in the forex market or any other financial market without having a registered broker on your side.

It is recommended that prospective currency traders carefully research the reputation of brokers before opening a trading account.

You might also want to explore all the services provided by several brokers on your list and the one that suits you is your forex broker.

At the same time, you also want to check the assessments and expenses of brokers, how much price you have to pay to open your forex trading account.

What all charges will be added such as deposit and withdrawal charges or annual maintenance charges? These queries are something natural while opening a forex trading account.

You can compare the charges of multiple brokers and then decide. Some brokers may offer more advanced trading platforms with analytical resources that may help you make better-informed trading decisions.

What are the margins?

After opening your account you will have to decide whether to use the margin given by the broker or not.

Margin is essentially the amount of money a trader must deposit to place a trade and hold a position.

Margin is not the cost of a transaction, but rather a security deposit that a broker maintains while a forex trade is open. Forex margin trading allows traders to increase their positions.

Using margin can increase potential profits, but it can also multiply risks because traders will be responsible for covering losses incurred in their trading activities, even if they exceed their initial investment.

Opening a forex account is not difficult or troublesome, but in the trading process, you need to make sure you have the necessary trading skills. Because when you know, nothing is impossible.

Conclusion

Thank you for reading my article about how to open A forex trading account. I hope it was useful for everyone I tried to make it short and simple.

If you have further queries, don’t hesitate to comment below. I will be happy to help you out.

And don’t forget to share this post with your friends, who don’t know about how to open A forex trading account yet. It will help them out. Use the social share buttons to spread the knowledge.

So here you go get your self how to open A forex trading account today. Hope it was helpful to you folks and would love to see you all in the next post.

Forex trading

Harness volatility in the world’s most-traded financial market with the UK’s no.1 retail forex provider. 1

Start trading today. Call 0800 195 3100 or email newaccounts.Uk@ig.Com. We’re here 24 hours a day, from 8am saturday to 10pm friday.

Contact us: 0800 195 3100

Start trading today. Call 0800 195 3100 or email newaccounts.Uk@ig.Com. We’re here 24 hours a day, from 8am saturday to 10pm friday.

Contact us: 0800 195 3100

Why trade forex with us?

Get an edge with the UK’s best web-based platform and award-winning mobile apps 2

Negative balance protection ensures that your

account never stays below zero 3

Get friendly, expert support 24 hours a day from 8am saturday to 10pm friday

Identify FX opportunities on clear, fast charts and deepen your analysis with prorealtime

Get peace of mind trading forex online with a provider that's authorised and regulated by the FCA

Open a free forex trading account quickly and easily – you could be trading forex in minutes

Ways to trade forex with IG

| spread betting | CFD | DMA (forex direct) | |

| main benefits | profits are tax-free in the UK 4 | tax-deductible losses are useful for hedging 4 | increased market transparency and order control |

| accessible to | all clients | all clients | professional clients only 5 |

| traded in | £ (or other base currency) per point | contracts | lots |

| tax status | no capital gains tax (CGT) or stamp duty 4 | no stamp duty, but you do pay CGT. Losses can be offset as a tax deduction 4 | no stamp duty, but you do pay CGT. Losses can be offset as a tax deduction 4 |

| commission | commission-free | commission-free for FX | variable commission |

| platforms | web, mobile app and advanced platforms | web, mobile app and advanced platforms | L2 dealer, mobile app, terminals and apis |

| learn more | learn more | learn more |

What is forex trading?

Forex trading is the buying and selling of currencies on the foreign exchange market with the aim of making a profit.

Forex is the world’s most-traded financial market, with transactions worth trillions of dollars taking place every day.

What are the benefits?

- Go long or short

- 24-hour trading

- High liquidity

- Constant opportunities

- Trade on leverage

- Wide range of FX pairs

How do I trade forex?

- Decide how you’d like to trade forex

- Learn how the forex market works

- Open a forex trading account

- Build a trading plan

- Choose your forex trading platform

- Open, monitor and close your first position

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

How much does FX trading cost?

Margins

When you spread bet and trade cfds you do so with leverage – meaning you can win, or lose, a significant amount more than your initial deposit – called your margin. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your forex trade.

Spreads

Your key payment for trading forex is the spread – the difference between the buy and the sell price – our charge for executing your trade. We work to keep our spreads among the lowest in the business.

| Spot FX | retail margin | leverage equivalent | professional margin what is this? | Leverage equivalent |

| EUR/USD | 3.33% | 1:30 | 0.45% | 1:222 |

| AUD/USD | 3.33% | 1:30 | 0.45% | 1:222 |

| USD/JPY | 3.33% | 1:30 | 0.45% | 1:222 |

| EUR/GBP | 3.33% | 1:30 | 0.45% | 1:111 |

| GBP/USD | 3.33% | 1:30 | 0.45% | 1:111 |

| EUR/JPY | 3.33% | 1:30 | 0.45% | 1:222 |

| USD/CHF | 3.33% | 1:30 | 1.35% | 1:74 |

| spot FX | IG min. Spread | IG av. Spread 6 | IG av. Spread (00:00-21:00) 7 |

| EUR/USD | 0.6 | 1.00 | 0.75 |

| AUD/USD | 0.6 | 1.01 | 0.74 |

| USD/JPY | 0.7 | 1.12 | 0.83 |

| EUR/GBP | 0.9 | 1.71 | 1.19 |

| GBP/USD | 0.9 | 1.66 | 1.19 |

| EUR/JPY | 1.5 | 2.27 | 1.76 |

| USD/CHF | 1.5 | 2.15 | 1.91 |

How much will I have to pay?

Margins

When you spread bet and trade cfds you do so with leverage – meaning you can win, or lose, a significant amount more than your initial deposit – called your margin. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your forex trade.

Spreads

Your key payment for trading forex is the spread – the difference between the buy and the sell price – our charge for executing your trade. We work to keep our spreads among the lowest in the business.

| Spot FX | retail margin | leverage equivalent | professional margin | leverage equivalent |

| EUR/USD | 3.33% | 1:30 | 0.45% | 1:222 |

| AUD/USD | 3.33% | 1:30 | 0.45% | 1:222 |

| USD/JPY | 3.33% | 1:30 | 0.45% | 1:222 |

| EUR/GBP | 3.33% | 1:30 | 0.45% | 1:111 |

| GBP/USD | 3.33% | 1:30 | 0.45% | 1:111 |

| EUR/JPY | 3.33% | 1:30 | 0.45% | 1:222 |

| USD/CHF | 3.33% | 1:30 | 1.35% | 1:74 |

| spot FX | IG min. Spread | IG av. Spread 6 | IG av. Spread (00:00-21:00) 7 |

| EUR/USD | 0.6 | 1.00 | 0.75 |

| AUD/USD | 0.6 | 1.01 | 0.74 |

| USD/JPY | 0.7 | 1.12 | 0.83 |

| EUR/GBP | 0.9 | 1.71 | 1.19 |

| GBP/USD | 0.9 | 1.66 | 1.19 |

| EUR/JPY | 1.5 | 2.27 | 1.76 |

| USD/CHF | 1.5 | 2.15 | 1.91 |

It’s free, quick and simple to create an account with us. Open one today, and you’ll get access to over 17,000 financial markets.

When you’re ready, you choose your deal size. What’s more, you'll get lower minimums for one month while you master the markets.

Discover your next opportunity

Search our huge range of forex pairs.

Live FX prices

These prices are indicative only, and subject to our website terms and conditions.

Choose your currency trading platform

Seize opportunity at your desk or on the go with the UK’s best web trading platform and mobile trading app. 2

Award-winning forex provider

Forexbrokers is compensated by IG for marketing

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Choose the world's no. 1 spread betting provider

Why open a trading account with anyone but the best spread betting provider? With 45 years of experiance, we're proud to offer a truly market-leading service.

Get the latest forex news

EUR/USD, GBP/USD, and USD/JPY driven by dollar gains

USD/JPY on the rise as EUR/USD and GBP/USD fall back

EUR/USD, GBP/USD, and AUD/USD likely to turn lower despite brief gains

GBP/USD latest: head-and-shoulders top points to falls ahead

Try these next

Spread betting

How to manage risks

Learn more about us

Learn more about spread betting with IG.

Mitigate against forex trading risk with our range of stop and limit orders, and keep an eye on forex prices with customisable alerts.

See how we've been changing the face of trading for more than 40 years.

1 by number of primary relationships with FX traders (investment trends UK leveraged trading report released june 2020).

2 best trading platform as awarded at the ADVFN international financial awards and professional trader awards 2019. Best trading app as awarded at the ADVFN international financial awards 2020.

3 negative balance protection applies to trading-related debt only, and is not available to professional traders.

4 tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

5 the advertised offering is only available to individual clients capable of obtaining ‘professional’ status. This requires experience of trading relevant products on your own account above a certain size, experience of working within the financial sector for at least one year in a relevant position and/or a personal investment portfolio worth at least €500,000.

6 average spread (monday 00:00 - friday 22:00 GMT) for the 12 weeks ending 29th may 2020. For our minimum spreads, please see our forex spread bet and CFD details.

7 average spread (between 00:00-21:00 GMT monday to friday) for the 12 weeks ending 29th may 2020. For our minimum spreads, please see our forex spread bet and CFD details.

8 average spread (monday 00:00 - friday 22:00 GMT) for the 12 weeks ending 19th march 2019. There is also a commission charge for forex direct.

Markets

IG services

Trading platforms

Learn to trade

Contact us

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and cfds with this provider. You should consider whether you understand how spread bets and cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, etfs and etcs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG markets ltd, spread betting provided by IG index ltd. IG is a trading name of IG markets ltd (a company registered in england and wales under number 04008957) and IG index ltd (a company registered in england and wales under number 01190902). Registered address at cannon bridge house, 25 dowgate hill, london EC4R 2YA. Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority.

The information on this site is not directed at residents of the united states, belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

So, let's see, what we have: fxdailyreport.Com so you have thought about it, and you have finally decided you are to start investing in forex trading? Well, forex trading can be a fascinating business, and nowadays, there is at how to open account in forex trading

Contents of the article

- My list of forex bonuses

- Fxdailyreport.Com

- How to open a forex trading account

- What is needed and why

- Typical requirements to get started

- Industry compliance

- Forex trading and risk

- Forex should be boring

- Keep your cool

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- How to open a forex trading account

- Find the right broker

- Information required for account creation

- Choose the account type

- Industry compliance

- Registration

- Activate the account

- Summary

- How to open a forex trading account?

- What is currency tradingor forex trading?

- How to open aforex trading account?

- How does leveragework in forex trading?

- The top 10 tips forforex trading in india

- The top forex tradingstrategy

- What are currencyderivatives?

- How to start currencytrading in india?

- Which is the best forextrading platform in...

- How to open a forex trading account?

- What is the difference between a forex trading...

- How to open a forex trading account with samco?

- How to open a forex trading account?

- Types of trading accounts

- Read the contracts

- Registry

- Activation of the trading account

- How to open account in forex trading

- How to open A forex trading account, one should...

- How to open A forex trading account?

- Conclusion

- Forex trading

- Why trade forex with us?

- Ways to trade forex with IG

- What is forex trading?

- What are the benefits?

- How do I trade forex?

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Start trading now

- Start trading now

- How much does FX trading cost?

- How much will I have to pay?

- Discover your next opportunity

- Choose your currency trading platform

- Award-winning forex provider

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Get the latest forex news

- EUR/USD, GBP/USD, and USD/JPY driven by dollar...

- USD/JPY on the rise as EUR/USD and GBP/USD fall...

- EUR/USD, GBP/USD, and AUD/USD likely to turn...

- GBP/USD latest: head-and-shoulders top points to...

- Try these next

- Spread betting

- How to manage risks

- Learn more about us

- Markets

- IG services

- Trading platforms

- Learn to trade

- Contact us

Contents of the article

- My list of forex bonuses

- Fxdailyreport.Com

- How to open a forex trading account

- What is needed and why

- Typical requirements to get started

- Industry compliance

- Forex trading and risk

- Forex should be boring

- Keep your cool

- Forex trading account – how to open trading...

- How to open trading account

- Choosing trading account type

- Managed account

- Trading account size

- Leverage

- Registration

- Trading account activation

- FREE 5 day email course

- BETA TESTERS WANTED

- FREE PDF's

- 0 comments

- How to open a forex trading account

- Find the right broker

- Information required for account creation

- Choose the account type

- Industry compliance

- Registration

- Activate the account

- Summary

- How to open a forex trading account?

- What is currency tradingor forex trading?

- How to open aforex trading account?

- How does leveragework in forex trading?

- The top 10 tips forforex trading in india

- The top forex tradingstrategy

- What are currencyderivatives?

- How to start currencytrading in india?

- Which is the best forextrading platform in...

- How to open a forex trading account?

- What is the difference between a forex trading...

- How to open a forex trading account with samco?

- How to open a forex trading account?

- Types of trading accounts

- Read the contracts

- Registry

- Activation of the trading account

- How to open account in forex trading

- How to open A forex trading account, one should...

- How to open A forex trading account?

- Conclusion

- Forex trading

- Why trade forex with us?

- Ways to trade forex with IG

- What is forex trading?

- What are the benefits?

- How do I trade forex?

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Deal seamlessly, wherever you are

- Feel secure with a trusted provider

- Start trading now

- Start trading now

- How much does FX trading cost?

- How much will I have to pay?

- Discover your next opportunity

- Choose your currency trading platform

- Award-winning forex provider

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Choose the world's no. 1 spread betting...

- Get the latest forex news

- EUR/USD, GBP/USD, and USD/JPY driven by dollar...

- USD/JPY on the rise as EUR/USD and GBP/USD fall...

- EUR/USD, GBP/USD, and AUD/USD likely to turn...

- GBP/USD latest: head-and-shoulders top points to...

- Try these next

- Spread betting

- How to manage risks

- Learn more about us

- Markets

- IG services

- Trading platforms

- Learn to trade

- Contact us

- Contents of the article

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.